Retail sector: is everything back to how it was before coronavirus?

- Business Tendency Surveys

- Swiss Economy

- KOF Bulletin

Business in the retail sector improved considerably in July. The results of the KOF Business Tendency Surveys show that the situation is now as satisfactory as it was before the pandemic. Were the events of this spring just a brief aberration for the retail sector?

The answer is no – and not only because future developments are uncertain and continue to involve particular risks. The pandemic has led to a polarisation in the retail sector. An initial indication of this trend is the pattern of responses to the question about the business situation. On balance, assessments of this situation are now almost as positive as they were back in February. About 65 per cent of respondents at that time said that their situation was satisfactory, while 20 per cent rated it as good and 15 per cent thought it was poor.

In July, these responses varied much more widely. Only 47 per cent of companies still rated their situation as satisfactory, whereas almost 30 per cent considered their situa-tion to be good and about 23 per cent said it was poor. The 'good' and 'poor' responses have gained in importance. There are therefore a considerable number of winners and losers.

Supermarkets and department stores are among the winners

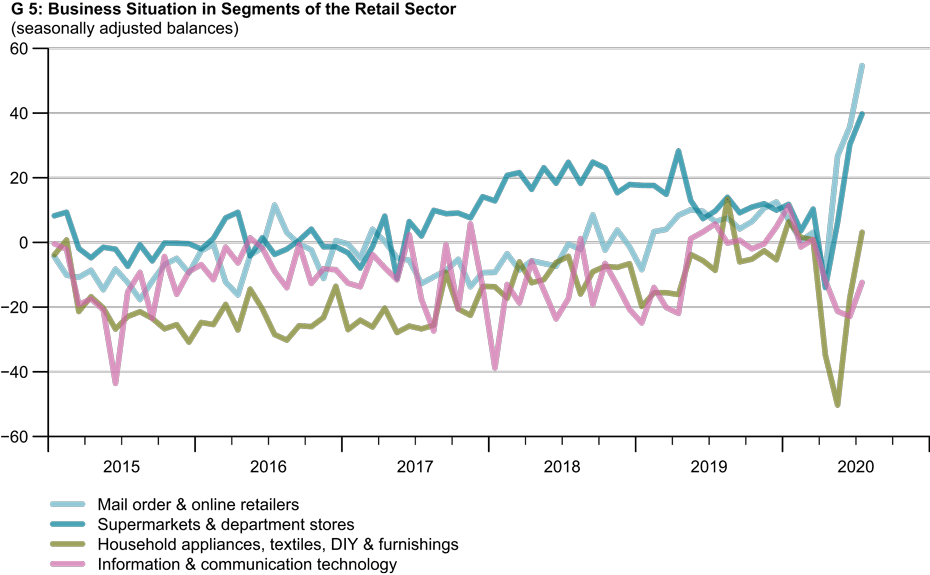

The winners here include supermarkets and department stores as well as mail order and online retailers, whose business situation is clearly better than it was before the crisis. Business is below average in food and the specialist trade in information and communication technology equipment. The situation for specialist retailers of household appliances, textiles, DIY and furnishings is more or less average. This is despite the fact that, according to sales statistics from the Swiss Federal Statistical Office (BFS), sales in May and June were already significantly higher than they had been in February – both for the latter group and for the specialist trade in information and communication technology equipment.

However, the implicit deflators derived from the FSO data show that there was above-average downward pressure on prices in these two segments of the retail sector. By contrast, these implicit deflators suggest that mail order and online retailers hardly lowered their prices at all. The earnings situation of mail order and online retailers has improved over the past few months, as indicated by the results of the KOF Business Tendency Surveys. Earnings at supermarkets and department stores have recently been stable to slightly positive again, while earnings in the other segments have come under greater pressure.

Prices are unlikely to change much

Retailers have raised their prices – especially those for food. On average, however, retail prices are relatively stable. According to the KOF Business Tendency Surveys, retailers expect little movement in sales prices in the near future as well. They believe that sales are also unlikely to change much in the near future. Consumers remain cautious. Although the consumer sentiment index published by the State Secretariat for Economic Affairs (SECO) in July was no longer as negative as it had been in April, consumers' expectations about the general economic situation and their own financial situation remain below average over the longer term. The same applies to the propensity to make major purchases.

Overall, current data suggest that the retail sector has recovered fairly quickly. However, the first few months of the COVID-19 pandemic has created winners and losers. As in many other sectors of the economy, developments over the coming weeks will certainly depend on the further course of the pandemic. Firms are currently expecting to see less dynamic but, nevertheless, stable economic trends.

Further information on the KOF Business Tendency Surveys can be found here.

Contact

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland