KOF Business Tendency Surveys: recovery progressing in leaps and bounds

- Swiss Economy

- Business Tendency Surveys

- KOF Bulletin

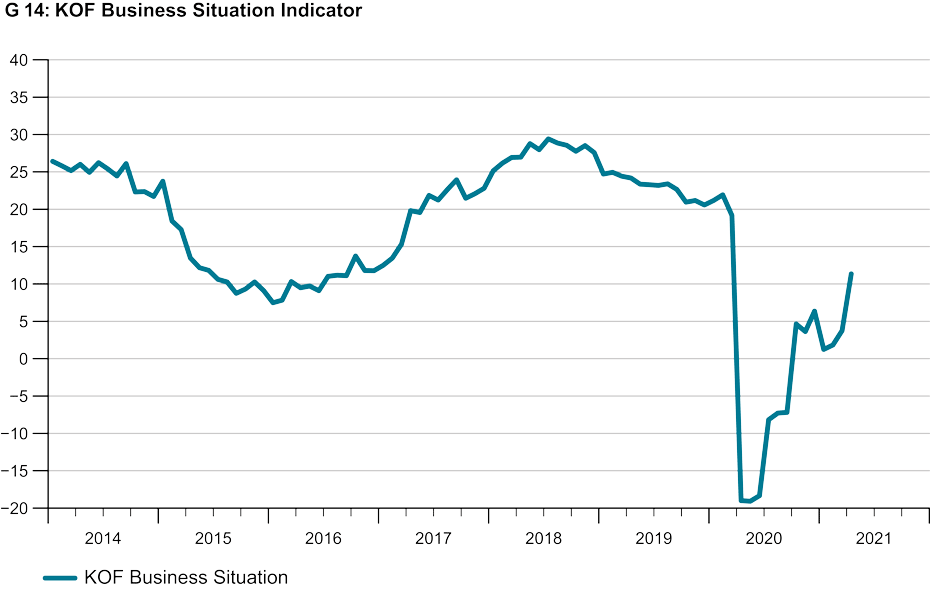

The Swiss economy reported a significantly better business situation in April than in the previous month (see G 14). The upward trend in the Business Situation Indicator, which has been ongoing since the beginning of the year, is thus continuing at an accelerated pace. Firms are also much more confident about developments over the coming months than they were in the previous month and at the beginning of this year.

The significant improvement in the business situation stems primarily from the manufacturing, retail and wholesale sectors, where things have clearly improved in each case. Business in these industries is now predominantly buoyant. The manufacturing sector hopes to gradually overcome the crisis. However, the timely availability of intermediate products is becoming a growing concern for manufacturers and wholesalers.

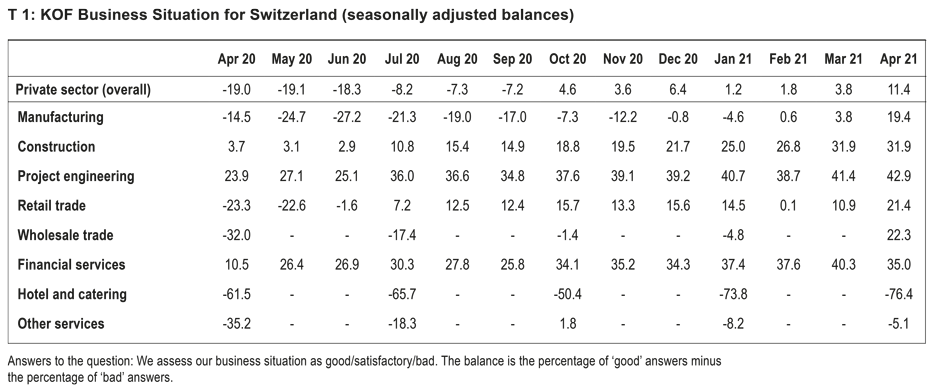

Business in the retail sector is now stronger than it has been since before the beginning of the financial crisis in 2008. Business in project engineering is slightly better than it was in the previous month and at the beginning of the year. The situation in other services is not quite as bad as it was at the beginning of the year. However, the recovery among service providers is very slow and their overall position remains challenging. In construction, on the other hand, the situation is stable. Although business in financial services and insurance is no longer quite as strong as it was in the previous month, it remains predominantly encouraging. The worst performer is once again the hospitality industry, where there has been no improvement since the beginning of the year. The situation here remains bleak. However, most of the responses to the Business Tendency Surveys were received before the easing of restrictions announced by the Swiss Federal Council on 14 April this year. The responses received after this decision tended to be somewhat less pessimistic, especially in the food service sector. Below is a detailed overview of the business situation in the various sectors (see T 1).

The situation in manufacturing is improving

The manufacturing sector is sensing that spring is in the air since its business situation improved significantly in April. The positive trend is visible across large swathes of this sector. Companies have managed to acquire further new orders and, consequently, they are somewhat more relaxed about their existing order books. Production has already been ramped up significantly and capacity utilisation has risen. The current capacity utilisation rate of 82.5 per cent is actually above average on a longer-term comparison.

The situation in the building-related sectors is becoming more buoyant

Business in the project engineering and construction sectors linked to building activity was stable to slightly positive in April. While the value of the Business Situation Indicator rose modestly in the project engineering sector, it remained unchanged in the construction industry. Nevertheless, the performance of both sectors since the beginning of the year has been fairly positive overall. However, business is not as buoyant as it was before the pandemic. The level of demand at project engineering firms is more encouraging than it was in the previous month, and the size of order books has increased noticeably. The construction industry is also registering brisker demand for its services. However, production activity has been adjusted only slightly.

Retailers and wholesalers are bouncing back with a vengeance

February’s dip in the retail sector has finally been overcome. Business improved sharply in April, which means that it is now better than it has been since 2008, i.e. since before the financial crisis. Customers are buying significantly more goods than before and companies are less critical of inventories. The business situation in the wholesale sector is improving considerably. However, there are two divergent trends here. The improvement stems from the wholesale trade in goods used for production. This upward trend is in line with the more encouraging situation in manufacturing. In contrast, the wholesale trade in consumer goods remains stuck in its trough.

Financial services providers are doing well

The Business Situation Indicator for the financial services and insurance sector has fallen slightly. However, business remains good. Institutions also see this decline as temporary; the outlook for business over the coming six months is more positive than it was in the previous month. Earnings – especially at banks – have recently performed very well. Survey respondents increasingly expect earnings to grow in the near future.

The hospitality industry remains in the doldrums

The hospitality sector continues to struggle. While the business situation in the mountain and lake regions has improved slightly, the towns and cities have seen no improvement. However, the vast majority of responses were received before the Swiss Federal Council announced its decision to open outdoor bars and restaurants on 19 April. This measure could bring about a modest turnaround. This is at least indicated by the responses that KOF received from businesses after this decision. Bars and restaurants had previously been closed except for takeaway and delivery services as well as catering for overnight guests. Hotel occupancy rates were again very low and many rooms remained empty. At least accommodation providers’ expectations for the number of overnight stays in this area are no longer quite as pessimistic as before. However, this has not yet been reflected in the number of reservations received. Nevertheless, the fact that the demand outlook is now only rarely negative means that fewer staff cuts are planned and hardly any price reductions are scheduled. Overall business prospects for the coming six months are no longer negative for the first time since the beginning of the coronavirus crisis.

Other service providers are struggling to overcome their slump

The recovery for the remaining service providers has been sluggish so far this year. Aside from the fact that the Business Situation Indicator was even lower during the first coronavirus wave, the situation remains historically bleak. At least these service providers can see light at the end of the tunnel. Business forecasts have recently become more optimistic again and firms are increasingly expecting demand for their services to pick up.

The detailed findings of the KOF Business Tendency Surveys (including tables and charts) are available on our website.

Contact

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland