Investments of Swiss Companies on the Rise Again

- KOF Bulletin

- Surveys

Swiss companies plan to increase their investment activities by around 4.5 per cent in 2017. The envisaged rise in capital investments and the substantial increase in planned growth investments indicate that the outlook among Swiss companies has become slightly more optimistic. These are the results of the KOF Investment Survey conducted in autumn 2016.

Switzerland’s economic development in the last few years had its ups and downs. After an approximate two per cent expansion in 2014, the sudden revaluation of the Swiss franc in January 2015 put the brakes on production growth in Switzerland. Despite the revaluation and its associated competitive disadvantages, Swiss GDP still grew by a further 0.8 per cent in 2015. According to estimates based on preliminary SECO figures, Switzerland’s economic performance has improved more robustly in 2016 (1.4%). The recovery is expected to continue this year and the economy is likely to pick up more speed. The current KOF forecast anticipates GDP growth of around 1.6 per cent in 2017.

The investment trend in any economy is closely linked with the GDP trend. In economic boom times, investment is usually higher than during slow phases. Largely in line with the GDP trend, the trend in capital investments has been rather inconsistent in the last three years. On a price-adjusted basis, capital investments expanded by 2.8 per cent in 2014, 1.6 per cent in 2015 and 2.3 per cent in 2016. In comparison, the average capital investment growth rate in the period 2002 to 2012 was around 2.1 per cent.

Companies want to increase investments in 2017

The KOF Investment Survey is now delivering first estimates of investment activities for the year 2017. The survey results indicate a capital investment growth rate of a nominal 4.5 per cent.[1] A 4.5 per cent increase in capital investments is seen as a strong investment stimulus. In comparison, the average rate of change in the last four years was approximately 2.2 per cent.

The investment figures collected for the year 2017 are based on investment plans that the respondents have drawn up but are not certain to carry out. KOF also enquired about the companies’ subjective implementation certainty to determine the precision of the rate of change resulting from the plans. In autumn 2016, a total of 84.8 per cent of the companies rated their 2017 investment plans as certain or very certain. In contrast, 15.2 per cent of the companies were uncertain or very uncertain with regard to their plans. The level of implementation certainty is thus the same as in the preceding year.

Confidence on the rise

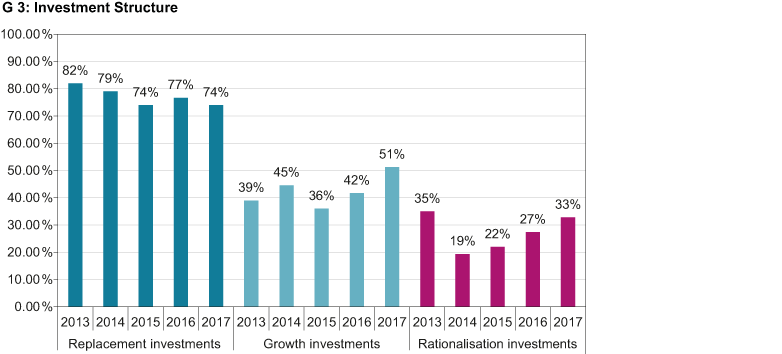

Graph G 3 shows the percentage of companies that carried out replacement, growth and rationalisation investments in the last five years. While the percentages in the period 2013 to 2016 refer to implemented investments, the 2017 figures relate to planned investments. Specific investments are not necessarily limited to one category but may be assignable to several or all categories.

In terms of economic activity, the different categories carry different weights. While pure replacement investments serve to replace existing plant and machinery and do not affect the production capacity of an economy, growth investments are of key importance to future economic development. On the one hand, growth investments raise the capital stock and hence the production capacity of an economy, on the other hand they act as an indicator of the companies’ expectations. In times of low economic activity combined with a negative outlook and a high level of uncertainty, companies usually hesitate before expanding their production facilities and often restrict themselves to replacing existing facilities. In contrast, during an economic boom, companies expect rising demand and expand their capacities in response.

According to the KOF Investment Survey, over 50 per cent of the respondents are planning to make growth investments in 2017, indicating a more optimistic outlook. A substantial portion of the budgeted 4.5 per cent increase in capital investments is likely to go into the expansion of existing capacities, which will raise the total production potential in Switzerland. Aside from higher growth investments, 2017 is also likely to see an increase in rationalisation investments. In the course of rationalisation investments, companies replace existing production facilities with more efficient ones and seek to raise their competitiveness with the help of the new facilities.

[1] The rates of change in the survey results reflect the capital investments of private companies in Switzerland. The agricultural sector, private households and semi-public enterprises are either partially included or not included at all. The rates of change are therefore not directly comparable to those of the VGR (national accounts).

Contact

Professur f. Wirtschaftsforschung

Leonhardstrasse 21

8092

Zürich

Switzerland