KOF Business Tendency Surveys: Companies Report Subdued Situation at the Beginning of the Year

- KOF Business Situation Indicator

- KOF Bulletin

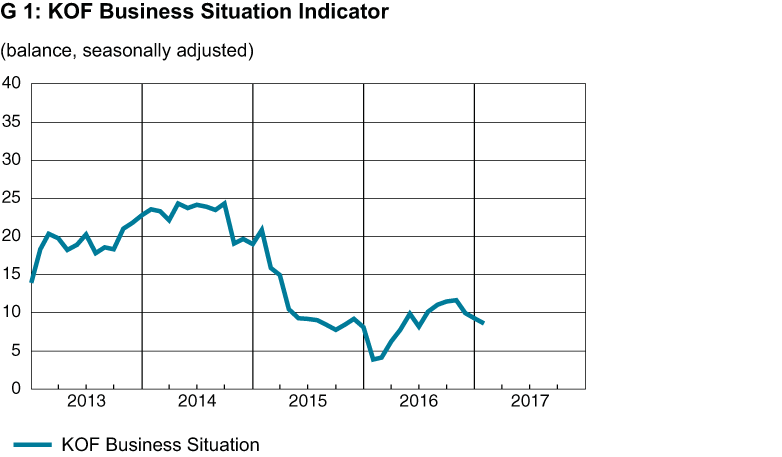

The KOF Business Situation Indicator for the Swiss private economy declined slightly at the start of 2017, resulting in the third monthly slowdown of the business situation in a row. Nevertheless, companies considered their situation to be more favourable in January 2017 than at the beginning of 2016. The latest slowdown shows, however, that the Swiss economy is still on difficult terrain.

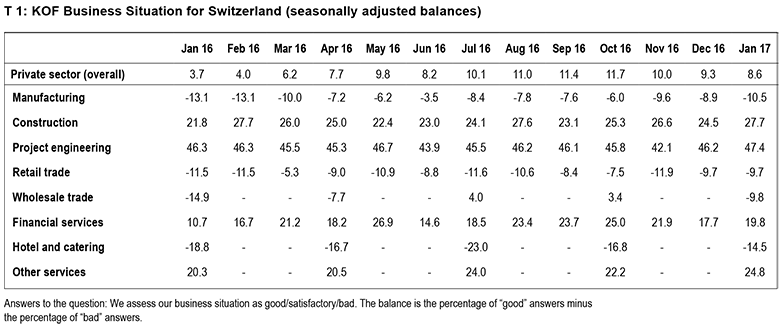

Development by economic sector

The slowdown of the business situation is primarily due to the assessments provided by manufacturing companies and wholesalers. In the manufacturing industry, the indicator dropped for the third time in a row, albeit just slightly like in the previous two months. Nevertheless, this trend shows that tension appears to be on the rise again among manufacturing companies. In the retail trade, the situation is almost unchanged; in this sector, the assessment is stagnating at a low level. In contrast, the situation has improved in the construction and project engineering sector, among banks and insurances, in the hotel and catering industry and among the other service providers.

Slowdown in the manufacturing industry, recovery in the construction sector

The situation in the manufacturing industry has deteriorated slightly, with companies considering their situation at the beginning of the year as less favourable than last summer. Incoming orders declined at the end of 2016 and companies tended to slightly reduce their production volumes. This affected capacity utilisation of machinery and equipment, which declined on a seasonally-adjusted basis. Close to half of the respondents mentioned insufficient demand as an impediment to their business activities. Recently, these complaints have been particularly frequent among export-oriented companies. On top of this, enterprises are increasingly forced to make renewed price concessions. The slower business situation is juxtaposed however with a slightly more optimistic assessment of the near future. Although pressure on selling prices is likely to persist, companies are still expecting a recovery in terms of their order books. Respondents also increasingly anticipate opportunities in their foreign business activities. All in all, the companies plan to expand production volumes.

The positive situation in the construction-related building trades and project engineering sector improved further. However, neither the construction companies nor the project engineering firms expect this trend to continue in the coming six months. Falling prices in the construction industry continue to put pressure on the companies’ earnings situation. Utilisation of machinery and equipment has declined further, although more companies are complaining about weather-related impediments than in the same period of last year. Accordingly, capacity utilisation in the civil engineering sector dropped substantially. In return however, companies received contracts which could not be completed. The scope of the order books has increased. In the case of the project engineering firms, fees are also under pressure, although the respondents hope that their earnings situation will stabilise in the near future. They expect to expand their service provision in the coming three months. Residential construction is increasingly turning into a stumbling block. In contrast, the volume of new contracts in the industrial-commercial field has hardly changed.

Retail and wholesale remain sluggish, hotel and catering is picking up

In the retail trade, the business situation at the start of the year was more or less unchanged compared to the last survey. The indicator has been treading water for over a year now, marking a rather unsatisfying situation in the retail trade. However, according to the businesses, both customer frequencies and sales volumes declined very little compared to the same month last year. Downward pressure on selling prices is much lower than last January. Nevertheless, retailers do not expect a turnaround in sales in the near future and remain cautious when ordering new goods.

Following a slight rebound last summer, the situation in the wholesale trade slowed down again in January. Demand dropped off and stocks increased. Over two-thirds of the respondents report insufficient demand. The companies are also expecting a rise in purchase prices.

In the hotel and catering industry, the business situation improved further in January. Although the respondents are still predominantly dissatisfied with their situation, on balance the negative voices declined for the second consecutive time. Enterprises located in the mountains did not keep pace with January’s positive overall trend. On the contrary, their business situation slowed down. Broken down into catering and hotel establishments, the former reported a clear improvement of their situation while the latter are less satisfied with their situation than in the preceding quarter. Although many catering companies complain about insufficient demand and unfavourable weather conditions and are sceptical when it comes to demand in the coming months, they hope to be able to raise prices slightly to make up for these factors. In contrast, hotel businesses expect a further drop in the prices of their services. This affects the companies’ outlook although the number of overnight stays has recently stabilised and the earnings situation has deteriorated very little.

Banks, insurers and other service providers more optimistic

Following a gradual slowdown in autumn, banks and insurers reported a stabilisation of their business situation. Especially banks gave a more favourable assessment of their situation at the beginning of the year. For the first time in a long time, they no longer give a negative assessment of their business situation with foreign clients. On top of this, they were more satisfied with their domestic business in January than in the previous quarter. Corporate demand increased particularly. For the near future, the institutes anticipate a higher volume of company loans, although they assess credit ratings more sceptically than before. Banks have become more confident again with regard to the future earnings trend. All in all, banks and insurers have a more positive outlook on the business development in the coming six months than before. Compared to the previous year, the decline in the net return on capital has stopped and rising premium scales are expected in the near future.

The business situation of the other service providers improved again in January. Especially business service providers, among them consultancy firms, reported a brighter situation than in the previous quarter. All in all, demand for other services rose in the past three months and complaints about insufficient demand have declined. The companies managed to stabilise their level of competitiveness but are afraid that they will have to lower the prices of their services in the near future. As regards the future trend in demand, the other service providers are confident.

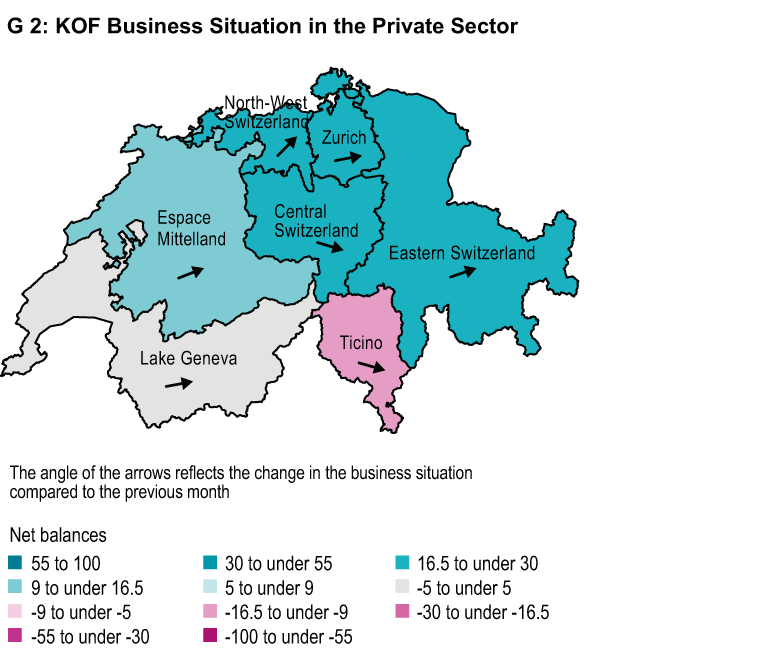

Business situation by region

From a regional perspective, only Ticino and Central Switzerland show a marked decline in the macroeconomic Business Situation Indicator. In the other regions – North-West Switzerland, Espace Mittelland, Eastern Switzerland as well as the Zurich and Lake Geneva regions – the situation improved slightly. Eastern Switzerland stands out in year on year comparison, with companies reporting a significant improvement of their situation at the beginning of this year compared to the start of 2016.

Contact

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland