Monetary Policy: Outlook Slowly Improving

- Monetary Policy

- KOF Bulletin

US monetary policy is gradually easing up. Increasingly, there are signs that a change in monetary policy may also become possible in Europe, albeit with a significant delay. In the meantime, the Swiss National Bank (SNB) is carrying on with its two-pillar policy.

FED takes the lead

In March 2017, the FED made another interest rate adjustment of 25 basis points, pushing the Federal Funds Rate up to a range between 0.75 per cent and one per cent. The signs from the labour market remain positive. However, inflation as measured by the ‘Personal Consumption Expenditures Price Index’ is still slightly below the FED’s longer-term target value of two per cent. Nevertheless, the FED is on course since the sound labour market situation is slowly having an effect on the wage trend, which, in turn, should ratchet up inflation. Since its inflation target is symmetric, the FED is likely to tolerate temporary future inflation rates above the target figure. Even though, thanks to a solid economic trend, KOF expects the FED to raise key interest rates three times by 25 basis points, both this and next year. This will give the FED a bit more freedom to employ conventional monetary policy measures in response to future crises.

ECB continues bond-buying programme

At its December meeting, the European Central Bank (ECB) announced that it would continue its bond-buying programme until the end of 2017, although it would reduce its purchases from an original 80 billion euros a month to 60 billion euros. At its March meeting, the ECB made no changes to the planned duration and scope of the current buying programme. At the beginning of 2017, total inflation rose significantly, even in the eurozone, and is expected to hover around two per cent in the coming months. However, since the rise is predominantly due to an increase in energy and food price inflation, which is most likely of a temporary nature, pressure on core inflation remains muted. According to the ECB, as yet, there are no signs of a convincing upward trend in core inflation. Consequently, there is still a need for very expansive monetary policies to ensure that inflation rates will swiftly return to a level of just under two per cent. Nevertheless, the risk of deflation is considered low for the foreseeable future. The ECB also announced that interest rates will remain at the present or lower levels for an extended period of time and well past the horizon of the net asset purchases. ECB policy will thus remain extremely expansive and a rise in interest rates is not expected during the forecast period.

SNB depending on other countries

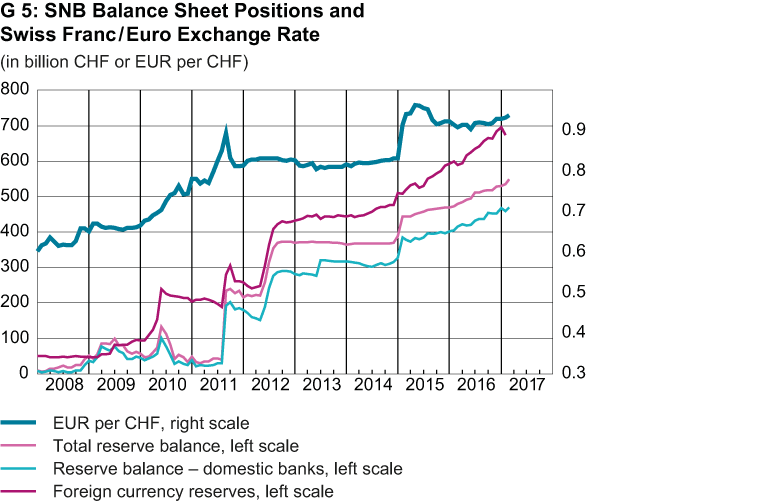

At its March meeting, the Swiss National Bank (SNB) decided to keep its two-pillar monetary policy (‘negative interest’ and ‘readiness to intervene’) expansive. The -0.75 per cent interest rate on demand deposits with the National Bank and the bank’s readiness to intervene on the foreign exchange markets are intended to keep investments in Swiss francs less attractive, thereby reducing pressure on the currency.

In February, inflation was back in positive territory, returning to the SNB’s target range in the first quarter of 2017. In contrast, core inflation, which excludes fresh seasonal products as well as energy and fuels, was slightly negative until well into February. During the forecast period, KOF anticipates low pressure on inflation and a rate that remains significantly below the one per cent mark.

The substantial increase in demand deposits since the start of 2017 indicates that the SNB has once again been more active on the foreign exchange market in order to weaken the Swiss franc. However, this is not an isolated case: The Danish central bank also intervened on the foreign exchange market in February, and the Czech central bank, which is defending a similar minimum exchange rate with the euro that the SNB once pursued, has recently experienced mounting pressure.

In the coming quarters, the SNB will do its best to keep Swiss money market interest significantly below that of the eurozone in order to reduce the attractiveness of the Swiss franc. Given the expected ECB policies, the National bank will thus be forced to continue its negative interest rate policy in the coming months. However, KOF does not anticipate any need for a further reduction of the negative interest; it appears that key interest rates have finally bottomed out. Instead, the target range for the three-month Libor is likely to remain between -0.25 per cent and -1.25 per cent, and interest on demand deposits with the National Bank is expected to remain at -0.75 per cent.

The second half of 2016 was dominated by surprising outcomes to a number of political events. The British vote in favour of Brexit led to a significant devaluation of the British pound. Nevertheless, thanks to its readiness to intervene, the SNB managed to cushion the attendant upward pressure on the Swiss franc as a ‘safe haven’. Even after the US elections and the constitutional referendum in Italy, significant revaluations of the Swiss franc were avoided. All in all, on a trade-weighted basis, the real external value of the Swiss franc has hardly changed over the past year. If one analyses the nominal exchange rates since mid-2016, the franc rose slightly against the euro and declined slightly against the US dollar. In its current forecast, KOF projects a euro/Swiss franc exchange rate of 1.07.

Contact

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland

Contact

No database information available