(Non-)Hotel Accommodation vs. Airbnb

- KOF Tourism Forecast

- KOF Bulletin

KOF publishes its Forecasts for Swiss Tourism twice a year. The latest study, which also contains structural analysis of the significance of various accommodation categories, including classic hotels, non-hotel accommodation and Airbnb as separate categories, shows that Airbnb is gaining ground in city destinations and regions with large numbers of holiday apartments.

Tourist accommodation is broken down into hotels on the one hand and non-hotel accommodation on the other. Available for the first time for the year 2016, the Federal Statistical Office’s (BFS) latest statistics for non-hotel accommodation provide supply and demand figures for commercially run holiday apartments, collective lodgings and campsites. Furthermore, Airbnb has been playing an increasingly important role in the last few years.[1]

How many beds are available?

On the supply side, the distinction between the different accommodation categories is made on the basis of their bed capacities. It should be noted that the non-hotel accommodation statistics are based on a sample survey. Campsites were not included since comparative supply analysis is difficult to perform. Properties may be counted twice if they are included in classic hotels while also being offered on Airbnb.

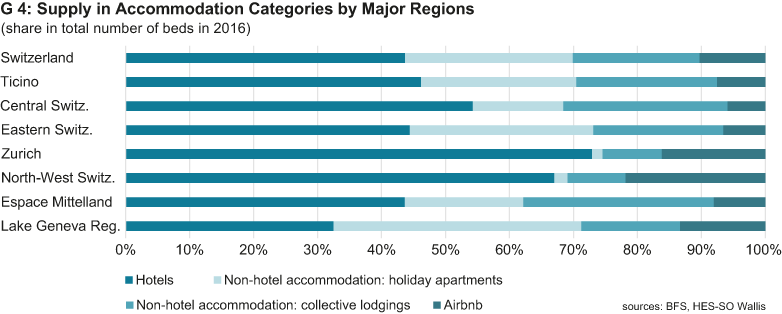

Nationwide, 272,000 hotel beds were offered in 2016, accounting for just under 44 per cent (Graph G 4) of the total number of beds provided by hotels, holiday apartments and collective lodgings as well as Airbnb. Non-hotel accommodation accounted for as much as 286,000 beds, with holiday apartments making up just over 50 per cent of this number. This corresponds to a market share of 46 per cent. As per the end of January 2017, the number of beds available via Airbnb amounted to 64,000, which represents a market share of 10 per cent.

Graph G 4 shows that the individual accommodation categories have different weightings in the different regions. At 40 per cent to 50 per cent of total bed capacities, non-hotel accommodation makes up a significant percentage in the Lake Geneva region (especially Valais), Eastern Switzerland (Grisons), Espace Mittelland (Bernese Oberland) and Ticino. In the city destinations of Zurich and North-West Switzerland, hotels have the highest market share. On top of this, Airbnb apartments have become a significant form of accommodation at a 16 per cent and 21 per cent market share respectively.

The trend of the last few years illustrates the increasing role played by Airbnb. Between 2014 and 2017, the number of hotel beds remained more or less unchanged at 272,000. While hotel capacities expanded in urban regions, such as Zurich, Waadt and Basel, they declined in Valais, Ticino, Central Switzerland and Eastern Switzerland. In the same period, the number of beds offered via Airbnb tripled, increasing by 43,000. The fastest growth was recorded in cantons with large numbers of holiday apartments, such as Valais (+14,000 beds), Grisons (+5,400), Bern (+4,300) and Ticino (+2,000), and in urban cantons like Waadt (+3,700), Zurich (+2,900) and Basel (+2,200).

How big is the demand for beds?

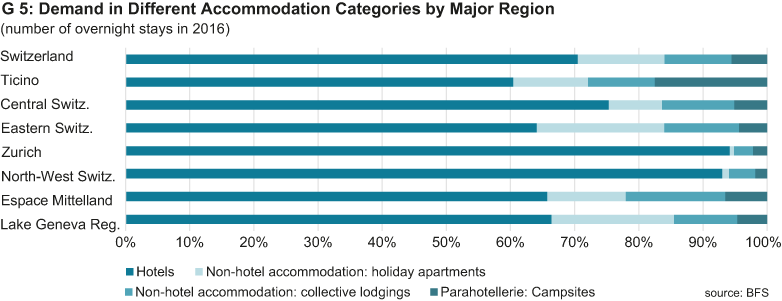

On the demand side, comparative analysis of accommodation types is based on overnight stays. In 2016, non-hotel accommodation (holiday apartments, collective lodgings and campsites) registered around 14.9 million overnight stays, accounting for approximately 30 per cent of all tourist accommodation.[2] Holiday apartments made up just under 14 per cent. Owing to lower capacity utilisation compared to the hotel industry, the share of non-hotel accommodation in total demand is lower than its share in total supply.

As shown in Graph G 5, the predominantly urban regions of Zurich and North-West Switzerland generate over 90 per cent of all overnight stays in the hotel sector. High shares of non-hotel accommodation can be found in Eastern Switzerland (Grisons), Espace Mittelland (Bernese Oberland) and the Lake Geneva region (Valais). Campsites play a significant role in Ticino.

In comparison to the hotel industry, non-hotel accommodation focuses predominantly on domestic guests, who were responsible for close to 70 per cent of all overnight stays in 2016. In the hotel industry, the share of domestic guests is 46 per cent. Furthermore, European guests accounted for over 80 per cent of overnight stays by foreign visitors in non-hotel accommodation, while non-European guests play a significant role in the hotel sector.

Pressure on classic hotels remains high

Nationwide, classic non-hotel accommodation accounts for around 44 per cent of all beds and 30 per cent of all overnight stays. It plays a particularly important role in the Alpine region. Demand is mainly of a domestic nature. Airbnb is a new accommodation type that has expanded considerably in the last few years and is likely to continue growing in the future. The importance of Airbnb is highest in cities and regions with large numbers of holiday apartments. The platform increases suppliers’ opportunities to offer non-hotel accommodation to foreign tourists and raise their capacity utilisation. Competitive pressure on classic hotels is likely to increase.

[1] Airbnb figures were collected by the Tourism Institute of Walliser Fachhochschule for the years 2014–2017.

[2] Hotel industry and non-hotel accommodation. Airnbnb demand-side information not available.

Die aktuellen KOF Prognosen für den Schweizer Tourismus finden Sie hier.

Contacts

No database information available

No database information available

KOF FB Konjunktur

Leonhardstrasse 21

8092

Zürich

Switzerland