KOF Investment Survey: Companies Revise Up 2017 Investment Plans

- KOF Bulletin

- Surveys

According to the results of the semi-annual KOF Investment Survey, total investments by Swiss companies are set to rise in 2017. The respondents are planning to expand investment activities by around six per cent this year. This represents a slight upward correction of investment plans compared to the last Investment Survey.

After the completion of the Investment Survey which was conducted in spring 2017, we now have a second set of figures on investment plans for the year 2017. The respondents had already been surveyed on their expected 2017 investment activities last autumn. At the time, they anticipated an increase in investment activities of around five per cent, with industry and construction being the main drivers. According to the current results, the companies have adjusted their expectations and are now anticipating slightly higher investment dynamics of around six per cent in 2017. There has been a minor shift among the sectors. While investment activities in the industrial and construction sectors may be slightly less dynamic than expected in autumn, the service sector revised up its expectations. In 2018, the companies expect a further rise in investment activities. However, according to the current survey, this increase will be much more moderate than in 2017.

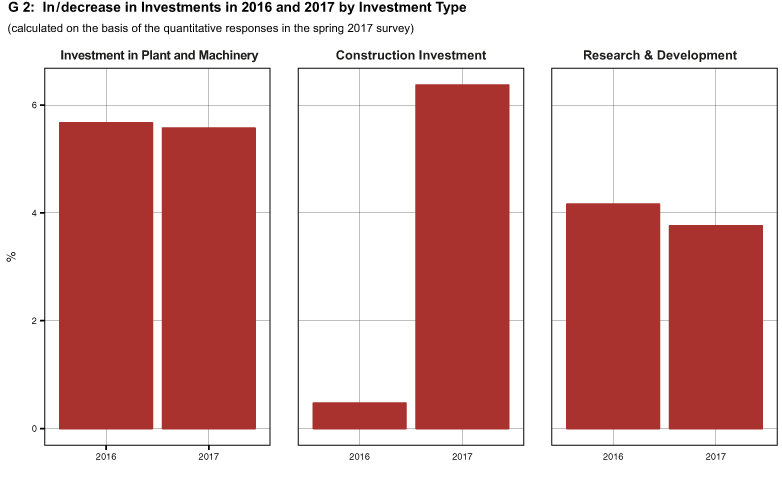

Service providers drive gross investment

This year, industry is likely to record solid growth in investments. Compared to autumn 2016, the respondents expect slightly slower gross investment growth of around four per cent (autumn survey: 5%). Construction investments are set to expand by two per cent and investments in plant and machinery (excluding R&D) by up to five per cent. Research and development expenditure will rise by around three per cent. The biggest increase in investment is planned by the textile industry as well as the chemical and pharmaceutical industries. Paper and print product manufacturers and metal product producers report the largest expected decline in investments.

As well as industry, the increase in macroeconomic private investments is also driven by positive dynamics in the tertiary sector. There has been a significant upward revision of expected 2017 investments in the service sector. Gross investments in this area are set to rise by just under seven per cent (autumn: 4%). The biggest rates of change are reported by telecommunications as well as banks and financial service providers. Transport also expects a high growth rate. In contrast, investments in the distributive trades (cars, retail and wholesale) are declining. The construction industry is slightly less optimistic about its 2017 investment activities than industry and services. According to the respondents, gross investments are likely to rise by around three per cent this year, driven exclusively by the main construction trades. Companies in the conversion business plan to reduce their investments this year.

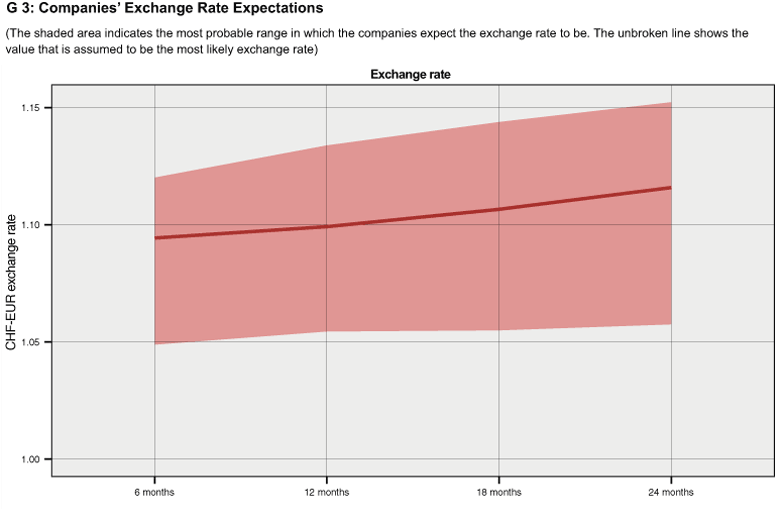

Swiss companies anticipate slight devaluation

Aside from questions regarding companies’ investment activities, the KOF Investment Survey in spring also includes a question regarding the future development of the exchange rate. In this context, KOF asks the companies about their subjective exchange rate expectations. In specific, the companies are asked to state the upper and lower limits of a target range in which the Swiss franc to euro exchange rate will most likely be in the coming 6, 12, 18 and 24 months. Subsequently, the companies are asked to indicate the figure within the range they consider most likely.

According to the current survey results, the companies expect a Swiss franc to euro exchange rate of around 1.09 in the coming two years. With the exchange rate fluctuating around 1.07 during the main survey response period in March and April, the companies anticipated a slight devaluation. According to the survey results, in March and April the companies anticipated an exchange rate of 1.08 in six months and a slightly weaker rate of 1.09 in two years. However, on the whole, the companies’ expectations are dominated by significant insecurity regarding the actual exchange rate, which is reflected by the wide spread. The average limits of the target ranges stated by the companies indicate expectations of an exchange rate between 1.04 and 1.12 in two years’ time.

Over 2,700 companies took part in the KOF Investment Survey in spring 2017.

Find more information about the KOF Investment Survey here.

Contact

Professur f. Wirtschaftsforschung

Leonhardstrasse 21

8092

Zürich

Switzerland