Bitcoin: Flavour of the Month or Tomorrow’s World Currency?

A conventional currency functions as a ‘medium of exchange’, a ‘store of value’, and a ‘unit of account’. Blockchain based cryptocurrencies such as Bitcoin satisfy only the first two of those criteria. So far, the use of bitcoin has been limited to a medium of exchange, but that could change.

In May 2010, a developer bought two pizzas using 10,000 bitcoins. The value of 10,000 bitcoins today is more than USD 64 million, making that pizza the most expensive food in history. Despite the meteoric rise of the bitcoin in 2017, economists are divided on the topic of cryptocurrencies. Some regard bitcoin as a passing fad, call its lofty valuation “a bubble”, or regard its anonymity aspect as “fraud”, while others believe that cryptocurrencies will continue to evolve and take over. Demand for bitcoin has been growing rapidly, partly helped by geopolitical tensions, and partly by its widening acceptance in retail trade, especially in countries like Japan.

Bitcoin and Blockchain

Compared with conventional payment systems where consumers settle payments via a trusted financial institution’s ledger, the cryptocurrency systems operate on a proof-of-work basis that allows its participants to maintain a decentralized network (public ledger). In contrast to electronic money, bitcoin does not represent a legal tender. Bitcoins are held in ‘digital wallets’, which are comparable to bank accounts, with the main difference being that other users know how much is in an account but do not know the holder’s identity. Bitcoin transactions are collected into ‘blocks’ by specialized users called ‘miners’. With the help of cryptographic software, they subsequently verify the anonymous transaction blocks that are connected into a chain (‘blockchain’), a public ledger that contains all the transactions. Miners are rewarded by the system through the issuance of new bitcoins, which increases the supply of bitcoins. The system is governed by an exogenous money supply limit; the maximum number of bitcoins that can ever be issued (21 million) is to be reached by 2040. Bitcoin is currently the largest blockchain network, followed by Ethereum, Bitcoin Cash, Ripple and Litecoin. We focus on bitcoin as it has the highest market capitalisation (USD 100bn) and longest data history.

Bitcoin in Switzerland

Switzerland is regarded as a frontrunner in adoption of financial innovations. Being a major hub for the Fintech sector, a lot of cryptocurrency businesses are located in Zug, a.k.a. Switzerland’s "Crypto Valley". There have also been efforts by Swiss authorities to test the technology through various channels: The Zug municipality ran a six-month pilot project last year, where bitcoin payments of up to CHF 200 were accepted for standard government services. Albeit small, the pilot project was heavily criticized because people cannot (yet) pay taxes with bitcoin. Another initiative was the launch of bitcoin ATMs by SBB, Switzerland’s national railway company, as part of a two-year experiment. Ironically, bitcoins cannot (yet) be used to purchase a rail ticket. Recently, Switzerland's financial markets regulator, FINMA, approved a Swiss private bank for bitcoin asset management, signalling that digital currencies are here to stay.

Economics of Bitcoin

A conventional currency functions as a ‘medium of exchange’, a ‘store of value’, and a ‘unit of account’, but bitcoin satisfies only the first two of those criteria. So far, it has been a limited medium of exchange mostly in the US, China and Japan. Despite its high volatility, bitcoin is emerging as ‘digital gold‘. Implications for central banks would result if any of the cryptocurrencies would become a global ‘unit of account’. For example, the ‘seigniorage’ benefit (the difference between the face value of money and the cost of printing) would disappear. A Swiss franc banknote on average costs about 30 cents to produce. The difference between the face value of the note and its cost can be used to purchase assets and is partly transferred to the federal government. In developing countries with high inflation and less independent central banks, these revenue transfers can be a significant source of government revenue. Given that the cryptocurrency supply is determined by its miners, the management of business cycles via monetary policy would become a challenging task for central banks.

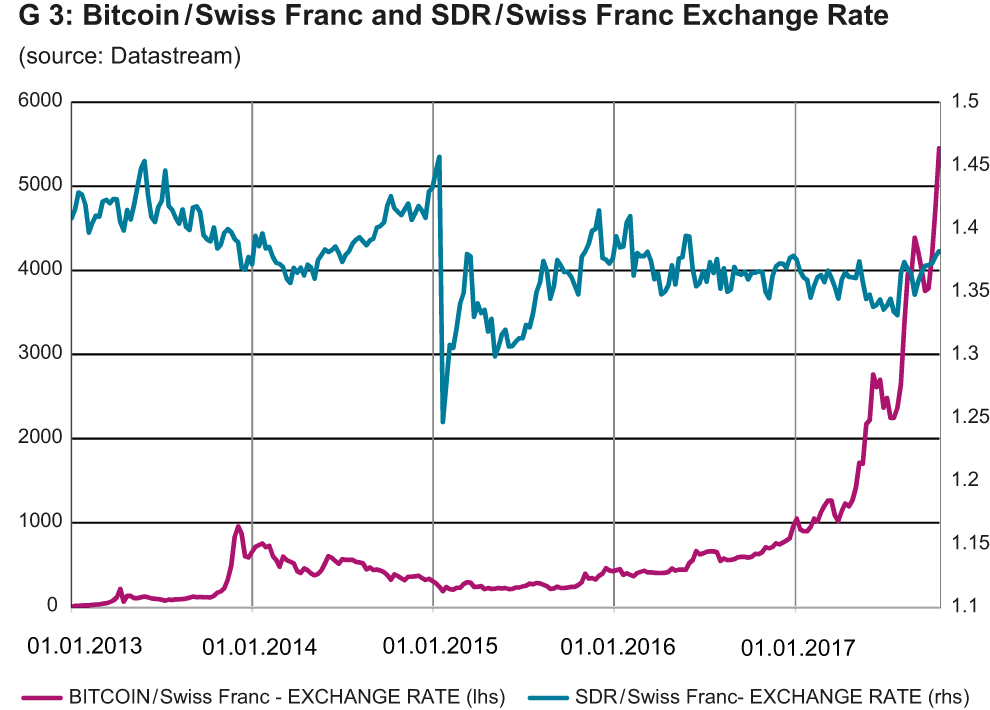

Figure 3 shows the development of the Bitcoin/CHF versus the Special Drawing Rights (SDR)/CHF exchange rate. We choose to compare the two due to comments by Christine Lagarde, head of the IMF, about the possibility of the IMF developing its own cryptocurrency by incorporating the blockchain technology into SDR. SDR was created by the IMF from a basket of currencies (the US dollar (42%), euro (31%), Yuan (11%), Yen (8%), and Pound sterling (8%)) to replace the dollar as the world’s reserve currency, accommodating the growth of world trade. Bitcoin also has an appeal as a global currency because it is free from government and central bank influence. Like SDR, bitcoin is universal, but unlike SDR, it can be accessed by private companies and consumers.

Weekly and monthly return correlations between Bitcoin/CHF and SDR/CHF data are positive (a range of .2 to .3). The monthly return correlations between Bitcoin/CHF and the price of gold are close to zero, making us sceptical about bitcoin’s safe-haven status.

Before Bretton Woods, John Maynard Keynes devised an ambitious plan in 1942 to set up an International Currency Union, with a gold-backed international unit of account named “bancor” (not to be confused with ‘Bancor the cryptocurrency’). At the SNB’s Karl Brunner lecture in Zurich, guest speaker John B. Taylor emphasized the need to reform the international monetary system, arguing that competitive devaluations can be a source of instability in the global economy. It remains to be seen if the IMF will use the blockchain technology to establish a world currency in the spirit of bancor, but with the added advantages of bitcoin. Such efforts would paradoxically go against the raison d'être of bitcoin, which was originally created as a decentralised ‘peer-to-peer network’ avoiding any institutional intervention.

Contact

No database information available