Upswing has Arrived, Sports Events Dominate the Cyclical Trend

- Swiss Economy

- KOF Bulletin

The significant upturn in the global economy is also stimulating the Swiss economy. Foreign trade is benefitting from this situation. Investments in plant and equipment are also picking up. GDP is expected to expand by 2.3% in 2018 and by 1.7% in 2019. The labour market situation is improving as employment figures are going up and the unemployment rate is declining. These are the results of the current KOF Economic Forecast.

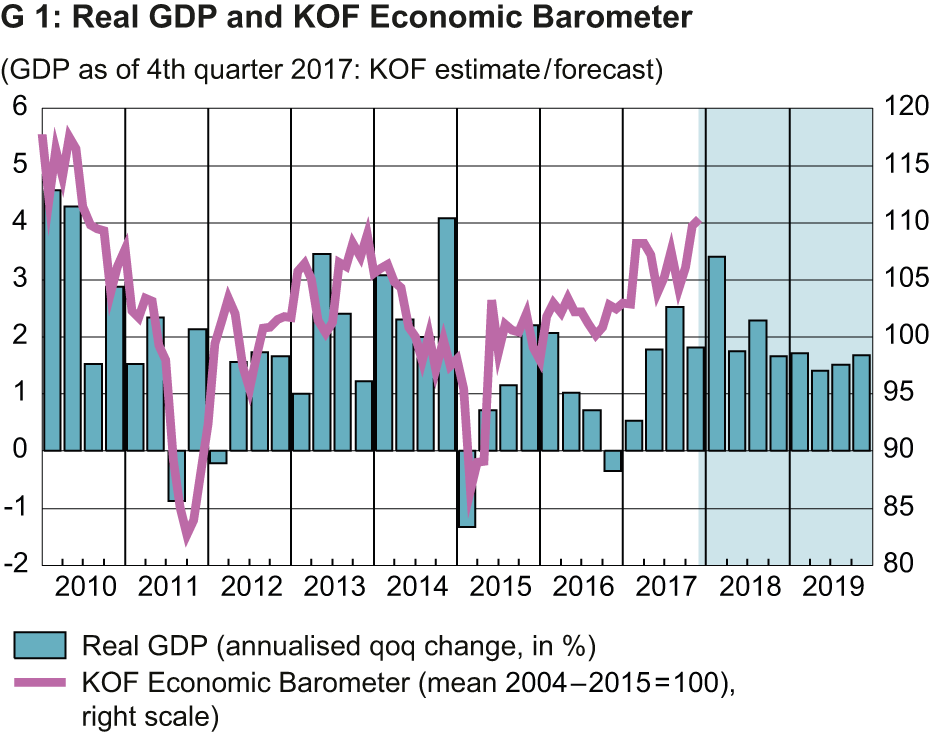

At present, the global economy is enjoying a significant upswing, which is likely to continue for the foreseeable future. In keeping with this trend, the available indicators of the state of the Swiss economy are almost exclusively positive. Leading, coincident and lagging confidence indicators have all gradually perked up (see G 1). On top of this, the quantitative data on exports and the quarterly estimates by the State Secretariat for Economic Affairs (SECO) are predominantly positive. However, it is mostly SECO’s latest upward revisions of the official value creation data that resulted in an adjustment of our projected GDP growth rate for the current year from 0.8% to 1%.

International sports events boost Swiss GDP

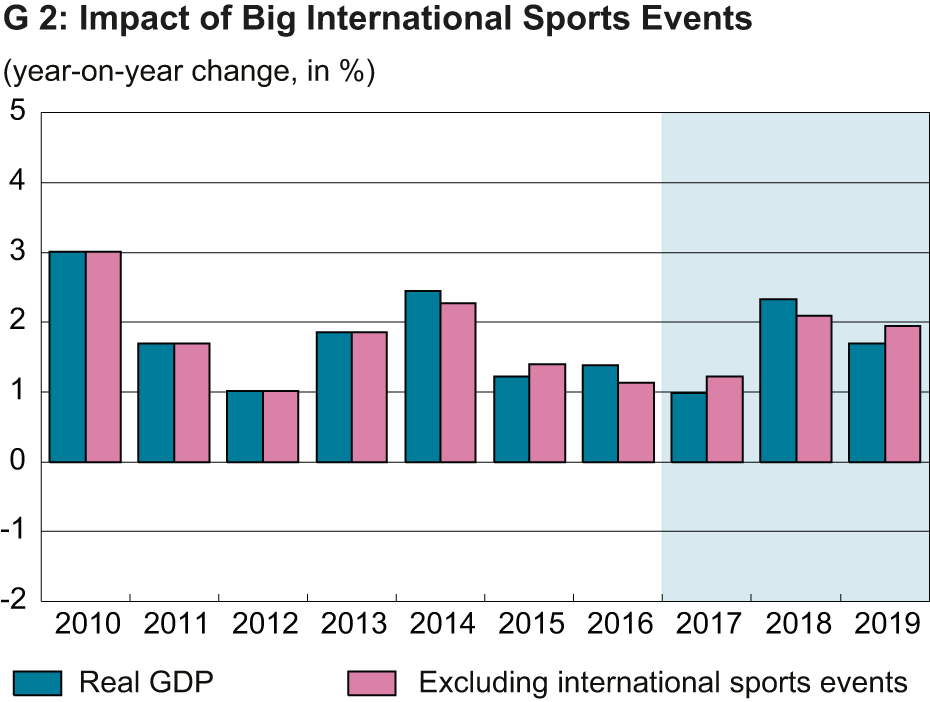

The average annual GDP growth rate of 1% for 2017 is extremely low in historical comparison and therefore difficult to reconcile with the above-mentioned indicators. This circumstance can be explained with the quarterly GDP trend: At the beginning of the year, the economic situation was substantially weaker than towards the end of the year, and initially, sluggish growth was not fully compensated by stronger results in the second six months. On top of this, income generated from big international sports events organised by sports umbrella organisations domiciled in Switzerland have been posted under Swiss production since 2017 – an accounting adjustment that affects statistics as of the year 2014 (see G 2). In 2016, these events led to a marked increase in value creation of just under 0.3 percentage points. The lack of any events of this scale in 2017 has pushed down the statistical growth rate for 2017 to the same degree.

The international sports events associated with the biggest income take place every four years, but not in the same year. Due to this rhythm, big international sports events occur in all even years, while odd years only host smaller events. As a consequence, the GDP growth rate in 2018 will be higher than suggested by the anticipated development of the other sectors. In 2019, GDP growth rates are once again expected to be lower. We have included this cycle in our forecast and expect GDP growth rates of 2.3% in 2018 and 1.7% in the following year.

GDP trend does not fully reflect the cyclical trend

As regards the observation and analysis of the cyclical trend, with income from big sports events now being posted with an effect on GDP, the GDP trend is even less coincident with the economic trend than before. It has been clear for a while now that the profits generated from merchanting have a substantial impact on the Swiss GDP trend, without having any of the effects on the labour market or prices that usually arise in conventional value creation through production and services. In the same way, changes in inventories, which are reported together with statistical differences between production and end use of the produced goods, also often elude any clear interpretation. Since big sports events may be considered as similarly isolated from the rest of the Swiss economy as merchanting, economic analysis must increasingly disregard the effect of such activities and events to arrive at a sensible interpretation of labour market and price trends. For instance, in the period from 2015 to 2017, the economic trend following the CHF revaluation shock at the beginning of 2015 is significantly more plausible if analysis excludes the big sports events, with 2017 being the year of economic recovery, than the GDP series with the noticeable peak of growth rates in 2016.

Positive labour market trend

The current upswing is now slowly filtering through to the labour market. Fulltime equivalent employment is back on the rise after a virtual stagnation in the period between the suspension of the minimum exchange rate at the beginning of 2015 and mid-2017. The rate of unemployed registered with the employment office has been declining since the beginning of the year and is now back at the level recorded at the beginning of 2015. In the forecast period, we expect a further rise in employment numbers and a successive decline in the unemployment rate until the beginning of 2019 – from just over 3% today to 2.9% for registered unemployment and from 4.7% to 4.5% for unemployment according to the internationally comparable definition.

Our forecast anticipates no change in the CHF/EUR exchange rate of just under 1.17 until the end of 2019. This exchange rate is particularly advantageous for the Swiss export industry, which includes numerous sectors whose margins and sales suffered considerable losses in 2015 and 2016. Retailers are also benefitting from the exchange rate trend as cross-border shopping is becoming less attractive.

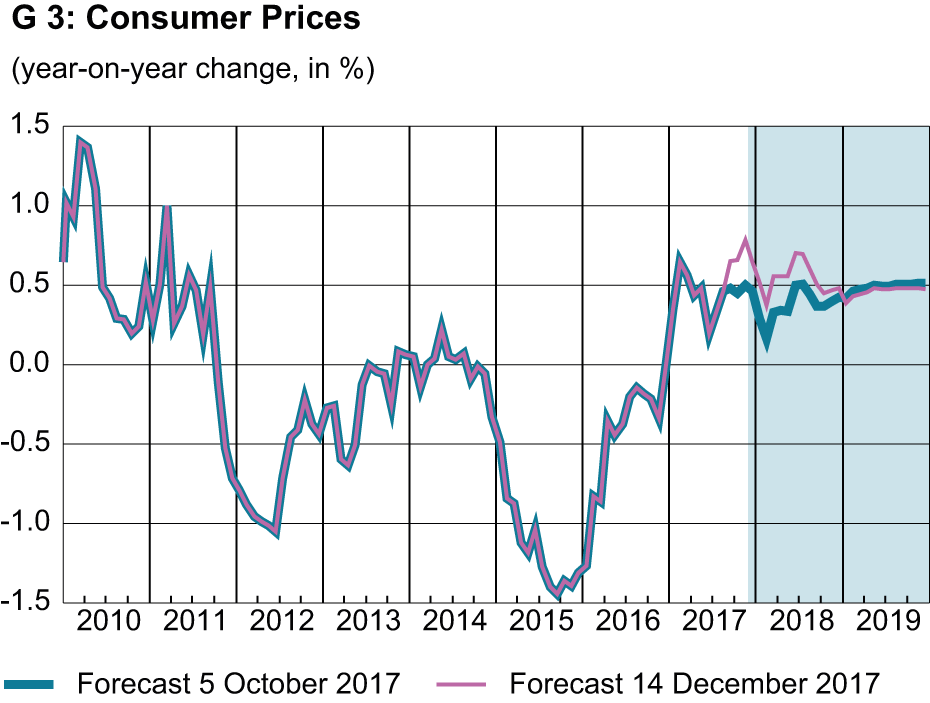

Interest rate adjustment in sight

According to our forecast, the negative interest phase will slowly come to an end. We expect a rise in long-term interest rates as early as 2018, and a potential slow rise in short-term interest rates, which are currently still negative, in 2019. During the forecast period, we do not anticipate an active reduction of the Swiss National Bank’s (SNB) exceptionally high balance sheet total which arose from past currency purchases. Even at the present exchange rate, the rise in prices will remain small; only a strong devaluation or a significant rise in crude oil prices could result in inflation rates beyond the SNB’s comfort zone and hence in restrictive monetary measures (see G 3).

Contact

KOF FB Konjunktur

Leonhardstrasse 21

8092

Zürich

Switzerland