Eurozone Debt (1/3): Government Budgets

- KOF Bulletin

- World Economy

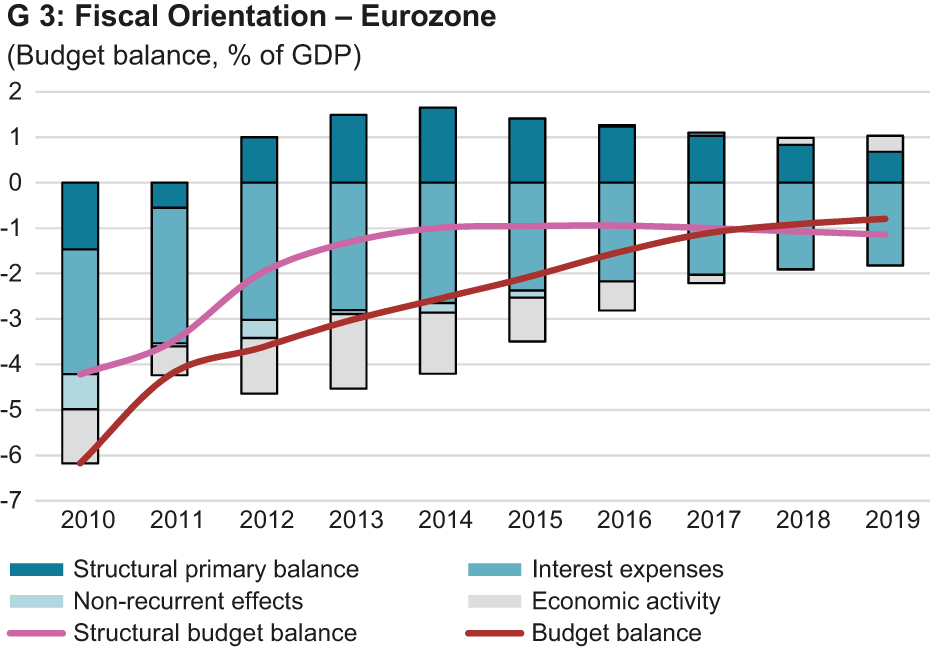

The first of three articles on Eurozone debt focuses on government budgets. Since the debt crisis, the Eurozone member states have significantly reduced new borrowing, with the deficit-to-GDP ratio – a key convergence criterion under the Maastricht Treaty – falling steadily from over 6% in 2010 to just above 1% last year. However, consolidation efforts are on the decline again.

A breakdown of the budget deficit allows for more detailed analysis of the economic impact of public debt (see Graph G 3). A small part of the budget balance is made up by non-recurrent effects and other temporary measures, for instance funds spent on bank rescues or proceeds from the auctioning of mobile licenses. Another part consists of the cyclical component which corrects lower tax revenue and higher social expenses in times of weak economic activity. After adjustment for these cyclical and non-recurrent effects, one arrives at the structural budget balance. Accordingly, this balance reflects the theoretical budget balance if the economy were working at full capacity and the production gap were closed. The European Commission estimates that the structural budget deficit improved from 4.3% in 2010 to around 1% in 2014. Since then, however, it has remained largely unchanged although the ECB’s low interest rate policy of the last few years has significantly reduced the interest burden on public households.

To arrive at a reliable measurement of the fiscal orientation and the associated economic effects, interest expenses are deducted from the structural budget balance. Since interest expenses mostly affect finance companies or budgets with high savings quotas, they are of minor relevance to the economy. Changes in the so-called structural primary balance, which results after this deduction, indicate the fiscal orientation. The structural primary balance suggests that, instead of using the relief afforded by lower interest rates to continue their consolidation efforts, government budgets in the Eurozone have pursued a more expansive orientation in their fiscal policies.

Consolidation measures were taking effect

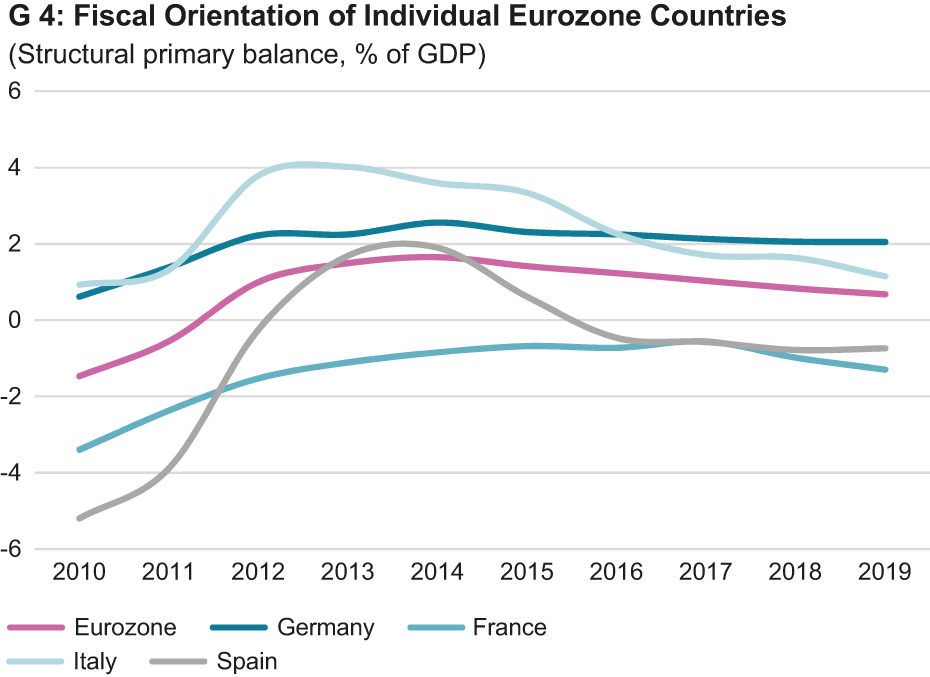

After the big recession, the aggregated structural primary balance in the Eurozone showed a deficit of 1.5%. Government budgets’ consolidation efforts during the debt crisis were having an effect and the structural primary balance improved significantly, reaching a surplus of 1.6% in 2014. Since then, however, efforts have been waning and the balance is likely to have amounted to around 1% in the past year. A glance at the big member states shows that the structural primary balance improved substantially until 2013/14 and fiscal policies were thus mostly following a restrictive orientation (see Graph G 4). Both Italy and Spain have since adopted slightly expansive monetary policies, while German and French policies should be mostly neutral.

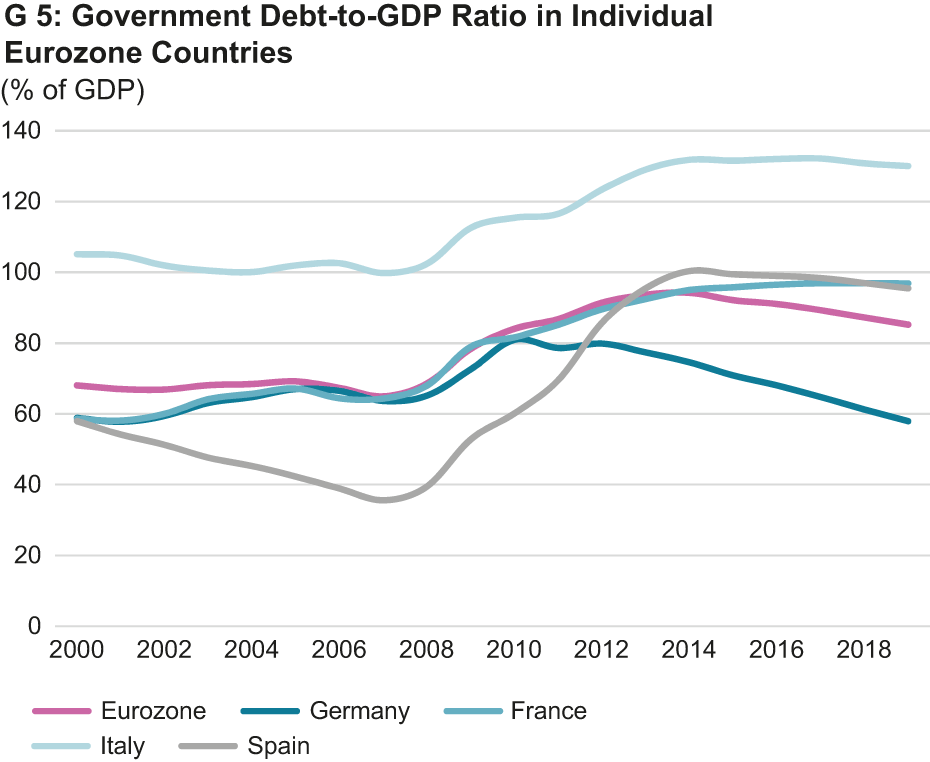

During the crisis years, stimulus packages and bank rescues resulted in a substantial increase in sovereign debt in many countries and debt levels are still higher than before the crisis (see Graph G 5). In the Eurozone, the debt-to-GDP ratio currently stands at just under 90%. In 2007, it was still at 65%. Among the bigger countries, at around 130%, Italy has a particularly high debt-to-GDP ratio. However, Portugal and Greece also have very high ratios of 130% and 180% respectively. Spain and France both stabilised their debt-to-GDP ratios at a high level. All in all, government budgets in the Eurozone have substantially less fiscal leeway now than they had before the crisis. For most countries, the Maastricht debt ceiling of 60% is out of reach. Among the big nations, Germany is the only one that may reach this criterion in the near future.

In the coming years, the European Central Bank is likely to initiate a normalisation of its monetary policy. A rise in interest rates would also push up the financing costs incurred by government budgets. This raises concerns in two areas: On the one hand, debt-to-GDP ratios are now much higher than a decade ago. On the other hand, since the crisis, some countries have acquired noticeable spreads compared to German government bond yields. Both factors are likely to affect the financing costs of countries with more significant debts.

How soon a normalisation of monetary policy will affect the interest burden of the individual countries depends on various factors, such as the speed of the interest rate turnaround, the trend in risk premiums and the debt structure. Analysis of outstanding bonds in Germany, France, Italy and Spain shows that between 15% and 18% of the outstanding debt is typically financed via short-term instruments (due in < 1 year) and a further small percentage via bank loans. In the case of short-term financial instruments, interest rate changes should affect government budgets relatively swiftly. The largest percentage of public debt has an average term to maturity of 4 to 6 years. Accordingly, the full impact of interest rate changes on the interest burden of public budgets would be delayed for several years.

In the medium-term, an interest rate turnaround would result in an additional consolidation requirement every year, when expiring bonds are replaced with new securities that may be subject to higher interest rates. This involves the danger of a new sovereign debt crisis in the Eurozone, spreading primarily from the countries with higher debt levels. It is not clear whether institutional framework conditions in the Eurozone are now strong enough to counteract this risk.

Contact

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland

Contact

No database information available