Swiss Foreign Trade in 2017: Financial Crisis Dip Compensated After Close to 10 Years

- Swiss Economy

- KOF Bulletin

Last year, export companies managed to emulate the export figures of the period before 2008. Finally, foreign trade appears to have recovered from the recession and the Swiss franc shock.

Review of 2017: back to 2008 levels

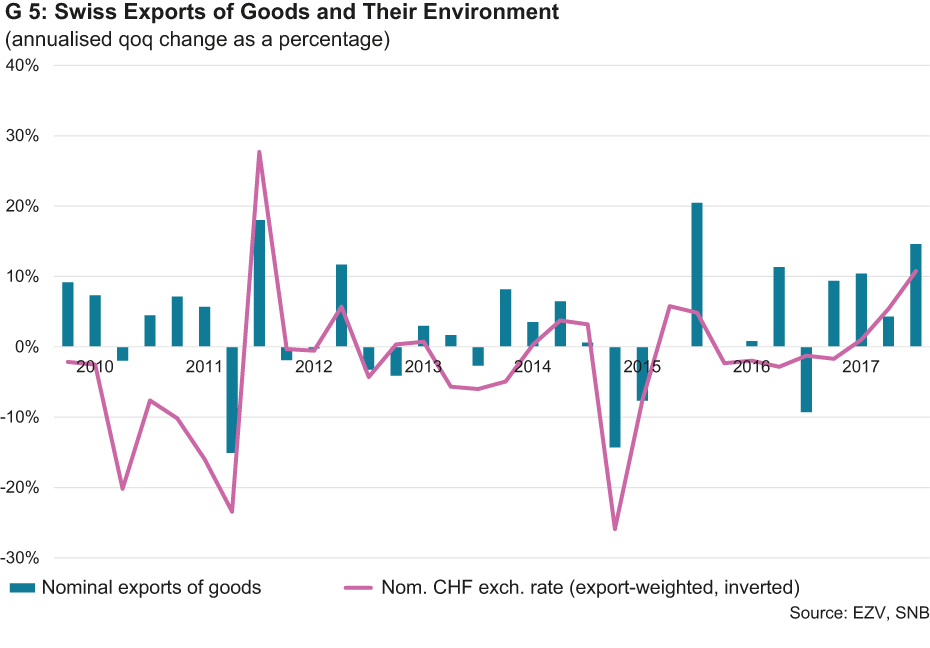

The Swiss export industry ended the last year on a good note. According to the foreign trade statistics, the domestic industry exported goods worth over CHF 220 billion in 2017. This represents a 4.7% increase over the previous year. Exports of goods were back at the level of the year 2008 and hence the period before the big recession and the subsequent waves made by the Swiss franc appreciation and its negative impact on the export industry (see G 5).

Thanks to the robust global economy, exports expanded on a broad basis. A slight dip in the currency allowed prices in CHF to rise, which should have resulted in a certain improvement of exporters’ margins. On a price-adjusted basis, exports of goods in 2017 rose by 1.7% over the previous year. Robust export demand has also driven up imports of goods. Despite higher prices, imports rose by a nominal 6.9% last year.

Sector analysis: strong watch industry

In terms of sectors, the chemical-pharmaceutical industry once again delivered a substantial contribution to export growth in 2017. However, this result primarily arose from a statistical overhang from the year 2016 when the industry’s foreign sales expanded by more than 10%. By contrast, the trend in 2017 remained largely flat. Other sectors were far more dynamic. Following two difficult years, the watch industry was picking up again and increased its exports by just under 3%. Demand rose particularly in the key Hong Kong and Chinese markets. Foreign sales of precision instruments, which also include medical devices as well as measuring and test equipment, also met with healthy demand abroad and have now reached a level of 80% of watch exports. Growth in this sector amounted to approx. 4.5%. On top of this, the lively global economy, especially in the Eurozone, is finally having an effect on the MEM (mechanical engineering, electronic, metal) industry. While the last M in MEM, the metal companies, raised exports by 12%, overseas sales of machinery, electronics and instruments expanded rather slowly – especially in the second six months of the year.

Country analysis: China’s importance is growing

On the one hand, the positive export trend in the last year is due to stable growth of demand in the industrialised countries. On the other hand, sales opportunities have also improved in most emerging markets. Big emerging markets, such as Brazil and Russia, have finally come out of recession and demand in Asia has also regained some of its previous dynamics. The only exception were the oil exporting countries, where demand remained on the weak side. However, China is becoming an increasingly important market for Swiss industry. Given an export volume of CHF 11.4 billion, China has overtaken the UK and is now the fifth most important trading partner. On the import side, China was also playing an increasingly important role in the last year.

Outlook remains favourable

At the beginning of the current year, the international environment remained positive for the Swiss export industry. The dynamic foreign trade trend of the last two quarters appears to continue, as reflected by the foreign trade statistics’ January figures. Current business tendency surveys also indicate that domestic industrial companies expect further strong impulses from their export business. All in all, it looks like the Swiss export industry has embarked on a solid path of recovery.

Contact

No database information available