KOF Economic Forecast, Spring 2018: Broad-Based Upswing

- Forecasts

- KOF Bulletin

The Swiss economy is booming. KOF expects a comparatively high GDP growth rate of 2.5% this year and a relatively favourable economic trend in 2019 (1.8%). There is good news from the employment market, which should record a slight decline in the unemployment rate. Inflation will slowly move into the positive range.

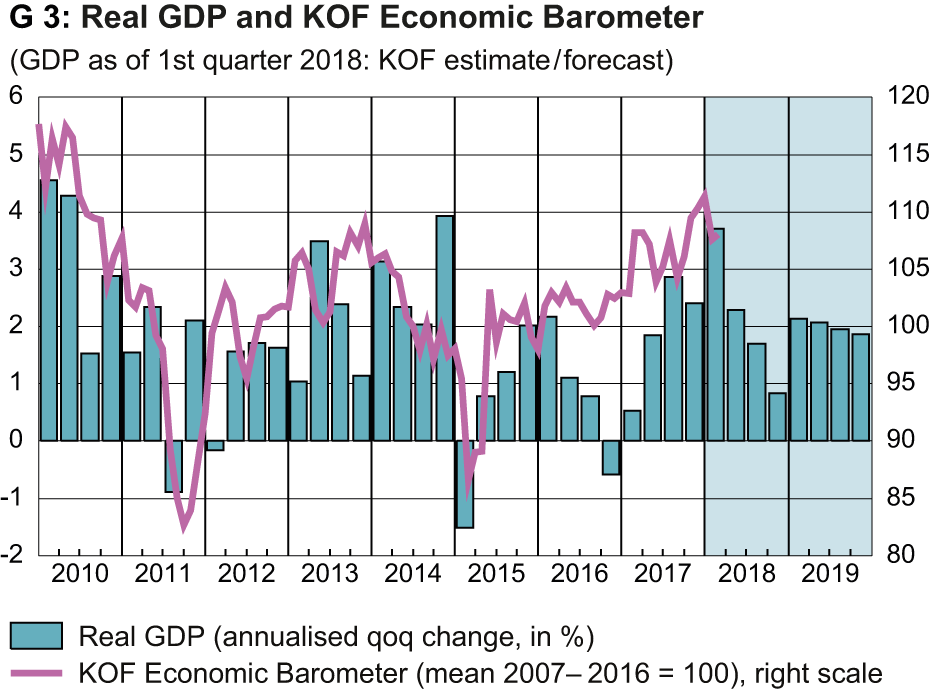

At present, the Swiss economy is following a very favourable trend (see G 3). Both export- and import-oriented sectors are expanding substantially and news from the corporate sector is almost uniformly positive. The main reason for this excellent development is the improved economic situation in Switzerland’s key trading partners, although the Swiss franc’s weakening against the euro also contributed. The exchange rate trend predominantly resulted in a further margin recovery among exporting companies.

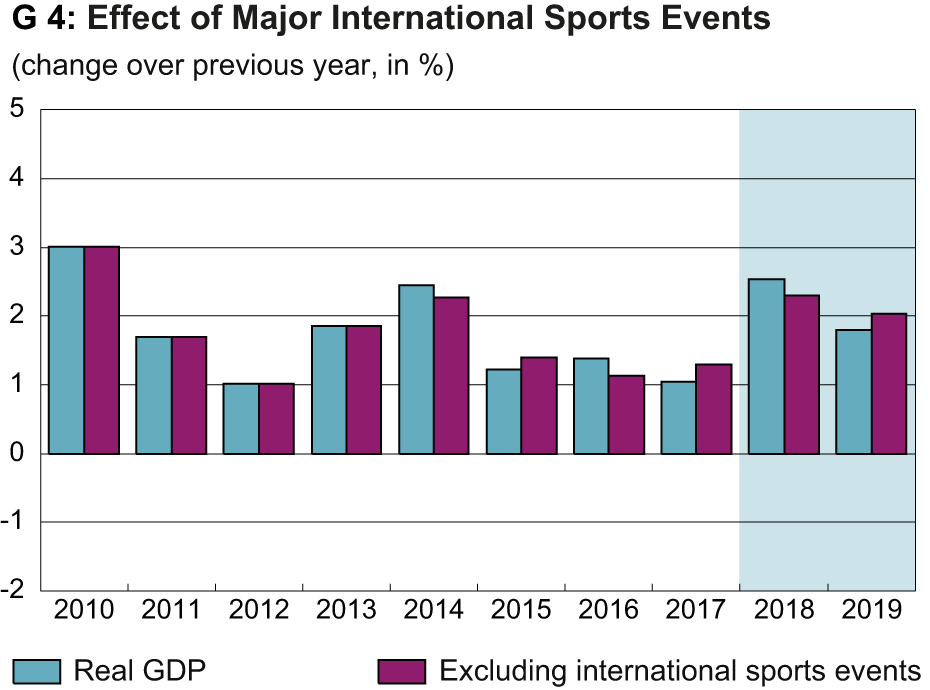

In its spring forecast, KOF has adjusted its projections slightly upward compared to the winter forecast. We now expect the economy to grow by 2.5% this year. However, part of this increase is due to events that relate only indirectly to production activities on Swiss soil. Large portions of the income from big international sport events are included in the Swiss gross national product (GDP) if the organising association is domiciled in Switzerland and appropriates the respective income. In the current year, two such big events have, or will be, taking place – the Olympic Winter Games in South Korea and the Football World Cup in Russia. The IOC and FIFA, which hold the marketing rights to these events, are both domiciled in Switzerland. We estimate that the associated additional added value accounts for approximately 0.3% of Swiss GDP. In the absence of this effect in the following year, the estimated growth rate for 2019 is 1.8%. However, adjusted by the effects of the sports events, the anticipated growth rate for 2019 is hardly lower than the growth rate for this year (see G 4).

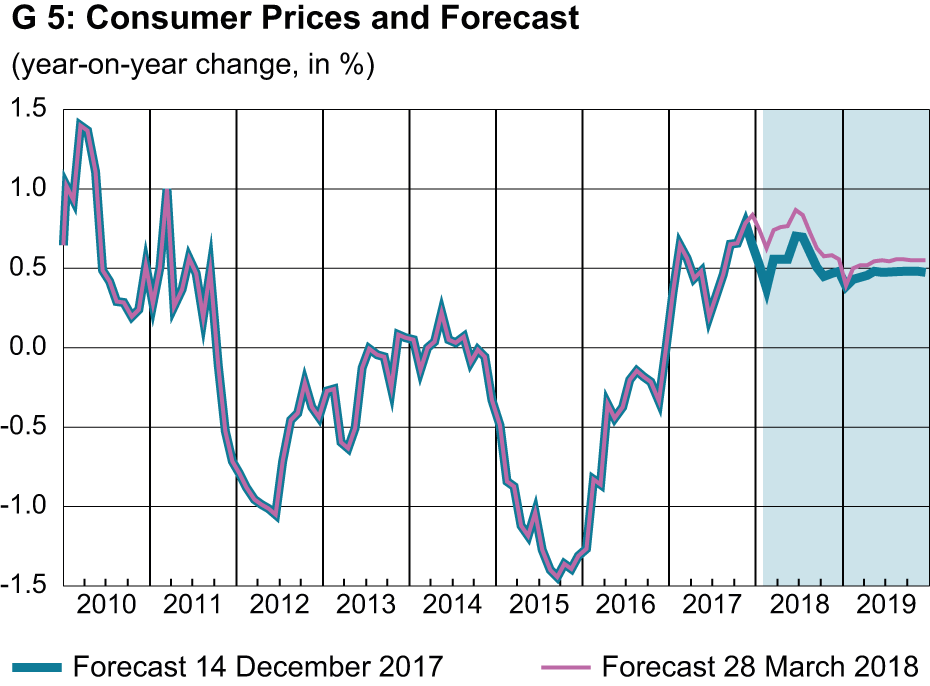

Due to this special effect, it is not surprising that employment figures are rising insignificantly, unemployment is declining slowly and upward pressure on wages is minor despite robust economic growth – and contrary to a swift glance at the growth rates for 2019. Consequently, domestic production is placing very little upward pressure on prices. Nevertheless, the lower CHF/EUR exchange rate and the slightly higher crude oil price are likely to result in an inflation rate of 0.7% this year. Inflation is likely to remain low and may even decline over the course of the year (see G 5). It is therefore unlikely that a need for more restrictive monetary policies will be derived from rising prices.

Given the current situation, we expect the Swiss National Bank (SNB) to remain in line with the European Central Bank’s (ECB) interest-rate policy in order to maintain the usual interest spread to euro investments. The ECB is not expected to introduce any interest rate adjustments before 2019. Our forecast also assumes a relatively stable exchange rate between the Swiss franc and the euro, and we do not expect the SNB to come under any pressure to act.

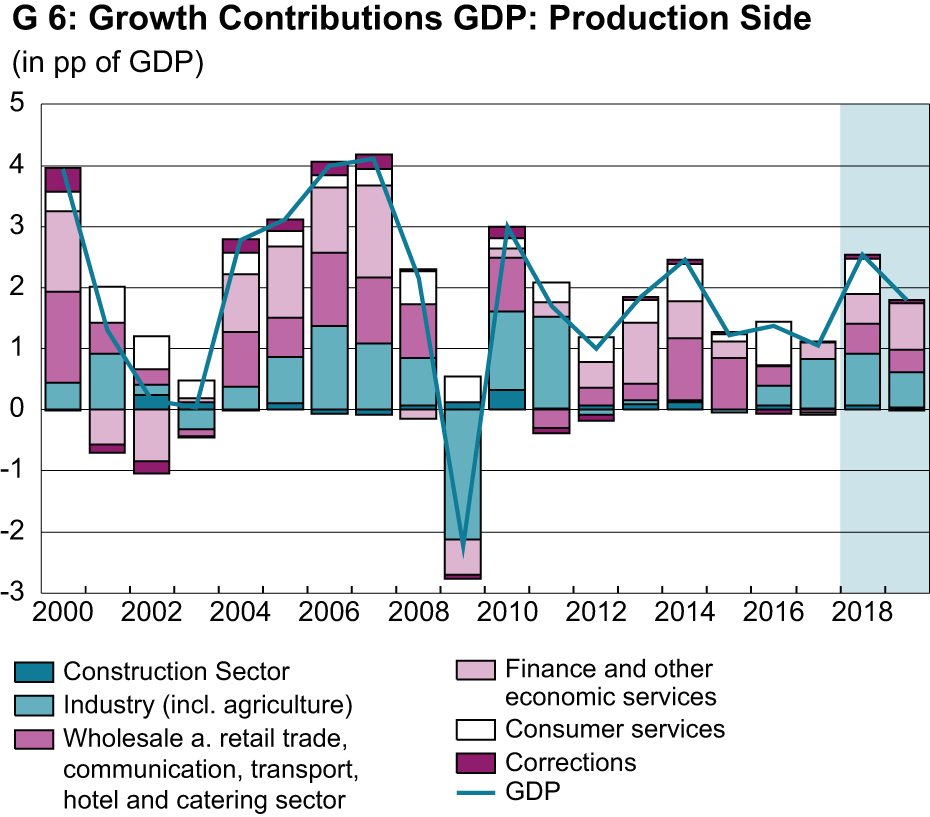

The positive economic trend is currently broad-based (see G 6). In contrast to the last few years, when the pharmaceutical industry was the main growth driver aside from the domestically-oriented education and healthcare sectors, other industries are now also contributing significantly to the upswing. The mechanical engineering and metal sectors, which had a very difficult time in the last few years, are growing again, and the temporary decline in the watch industry should be over now. Even tourism, which has received its only positive momentum from domestic and non-European visitors, has been reporting an increase in guests from neighbouring countries. This is particularly important for regions that benefited little from the past increase in Asian visitors.

The situation in the distributive trades has also stabilised. Retail, a domestically-oriented sector that had come under increased pressure from cross-border shopping in the last years, has managed to improve its position due to the weaker Swiss franc. The industry has adopted an optimistic outlook and both turnover and revenue should be on the rise.

Merchanting has failed to achieve any substantial increase in revenues since 2010. This is due to exchange rate effects since the industry’s earnings are almost exclusively generated in foreign currencies. It is difficult to forecast revenues in this sector given their significant dependence on regionally diverging commodity prices that are also subject to considerable fluctuations. Our forecast is based on a technical assumption and anticipates revenues in the same ballpark as in the last few years. The sector’s activities, subjected to stricter regulation, which will lead to higher costs but will not necessarily reduce gross revenues.

The balance has shifted in the financial sector. Before the financial crisis, added value in banking was generally twice as high as in insurance. Since then, income in the lending industry has declined while insurance has continued to grow. As a consequence, added value in the insurance sector is now very close to that generated in banking. Our forecast anticipates a return to more significant growth in the financial sector as a whole, not only in the insurance business.

Improved prospects are usually associated with a higher propensity to invest. With construction activities already rather lively, especially in the residential and education/healthcare sectors, no further substantial increase is expected. We even anticipate a slight decline in residential construction since the number of completed apartments already exceeds the expected rise in demand. Given our expectation of a shift in investments in plant and machinery from the transport sector to the other industries, growth is likely to be lower than in the last few years. Although a return to higher investment in the transport sector, which would lead to more investment and higher imports, is not impossible, the short-term effects on added value in Switzerland should be on the modest side.

Forecast risks

As is often the case, the main risks associated with our forecasts relate to the international environment. If the exit from ultra-expansive monetary policies in Switzerland’s main export markets is less successful than anticipated, or if tension in one of the international flashpoints significantly affects economic uncertainty, our assumptions may turn out to be over-optimistic. In addition, the risk of an uncontrolled Brexit in spring 2019, which is currently on the rise, could affect the European economy and hence Switzerland. As a traditional safe-haven currency, the Swiss franc poses a potential risk to the Swiss economy, which could also manifest itself during the forecast period. A further escalation of international trade disputes would also have a dampening effect on the global, and consequently the Swiss, economy.

Possible positive surprises include a European investment cycle that accelerates faster than expected. The current upswing in Europe is already driven by positive investment activities. The internationally-oriented Swiss economy would benefit if investments rose faster than anticipated.

Contact

KOF FB Konjunktur

Leonhardstrasse 21

8092

Zürich

Switzerland