Swiss Companies Expand Capacities

- Swiss Economy

- KOF Bulletin

Total investment in Switzerland continues to rise in 2018, as shown by the results of the semi-an-nual KOF Investment Survey. Surveyed companies intend to increase investment activities by around 8% this year. A significant part of the planned investments will be funnelled into the expan-sion of existing capacities.

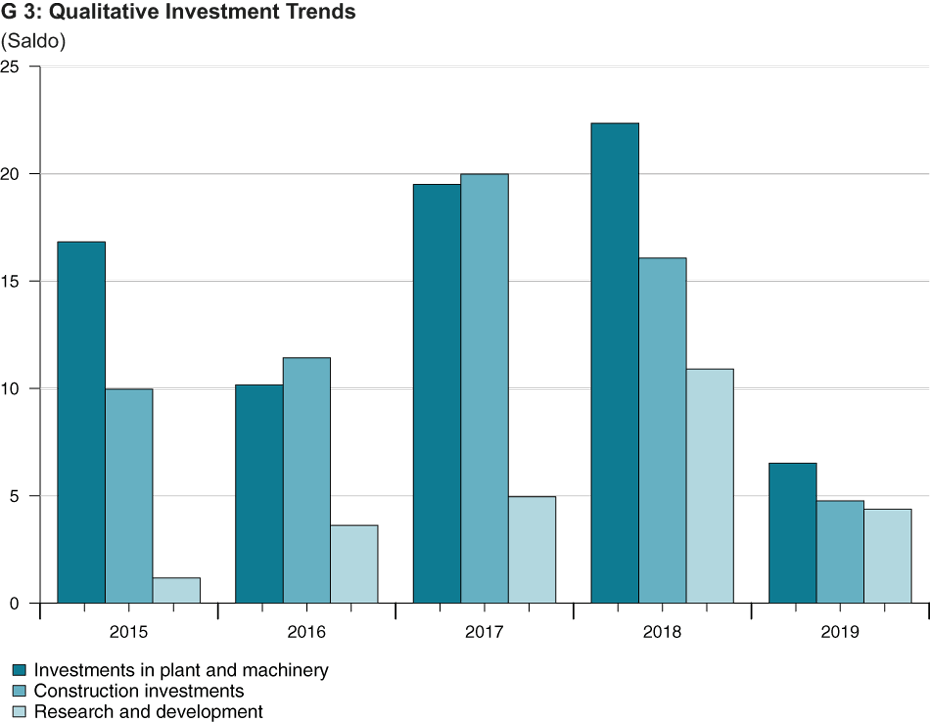

The Investment Survey conducted in spring 2018, which has now been completed, provides the second set of invest-ment figures for 2018. Last autumn, the survey participants already provided assessments of their expected investment activities in 2018. At the time, they anticipated an increase in investment activities of around 8%, with industry and the service sector the main growth drivers. The current results show that the respondents’ expectations have not changed much. According to the survey, the companies still antic-ipate a robust rise in investments of some 8% in 2018. The main dynamics are coming from the manufacturing industry and the service sector. Swiss construction com-panies have budgeted a less significant rise in invest-ment spending in the current year. The growth in total investments is driven both by investments in plant and machinery and construction investments. Research & development expenditure also shows robust dynamics this year. For 2019, the companies anticipate a slight decline in investment activities. According to the current survey, growth in investments will be much more moderate than in 2018. The results of the Investment Survey suggest that the latest Swiss investment cycle will end in 2019.

Industrial and service sectors provide momentum

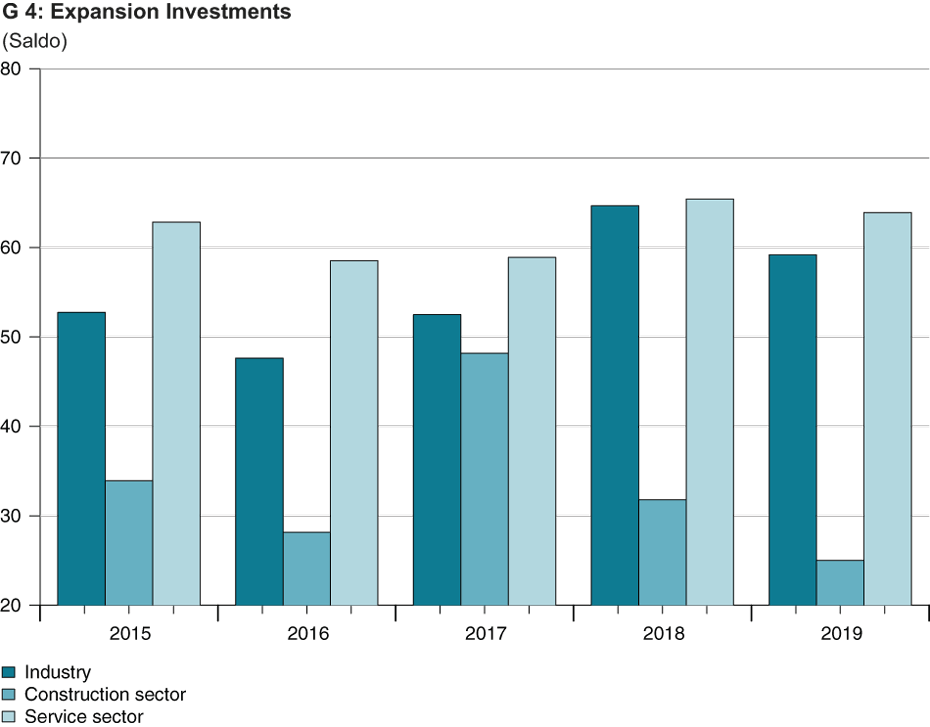

According to the survey participants, the percentage of expansion investments is set to rise further in 2018. Around 65% of the industrial enterprises and service providers plan to expand their production capacities in 2018. Despite lower investment dynamics, the percentage of expansion investments should also remain high in the coming year. Although the share of companies budgeting for expansion investments will decline slightly in both sectors, the overall percentage will remain at a high level. In contrast to indus-trial enterprises and service providers, the percentage of construction companies investing in capacity expansion is far lower. While the share of construction companies investing in expansion was close to 50% in 2017, only 32% of the investing companies are planning to invest in the expansion of their production capacities in the current year. This percentage is set to decline even further in 2019. All in all, only one in four Swiss construction companies is plan-ning to invest in capacity expansion.

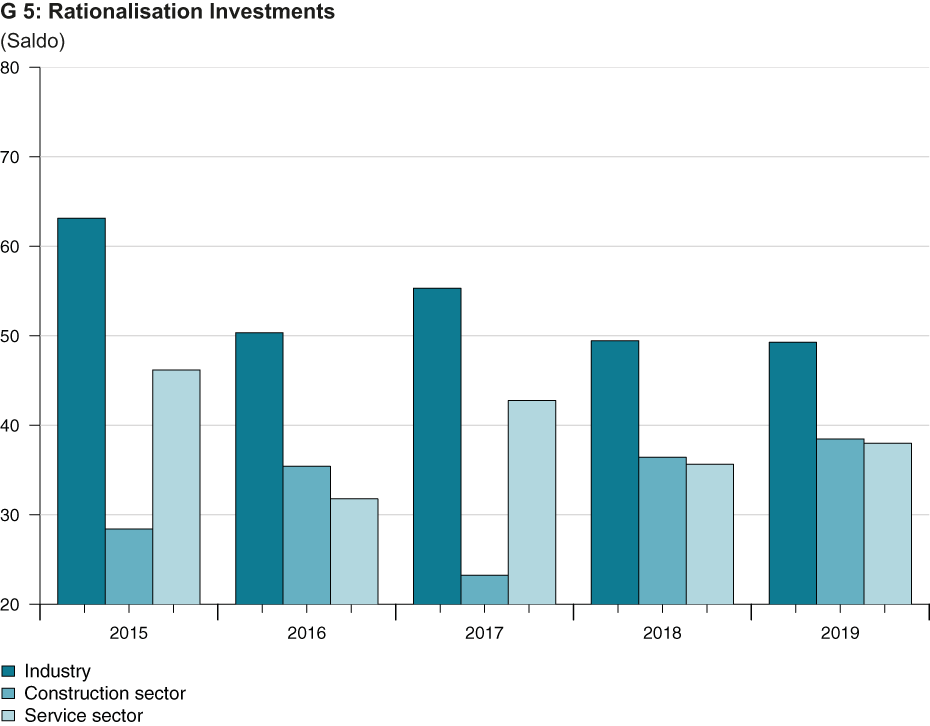

The percentage of rationalisation investments is set to decline slightly in both the manufacturing industry and the service sector. While pressure to rationalise had risen substantially after the Swiss franc appreciation in 2015 and efficiency dominated the companies’ investment decisions, rationalisation now plays a secondary role in current investment plans. Similar to expansion investment, rationalisation investment in the construction sector pre-sents a heterogeneous picture. In the past three years, the percentage of construction companies investing in ration-alisation was relatively small. This is firstly due to the fact that the impact of the Swiss franc crisis was lower on the construction sector than on the manufacturing industry and the service sector, and secondly that Swiss building companies have benefited from expansive construction activities in the last few years, which reduced the pressure to rationalise. The current year will see a shift from expansion to rationalisation investments. According to the survey results, the percentage of construction com-panies investing in rationalisation will rise substantially in the coming two years.

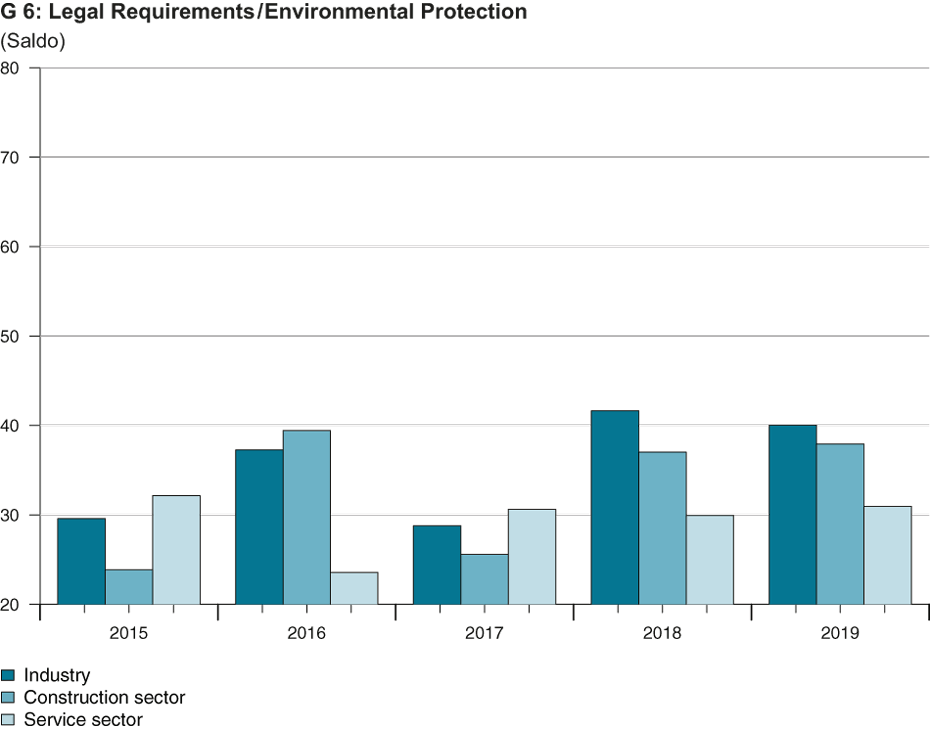

In 2018 and 2019, investments due to commercial stipula-tions and legal requirements will also play a slightly more prominent role aside from expansion and rationalisation investments. Especially the industrial sector is likely to invest more due to legal standards.

Contact

Professur f. Wirtschaftsforschung

Leonhardstrasse 21

8092

Zürich

Switzerland