Real Estate Investments by Swiss Institutional Investors Pose a Downside Risk

- Construction Industry

- KOF Bulletin

Most Swiss people rent their home rather than buy an apartment or house during their lifetime. Only 38% of Swiss households are homeowners – the lowest homeownership ratio in Europe. Furthermore, only a fifth of the housing stock are single family dwellings – with a declining trend. The reasons behind these low figures are both structural and cyclical.

This blog post highlights the main drivers, sheds light on the recent development towards multi-family house construction and provides an outlook of Swiss residential construction in the next years.

Structural factors

It is not straightforward to explain the low homeownership rate in Switzerland structurally. However, there are some factors which may influence the households’ decision to rent rather than to buy a home. First of all, there are very few tax policies incentivising homeownership – especially compared to other European countries – and the national rental value is part of the income tax base. Furthermore, the high quality of rented apartments and houses across all sizes and locations make renting attractive. Additionally, the high price level of real estate make house or apartment purchases unaffordable for a large circle of households – despite the current attractive financing conditions. This list of structural factors is certainly not exhaustive. Delbaggio & Wanzenried (2010) provide further explanations for regional differences in homeownership.

Cyclical developments

On the cyclical front, recently there have been a couple of policies and economic conditions which accentuate the trend to multi-family house construction. Since 2012, a couple of macroprudential policies have been introduced to reduce mortgage lending and to increase the resilience of the Swiss banking sector towards a housing bubble or a real estate crisis. For instance, the self-regulatory measures by Swiss banks comprise new minimum requirements for mortgage financing such as the amortisation of a third of the mortgage in 20 years (since 2012), respectively in 15 years (since 2014), equity requirements of 10% as well as the valuation at the lower of cost or market. Furthermore, the Swiss National Bank activated the countercyclical capital buffer of 1% in 2013 and increased it to 2% in 2014. The Swiss economy experienced a severe real estate crisis in the 1990s. Therefore, policymakers and the public are very sensitive towards sharply rising house prices and real estate bubbles.

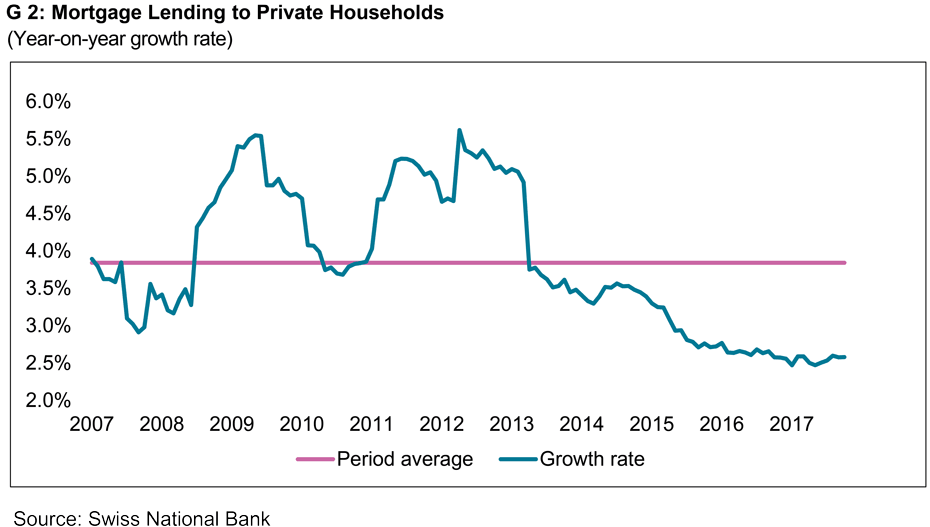

These measures seem to have had a dampening effect on mortgage lending. As illustrated in the chart, mortgage lending to households expanded on a high rate of 5-6% from 2009-2013 year-on-year. Since 2014, mortgage lending calmed down significantly, reaching growth rates of 3%, which is well below the average growth rate of the past ten years – despite the extremely attractive mortgage rates. It is of course difficult to evaluate to what extent supply, demand or even macroprudential policies are responsible for the slow down in mortgage lending. Nevertheless, macroprudential policies certainly contributed to some extent.

The low interest rate environment in Switzerland since the financial crisis does not only make mortgages affordable, but also attracts investments by institutional investors in the real estate market. With low or negative government bond yields, the institutional investors are on a search for yield to invest the ample liquidity available. The return differential between real estate investments and the government bond yield has fallen, but is still remarkable with 3.6% last year. In 2017, Swiss pension funds invested 23% of their portfolio in real estate (Credit Suisse Pension Fund Index). In 2003, when the Pension Fund Index was introduced, the share was only 8%. Recently, the investors got more cautious with regards to object choice. Real estate prices in the periphery may start to correct and a supply surplus may build up.

Therefore, the Swiss National Bank sees a heightened risk for residential investment property lending. “[It] monitors the development on the mortgage and real estate markets closely, and regularly reassess the need for an adjustment of the countercyclical capital buffer.” (SNB, 2018). With rising interest rates and a sharp correction of real estate prices, the high investments of institutional investors into multi-family housing pose a risk to both residential construction and the Swiss banking sector.

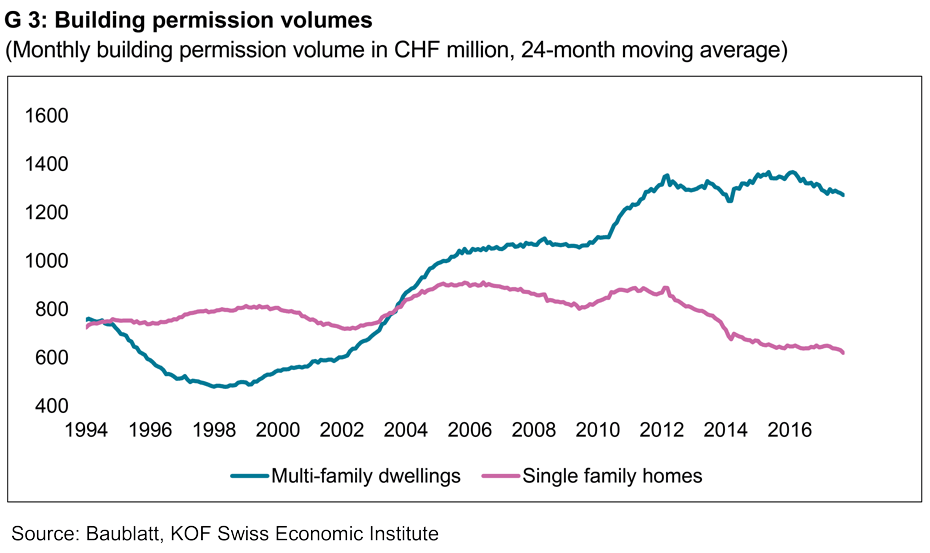

The trend to multi-family house construction can also be seen in the volume of construction permits. Chart 2 illustrates the 24-month moving average value of new multi-family house and single-family house permits since 1994. Since 2010, the construction costs associated to new multi-family house permits rose to about CHF 1,300 million per month on average. However, it shows a declining trend since 2013 – shortly after the introduction of macroprudential policies.

Residential construction outlook

The Swiss residential sector is currently developing robustly, but is not able to achieve the high growth rates of the boom years 2008-2014. A normalisation of monetary policy with rising interest rates will slow down the housing market from 2019 onwards. We expect a decline by -1.2% in 2019 and by -0.9% in 2020. The market is slowly saturated and a supply surplus may start to build up.

The trend to multi-family house construction will certainly continue, as can be seen by the volume of construction permits. However, a stronger than expected fall in investments of institutional investors poses a downside risk for the Swiss residential sector.

Contact

No database information available