Swiss tourism: a return to competitiveness thanks to falling prices

- KOF Tourism Forecast

- KOF Bulletin

Following an extended lean period, the Swiss tourism sector has the wind in its sails again. The main reason for this is the fall in relative prices, in particular compared to Austria.

Following a difficult couple of years, the Swiss tourism sector has the wind in its sails again. Foreign demand, measured in terms of the number of overnight stays in hotels, has been growing again since 2017. However, alongside real demand, corporate earnings are particularly important for operators in the tourism sector. Prices are an important ingredient in this mix. Especially during periods of strength for the Swiss franc, many hoteliers slash their prices due to the weak demand, and have thus been able to make up in part for drops in demand. Thanks to this price restraint, it has been possible to make up for some of the loss in price competitiveness compared to foreign operators resulting from the increase in the value of the Swiss franc. However, since the cost structure leaves little room for manoeuvre for many operators, this has led to a fall in corporate earnings. How have prices in the tourism sector performed compared to the economy as a whole, and compared to foreign countries? And what can be said about future price trends?

Tourism prices relative to the economy as a whole and compared to foreign countries

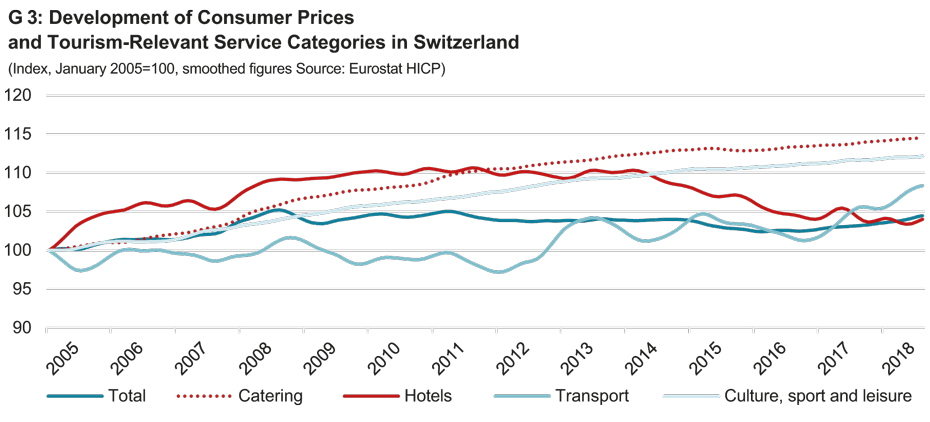

Over the last few years, consumer prices have trended sideways and have been following a downward trajectory since 2010. In particular imported goods have become cheaper as a result of the stronger franc. Until 2010, prices in the hotel sector grew slightly more strongly than the index as a whole, although have clearly fallen back since 2015 (see graph G 3). Prices in the hotel sector this year are around 5% below the 2010 level. Compared to the hotel sector, prices in other tourism categories such as catering, transport services and culture, sport and leisure services have increased since 2010, and have in fact grown even more strongly than the index as a whole. In contrast to the hotel sector, most demand in these categories is non-tourist.

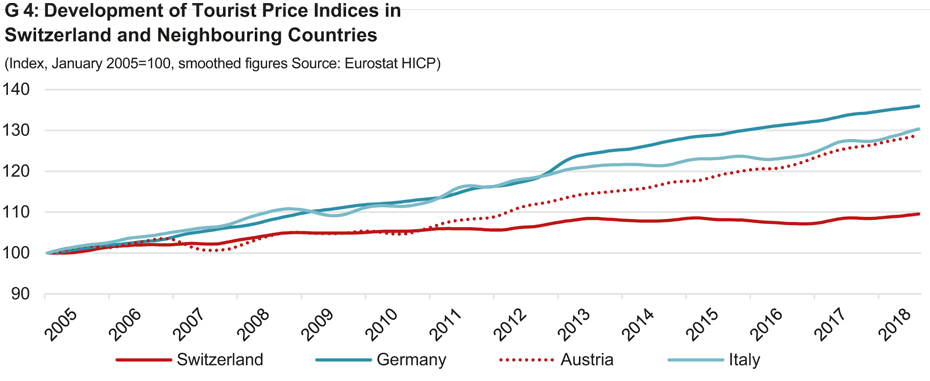

In order to be able to compare tourism prices in Switzerland with prices abroad, a tourism-specific price index can be obtained from the service categories mentioned above. The weighting of the individual categories in the index corresponds to the share of spending attributable to Swiss tourism, and is based on the Tourism Satellite Account. The shares of spending may be broken down as follows: 34% for culture, sport and leisure services, 27% for transport services, 23% for hotels and 16% for catering. Tourism-related products such as for example retail trade or healthcare spending are not taken into account. A tourism-specific price index is calculated for Switzerland as well as for Germany, France, Italy and Austria. For the sake of simplicity, we use the weighting established for Switzerland also for other countries. As the results in graph G 4 show, tourism prices in neighbouring countries have increased by around 30 to 35% since 2005. The price increase in Switzerland over the same period has been only 10%.

Price trends as an indicator of international competitiveness

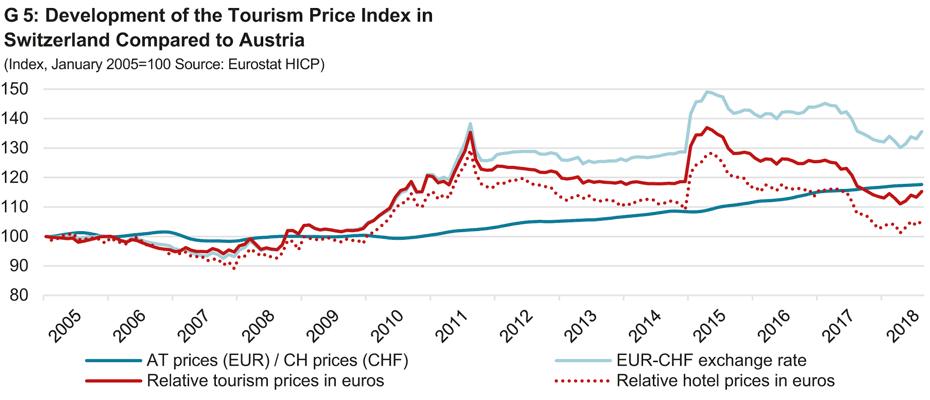

Price trends are an important indicator of international competitiveness. For this reason, we compare tourism prices in Switzerland with Austria, a country with a comparable tourism sector. Any increase in the value of the Swiss franc compared to the euro has had the effect of making Swiss tourist destinations more expensive at a stroke compared to Austria, and has accordingly increased relative tourism prices between the two countries calculated in euros (graph G 5, red line). However, this price difference has been made up for over the medium to long-term, at least in part, by price restraint in Switzerland. Austrian tourism prices in euros have risen more strongly than Swiss prices in francs (blue line), in particular since 2010. This means that the relative price ratio in euros is at present only around 15% higher than it was in 2005. However, if only hotel prices are considered, the relative level from 2005 has almost been reached.

Outlook

The Swiss tourist sector has partly made up the competitive price disadvantage resulting from the increase in the value of the Swiss franc through price restraint. Thanks to increasing demand and steady supply on pan-Swiss level, capacity utilisation is currently rising. There are signs once again of price rises, along with the associated improvement in corporate earnings, in particular in the hotel sector. It is also apparent from the KOF surveys that the middle of last year marked a sea change in price expectations. Assuming that the exchange rate between the franc and the euro remains stable, overall prices in the tourism sector as a whole are projected to rise this year by just under 1%. Increases in the hotel sector will be somewhat more restrained. Following continuing price falls this year, hotel prices are only expected to start rising next year.

Contact

No database information available