Is Switzerland Still at the "Spearhead of Innovation"?

- Innovation

- KOF Bulletin

KOF has investigated investment activities in the Swiss economy in the period from 2014 to 2016 on behalf of the Swiss State Secretariat for Education, Research and Innovation (SERI). The survey was conducted among private companies in the industrial, construction and service sectors. It appears that innovation activities have become more difficult and costly for Swiss companies.

Switzerland is still among the most innovative countries in the world, however…

For many years now, Switzerland has held one of the top places, if not the top spot, in international innovation rankings1. However, with a number of signs pointing towards a regressive trend, this picture is deceptive. Some of the relevant indicators have declined in the last few years, not least in comparison with other countries.

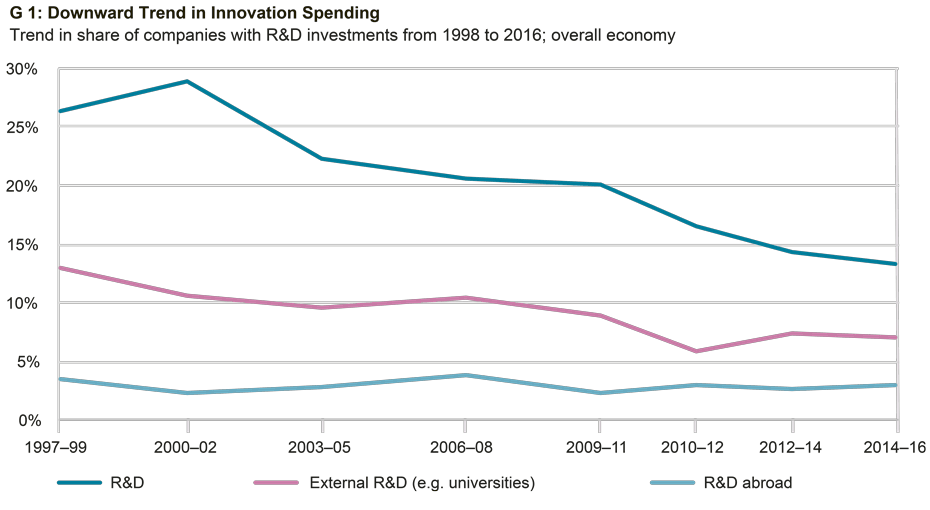

Increasingly, Swiss companies are finding it harder to innovate than in the past. The number of companies allocating funds to innovation activities is on the decline (see G 1). Two indicators confirm this trend. The largest drop is in the number of businesses conducting their R&D activities in Switzerland. By contrast, the percentage of Swiss companies conducting their R&D activities abroad has remained stable and external research contracts (universities and other research centres) have been back on the rise since 2012, after a long decline.

Irrespective of company size and sector, the main obstacle to innovation is the associated cost. The surveyed enterprises also often quote long payback periods as a substantial barrier to innovation. Lacking equity capital and opportunities to tap into external sources of funding, problems for SMEs primarily consist of the high cost of innovation and the associated financing.

Public innovation funding often goes to enterprises with more than 50 employees

In Switzerland, public innovation funding rarely involves direct financial support for companies. Instead, the government funds, for instance, a university’s share in joint enterprise-university research projects.

Despite the recent decline, the number of companies benefiting from public funding is now higher than 20 years ago. It is predominantly national programmes (e.g. by Innosuisse [formerly KTI]), cantonal support programmes and further national authorities which have increased their funding activities in the period from 2010 to 2014. Enterprises with more than 50 employees are the main beneficiaries of innovation funding (62.1% of all companies which received cantonal, regional or national funding in 2015). The financing problem primarily affects enterprises with less than 50 employees. In 2016, international funding programmes (e.g. by the EU) included no more than 2.1% of the companies. Again, it is mostly larger enterprises which take advantage of these programmes (6.5% compared to 1.8% SMEs).

Hence, it would be expedient if national programmes focussed more strongly on smaller companies which rarely benefit from international programmes.

Larger companies can invest more than SMEs

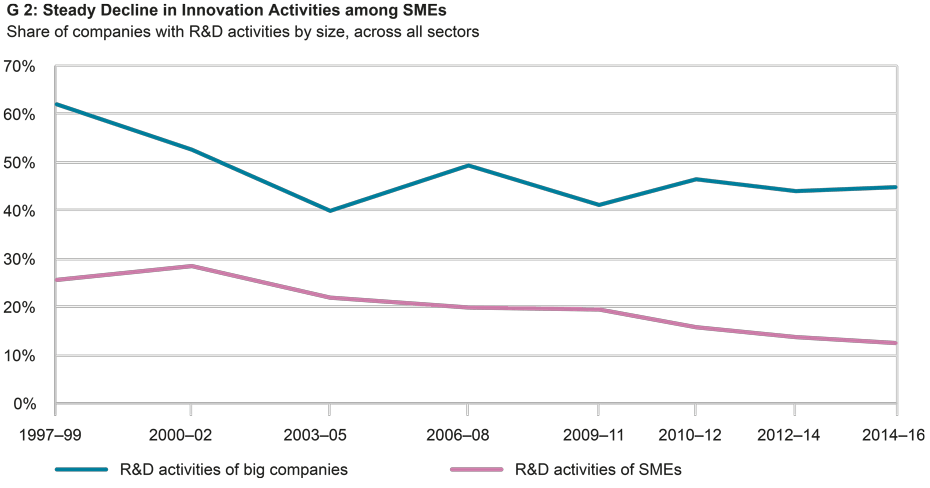

The gap between SMEs and big companies is widening where innovation is concerned. Since 2009, we have seen a slight rise in the percentage of big companies active in the field of R&D, while the share of innovation-active SMEs, which account for 99% of all companies in Switzerland, has been on the decline since 2000 (see G 2).

Furthermore, R&D spending as a percentage of sales is twice as high at big companies: Their average R&D intensity is 4.5%, while the respective figure for the overall economy is 2.2% and for SMEs 2.05%. On top of this, the number of innovative products as a percentage of sales has risen significantly among big companies in the last few years and now exceeds the average level of the other businesses (41% compared to 34.7%).

Link between innovation and digitalisation is getting stronger

Today, innovative companies in Switzerland are more likely to improve their products and adapt them to new developments generated by other innovators (e.g. optimisation of production processes) than to develop market innovations themselves (products or services).

Since digitalisation affects all aspects of enterprises and facilitates new business models, companies’ innovations and their degree of digitalisation are often closely linked.

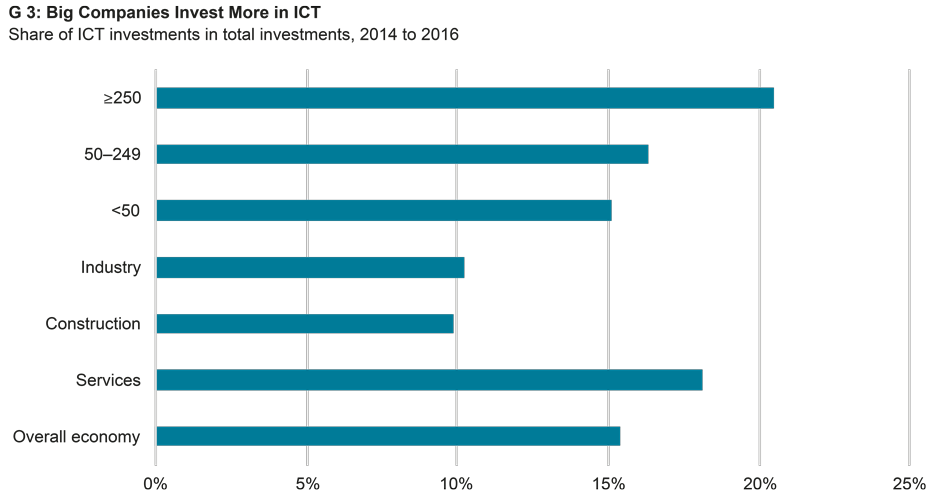

The degree of digitalisation can be assessed through the analysis of investments in information and communication technologies (ICT). In the period from 2014 to 2016, Swiss companies invested close to CHF 300,000 in ICT (hardware and software) on average. Big companies not only invest more in ICT in absolute terms, they also have a higher ICT investment percentage (measured on the basis of gross investments) than other companies (>20% compared to 16% for enterprises with 50–259 employees and 15% for smaller enterprises; see G 3). The same is true for services.

1 Global Innovation Index 2018 and the European Innovation Scoreboard 2018.

Contact

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland