Investment Dynamics Lower This Year

- KOF Bulletin

- Surveys

Total investment in Switzerland is set to lose momentum this year, as shown by the results of the semi-annual KOF Investment Survey. Although the respondents once again intend to increase their investment activities in the current year, they plan to do so to a lesser extent than in the last few years.

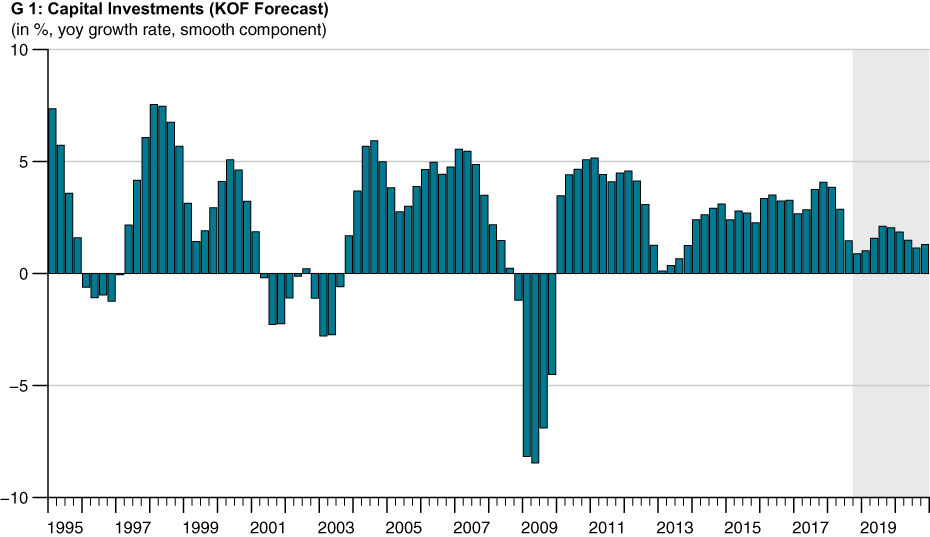

The Swiss economy has seen brisk investment activities for quite some time now. Although rather flat in historic comparison, the current investment cycle, which started in 2013, has been a remarkably long one and was still going in the first half of 2018 (see G 1). However, growth gradually slowed down over the second half of 2018. According to the KOF Economic Forecast, the investment cycle will come to an end in the current year. For 2018, for which definite figures are not yet available, KOF predicts a 2.3% increase in capital investments. In 2019, KOF expects a further decline in dynamics. All in all, KOF forecasts a real increase in capital investments of 1.7% for 2019. This projection is supported by the results of the current KOF Investment Survey.

The resilience of the current investment cycle is remarkable, especially its continuation throughout 2015 - the year in which Swiss companies were confronted with the suspension of the Swiss franc minimum exchange rate. There are two main reasons why, despite declining margins, companies were able to increase their capital investments by 2.3% during the year the minimum cap was abolished. Firstly, the share of imported capital goods is relatively high, allowing companies to implement lower-cost investment projects thanks to cheaper goods from abroad. Secondly, the appreciation of the Swiss franc pushed up the price of labour in relation to the price of capital. This made it more attractive for companies to invest in rationalisation and save costs. As a result, the relative share of companies investing in rationalisation increased substantially in 2015. By contrast, investments in capacity expansion played a comparably minor role.

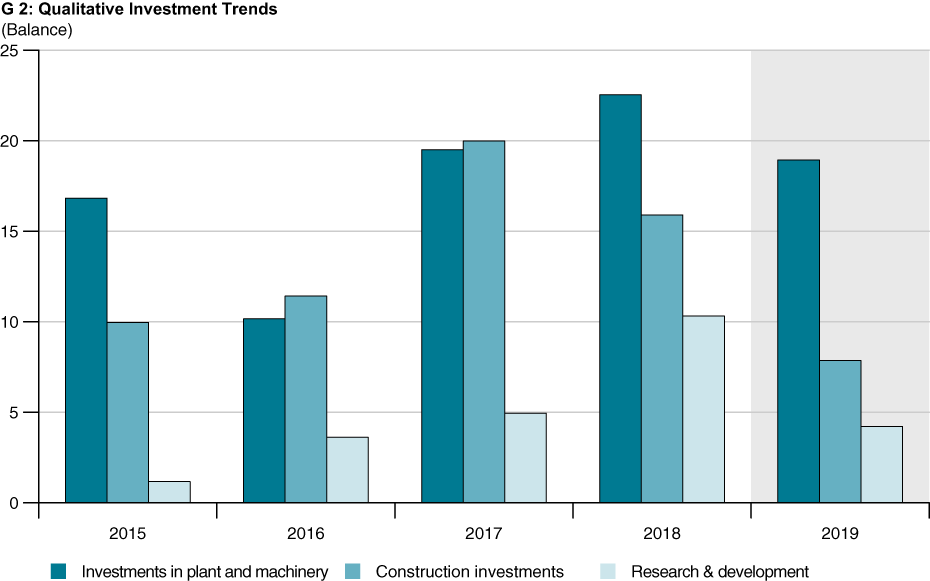

In 2016 and 2017, capital investments generally picked up speed. According to current estimates of the Swiss Federal Statistical Office (FSO), total capital investments rose by 3.4% in 2016. In 2017, Switzerland recorded a similar increase (3.3%). In terms of investment type, companies shifted their focus during these two years: According to the respondents of the KOF Investment Survey, the relative importance of rationalisation investments declined continuously throughout 2016 and 2017, while the share of companies engaging in expansion investments increased successively (see G 2). This trend continued in 2018: Investment activities were dominated by expansion investments in 2018, while rationalisation investments played a minor role. The current results of the KOF Investment Survey indicate a trend reversal in the present year, with rationalisation investments once again gaining importance.

Companies confirm expectations

The Investment Survey conducted in autumn 2018, which has now been completed, provides the second set of figures indicating the trend in corporate investments in 2019. According to the current results, companies’ expectations have hardly changed compared to the first survey in spring. As during the spring 2018 survey, the companies still expect investment momentum to slow down in 2019, with respondents anticipating lower dynamics in investments in plant and machinery as well as construction. Moreover, the companies believe that R&D expenditure will grow at a slower pace than previously (see G 3). Broken down according to size, the survey results show that smaller companies expect the most pronounced slowdown in investment dynamics. Big companies are capable of maintaining their expansion speed and can even increase it in some cases.

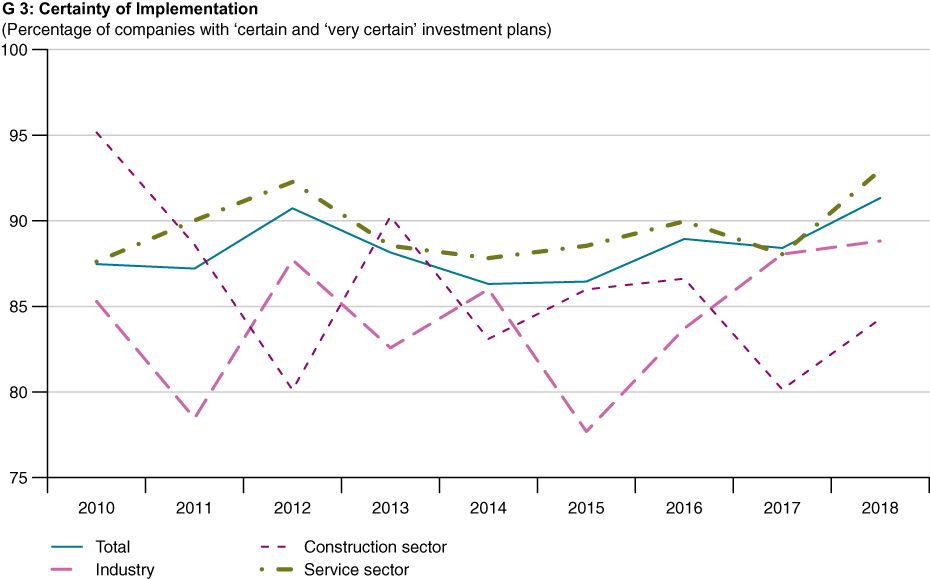

The investment tendencies compiled for the year 2019 are based on the companies’ plans, which are generally not yet of a definite nature. To determine the accuracy of the rate of change resulting from the plans, the companies were asked to assess the subjective certainty with which the planned investments will be carried out. In autumn 2018, 91.3% of the companies considered their investment plans to be certain or very certain, while 8.7% were either uncertain or very uncertain about their investment plans. All in all, the certainty of implementation is thus slightly higher than in past autumn surveys (see G 3).

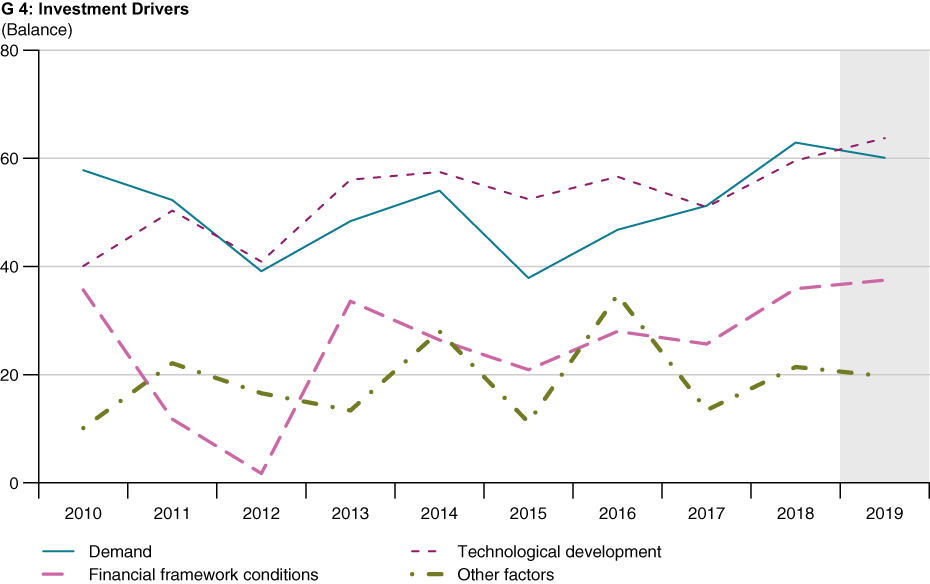

Investments driven by technological development

The results of the Investment Survey also shed light on the factors that affect companies’ investment decisions (see G 4). In 2018, investments were primarily driven by a positive demand trend. Demand will remain a driving force this year, although it has become slightly less relevant. According to the results of the KOF Investment Survey, technological developments are likely to be the main driver of investment in 2019. In 2018 and 2019, the companies are also benefiting from favourable financial framework conditions, which, according to the respondents, are having a positive effect on their investment activities. Analysis according to size categories shows that small and medium-sized companies benefit most from these favourable conditions.

Contact

Professur f. Wirtschaftsforschung

Leonhardstrasse 21

8092

Zürich

Switzerland