Globalisation Shifts Tax Burden onto Middle Class

- Fiscal Policy

- KOF Bulletin

Effectively taxing high-income businesses and workers is more difficult because of their global increase in mobility. According to a new study: Governments have consequently increased the income tax burden on the middle class. While, at the same time, the tax burden on top earners and businesses decreased.

Economists have long known that increasing globalisation would lead to considerable, but unequally distributed profits. This is due to heterogeneous effects on employment, wages and prices. For example, the disappearance of trade barriers in certain industries and labour markets can have negative effects on employment.

Globalisation-induced inequality could theoretically be alleviated by domestic policy. However, this would require a mechanism for redistributing profits to compensate those disadvantaged by globalisation. The defensive reactions to increasing globalisation in many places suggest that redistribution mechanisms of this kind are non-existent or ineffective in many cases.

The most obvious and frequently used instrument for such redistribution is income tax. Higher income tax could therefore be expected to go hand in hand with increasing globalisation, in order to impose relatively higher taxation on people with higher incomes. However, a new study by Peter Egger, Sergey Nigai and Nora Strecker shows that, since the mid-1990s, the effect has been the opposite. The top 5% of earners experienced a reduction in their relative tax burden, which increasingly shifted to employees in the middle and upper middle income brackets.

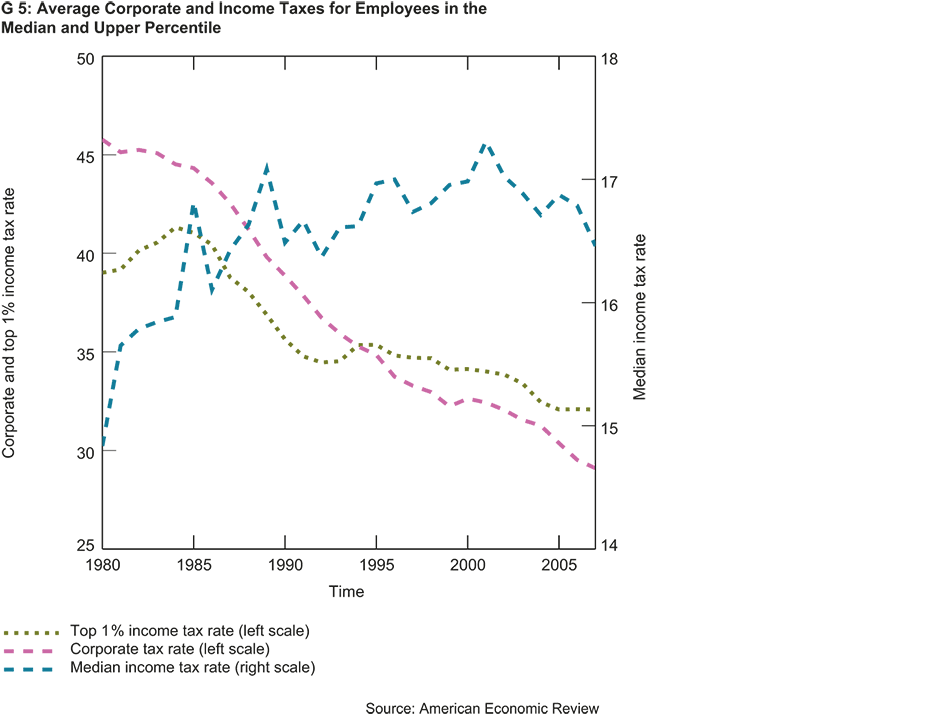

Mobility reduces effectiveness of taxes

Graph 5 shows how tax rates for businesses and incomes have changed in the 65 largest national economies between 1980 and 2007. Average corporation tax rates (red line) have fallen steadily during the period examined. This result illustrates what is known as the “race to the bottom”: It shows how tax competition between different locations results in falling corporation tax rates in all locations. Interestingly, diagram 1 also shows that the richest wage earners experienced similar tax competition – their average rate of income tax has also fallen steadily since the 1980s. By contrast, the average tax rate for employees in the median increased steadily during the same period.

Why was the tax impact on people in the middle of wage distribution so different to firms and high earners? The answer could lie in globalisation itself. Lower trade and migration barriers enable businesses and highly paid employees to be very mobile. This mobility influences the extent to which governments can collect tax revenues from these actors, before they move away for tax reasons. This mobility therefore severely restricts the effectiveness of taxation in a globalised world.

Similarly, lower effective tax rates are a significant factor in attracting foreign firms and a highly qualified workforce. Employees in the middle of income distribution, on the other hand, are much less mobile. This can be because their qualifications do not easily transfer across borders, or because they do not have the means to move for tax reasons. This limited mobility could be the reason why governments across the world have started to rely more on middle class workers to stabilise their tax base.

Coordination of taxation as a possible solution

Peter Egger, Sergey Nigai and Nora Strecker estimate that the top 1% of earners in OECD (Organisation for Economic Cooperation and Development) countries experienced, on average, a reduction in their relative income tax burden of 0.59 to 1.45 percentage points between 1994 and 2007, because of growing globalisation. The relative tax burden on the middle classes, on the other hand, rose by 0.03 to 0.05 percentage points. This indicates that the globalisation-induced change in tax progressivity has increased, and not reduced, net inequality. With the growing mobility of large enterprises and highly qualified employees, this process will probably continue.

A survey by Pew Research Center, conducted in 2014, revealed that around 60% of respondents saw inequality as a major challenge, and progressive taxation as a way of tackling this growing problem. However, in a globalised world, the solution cannot lie in unilaterally increasing marginal rates of tax, because, as long as tax competition for highly productive employees and companies exists, it is extremely difficult for countries to unilaterally tackle inequality with progressive taxes. One possible solution could be harmonisation and coordination on international income taxation. Although this is already a topic for taxes on capital, there is little discussion about international coordination of income tax. Examination of the costs and benefits of this kind of multi-lateral coordination might be worthwhile.

Contact

No database information available