Taxes: More Beneficial Terms for Larger Companies

- Fiscal Policy

- KOF Bulletin

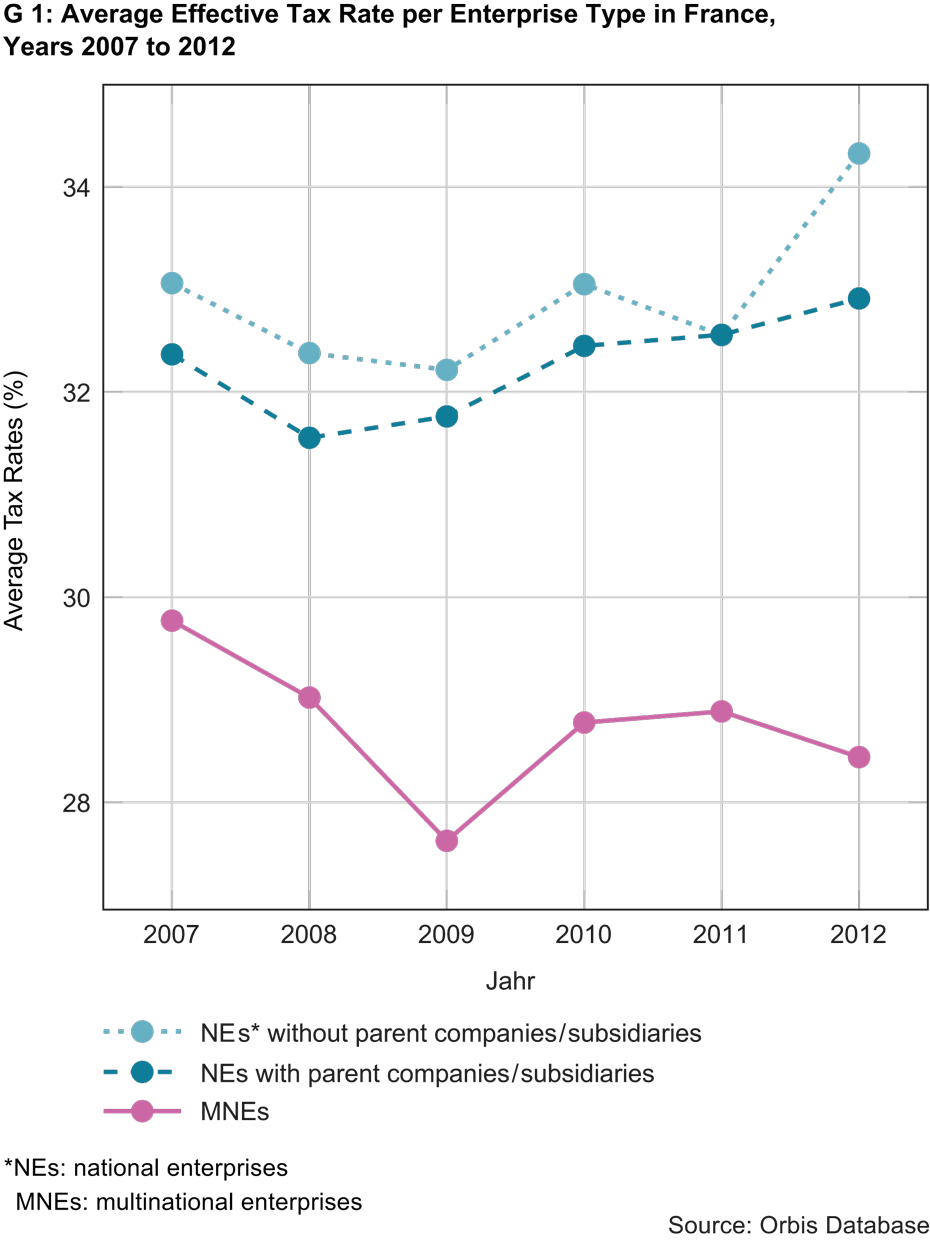

Multinational companies benefit from lower effective tax rates than national ones. The disparities result from differences in bargaining power with the state. Larger firms are able to negotiate deductions with the tax authorities and thus reduce their individual tax burden.

Multinational Enterprises (MNEs) are playing an increasingly important role within national and international business cycles. They are not only more profitable, more productive and larger but also pay higher salaries than companies with only a national presence. However, if larger groups pay hardly any corporation taxes, this leads to frustration and strident public protests. The Organisation for Economic Cooperation and Development (OECD) estimates that, every year, between 4% and 10% of global corporation tax income (thus between 100 and 240 billion US dollars) are lost to tax avoidance schemes.

In contrast to smaller and medium-sized enterprises and those that only have operations in one country, multinational firms are able to reduce their tax burden in three ways:

- Foreign subsidiaries enable MNEs to transfer profits abroad more easily in order to avoid tax in high-tax countries.

- Foreign subsidiaries prove to be more mobile than comparable national enterprises (NEs). This strengthens the hand of MNEs compared to NEs in negotiations with national governments.

- The greater economic significance of MNEs compared to NEs (in terms of profits, employee numbers etc.) further enhances this bargaining power.

These three aspects can result in a significantly lower level of tax on the corporate profits of multinational enterprises than on those earned by comparable national firms (see G 1). Classic profit transfer schemes such as transfer pricing (internal charges between different parts of a business), debt shifting or patent transfers followed by licence payments have previously been identified and addressed through coordinated action by international organisations.

A new working paper by Egger, Strecker and Zoller-Rydzek (2018) focuses on another scheme, which is related in particular to aspects 2) and 3): negotiations between tax authorities and enterprises. Companies can negotiate possible deductions with the tax authorities and thus reduce their individual tax burden. Binding tax rulings are an important instrument within this negotiating process. They enable enterprises to liaise with the tax authorities and to clarify deductions for any potential investments by them before they are actually made. Almost all European countries and the USA use these types of tax ruling.

More attractive for the tax authorities

The granting of tax concessions by the state is beneficial for MNEs in two senses. First, they are on average larger and significantly more profitable than NEs. This makes them more attractive for the tax authorities, which are hence willing to offer better terms to larger enterprises. Second, with their international parent companies and subsidiaries, multinational enterprises are more mobile and can thus more credibly threaten to transfer their operations abroad and to pay either no tax at all or significantly less tax in the country with which they are negotiating. These more credible foreign alternatives increase their bargaining power and can force tax authorities to make generous concessions.

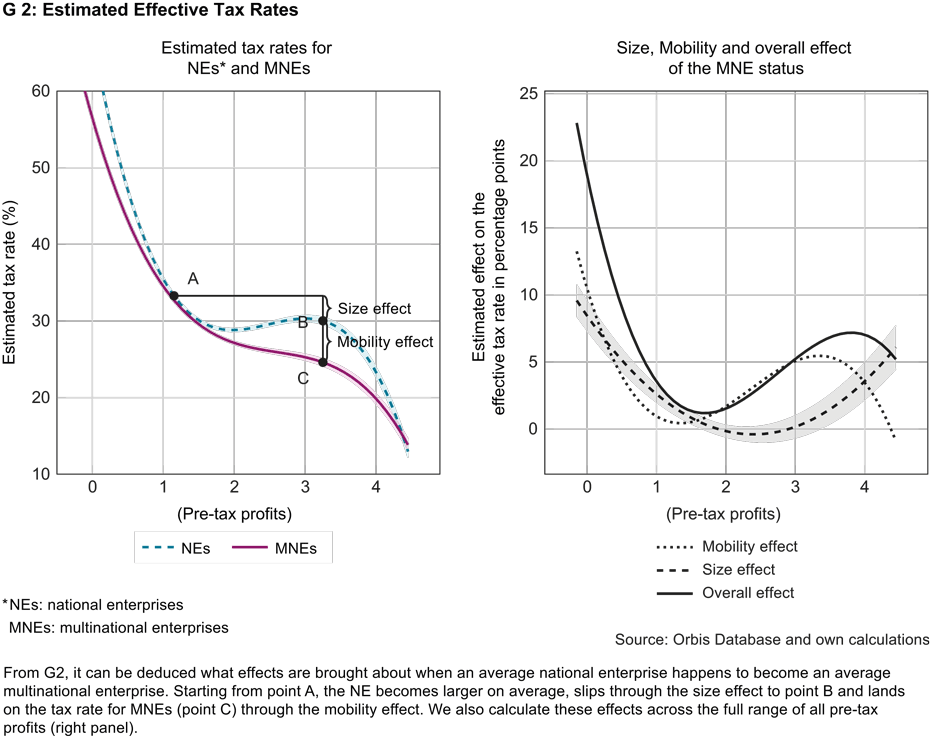

On an empirical level, it is difficult to distinguish between the various factors that contribute to the differential tax treatment of MNEs and NEs – profit transfer schemes and tax negotiations. However, it is possible to quantitatively isolate the various components of negotiations concerning tax loopholes from one another, thus separating the factors associated with the size of enterprises from those relating to their mobility. This is done by examining the various profit transfer schemes and comparing multinational firms specifically with national firms. The results of such a comparison for France were as follows: MNEs there benefit from an effective rate of corporation tax after profit transfers that is more than 6% lower than the rate applicable to comparable NEs (see G2).

In particular, effective tax rates are regressive in terms of size: i.e. the greater the pre-tax profit, the lower the effective rate of tax for the enterprise. This correlation is apparent both for MNEs and for NEs. This suggests that company size has an impact irrespective of the type of enterprise, and that this dynamic is more pronounced for MNEs simply because they are larger on average than NEs. Overall, both national and multinational firms appear to be able to negotiate lower rates of corporation tax with the French authorities, provided that they are larger or more profitable than other firms. Moreover, on account of their remarkable mobility, MNEs benefit from a further reduction in corporation tax rates, which cannot be attained by NEs.

According to a rudimentary calculation, the improved negotiating position of MNEs results in average tax savings of 20,000 euros per year per MNE. Assuming that there are around 17,500 multinational enterprises in France, this means that every year more than 360 million euros are negotiated away.

An extended version of this article can be found here.

Contacts

No database information available

No database information available