Higher Taxes and Their Impact on Investment: Evidence from European Countries

KOF Bulletin

The effects of taxes on corporate investment are strikingly heterogeneous. This article shows that the effects differ significantly when it comes to entrepreneur-led businesses and manager-led businesses. The impact of dividend taxes on companies also varies.

Companies differ in many respects. There are scores of small companies but just a few big ones. While ownership is concentrated in the case of entrepreneur-led businesses, ownership structures are typically fragmented in the case of big, manager-led businesses1. Given these differences, it may be assumed that different companies respond differently to tax charges.

With corporate taxation affecting some companies more than others, dissimilarity between companies plays an important role for political decision-makers. Most countries therefore offer R&D tax incentives to encourage innovation and growth.

Fiscal policy should support capital transfers

As a rule, financial bottlenecks are experienced by young, innovative companies where high investment and financing needs go hand in hand with low equity. Such companies tend to generate higher returns on capital. Big, well-funded businesses obviously do not face these problems and may even suffer due to over-investment. Instead of uniform treatment for all companies, fiscal policy should support the transfer of capital from less profitable to more profitable enterprises, encourage dividend distributions in big companies and grant small, fast-growing companies selective tax incentives. By definition, specific approaches would result in different treatment of different companies in all of these cases.

This study has developed an analytic framework which systematically correlates companies’ investments with their organisational and financial framework conditions. Analysis shows that entrepreneur-led companies and manager-led companies operate within very different financial parameters and that both groups are also heterogeneous in themselves due to different ratios of equity to investment needs.

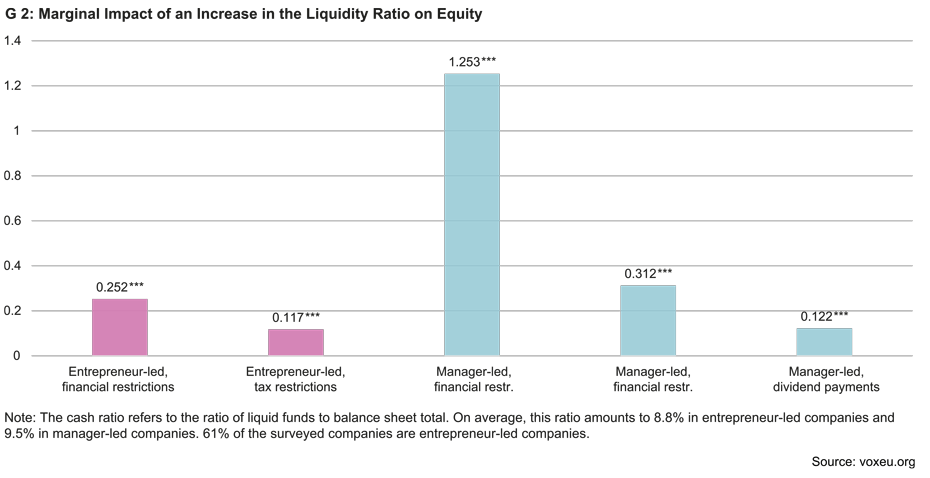

The results of the study are based on a panel of 35,092 enterprises in 17 European countries and cover the period 2004 to 2012. Graph 2 shows that, on an empirical basis, investment always depends on equity, albeit to a different extent. Theoretical analysis implies that even well-funded companies which encounter no problems in financing investments and taking out debt capital are slightly restricted due to fiscal reasons. By contrast, the impact of an even higher liquidity ratio on fiscally restricted, entrepreneur-led companies is more than twice as high. Furthermore, a severely restricted group was identified which not only pays no dividends but has also exhausted its capacity to take out additional debt capital.

Corporate taxes have a negative impact on all company types

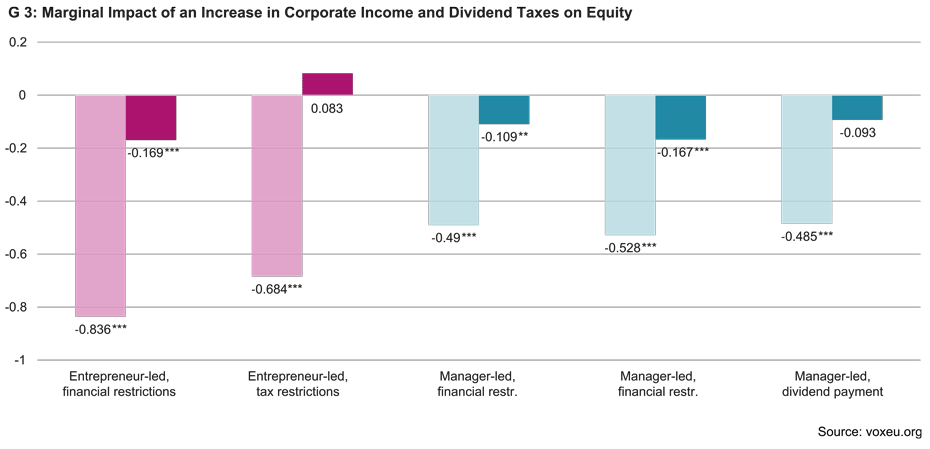

The estimates in Graph 3 illustrate the different tax sensitivities associated with corporate investment. The first lightly shaded bar in each group relates to corporate taxation, the second fully shaded bar to dividend taxation.

Corporate taxes have a negative impact on investment in the case of all company types. The impact is more significant for entrepreneur-led companies, where estimated coefficients are 40% to 70% higher, than for manager-led companies. A 10% increase in corporate taxes would cut investments by financially weak entrepreneur-led companies in half.

As regards dividend taxation, this has substantial negative effects on investments by financially weak entrepreneur-led companies as well as manager-led companies which do not pay any dividends.

In summary, the above analysis has found considerable heterogeneity in the tax sensitivity of corporate investments. Suitable political measures could include specific tax incentives for the most restricted companies if other measures are impractical or fail to solve their problematic access to debt capital.

---------------------------------------------------------------------------------------------------

1 For the purpose of this study, companies were defined as entrepreneur-led in cases where the biggest owner holds a share of over 50% (61% of all companies in the sample). Manager-led businesses are run by professional managers and governed by a board of directors.

A detailed version of this article can be found on the external page Ökonomenstimme (in German).

Literature

Chetty, R. and E. Saez (2005): Dividend Taxes and Corporate Behaviour: Evidence from the 2003 Dividend Tax Cut. Quarterly Journal of Economics 120, 791-833.

Egger, P., K. Erhardt, and C. Keuschnigg (2018): Heterogeneous Tax Sensitivity and Firm-Level Investments. CEPR Discussion Paper Nr. 13341.

Yagan, D. (2015): Capital Tax Reform and the Real Economy: The Effects of the 2003 Dividend Tax Cut. American Economic Review 105, 3531-3563.

Zwick, E. and J. Mahon (2017): Tax Policy and Heterogeneous Investment Behavior. American Economic Review 107, 217-248.

Contact

No database information available

No database information available