Global economic engine not yet up to speed

Growth in the eurozone remains below average, while the US economy is likely to lose momentum owing to an increasing slowdown in the labour market. No significant economic recovery is currently expected in China either.

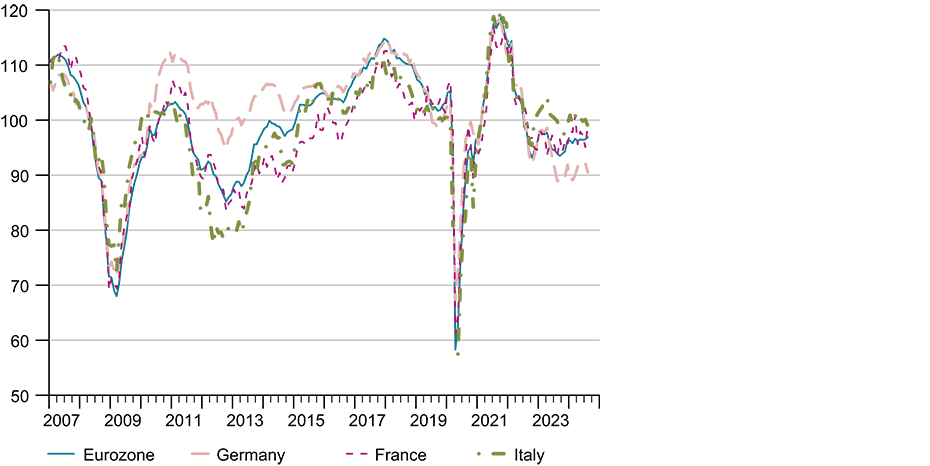

Following slightly positive growth at the start of the year, global economic activity was weak in the second quarter of 2024 and fell short of expectations. While the US economy once again posted surprisingly strong growth in gross domestic product (GDP), driven by robust consumer spending and strong investment in equipment, growth in the eurozone remained below average (see chart G 2).

This was primarily due to declining German GDP, which suffered from households’ reluctance to spend despite positive real wage growth and was held back by weak investment activity – partly as a result of more challenging funding conditions.

Key leading indicators not pointing to a significant upturn in the global economy

While the US economy is likely to lose momentum owing to an increasing slowdown in the labour market and a decline in private consumption, a moderate recovery is expected in the eurozone. Consumer spending in particular is likely to fuel a further economic recovery on the back of rising real wages and more benign funding conditions at the end of this year and especially over the course of next year.

Strong economic stimulus is currently not expected to come from China, given the problems in its property market. KOF is forecasting growth of 1.7 per cent (summer: 1.8 per cent) in global GDP weighted with Swiss exports for 2024 as a whole. Its forecast for 2025 is 2 per cent, which represents a downward revision of 0.2 percentage points compared with its summer forecast and is mainly due to its slightly lower forecast for Germany.

Inflation declining only gradually

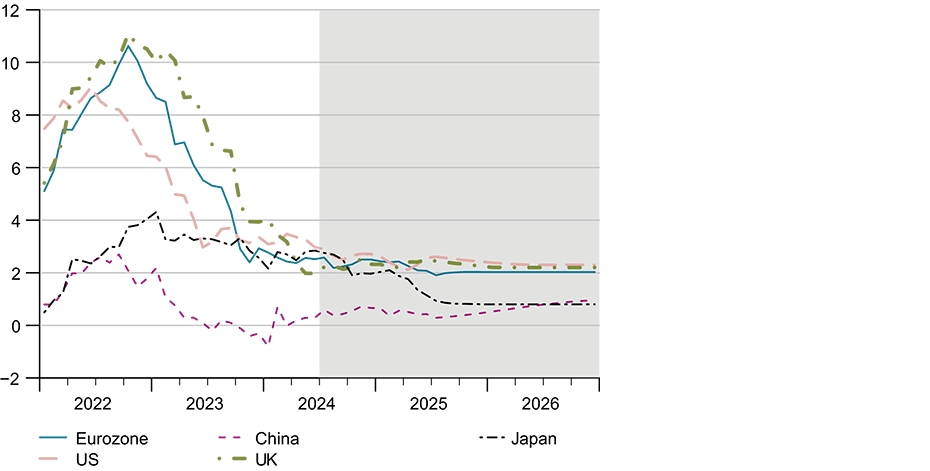

As expected, consumer price inflation in the eurozone and the United States has continued to weaken, although this decline is happening only slowly in the current year. This is partly because energy prices rose again slightly year on year at the start of the year, pushing up overall inflation.

In addition, higher transport costs caused by the rerouting of merchant ships owing to safety concerns along the Suez Canal route are weighing on producer prices. Some of these costs are likely to be passed on to consumers, which will further slow the decline in inflation. Core inflation has been stagnating in both economic areas for several months. In August it stood at 2.8 per cent in the eurozone and 3.2 per cent in the US, which is still well above the respective central banks’ targets.

KOF forecasts that inflation will remain above the central banks’ targets in the eurozone until summer 2025 and in the US throughout the entire forecast period – mainly as a result of persistently high price increases in the services sector. Consumer price inflation in Japan is likely to remain high for longer than recently expected. Subsidies aimed at reducing electricity and gas prices for households are due to be discontinued, which is likely to trigger a short-term rise in energy prices and maintain price pressures (see chart G 3).

Interest-rate cutting cycle continues

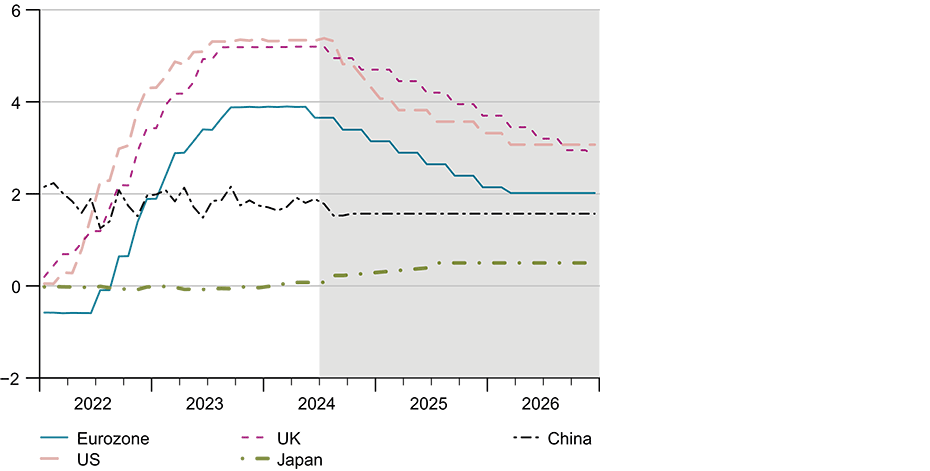

Given the weak economic activity and the downward trend in consumer prices in the eurozone, the European Central Bank (ECB) has lowered its key interest rate twice – by 25 basis points each time – since June 2024, which currently puts its deposit rate at 3.5 per cent.

The Bank of England (BoE) followed suit in August 2024 with its first interest-rate cut of 25 basis points, suspending the rate-cutting cycle at its September meeting. The US Federal Reserve (Fed) postponed its first rate cut owing to the slow decline in inflation and the robust state of the labour market in the first half of the year. It finally implemented its first cut of 50 basis points in September 2024.

KOF expects the ECB to carry out a further interest-rate cut of 25 basis points this year and four additional cuts in 2025. A similar policy of monetary easing is anticipated for the BoE. KOF expects to see a fairly cautious continuation of monetary easing by the Fed, with two further rate cuts of 25 basis points each in 2024 followed by four rate cuts in 2025. Given the heightened inflation prevailing in Japan, KOF expects the Japanese central bank to raise interest rates next year (see chart G 4).

Risks still mostly on the downside

Given the existing geopolitical uncertainty, such as the ongoing wars in Ukraine and the Middle East, the risks in this forecast are varied and predominantly on the downside.

Trade wars, particularly in the technology sector, could intensify further and weaken global trade. This is linked to the tariffs that the US, the EU and Canada recently imposed on Chinese electric vehicles, which are likely to result in retaliatory measures by the Chinese government.

In addition, the upcoming presidential elections in the US have fuelled uncertainty about the country’s future trade policies. There is an upside risk that the positive trend in real wages over recent months will lead to higher consumer spending.

KOF’s economic forecast is available in full here (pdf in German):

Download https://ethz.ch/content/dam/ethz/special-interest/dual/kof-dam/documents/Medienmitteilungen/Prognosen/2024/KOF_Vierteljahresanalyse_2024_3.pdf (PDF, 620 KB)

Contacts

KOF FB Konjunktur

Leonhardstrasse 21

8092

Zürich

Switzerland

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland