“Harris is more predictable than Trump”

In this interview, KOF economists Heiner Mikosch and Maurizio Daniele analyse the economic policy differences between Kamala Harris and Donald Trump and provide an outlook for economic developments in the United States.

The whole world is watching the US presidential elections with fascination. Why is the United States so important globally?

Daniele: The US is still the engine of the global economy. Virtually every country in the world – with the exception of special cases such as North Korea – has strong economic ties with America. This also applies to Switzerland. The US is Switzerland’s second most important export market – after the European Union – with a share of just under 20 per cent.

“The US is still the engine of the global economy.”Maurizio Daniele

The United States plays a crucial role in almost all geopolitical conflicts – whether in Taiwan, Ukraine or the Middle East. Is this one reason why the presidential elections are so important beyond the US?

Mikosch: Yes. The US sets the global agenda, be it in geopolitics or international agreements. Projects such as a global minimum tax can only work if America is on board. If the US starts a trade dispute with China, every other country will have to decide what its stance and position will be.

Daniele: To give just one example: Dutch company ASML, which manufactures specialised equipment for chip production, had to stop supplying some machinery to China this year following US pressure on the Dutch government. This shows just how dominant and powerful America is.

“Trump is known for governing in a disruptive and ad-hoc way. We therefore believe that there would be greater political uncertainty if he were to win”Heiner Mikosch

Kamala Harris and Donald Trump are running against each other in the election. What are the main differences between these two candidates?

Mikosch: Trump is known for governing in a disruptive and ad-hoc way. We therefore believe that there would be greater political uncertainty if he were to win. Positive outcomes for the economy are conceivable under Trump: he could, for example, de-escalate certain international conflicts by doing deals. But there are also negative scenarios if he and his fellow campaigners inflict lasting damage on democratic institutions in the US.

And Kamala Harris?

Mikosch: Harris is more predictable than Trump. She operates more along the lines that we know from Barack Obama and Joe Biden. We would therefore have less political uncertainty under her.

What do the two candidates stand for in terms of geopolitics and trade policy?

Mikosch: Trump sees the US as the strongest player in a global power struggle between several actors. Despite all the uncertainty emanating from him, the most likely scenario is that he will raise import tariffs further and provoke conflicts with his trading partners again. This could affect the EU just as much as China. Trump’s approach follows a consistent pattern. He identifies the weaknesses of other countries depending on the situation, triggers a conflict and then tries to get a better deal for the United States. Harris, on the other hand, is a transatlanticist. She sees Europe and America as natural allies – with the US being the clear leader, of course, as far as she is concerned. She too would pursue a protectionist trade policy but would primarily target China and try to get Europe to side with the US.

How do Trump and Harris differ on domestic economic policy?

Daniele: Trump would introduce further tax cuts. He aims to fund these by imposing import tariffs. It is unrealistic to expect this strategy to work. Harris is more likely to raise taxes on companies and top earners in favour of higher welfare benefits and tax cuts for the middle class. Both candidates are likely to increase the national debt further.

Mikosch: There is a greater chance that Trump’s tax cuts will lead to another economic boom. But there is also a risk that this could backfire. One possible scenario under Trump is that the economy overheats, inflation returns, the central bank is forced to react, the dollar depreciates and there is turmoil in financial markets. The US would then slide into a recession.

Are there political or economic reasons why such a controversial politician as Trump has played such an important role for years?

Mikosch: Trump is not an isolated phenomenon. Populism and anti-establishment politics exist in Europe as well. Globalisation and the rise of China have caused redistribution in the US. There are winners and losers both at an individual level and in terms of entire regions. The lower middle class and all industrial sectors that are competing with China for imports have tended to lose out. Exacerbating this ‘China shock’, the ‘automation shock’ has also destroyed jobs in industry. We have seen similar developments in Europe. Here, however, we have a welfare state, whereas the US has hardly any. For a long time, neither the Democrats nor the Republicans managed to champion the cause of the losers of globalisation. The Democrats focused on the well-educated urban class and minority groups. Many voters have responded by moving from the left to the far right and voting for Trump, who has hijacked the Republican party and neutralised large parts of its establishment. We are seeing a similar process, albeit not quite as pronounced, in Germany with the AfD and in France with Marine Le Pen’s party, which have managed to mobilise many people who originally voted for the Left. Socio-political wedge issues such as abortion and cultural identity also play a crucial role in this voter migration, of course, in addition to the economic circumstances mentioned above.

What is your economic outlook for the United States?

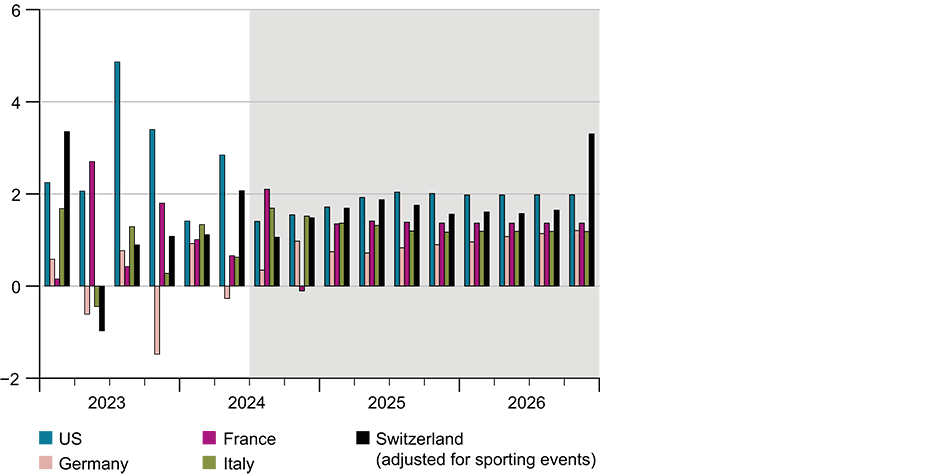

Daniele: Economic growth in the US has been relatively solid in recent quarters compared with the major European economies (see chart G1). Household consumption and corporate investment remain high. However, the first signs of a slowdown are becoming apparent. Among other things, the supportive effects of fiscal policy are coming to an end and the labour market is increasingly cooling, which is likely to lead to weaker growth in private consumption. In addition, the more challenging funding conditions – i.e. persistently high interest rates – are likely to have a dampening effect for some time. We therefore anticipate a gradual economic slowdown, particularly in the second half of this year and next year, before the economy picks up speed again in 2026.

Has US inflation been beaten?

Daniele: The trend looks good at the moment. As expected, consumer price inflation has continued to weaken recently after energy prices higher than last year pushed up inflation again at the start of the year. Nevertheless, the core rate of inflation – i.e. inflation excluding volatile energy and food prices – remains high and has largely stagnated in recent months. Furthermore, as already mentioned, inflation could return under Trump.

So, in hindsight, has the Fed done a good job?

Daniele: By and large, yes. By reacting quickly and decisively to tighten monetary policy, it has managed to reduce inflation considerably within a short space of time without unduly constraining economic activity. Given the robust growth in employment and the economy last year and the significant cooling of the labour market this year, it could perhaps have raised interest rates a little earlier and lowered them again sooner.

Where do you expect US interest rates to be at the end of this year and at the end of 2025?

Daniele: After the Fed had initially postponed its first rate cut in response to the only slow decline in inflation compared with the European Central Bank, it initiated the cycle of cuts at its September meeting. We continue to expect a fairly cautious easing of monetary policy on the part of the Fed and see key interest rates within the target range of 4.25 per cent to 4.5 per cent at the end of this year. Next year we expect to see four further interest-rate cuts, i.e. a total of 100 basis points. We would then be somewhere between 3.25 per cent and 3.5 per cent by the end of 2025. In the long term, i.e. beyond 2025, interest rates are likely to stabilise at just over 3 per cent.

Contacts

KOF FB Konjunktur

Leonhardstrasse 21

8092

Zürich

Switzerland

KOF Bereich Zentrale Dienste

Leonhardstrasse 21

8092

Zürich

Switzerland

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland