The Swiss labour market is doing fairly well

Employment is continuing to grow, while unemployment is rising slightly. KOF expects that the phase of declining real wages will come to an end this year.

The Swiss labour market is feeling the effects of the current economic weakness in key European markets and the lack of economic stimulus coming from Switzerland. According to KOF’s latest forecast, employment and the number of people in work in Switzerland will grow at slightly below-average rates in the third and fourth quarters of 2024.

From next year onwards, job creation should pick up modestly in line with the marginally better economic trend. Overall, KOF is forecasting solid job growth of 1 per cent (0.9 per cent in full-time equivalents) for next year – a figure that is slightly below the long-term average but well below this year’s growth of 1.4 per cent.

The number of people in work is expected to rise by 1.3 per cent in 2025, while job growth is likely to continue at a similar pace in 2026. KOF expects employment to grow by 1.1 per cent in 2026 (see chart G 6).

Unemployment increases slightly during the forecast period

KOF’s forecasting models suggest that the recently observed rise in unemployment will continue over the coming quarters, albeit at a slower pace. Unemployment rates as defined by the International Labour Organization (ILO) and the rate of registered unemployed according to Switzerland’s State Secretariat for Economic Affairs (SECO) will reach their longer-term averages by the end of the forecast horizon.

The ILO is forecasting that the overall unemployment rate will rise from 4.3 per cent this year to 4.7 per cent in 2026, while the rate of registered unemployed will rise at a lower level from 2.4 per cent in the current year to 2.8 per cent in 2026. KOF expects unemployment to be slightly higher next year than it has been previously (see chart G 7). KOF also expects growth in the labour force and employment over the coming quarters to be slightly weaker than they were in the summer forecast.

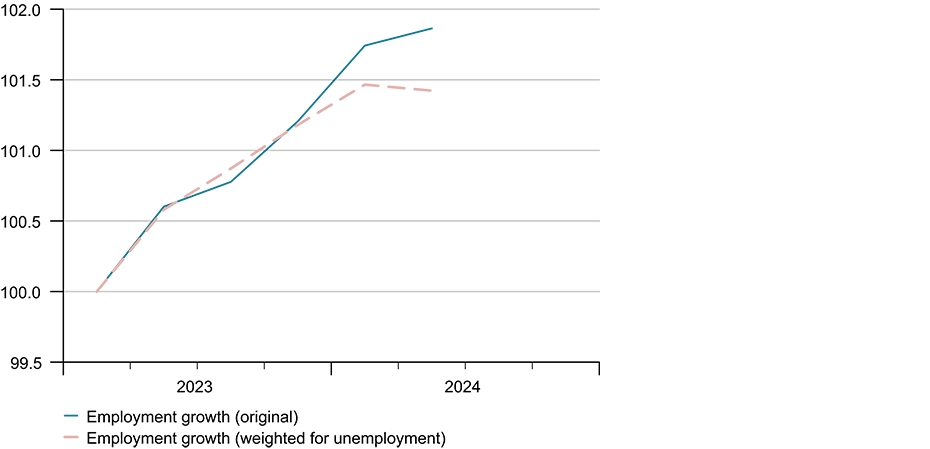

Slower job growth in the second quarter of 2024

The latest labour market figures show that the anticipated consolidation phase began in spring 2024 following two strong years. Employment growth slowed in the second quarter of 2024, when only 8,000 additional jobs were created on a seasonally adjusted basis, compared with an average of 26,000 jobs per quarter in 2022 and 2023.

The number of people in work rose by only a modest 10,000. Significant contributions to job growth came from the arts, entertainment, transport, warehousing, health and social services, while the temporary sector reported a significant decline in employment.

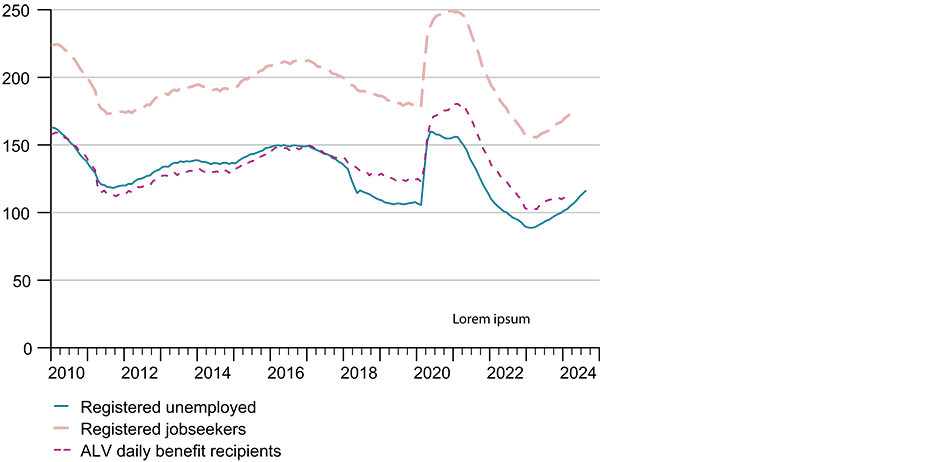

Accelerated rise in unemployment

SECO’s registered unemployment figures provided a clear indication of slowing momentum in the labour market. The number of registered unemployed rose by around 2,200 people per month on a seasonally adjusted basis between the beginning of April and the end of August. The growth in unemployment thus accelerated compared with the previous months (see chart G 8).

This increase was relatively broad-based, affecting unemployed people of both genders and all ages and education groups. Registered unemployment grew particularly sharply among unemployed people with tertiary education.

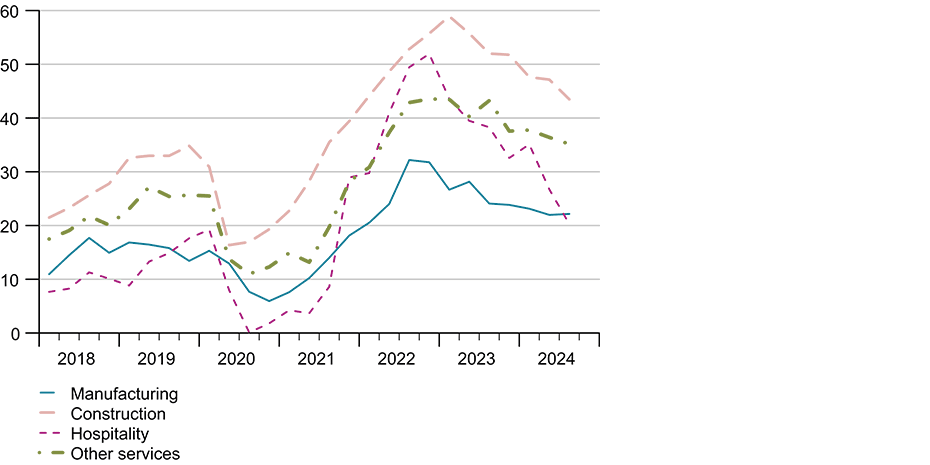

Can the unemployed not fill the vacancies?

One explanation for the recent acceleration in unemployment despite solid job growth is the sectoral composition of this job growth. Sectors in which unemployment is above average – such as temporary employment, manufacturing, hospitality and construction – reported low job growth. In fact, the number of jobs in the second quarter of 2024 fell across the economy as a whole if the employment growth of individual sectors is weighted by the longer-term share of registered unemployment in a sector (see chart G 9).

In addition, the rise in unemployment may be partly due to a temporary increase in the mismatch between the skills of the unemployed and the current demand for labour.

Unemployment rose significantly in some sectors – such as pharmaceuticals, the manufacture of data processing equipment and watches, and IT service providers – that reported robust job growth at the same time. This suggests that those who have lost their jobs could not easily be employed in areas where job growth has occurred

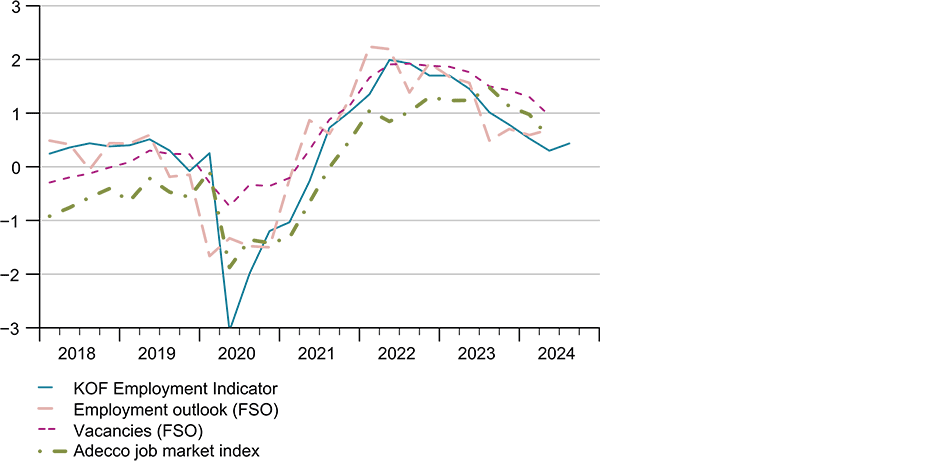

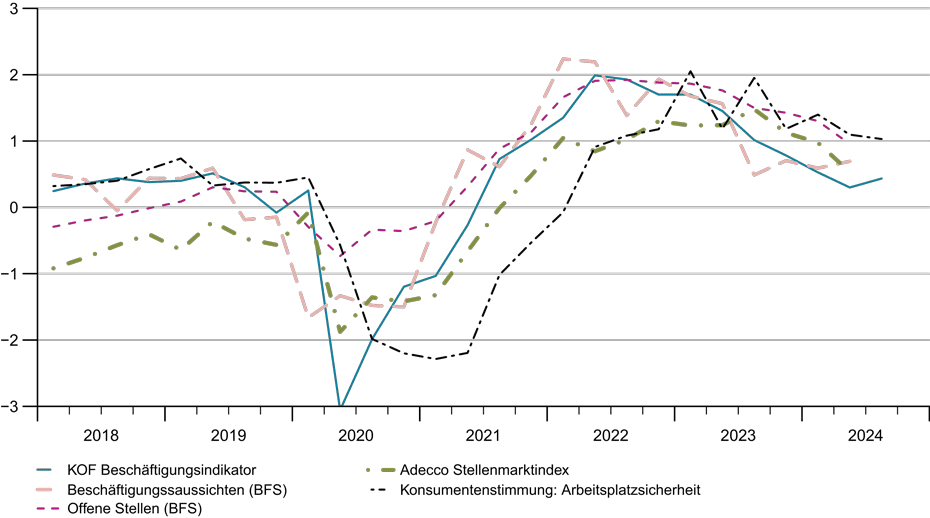

Indicators suggest a robust labour market

Despite the rise in unemployment, however, key labour market indicators continue to point to a solid labour market. The labour shortage calculated by KOF remains relatively high in almost all sectors (see chart G 10). The same applies to the number of job vacancies according to various labour market indices and the KOF Employment Indicator, which reflects the employment assessments and expectations of around 4,500 Swiss firms.

These indicators have recently trended either sideways or slightly downwards but remain above their longer-term averages. In line with our employment forecast, these indicators therefore suggest that the current normalisation in the Swiss labour market constitutes a soft landing (see chart G 11).

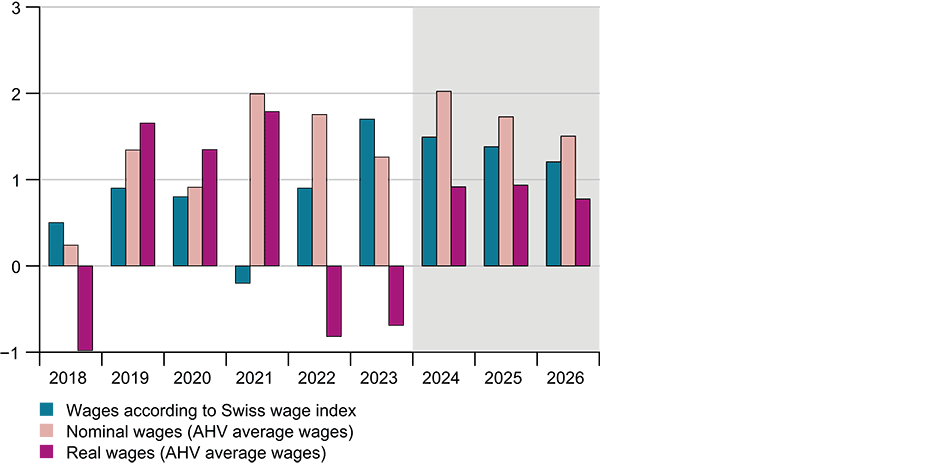

Real wages rising during the forecast period

One peculiar aspect of labour market trends over the past two years has been the fact that wages have been declining in real terms despite the historically high labour shortage. This KOF forecast assumes – as do previous forecasts – that the decline in real wages will come to an end this year (see chart G 12).

KOF’s forecast of real wage growth remains virtually unchanged since its last forecast, although inflation has recently slowed surprisingly sharply. This is because the new data available for both 2024 and 2025 suggest slightly lower nominal wage growth than the growth rates published by KOF in its summer forecast. Despite lower inflation, real wages are therefore unlikely to rise more sharply this year and next than previously expected.

Firms expect wages to rise by 1.6 per cent next year

Overall, KOF expects nominal wages to grow by 1.4 per cent in 2025 according to the Swiss wage index (SLI), which equates to real wage growth of 0.7 per cent after deducting inflation. Real average wages – full-time equivalent employees’ remuneration according to the national accounts – are forecast to grow by 1 per cent in real terms in 2025. A key comparator for these forecasting models is the wage expectations that KOF surveyed in July as part of its Business Tendency Surveys. Firms across all sectors expected to see wage growth of 1.6 per cent over the next twelve months.

SLI wages forecast to grow by 1.5 per cent in 2024

KOF is forecasting wage growth of 1.5 per cent according to the SLI and 2 per cent according to the national accounts average wage concept for the current year, which should equate to real wage growth after deducting expected inflation of 1.2 per cent.

KOF’s latest economic forecast is available in full here (pdf in german):

https://ethz.ch/content/dam/ethz/special-interest/dual/kof-dam/documents/Medienmitteilungen/Prognosen/2024/KOF_Vierteljahresanalyse_2024_3.pdf

Contact

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland