KOF Business Tendency Surveys from October 2019: Business Situation under Further Pressure

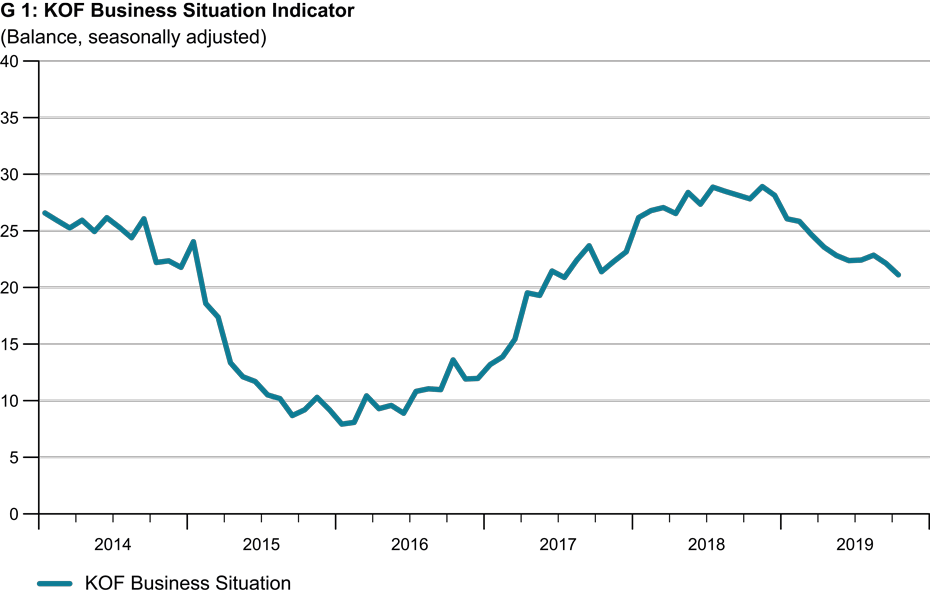

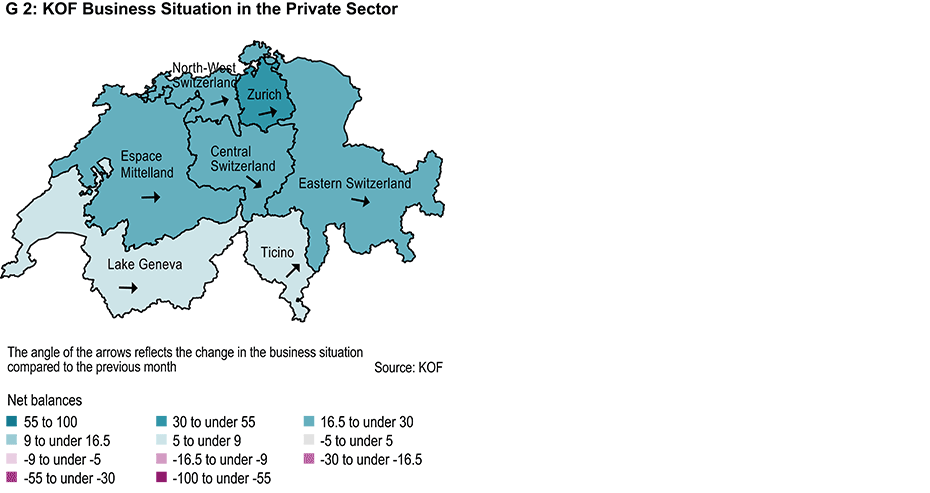

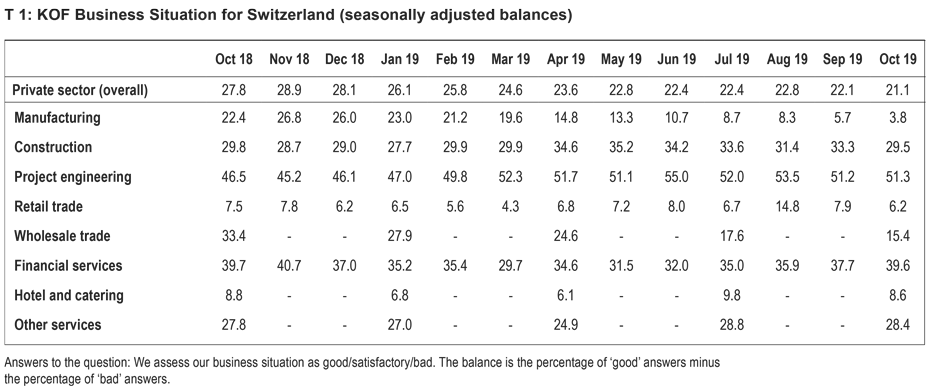

The Business Situation Indicator recorded another decline in October, having previously remained practically unchanged over the summer months (see G 1). The business situation is currently significantly less positive than it was last autumn, and has been worsening for several months, in particular in the manufacturing sector. The global economic slowdown is increasingly having knock-on effects on Switzerland.

Business situation by sector

The Business Situation Indicator fell in October in most sectors of the economy considered. The negative trend was particularly marked in the manufacturing sector, where the Indicator fell for the eleventh month in a row. In addition, both retailers and wholesalers posted falls in October. The business situation in the construction sector is not as positive as it was during the previous month. The hotel and catering sector was unable to continue the upward trend from the previous quarter. Project engineering firms and other service providers report very little change in their business situation. Only financial service providers and insurers report a noticeable improvement in the business situation.

The results sector by sector

The headwind in the manufacturing sector is becoming stronger, with order books shrinking. The business situation in the manufacturing sector has worsened for the eleventh month in a row. Whilst the situation in October of last year was mainly good, it is now only satisfactory. Complaints concerning thin order books have picked up again, whilst production has been cut back slightly. As a result, capacity utilisation rates fell. Nonetheless, the competitive position of businesses has not changed either nationally or internationally. In order to achieve this companies have been forced to slash prices, resulting in a squeeze on profits. Despite this pricing policy, companies have been increasingly battling with weak demand for their products. In addition, financial restrictions are starting to play a greater role again. Confidence in future business performance is tailing off, and despite further price cuts order books are not expected to get any larger. As a result, companies are planning to reduce staffing levels slightly.

Retailers and wholesalers have lost momentum, with no significant increases in sales on the horizon. The business situation for retailers is currently similar to how it was at the start of this year. The situation is assessed as slightly positive, with only a few fluctuations over the last few months, and only marginal changes recently to sales volumes and profits. Overall employee numbers are considered to be appropriate, and as a result no changes to staffing levels are being planned. Over the coming months retailers are forecasting slightly increased turnover, although against a backdrop of falling prices. The business situation has deteriorated further for the wholesale sector. However, the Indicator fell less abruptly compared to the previous quarter. This deceleration is due to the stabilisation of the situation for wholesale distributors of consumer goods. On the other hand, the situation worsened further for wholesale distributors of production goods. Considered overall, wholesale earnings are under a little pressure. Wholesalers are not expecting there to be any significant change to the demand trend in the near future.

The situation is good in the construction sector, and construction activity is forecast to increase further a little over the next few months. The business situation in the construction-related building and project engineering sectors developed unevenly in October. The business situation remains good in the project engineering sector. Demand for project engineering services picked up more strongly, thus resulting in healthier order books. The downward pressure on prices has therefore eased further, and firms are looking to beef up their staffing capacity with new appointments. The Business Situation Indicator for the construction sector fell slightly in October. Nevertheless, the situation is largely good here. Capacity utilisation rates for machinery and equipment rose in step with the moderate expansion in construction activity. Staffing figures are considered to be a little low; however, firms are finding it increasingly difficult to take on additional staff. According to the information provided by companies, both demand and construction activity are set to increase slightly over the next three months.

Within the hotel and catering sector, hotels are benefiting from an uptick in the number of overnight stays, although demand for catering businesses is not increasing. The Business Situation Indicator for the hotel and catering sector is following a slightly downward trend. Whilst the business situation has improved slightly for hotels, it is less positive for caterers than it was during the previous quarter. Demand has not increased any further in the catering sector. Sales of food and drink are below last year’s levels. Caterers are not expecting there to be any significant change in the business situation over the coming months. They are forecasting practically no shift in either the demand for or sales of food and drink. Hoteliers’ profits have increased over the last three months. Room occupancy rates have remained unchanged, whilst earnings have increased. Businesses are expecting figures for overnight stays by both foreign and national visitors to rise. However, they aim to avoid having to increase prices any further.

The business situation is good for financial service providers and insurers, and earnings are projected to remain stable over the coming months. Financial service providers and insurers are more satisfied with their business situation than they were last month, with demand continuing to increase. Whilst profits were up slightly however, operating expenses increased more than operating revenues. Financial sector operators are planning to hire staff in the face of a continuing lively demand trend. They should be able to do so, as there does not appear to be any lack of available workers.

Also the sub-group of banks is planning to take on more staff. The business situation of banks is continuing to improve, and is assessed in very positive terms above all for domestic clients. Demand from domestic private clients increased again. However, demand from domestic corporate clients has not increased much recently. Banks are confident regarding demand from private clients also over the coming months. Lending figures to domestic corporate clients are however expected to rise more slowly, amongst other things because banks are now classifying certain clients as less creditworthy. Survey participants remain more optimistic about trading and commission business, albeit not as much as during the previous quarter. They are not expecting fixed-income business to be particularly dynamic. Overall, profits are not expected to change much.

The situation in the other services sector remains stable. Additional staff are still required, although the need to increase staffing levels is not as pressing as it previously was. The business situation for other service providers is just as good at the moment as it was three months ago. Capacity utilisation is approximately at last year’s levels. Profits have also been quite stable for the last three quarters of a year. Although demand is increasing, service providers’ prices have come under a little pressure. According to respondents, demand for their services is set to rise more slowly in the near future. They therefore do not intend to expand the workforce as much as they previously did. As a result, Switzerland has lost a little power from an important job creation engine.

Contact

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland