Global Barometers weakened in June

After two months of relative stability, the Global Barometers weakened in June, reflecting the challenging recovery of the world economic activity in 2023. The decline was influenced by the deterioration of the economic environment in the Asia, Pacific & Africa region and in Europe.

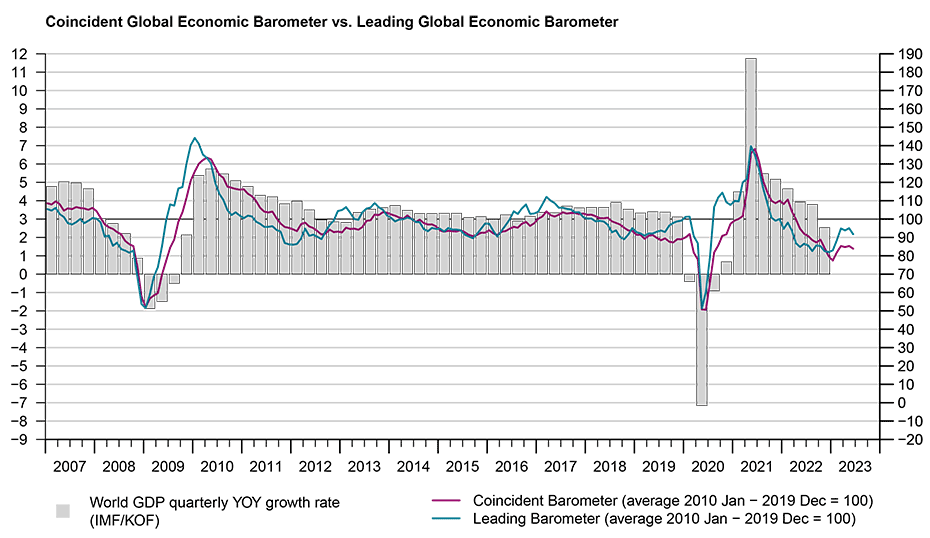

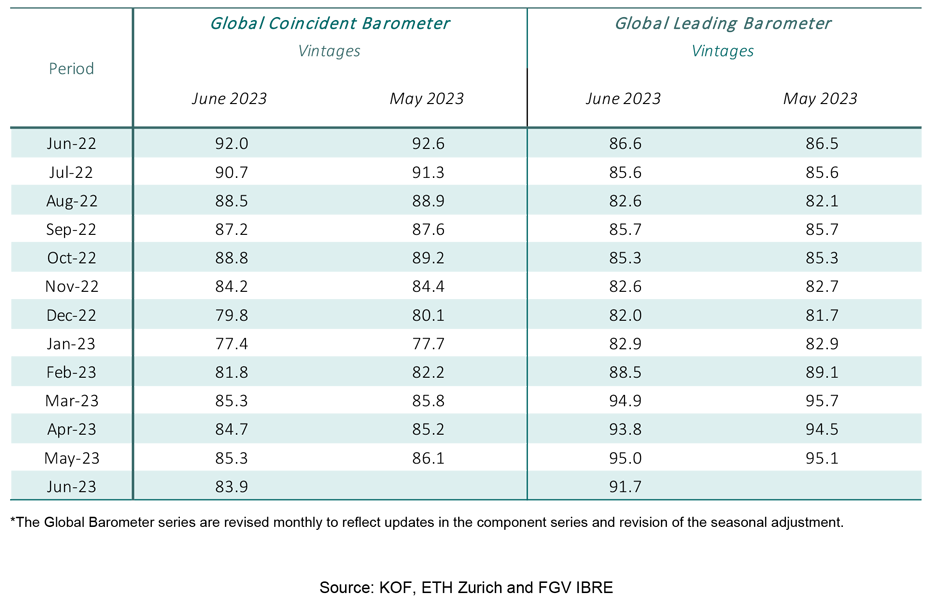

The Coincident and the Leading Global Economic Barometers fall by 1.4 and 3.3 points to 83.9 and 91.7 points respectively in June 2023. This is due to a deterioration in both the assessment of the current situation and the expectations in the Asia, Pacific & Africa region and in Europe. After the indicators did stabilise over the previous two months, they are now moving away from the historical average of 100 points.

“The decline in both barometers in June reflects the fragility of the normalisation tendencies observed earlier in the year. After the relief of having survived the winter in terms of the energy crisis and the hope that the opening up of the Chinese economy would provide a strong boost to the global economy, the impact of ongoing geopolitical tensions, higher price levels and the rise in key interest rates in many parts of the world is increasingly weighing on business and consumer sentiment and assessments. The below-potential global economic growth already observed over the winter is likely to continue as the year progresses”, evaluates Jan-Egbert Sturm, Director at KOF Swiss Economic Institute.

“The below-potential global economic growth already observed over the winter is likely to continue as the year progresses.”Jan-Egbert Sturm, Director at KOF Swiss Economic Institute

Coincident Barometer – regions and sectors

In June, the Asia, Pacific & Africa region and Europe contribute negatively with -1.1 and -0.5 points, respectively, to the decline in the Coincident indicator, while the Western Hemisphere contributes positively with 0.2 points. The three indicators appear to continue to face headwinds, reflecting the ongoing weakness of the world economy, influenced by the impact of monetary tightening and uncertainty about the Chinese economic growth. The graph below shows the contribution of each region to the deviation of the Coincident Barometer from its historical average of 100 points.

All Coincident sector indicators fall this month, except for Construction, which, nevertheless, remains the lowest among the sectors.

Leading Barometer – regions and sectors

The Leading Global Barometer leads the world economic growth rate cycle by three to six months on average. As in the case of the Coincident Barometer, the Asia, Pacific & Africa region and Europe contribute negatively with -3.2 points and -1.3 points respectively, while the Western Hemisphere contributes in the opposite direction with 1.2 points. With two notable declines in a row, the Leading indicator for Europe is again the lowest among the regions. Overall, the level of the indicators points to sceptical expectations for economic activity in Europe and the Western Hemisphere, motivated by the inflationary environment and high interest rates, but moderated by economic growth in the Asia, Pacific & Africa region.

The Leading indicator sectors follow the same tendency as the Coincident sectors, with decreases in all sectors except Construction, which records an increase of 10.2 points for the month. The Economy (aggregated business and consumer evaluations) remains the highest among the sectors, while Services is the lowest, being the only indicator below 90 points.

The Global Economic Barometers

The Global Economic Barometers are a system of indicators enabling timely analysis of global economic development. They represent a collaboration between the KOF Swiss Economic Institute of the ETH Zurich in Switzerland and Fundação Getulio Vargas (FGV), based in Rio de Janeiro, Brazil. The system consists of two composite indicators, the Coincident Barometer and the Leading Barometer. The Coincident Barometer reflects the current state of economic activity, while the Leading Barometer provides a cyclical signal roughly six months ahead of current economic developments.

The two Barometers comprise the results of economic tendency surveys conducted in more than 50 countries with the aim of achieving the broadest possible global coverage. The advantages of economic tendency surveys are that their results are usually readily available and are not substantially revised after first publication.

The Coincident Barometer includes more than 1,000 different time series, while the Leading Barometer consists of over 600 time series. Cross-correlation analysis is used to decide which individual time series are included in the barometers. This involves correlating the individual time series with a reference series. The reference series used is the year-on-year growth rate of global gross domestic product (GDP), where the individual national GDPs are aggregated at purchasing power parity to form global GDP. A time series is only included in a Barometer if it shows a sufficiently high correlation and a suitable synchronization or lead with the reference series. The time period used for this correlation analysis currently runs from January 2010 to December 2019.

The series of the two Barometers are revised each month at publication and are standardized to have a mean of 100 and a standard deviation of 10 for the 10-year period previous to the most recent observations.

The methodology is described in:

Klaus Abberger, Michael Graff, Aloisio Jr. Campelo, Anna Carolina Lemos Gouveia, Oliver Müller and Jan-Egbert Sturm (2020), The Global Economic Barometers: Composite indicators for the world economy. KOF Working Papers, vol. 471, Zurich: KOF Swiss Economic Institute, ETH Zurich, 2020.

Contact

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland