Possible Impact of the Brexit Referendum on the UK, the EU and Switzerland

KOF Bulletin

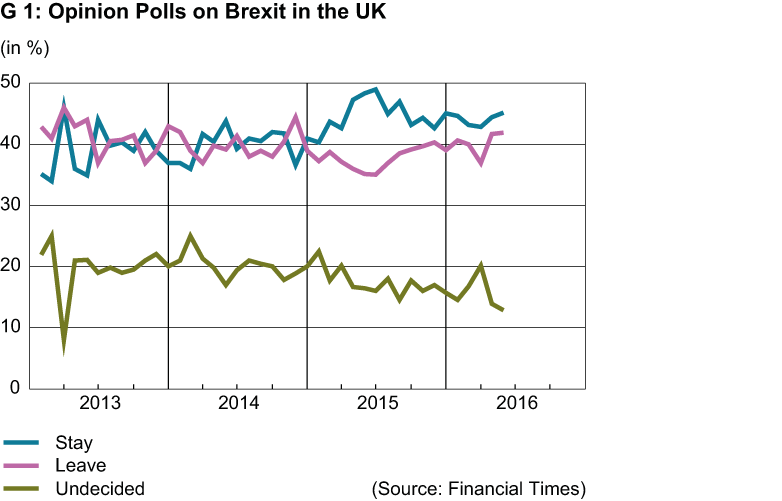

The Brexit vote will take place on 23 June 2016. Opinion polls show that the number of opponents to the United Kingdom’s exit from the EU is roughly equal to its proponents (see G 1). According to AIECE, a ‘no’ outcome is slightly more likely. Nevertheless, the referendum has already had a negative impact on the British economy. This article provides an overview of the further consequences that may arise from a Brexit not only for the UK but also for the EU and Switzerland.

In the context of an internal report, the Association of European Conjuncture Institutes (AIECE) has polled its members, among them KOF, on the subject of Brexit. According to the institutes, the probability of Britain leaving the EU ranges between 25% and 50%. The majority of institutes expect the potential consequences of an exit to be negative for both the UK and the EU.

Uncertainty squeezes investment activities

Irrespective of the consequences of a possible exit, uncertainty about the outcome and impact of the vote is already having negative anticipatory effects. Gross capital investment has taken a noticeable dive. Since the end of 2015, the GBP has lost around 7% against its main trading partners’ currencies and implied volatility arising from futures contracts is at its highest level since the financial crisis. A vote in favour of staying in the EU is likely to reduce uncertainty, result in a revaluation of the Pound and encourage increased investment due to catch-up effects in the second half of 2016.

Political problems in the case of an exit ...

Should the exit proponents win the vote, a two-year renegotiation process on the UK’s economic and political relations with the EU will kick off. Possible steps allowing the UK simplified access to the Single European Market could consist of joining the European Economic Area (EEA), bilateral agreements and free trade agreements with the EU. As the examples of Norway and Switzerland show, these scenarios would, in all probability, be associated with conditions, such as free movement of persons, and the adoption of EU regulations. To avoid creating a precedence, the EU will not be keen on making any major concessions to the UK during the renegotiations. On top of this, as a single state, the UK will be in a weaker negotiating position and will have to take a backseat role in regional free trade negotiations, such as the Transatlantic Trade and Investment Partnership (TTIP). A Brexit could furthermore encourage voices in Scotland calling for an exit from the UK and affiliation with the EU.

The impact of an exit on the EU is even more difficult to assess. On the one hand, the absence of the UK, which has repeatedly slowed down further integration in the past, may result in closer integration among the remaining countries. On the other hand, Brexit could set a sign for other countries to pursue a more sceptical policy towards integration or even decide to leave themselves. The majority of institutes polled by AIECE assume that Brexit would have a negative effect on further integration in the EU. However, he above impacts may not even be mutually exclusive: Britain’s exit could trigger further withdrawals and the remaining countries could subsequently pursue closer political integration.

... and negative consequences for the economy

A meta-study conducted by the Cologne Institute for Economic Research shows that, even in scenarios involving simplified access to the Single European Market, a large majority of scientific studies rate the impact of a Brexit as negative and warn that the effects may actually be underestimated. The National Institute of Economic and Social Research has conducted a study investigating the economic impact of a complete discontinuation of the free trade agreements with the EU on the UK economy. According to the authors, the decline in macroeconomic production in the ‘leave’ scenario’ compared to the ‘stay’ scenario’ would amount to 1% in 2017 and 2 to 3% in the subsequent years. On top of that, the anticipated devaluation of the Pound is likely to result in high inflation which would restrict the monetary leeway of the Bank of England. Depending on the scenario, the authors estimate a longer-term decline in exports of up to 29% and a drop in foreign direct investment of up to 24%. Possible positive effects on economic growth may be anticipated in the longer term, for instance in a study carried out by the Institute of Economic Affairs. The authors surmise that the disappearance of some of the regulatory burden and more flexibility in the negotiation of free trade agreements and agreements on the free movement of persons may increase the UK’s production capacity in the longer term.

The EU is also likely to feel some negative effects following a UK departure from the economic area. As to the extent of such effects, one can only speculate. The countries that have the closest trade relations with the UK, for instance Germany, France, Netherlands and Belgium, would probably suffer most from a Brexit. The change in the EU’s balance of economic power – with the UK as the proponent of free market policies, France the proponent of a statist approach and Germany in the middle – could, however, be a more important impact in the long-run. Consequently, an EU minus the UK may come to pursue more statist and interventionist policies.

Impact of Brexit on Switzerland

A UK exit would also be likely to affect Switzerland’s negotiations with the EU regarding the compatibility between agreements on the free movement of persons and the implementation of the Swiss anti-mass immigration initiative. On the one hand, Switzerland might be able to join forces with a post-Brexit UK and other countries in EU negotiations to achieve the best possible result. The common interest between the countries would be unrestricted access to the Single European Market, excluding free movement of persons and political integration. On the other hand, to reduce any incentives for further departures following a UK exit, the EU would be keen to signal that going solo does not pay off. Accordingly, the EU would be likely to follow a hard line in its renegotiations on future relations with the UK. With a view to consistency, this hard line would also be applied to the EU negotiations with Switzerland. Since Switzerland has less negotiating power than Britain, the country is likely to come home with an even less satisfying result than the UK. The risk that the EU may want to make an example of Switzerland to deter other countries cannot be dismissed.

Contact

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland