Swiss Economy Running out of Steam

- Swiss Economy

- KOF Economic Forecasts

- KOF Bulletin

Whilst the Swiss economy remains robust overall, its growth rate will slow this year to 1.6 per cent. Gross domestic product (GDP) is then forecast to rise by 2.1 per cent in 2020. Private consumption will provide a significant boost to the economy over the forecast period. Unemployment will remain low thanks to solid economic growth.

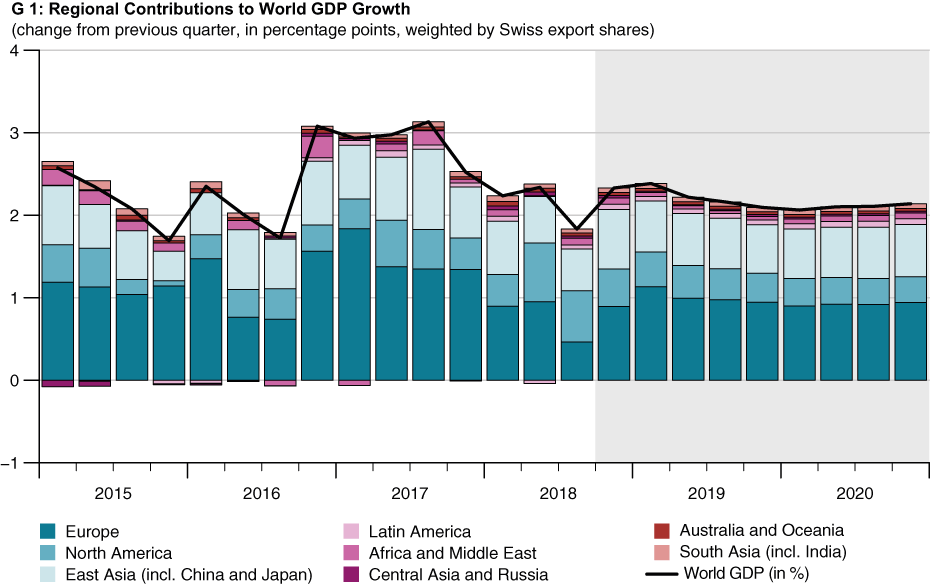

World economic growth in 2018 flatlined compared with the previous year. This tendency will also continue into the current year. In the United States it is expected that the previously strong economic growth will fall back to normal levels in 2019, with private consumption remaining high owing to the positive labour market situation and real wage increases. Economic growth in China is set to decline, as in the eurozone. Since there is no slack left in increasing parts of the economy as a whole in the euro area, major economic progress is no longer possible in some countries. In addition, political developments – such as the international trade war, the recently resolved dispute concerning Italy’s budget and the related financial market risks – have increasingly been constraining companies’ propensity to invest. The economic situation in many emerging markets will be subdued during this and subsequent quarters by liquidity outflows and currency devaluations.

Although the risk of a rapid global downswing has grown recently, KOF is expecting a soft landing for the world economy over the forecast period (see G 1). This means that foreign trade will provide a weaker stimulus to the Swiss economy over the coming year. This is especially the case for trade in goods; trade in services, on the other hand, is expected to perform strongly.

The domestic economy, including private consumption in particular, will provide a more significant boost to the Swiss economy during the forecast period. The incipient positive development in private consumption was partially offset during the third quarter of 2018 by various non-recurring effects. The hot and dry summer along with the supply difficulties experienced by certain foreign car producers resulted in a near-stagnation of consumer spending. Private consumption is thus expected to grow by around 1.2 per cent this year and could increase by roughly 1.6 per cent in 2020. This trend is being supported by the performance of the labour market along with rising disposable household incomes, thereby paving the way for an expansion in consumer spending.

Good prospects for the labour market

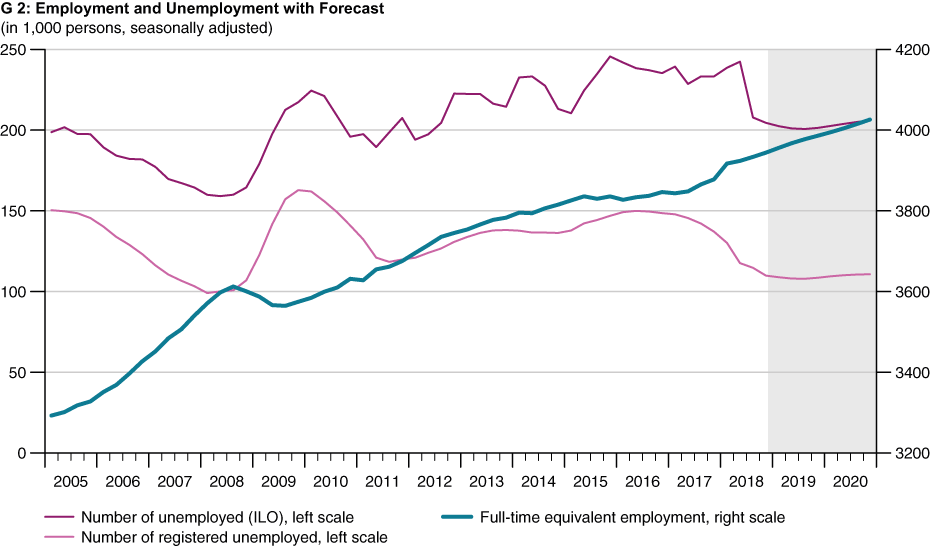

The labour market performed well last year. Although the general growth in employment slowed somewhat during the third quarter compared with the previous year, employment prospects continue to be buoyant and numerous labour market indicators remain at a high level. Full-time equivalent employment is projected to grow by 1.1 per cent in 2019 on the back of a 1.8 per cent increase in 2018. The unemployment rate as calculated by the State Secretariat for Economic Affairs (SECO) will this year remain more or less where it was at the end of 2018, averaging 2.4 per cent. According to the International Labour Organization (ILO), the employment rate will follow a similar trajectory at slightly above 4 per cent both this year and next (see G 2).

After three good years, employed persons in Switzerland will now have to forgo some of their previous gains. Although nominal wages rose at comparatively low rates over the years 2014 to 2016, the purchasing power of salaries grew owing to falling consumer prices. This led to strong annual increases in real salary levels. Since 2017 this trend has reversed. Real wages stagnated in 2017 and, owing to slightly higher inflation, are set to fall in 2018. This year, wage increases according to the Swiss Salary Index are expected to post a 1 per cent rise. Average salaries calculated based on the share of wages within the national accounts – which, in contrast to the Swiss Salary Index, also take account of bonuses and wage variations resulting from changes in sectoral structures – are forecast to rise at a similarly robust rate. Given that this year’s inflation forecast is 0.6 per cent, this will slightly increase the spending power of wages.

Inflation remained low at just under 1 per cent in the second half of 2018. Core inflation only accounted for around half of the overall figure. Compared with autumn, the forecasts for 2018 and 2019 have worsened slightly. This mainly reflects the significant fall in oil prices along with the slightly lower inflation expected in service sector prices. The outlook for 2020 remains unchanged compared with the autumn forecast at 1 per cent. The overall inflation risk is low, although the core rate is projected to increase.

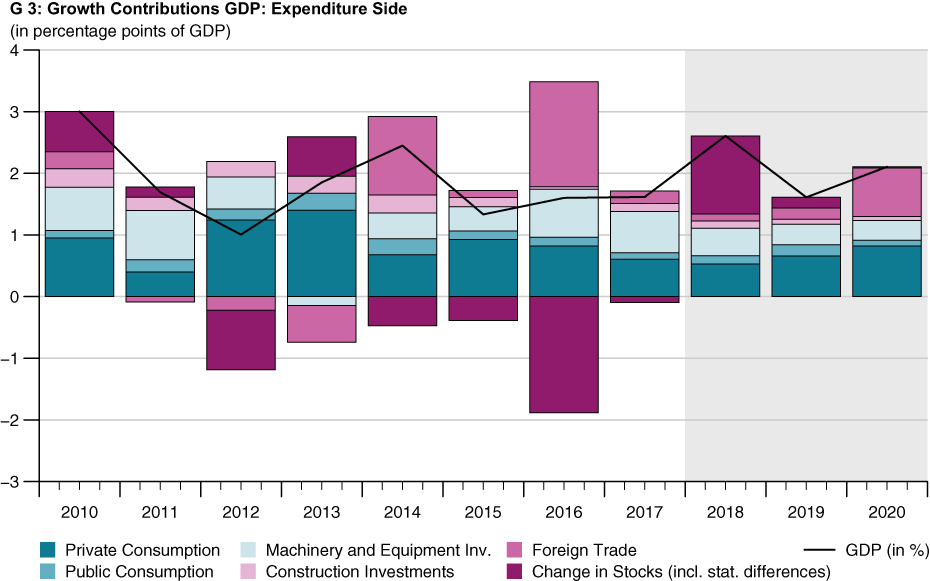

Weaker growth in investment in fixed assets

The prevailing uncertainty within international trade is having a negative impact on decisions concerning the location of production facilities, and thus also on investment decisions. Switzerland is also being affected by this. Excluding non-recurring effects (purchases of aircraft and trains, which increased), the investment cycle for plant and machinery that started in 2015 will come to an end, reaching its low point in the winter of 2019/20 (see G 3). This will thus bring to an end an unusually flat and protracted investment cycle, which differed considerably from the more typical shorter and steeper cycles observed since the 1980s. The only positive development expected is in the area of transport infrastructure.

However, investment will be lower than in the past, especially investment in residential construction. This is due above all to the fact that the number of completions has for some time been significantly lower than the increase in the number of households, resulting in additional vacancy rates.

Major sporting events distort economic developments

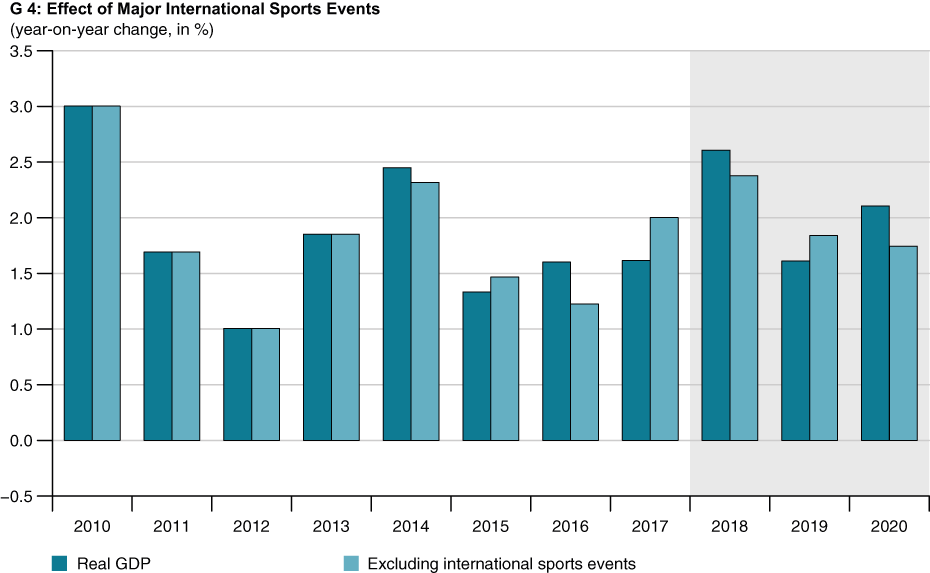

The forecast for growth in Swiss gross domestic product (GDP) is 2.6 per cent for 2018, 1.6 per cent for 2019 and 2.1 per cent for 2020 – following moderate GDP growth of 1.6 per cent in 2017. The Swiss economy has passed the high point in its growth cycle which, according to provisional Swiss GDP data, came in the first quarter of 2018.

The pattern of Swiss GDP growth over time is only of limited assistance in determining the Swiss economic cycle, as it is distorted by major international sporting events which have little to do with the performance of the domestic economy. In addition, it is known that the international trade in commodities has for a long time made a significant yet irregular contribution to Swiss value added. Using the available information, which supplements the official ‘headline’ GDP data, an estimate of ‘core GDP’ that factors out these aspects can be calculated (see G 4). Forecasted annual growth in adjusted GDP is 2.5 per cent for 2018, 1.7 per cent for 2019 and 1.8 per cent for 2020.

The surprisingly negative GDP growth in the third quarter of 2018 is mainly attributable to one-off effects. The diesel emissions scandal had an impact on gross value added for automobile industry suppliers. In addition, car sales in Switzerland were heavily affected. Furthermore, the retail trade suffered from the extreme weather conditions during the summer. The unusually long and hot summer caused a fall in demand for autumn clothing. The extraordinary weather conditions also had an adverse impact on electricity generation, as the unusually low levels of rainfall led to a reduction in electricity generated by fluvial and storage power stations.

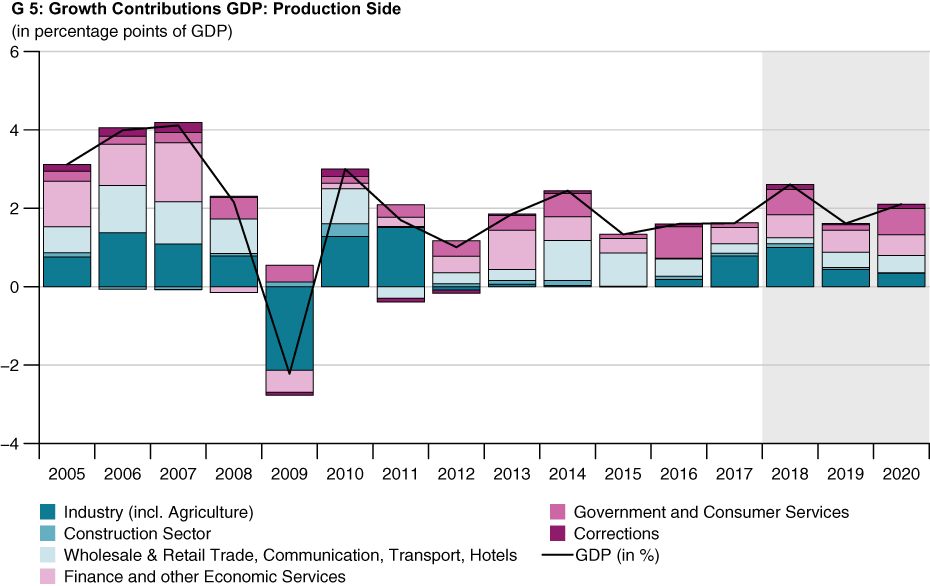

The unexpected fall in sales in the pharmaceutical industry during the third quarter of 2018 also reduced value added. We are proceeding on the assumption that sales in the pharmaceutical industry will recover during the fourth quarter of 2018, thereby offsetting the low level during the third quarter. In view of the more subdued international economic outlook, however, the growth rate for gross value added by the manufacturing sector in 2019 and 2020 has been revised slightly downwards (see G 5). 2019 and 2020 will see a somewhat weaker – albeit solid – expansion in Swiss economic activity.

The ‘unconventional’ stance of Swiss central bank policy, with a target interbank rate of –0.75 per cent, is set to continue for a further year, although we expect to see the first changes before the end of our forecast period. We continue to forecast a gradual tightening of policy by the US central bank over the next two years, albeit at a slower rate, also as a result of the recent increase in international risks.

As expected, the European Central Bank (ECB) is taking its time with its first interest-rate hike. The key driver behind this stance is the persistently low rate of core inflation as well as the risks and uncertainties associated, amongst other things, with Brexit and financial market upheavals. Nevertheless, we are still proceeding on the assumption that the ECB will replicate the interest-rate rises in the United States next spring, although the likelihood of such an outcome has declined.

The Swiss National Bank (SNB) reaffirmed its negative interest rate at its September meeting. At the present time, interest rates would appear to be a suitable instrument for protecting Swiss exporters against any excessive appreciation of the Swiss franc, since central bank checking accounts provide no evidence of foreign-currency interventions by the SNB. As the Governing Board is not expected to risk any significant appreciation in future and inflation will remain low in the immediate term, interest-rate policy will continue to be focused primarily on the ECB.

The KOF presents quarterly its forecasts for the economic development of Switzerland. A detailed analysis of the global economic and political framework is prepared, on the basis of which a comprehensive economic forecast is based. This model-based forecast is characterised by a high degree of disaggregation and provides a wide range of information on the current and expected development of key economic indicators.

Further information and more detailed forecast figures can be found on the forecast website.