Companies expect to see falling real wages and higher inflation in the long term owing to the war in Ukraine

- KOF

- Inflation

- KOF Bulletin

- Surveys

Russia’s invasion of Ukraine has lowered Swiss companies’ expected wage growth and, at the same time, raised their inflation forecasts. Small and medium-sized enterprises in particular, as well as companies in the manufacturing sector, expect to see higher prices in the long run. In purely arithmetical terms, the information provided by these firms translates into negative real wage forecasts, which are even more negative than they were before the war in Ukraine.

Inflation continues to rise in many countries. Until recently, central banks such as the European Central Bank (ECB) and the Swiss National Bank (SNB) considered the current wave of inflation to be fairly temporary, although it turned out to be more persistent than initially expected. They attributed these elevated inflation rates mainly to base effects, supply bottlenecks and shifts in demand – all related to the pandemic – and expected these temporary factors to subside over the course of the year. As long as long-term inflation expectations remained anchored, underlying inflation should have remained stable and close to its targeted levels.

However, Russia’s invasion of Ukraine and the accompanying economic disruption could make this assessment obsolete. For the global economy, Russia and Ukraine are key suppliers of raw materials such as energy, metals and agricultural produce, the availability of which has been jeopardised by the war, pushing up their price as a result of Russia’s attack. This suggests that further price increases in these inputs will lead to higher operating and production costs, which in turn could translate into higher inflation expectations in the longer term and thus higher prices (D’Acunto and Weber, 2022). This is because oil shocks have already fuelled inflation expectations in the past, de-anchoring the expectations of both firms and consumers (Coibion and Gorodnichenko 2015, Coibion et al. 2018).

Business survey sheds light on wage and inflation expectations before and after the start of the war

Whether Russia’s invasion of Ukraine has had an impact on the wage and inflation expectations of Swiss companies can be examined with the help of survey data from KOF. Since 16 February, KOF has been conducting a special survey to investigate how Swiss firms determine the prices of their products and services and what factors influence the price formation process. The companies surveyed include businesses from all sectors of the Swiss economy with the exception of agriculture. As part of this survey, these firms were asked how high they thought the annual rate of inflation in Switzerland – as measured by the national consumer price index – would be in the next twelve months (short term) and in five years’ time (long term). In addition, the companies were asked for their assessment of how employees’ gross wages in their organisations would change, on average, between today and one year from now.

The empirical method used takes advantage of the fact that the survey was launched before Russia’s invasion and has continued to be conducted since then. This means that the responses of firms that completed the survey before 24 February (the first day of the war) can be compared with those of firms that responded during the war. The war’s impact on inflation and wage expectations can therefore be identified based on the assumption that the war in Ukraine has been the main factor influencing companies’ expectations over the period surveyed. Because the survey was conducted electronically, it is possible to determine exactly when the relevant responses were submitted. 652 companies responded before the invasion started, and 578 firms have responded since then.

Higher inflation expectations since the outbreak of the war

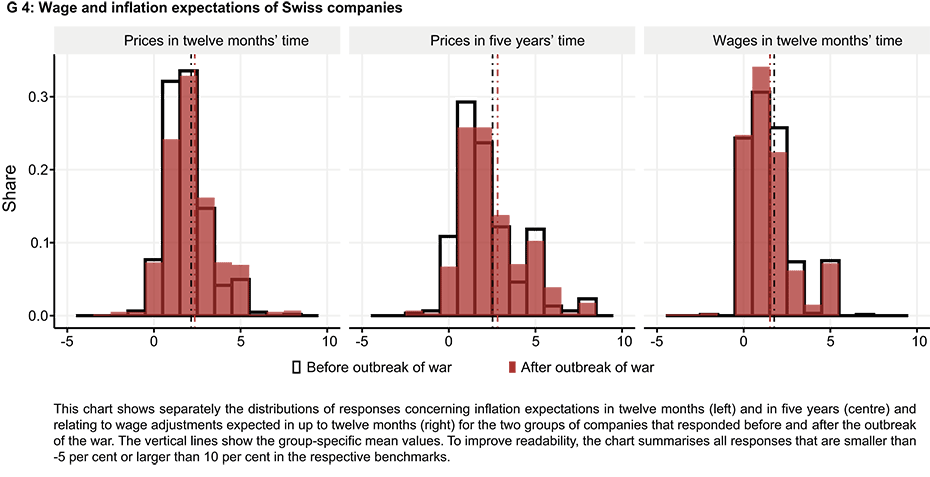

Chart G 4 shows separately the distributions of responses concerning inflation expectations in twelve months (left) and in five years (centre) and relating to expected wage adjustments in up to twelve months (right) for the two groups of companies that responded before and after the outbreak of the war.

Swiss companies expect to see higher inflation rates over both the short and long term since Russia’s invasion. 1 Before the war started, firms expected the inflation rate to rise to an average of 2.10 per cent (median: 2 per cent) over the next twelve months. Since the war started, the expected increase has been 2.35 per cent (median: 2 per cent). Inflation expectations for the long run have risen from 2.37 per cent (median: 2 per cent) to 2.83 per cent (median: 2 per cent). A regression model shows that these increases are statistically reliable at the 5 per cent significance level.

In contrast, expected wage growth since Russia’s invasion has been lower. Before the war started, companies expected gross wages to increase by an average of 1.72 per cent (median: 1.5 per cent) between today and one year from now. Since the war started, expected growth has remained at 1.49 per cent (median: 1 per cent). The regression model shows that this decline is statistically reliable at the 10 per cent significance level.

Industrial sector driving rise in long-term inflation expectations

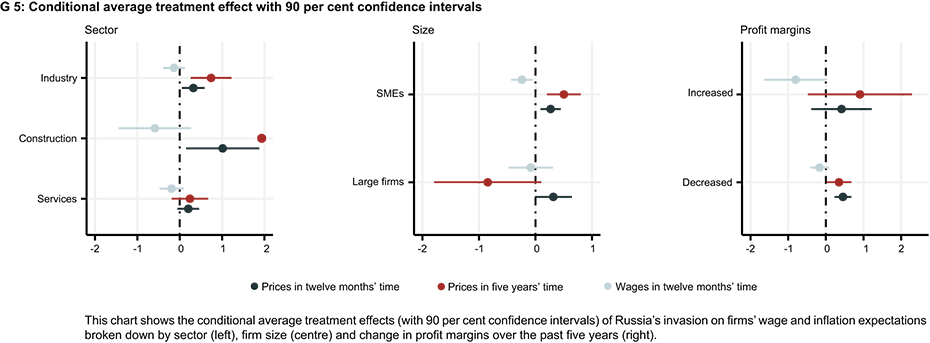

Chart G 5 documents the systematic heterogeneity between firms in terms of their wage and inflation expectations by showing the average treatment effects for each sector, firm size and margin situation with 90 per cent confidence intervals. 2 Broken down by sector, the left chart shows that the higher inflation expected in five years since the war started is driven by manufacturing firms. Their long-term inflation expectations have risen by 0.7 percentage points on average. This result seems plausible insofar as industrial firms in the value chain are directly exposed to various input factors such as energy and other commodities, whose prices have increased particularly sharply since the outbreak of the war. In contrast, the expectations of companies from the construction and service sectors have not changed significantly.

The middle chart shows the effect by company size. Small and medium-sized enterprises (SMEs) with fewer than 250 employees have tended to have higher long-term inflation expectations than larger companies since Russia’s invasion. At the same time, expected wage adjustments have fallen significantly among SMEs.

Finally, the chart on the right differentiates the effect according to whether companies believe that the profit margin on their product or service has increased or decreased over the past five years. Inflation expectations have increased in the case of those firms whose profit margins have decreased in recent years. Rising energy and commodity prices are already reducing profits for many companies. Accordingly, this result might indicate that firms whose profit margins are already under pressure are more likely to pass on the higher prices of input factors by raising their own prices.

Arithmetical real wage expectations have fallen since the war started

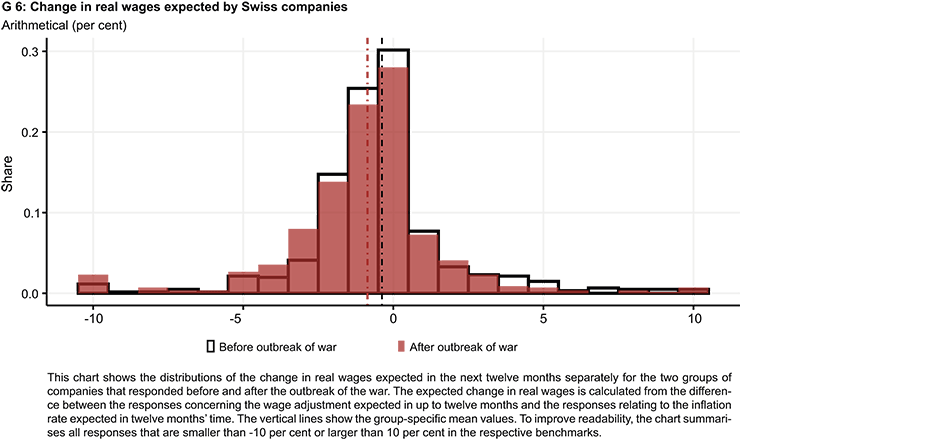

By correlating the responses concerning the expected wage and price adjustments, it is also possible to calculate how companies assess the change in real wages up to one year from now. The expected change in real wages is the difference between the expected change in gross wages in up to twelve months and the expected inflation rate in the next twelve months. Chart G 6 shows the distributions of these mathematically determined real wage expectations separately for the two groups of companies that responded before and after the outbreak of the war.

Even before the war started, the expected change in real wages was, on average, negative across all respondents. The information provided by the companies concerned indicates that they expected real wages to decline by 0.4 per cent (median: -0.5 per cent) in the next twelve months. After the war started, the expected change in real wages fell further to -0.9 per cent (median: -0.5 per cent). The survey’s results thus indicate that companies expect real wages to fall and that – owing to the war in Ukraine – they will fall more sharply in the next twelve months than they had expected before the war started.

All in all, the results of the special survey show that Swiss companies expect to see low wage growth and higher inflation in the short term since Russia invaded Ukraine. At the same time, their long-term inflation expectations have risen significantly, especially among companies in the manufacturing sector. This finding suggests that inflationary pressures may turn out to be more protracted than was expected before the war. In addition, arithmetic shows that companies expect real wages to fall and that – owing to the war in Ukraine – these are expected to fall more sharply in the next twelve months than they had expected before the war started.

____________________________________________

1 Open-ended quantitative questions often contain outliers consisting of implausibly small or large responses. This evaluation excludes responses smaller than -20 per cent and larger than 20 per cent as outliers.

2 These treatment effects are ‘conditional average treatment effects’. They measure, for each sub-group, the difference in average expectations between firms that responded after the outbreak of the war and firms that completed the survey before the war began.

Literature

Coibion, O and Y Gorodnichenko (2015), “Is the Phillips Curve Alive and Well after All? Inflation Expectations and the Missing Disinflation”, American Economic Journal: Macroeconomics 7(1): 197-232.

Coibion, O, Y Gorodnichenko and S Kumar (2018), “How Do Firms Form Their Expectations? New Survey Evidence”, American Economic Review 108(9): 2671-2713.

D’Acunto, F and M Weber (2022), “Rising inflation is worrisome. But not for the reasons you think”, VoxEU.org, 4 January.

Contacts

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland

KOF FB Konjunkturumfragen

Leonhardstrasse 21

8092

Zürich

Switzerland