Firms expect to see wage growth of 1.6 per cent in twelve months

- KOF

- Labour Market

- KOF Bulletin

A special survey conducted by KOF examines the wage expectations of Swiss companies from today until one year from now. A majority of firms in almost all sectors expect to see wage growth of 1 per cent or more.

What will happen with wages next year? There is little base data currently available in Switzerland to answer this question. Unlike many other countries, Switzerland does not conduct a quarterly survey of wages that shows what happens to them within a calendar year. Moreover, there is little information on what wage trends labour market participants expect to see in the near future. Surveys by private companies are published in the autumn and ask firms about their wage agreements for the coming year. However, these surveys are limited in terms of their representativeness and sample size, and they only take place once a year.

KOF intends to plug this information gap in future. There are plans for the companies participating in the KOF Business Tendency Surveys to be asked about their wage expectations on a quarterly basis. Thanks to the size and coverage of the survey data, the survey results would in future provide a quarterly quantitative assessment of expected wage growth in various sectors over the following twelve months.

The corresponding question on companies’ wage expectations was tested for the first time in a special KOF survey of price-setting behaviour. Specifically, these firms were asked: “How do you expect employees’ gross wages in your organisation to change on average between today and one year from now (in per cent)?” The wording of the question is intended to ensure that companies formulate their expectations for the next wage round.

On 16 February this year, 5,556 companies were asked to take part in these special surveys and 1,550 of them had participated by the end of March, which equates to a response rate of 27.9 per cent. Seven out of ten individuals who completed the questionnaire for their organisation described themselves as owners or managers, while around 17 per cent were heads of department. The wage expectations of these survey respondents are therefore likely to have a direct impact on actual wage levels at their organisation.

More than four out of ten companies expect to see wage growth of 2 per cent or more

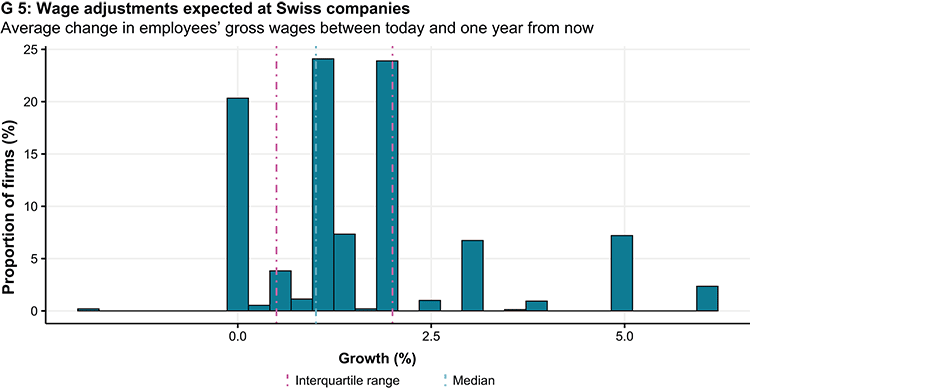

Chart G 5 shows that the firms surveyed expect gross wages to grow by 1.6 per cent on average over the next twelve months. The chart shows their unweighted responses to the question on wage adjustments. Questionnaires with wage growth rates of above 20 per cent or below minus 20 per cent were excluded.

The differences between organisations in terms of their expected wage adjustments are considerable. Slightly more than 40 per cent of companies expect to see wage growth of 2 per cent or more. Even 5 per cent wage growth is not unrealistic at some firms. On the other hand, about a quarter of companies expect to have wage growth of 0.5 per cent or less. One fifth of firms expect to see no pay increase at all. Hardly any survey respondents are expecting nominal pay cuts. There are also differences according to company size: larger firms tend to expect slightly lower wage increases than smaller businesses. If these survey responses are weighted according to the relevant companies’ full-time equivalent workforces, wage growth of 1.3 per cent is expected.

Almost all sectors expect to see wage growth of 1 per cent or more

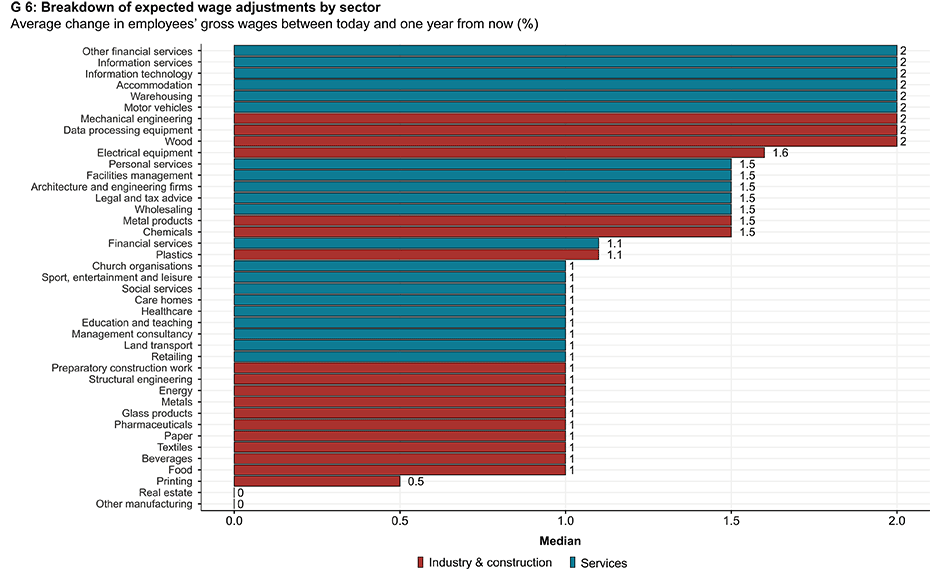

Chart G 6 illustrates the differences in (unweighted) wage expectations between sectors. It shows the median for each industry, i.e. the ‘middle’ value in the range of the sector’s responses when sorted in ascending order of wage growth. The chart focuses on industries with more than ten responses. The highest wage growth is expected by respondents in financial services, information services and technology, accommodation, warehousing, motor vehicles, the wood industry, mechanical engineering and manufacturers of data processing equipment, which includes the watchmaking industry. The median here is nominal wage growth of 2 per cent. Interestingly, these are industries with traditionally high wage growth rates (e.g. IT) and sectors that were hit hard by the COVID-19 pandemic and have recently been complaining about skills shortages (e.g. hospitality). At the lower end of the range of expected wage growth by sector is the printing industry with expected median wage growth of 0.5 per cent. The majority of respondents in real estate and other manufacturing even reckon that nominal wages will not increase at all. The median wage growth expected in almost all sectors is 1 per cent or more, which suggests that wage growth in the next pay round will be greater in nominal terms than in recent years, when it was mostly below 1 per cent.

Wages are usually only adjusted once a year

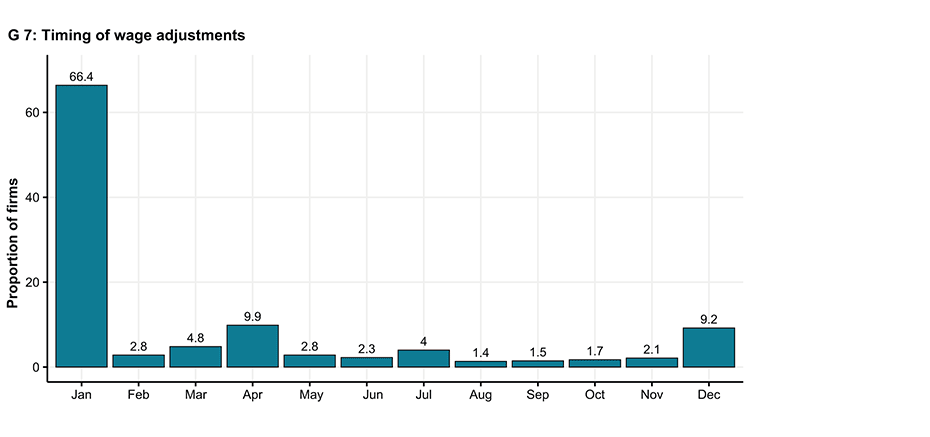

In order to further categorise the question on wage expectations in the special KOF survey, the companies were also asked in which months of the year they typically increase or reduce their wages. Chart G 7 shows that the vast majority of firms adjust their wages in either January (66.4 per cent of all responses) or December (9.2 per cent). Some companies adjust wages in March or April (14.7 per cent of all responses). Since firms had the option of selecting several months in the questionnaire, their responses also reveal how often they adjust their gross wages per calendar year. This shows that wages at 90 per cent of the companies surveyed are only increased once a year. 8 per cent of the firms surveyed state that they make two wage adjustments per year. These companies typically raise wages in January and July. About one in fifty firms report adjusting wages three times or more.

Interestingly, it is the smaller firms that tend to adjust their wages at the turn of the year. Large companies, on the other hand, more often adjust wages at other times. In terms of concrete figures, firms that adjust wages in January have an average of 123 full-time-equivalent members of staff. Companies that adjust wages in April, on the other hand, have an average of 370 full-time-equivalent employees. This situation means that the figures for the wage adjustment date are somewhat different if the survey responses are weighted according to workforce size. In this case, more than 55 per cent of wage adjustments take place in December or January. Accordingly, the proportion of wage adjustments that take place in March or April rises to 29 per cent.

Wages reflect cyclical turning points with a time lag

These results have important economic implications. The fact that nominal wages in existing employment contracts are only adjusted once a year is one explanation why wages usually lag well behind economic trends. The fact that many companies adjust wages around the turn of the year means that wages react more quickly to the cyclical changes that take place towards the end of the calendar year. Cyclical turning points early in a calendar year – especially those in May or June – have a less immediate effect on wages.

What these characteristics mean for wage levels in Switzerland was exemplified following the franc shock of 2015 and after the start of the COVID-19 pandemic in March 2020. The two most important economic turning points of the last decade coincidentally took place early in the calendar year – at a time when many companies had already set wages for the current year. This meant that it was almost a whole year before wages reflected the deterioration in the economy. During the first year of the pandemic, for example, wages grew respectably in nominal terms and even relatively sharply in real terms – owing to falling consumer prices – because they had been agreed at the end of 2019 when the economy looked much healthier. It was not until a year later that wages reflected the economic slump, when the economy was actually already clearly recovering.

Real wages are declining in 2022

The fact that companies typically adjust wages only once annually – and often at the beginning of the year – is likely to have a major impact on wage levels this year as well. This is because it is likely to mean that nominal wages in 2022 will react very little to the war in Ukraine and the price rises triggered by it. The war will only affect the next pay round, i.e. wages in 2023. Workers will demand compensation for the increase in consumer prices resulting from the war. Companies, on the other hand, are likely to reject demands for wage rises by citing greater economic uncertainty, higher production costs and, potentially, declining export demand. Which of these effects will prevail is difficult to predict.

Under its favourable scenario for the war in Ukraine, KOF therefore predicted in its latest economic forecast that nominal wages – as measured by the Swiss Wage Index (SLI) – would increase by only 0.8 per cent in 2022. KOF is forecasting growth of 1.8 per cent for 2023 in this scenario. The low level of nominal wage growth in 2022 will not be sufficient to compensate for the inflation expected in the current year. Real wages are therefore likely to fall by almost one per cent this year – according to the SLI – after having risen by 1.5 per cent and 0.1 per cent in 2020 and 2021 respectively. KOF is forecasting real wage growth of 1.1 per cent for next year.

Contact

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland