Domestic tourists guarantee success of Switzerland’s winter season

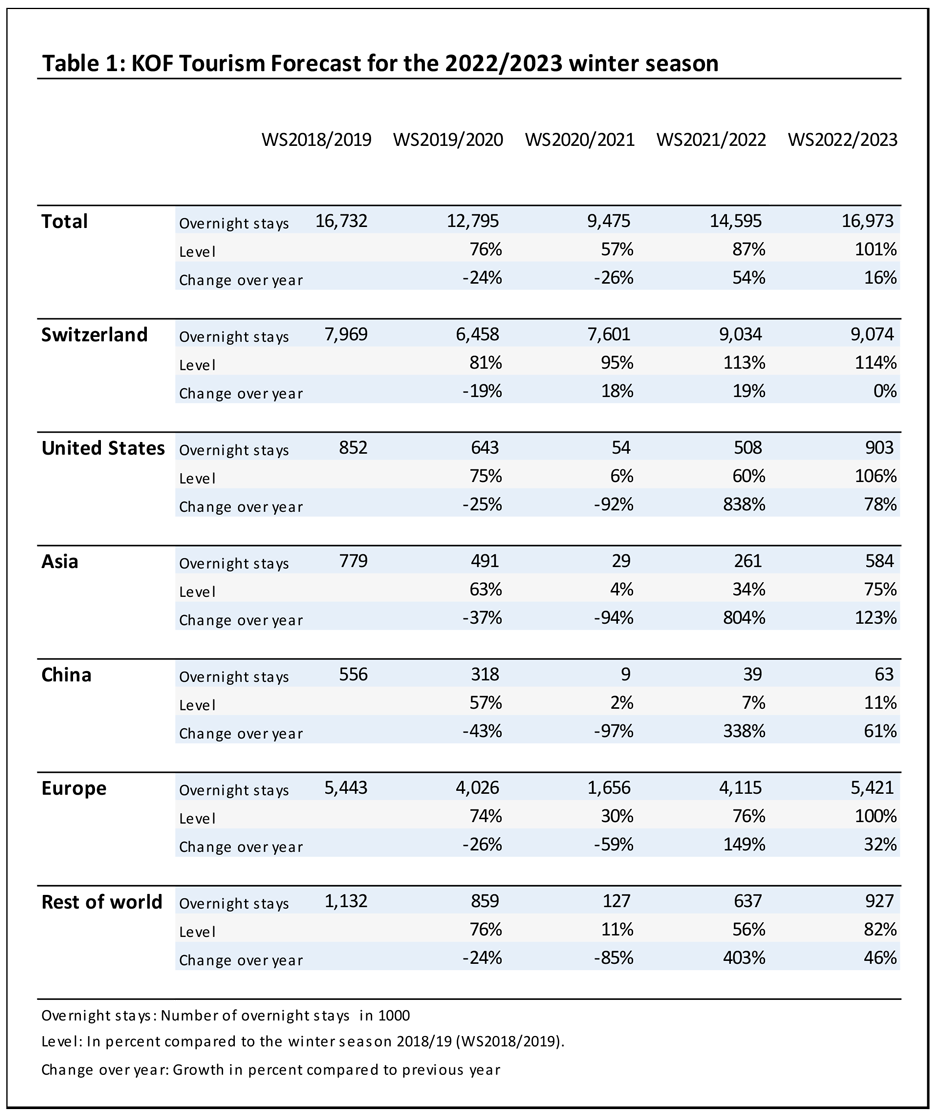

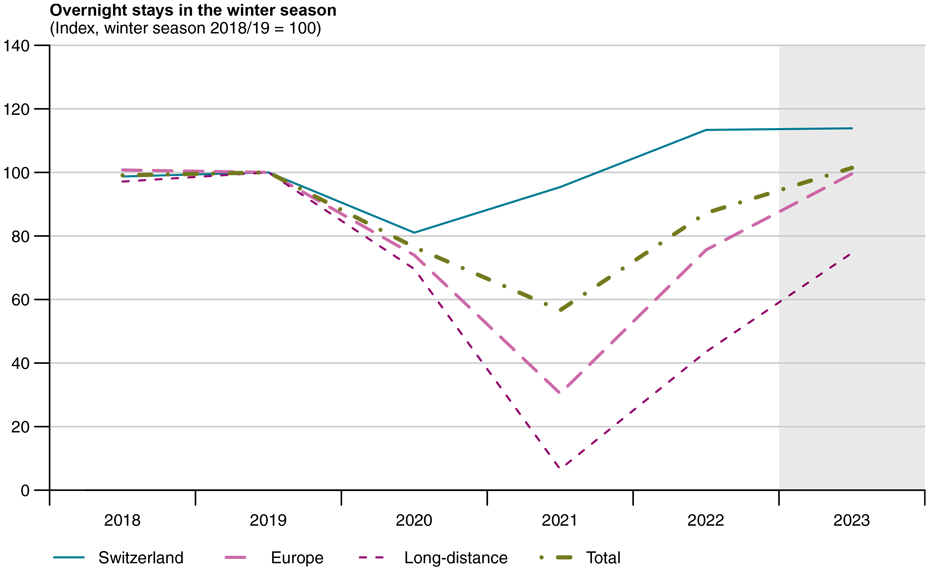

KOF’s Tourism Forecast concludes that Swiss tourism is on the road to recovery. While the summer season got off to a good start, tourism in winter should maintain this momentum and exceed pre-pandemic levels. The total number of overnight stays during the 2022 winter season will increase by almost 2.4 million (up 16 per cent).

Review of the summer season

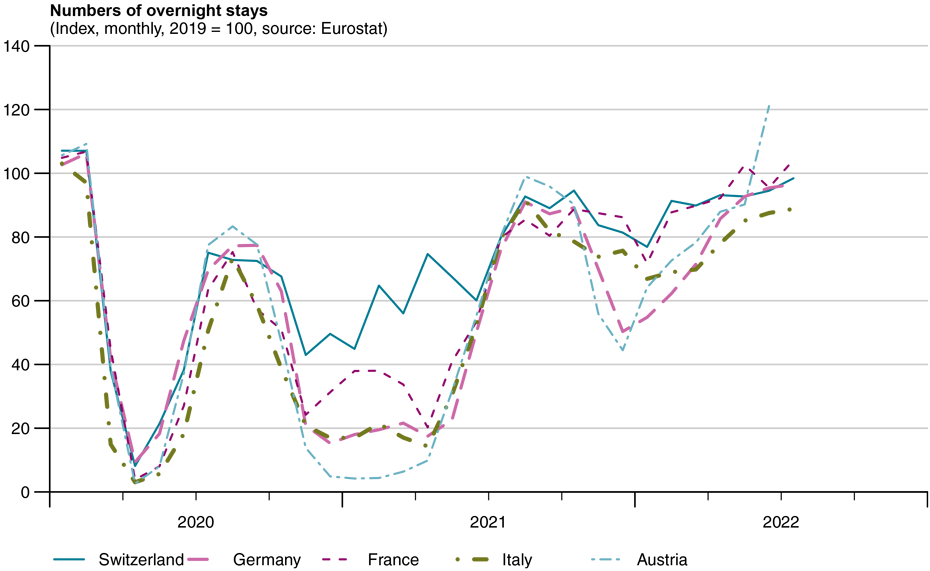

Since February 2022, tourism demand has recovered rapidly with the gradual lifting of COVID restrictions. During this year’s summer season, the number of overnight stays in Switzerland almost reached the level of the 2019 season, with overnight stays only 2 per cent below the pre-pandemic level. The strong propensity to travel, especially among the Swiss, appeared undiminished at the start of the summer season, and the trend towards spending more holidays in one’s own country continued. However, the return of long-distance travellers, especially those from the United States, was also noticeable in many holiday regions.

A comparison with neighbouring countries shows that the numbers of overnight stays in Italy, Germany, Austria and Switzerland were similarly high. In Austria, a particularly sharp increase was observed in June. The numbers of overnight stays there were more limited owing to the greater restrictions in place, which is why there were then more significant catch-up effects in the summer. Switzerland achieved robust growth in comparison.

Positive trends among foreign tourists:

- United States: The numbers of tourists from the United States revealed a highly positive trend even before the COVID-19 pandemic. The numbers of overnight stays, for example, increased by almost two-thirds between 2009 and 2019. Switzerland’s geographical location makes it particularly attractive for European trips by American tourists. As travel restrictions were relaxed, visitor numbers in the summer were almost as high as they had been before the pandemic. In August the level was, for the first time, even higher than it had been before the outbreak of the COVID-19 pandemic.

- France and the Netherlands: The mountain regions have been among the big favourites with guests from France and the Netherlands this year, with Eastern Switzerland and Bern reporting record numbers of travellers from these countries. Switzerland is likely to have benefited from the sharp rise in air travel prices this summer.

- Gulf States and India: These regions are becoming increasingly important for tourism in Switzerland. As an illustration: the numbers of overnight stays from these two regions before the pandemic were as high as those of Italian guests. Tourists from the Gulf States and India are expected to become even more important in future.

Negative trends:

- China: In 2019, before the outbreak of COVID-19, 154.6 million mainland Chinese travelled abroad, according to the World Bank. They spent more than 1.4 million nights in Switzerland in 2019, accounting for just under 3.5 per cent of total overnight stays and surpassing the number of French tourists, for example. However, there was little change during the summer months compared with previous months. The relevant level during these months remained unchanged at just under 7 per cent of the pre-crisis level. However, it is still unclear when travel activity will return to normal.

- Russia: The Swiss government decided in September 2022 to no longer issue fast-track visas for Russian nationals. This move has brought Switzerland’s visa regulations into line with those of the European Union. Consequently, the already declining numbers of Russian tourists are likely to fall further, even though they had reached just under a third of their pre-pandemic level by August.

Forecast of overnight stays during the 2022/23 winter season

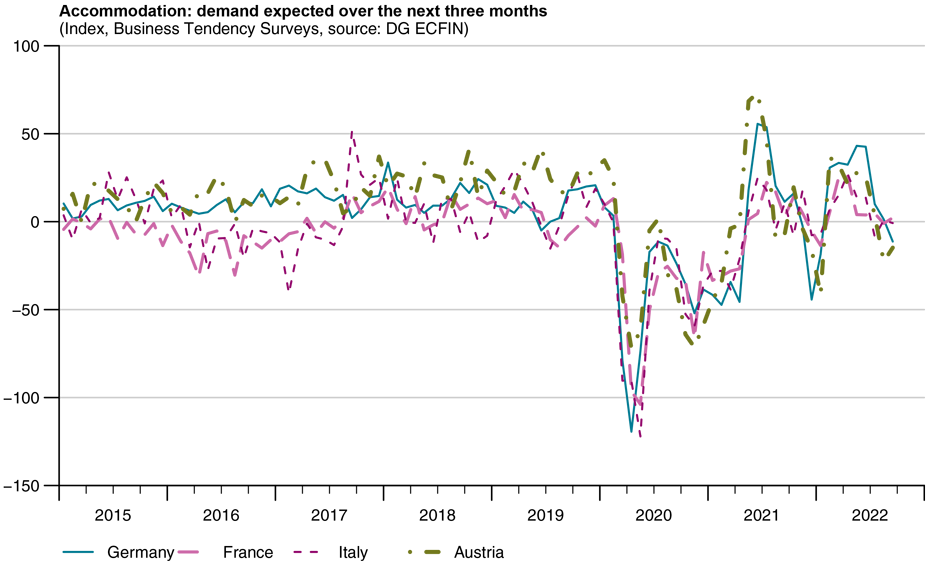

The international environment for the Swiss economy has deteriorated significantly in recent months. Strong economic growth is not expected to be achieved by neighbouring European countries either this winter or in the coming year. This is likely to affect both consumption and tourism demand. The appreciation of the Swiss franc is also likely to further dampen demand for travel (more on this in the upcoming KOF Bulletin on 4 November). In particular, the franc’s parity with the euro is likely to send a warning signal to many travellers and have a negative impact on the tourism sector, regardless of price increases. Nevertheless, the current recovery as well as the planning certainty around long-distance travel are more important factors that should continue to ensure growth in the tourism industry. At present, it is still unclear to what extent coronavirus will lead to further restrictions. This forecast therefore does not assume that any additional restrictions will be introduced.

The 2022/23 winter season is likely to be the first winter in Switzerland without severe restrictions since the outbreak of the pandemic. The greater planning certainty and also the savings accruing abroad will outweigh the effects of the economic downturn. In addition, the higher prices charged for the winter season make it less price-sensitive than the summer season. This catch-up effect will therefore offset the economic downturn in Europe in winter tourism.

However, higher electricity prices are dampening the recovery. Supply insecurity and high prices have also been depressing sentiment in the tourism industry lately. Recent surveys conducted in European countries show that the positive outlook for the coming months has deteriorated. However, Switzerland has an advantage over its neighbours. The prices of its overnight stays and ski passes are more stable, partly because its energy supplies are much less dependent on Russian commodities than neighbouring European countries are.

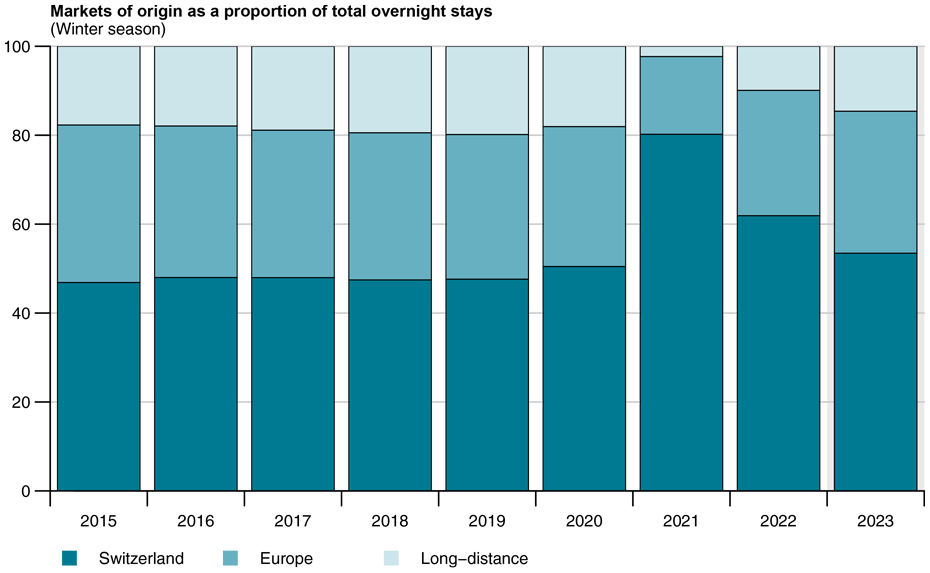

Above all, the trend towards spending more holidays in one’s own country, which has intensified since the COVID-19 pandemic, should have a positive effect on tourism. The winter season is expected to see a higher proportion of Swiss guests than in the past. In addition, the more transparent pricing policies of Swiss mountain railway operators compared with other countries should have a positive impact.

However, the numbers of long-distance travellers will remain below pre-pandemic levels. For example, the Japanese have only been able to travel abroad more easily again since this October. Russian guests will largely be absent during the forecasting period. Switzerland has in the past been a popular holiday destination for tourists from these countries, especially in January and February.

The medium- and long-term trends for the coming seasons will be presented in the November edition of the KOF Bulletin, which will focus on the influence of exchange rates. This will be published on Friday, 4 November this year.

Contact

KOF FB Konjunktur

Leonhardstrasse 21

8092

Zürich

Switzerland