A Glance at the Payment Practices of Swiss Residents – Payments Abroad Continue to Increase

- Swiss Economy

- KOF Bulletin

At least since the removal of the exchange rate floor, there has been much speculation regarding retail tourism by Swiss residents abroad. The survey concerning payments and cash withdrawals carried out by the Swiss National Bank (SNB) enables both structural and contingent conclusions to be drawn concerning the payment practices of Swiss residents both at home and abroad. Half of transactions paid for with Swiss credit cards abroad are concluded online.

In addition, the effects of the increase in the value of the Swiss franc also stand out within foreign transactions.

Over the past years, the use of credit cards by Swiss residents for payments within the country has not been widespread. The proportion of payments made with a national payment card (issued by a national bank, thus including both private and company cards) has been relatively constant over the years at around 20 per cent. Although the use of debit cards is declining, most national payments continue to be settled by debit cards (around 78 per cent in 2015). Just under one per cent of national payments were made in 2015 using (national) e-cash.

However, credit cards are being less widely used for foreign payments. Whilst around 94 per cent of payments (number of transactions) in 2005 were made with a national credit card, the figure in 2015 was just under 74 per cent. By contrast, debit cards (with a share of 17 per cent in 2015) are being used with increasing frequency along with e-cash, which accounted for more than nine per cent of payment transactions in 2015.

Most cash withdrawals abroad are still made using debit cards (74 per cent in 2015), whilst credit cards were used for just under 16 per cent. E-cash is also fairly important at 10 per cent.

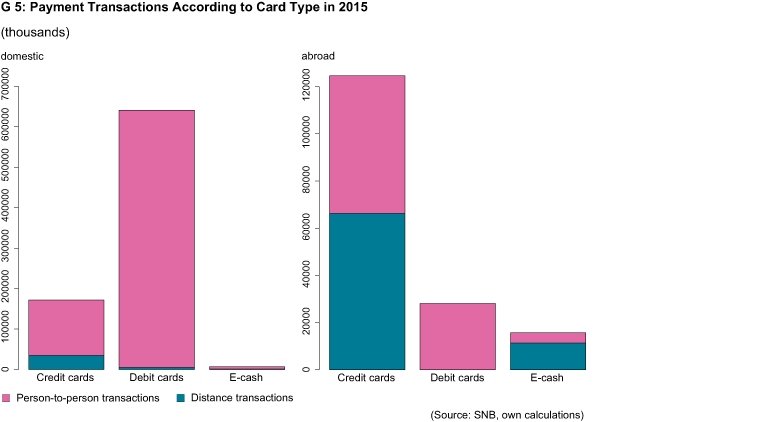

Distance selling playing a significant role

The popularity of online shopping is also reflected by these figures. Since December 2014, payments have been sub-divided depending upon whether they involve person-to-person or distance (online) selling. For distance transactions, credit cards account for around 53 per cent (2015) of the total number of payment transactions concluded abroad (see G 5). Within Switzerland the figure is a good 20 per cent. Since debit cards can only be used on a limited scale for online payments, their usage is only marginal, both nationally and abroad. E-cash is in turn mainly used abroad for distance transactions (72 per cent), although much less frequently in Switzerland (23 per cent).

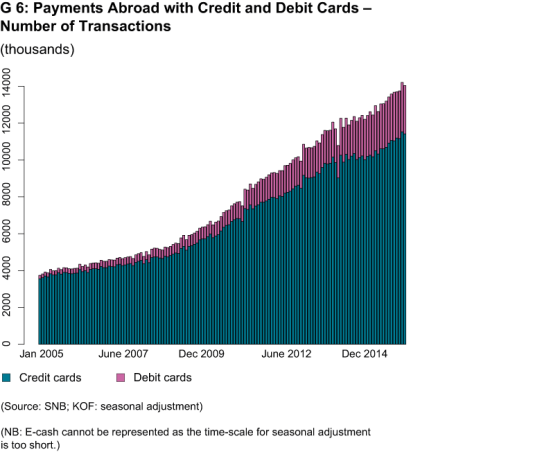

The influence of the exchange rate on the number of transactions abroad

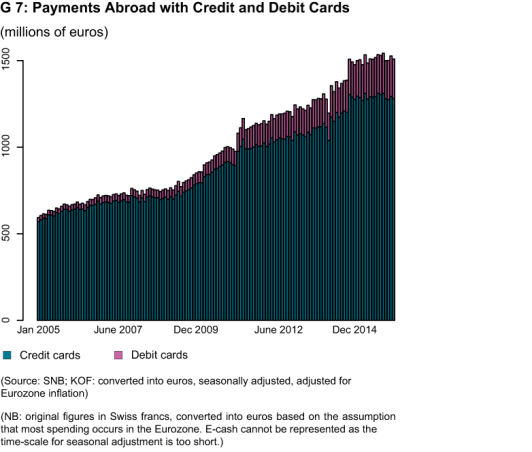

If the (seasonally adjusted) number of monthly payments abroad made using Swiss cards is considered (see G 6), in addition to the strong increase since 2009, a moderate upward shift is also apparent in June 2011, although not at the start of 2015. 2011 was characterised by a sharp increase in the value of the Swiss franc compared to the euro – comparable with the removal of the exchange rate floor at the start of 2015. However, the total amount of payments in millions of euros (converted into euros and adjusted for Eurozone inflation) also shows a significant increase in January 2015. Since then, the figure has stabilised at this level (see G 7). Since the removal of the exchange rate floor, Swiss residents have thus not been shopping significantly more abroad, although have been spending larger amounts abroad. In May 2014 payments made abroad appear to have been particularly low. This is probably due to the low bonus payments made in the spring of this year and the later holidays. For example, Ascension Day fell at the end of May, and the Pentecost public holiday in June.

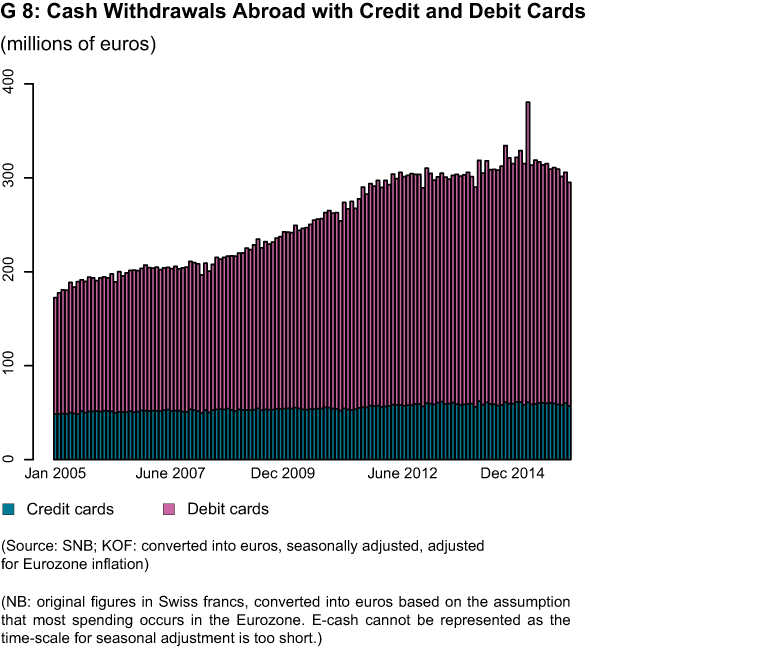

Cash withdrawals made using Swiss cards abroad (in millions of euros, seasonally adjusted and adjusted for Eurozone inflation, see G 8) do not show any clear jumps, although an upward trend since 2009 can be noted. However, a small peak was reached in January 2015, followed by a higher peak in July 2015. Thus, during the month in which the exchange rate floor was removed, particularly large withdrawals of cash were made abroad. Transactions abroad are generally particularly high in July as it is one of the most important holiday months in Switzerland. In July 2015 however, spending was significantly higher than in previous years. Nevertheless, the increasing trend of the past few years appears to have slowed overall. This could suggest that Swiss residents are using cards more frequently when abroad, rather than withdrawing cash. This means that the increase in foreign payments can probably be accounted for in part by structural changes in payment practices.

Contact

No database information available