No Consequences of Brexit for Switzerland – yet

- KOF Bulletin

- Surveys

Brexit will be keeping Europe busy for a long time, and its long-term consequences are not yet foreseeable. According to a KOF survey, this means that the direct consequences are still negligible for Swiss exporters. However, Switzerland's negotiating position with the EU is not expected to be improved by Brexit.

Brexit – or at least the stated intention of British voters to leave the EU – is a fact. However, since both the precise manner of departure and the drafting of the subsequent treaties between the United Kingdom and the EU are still entirely uncertain, it is still practically impossible to quantify the economic consequences with precision.

Nevertheless, Brexit is already influencing the real economy. First, the outcome of the vote had immediate implications for real economic indicators, such as the exchange rate. In addition, Brexit had a dampening effect on the expectations of British consumers and producers. At the same time, the depreciation of the pound sterling should increase demand for British products, and cushion any adverse economic consequences for the United Kingdom. However, the more subdued expectations and the related increased uncertainty are expected to lead overall to restraint on the part of consumers and investors and offset any exchange rate gains.

The direct consequences of Brexit for economic growth in the other EU Member States are unclear. On the one hand, the depreciation of the pound sterling is expected to result in depressed revenue for businesses which make a high proportion of their sales to the United Kingdom. On the other hand, various EU cities and regions are seeking to capitalise on Brexit. London is likely to become less attractive as a financial centre, and competitors are thus already actively vying for the attention of footloose financial services businesses. In addition, interest by other E.U. member states has already been noted in the EU institutions located in the United Kingdom, such as for example the European Medicines Agency (EMA).

Twin-track implications

The implications of Brexit for Switzerland are expected to be felt in two areas. First, the United Kingdom's departure from the EU is expected to complicate trade with the island nation, at least until trade relations between Switzerland and the United Kingdom have been regulated in new treaties. This would affect predominantly businesses with direct trade relations. On the other hand, Brexit is expected to have indirect knock-on effects on Switzerland. It may be assumed that it will worsen Switzerland's negotiating position with the EU with regard to the implementation of the initiative against mass immigration.

It is difficult to imagine that, in view of the expected tough negotiations with the outgoing United Kingdom, the EU would grant concessions to a third country in relation to one of its core basic values, free movement of persons. The requirements of the initiative against mass immigration are not compatible with the agreement on the free movement of persons between Switzerland and the EU, and the implementation of the initiative would constitute a violation of the treaty by Switzerland. Brexit has probably made it more likely that the EU would respond to a violation of the agreement on the free movement of persons by terminating the agreement. Since the agreement on the free movement of persons is associated by a guillotine clause with the further Bilateral II Agreements, this means that if one treaty is terminated then all Bilateral II treaties will lapse.

Survey of Swiss businesses

In order to throw greater light on the potential implications of Brexit for Switzerland, in July the KOF recorded the share of exports to the EU and to the United Kingdom of the Swiss companies that participate in the KOF business tendency survey. Export shares were thus determined for manufacturers, financial service providers and other service providers. The businesses from these sectors are expected to be those most heavily affected by Brexit. By recording export shares, it is possible to identify the businesses with particularly strong trade relations with the United Kingdom. The firms were subsequently divided into two groups, namely exposed (high share of exports) and not exposed (low share of exports).

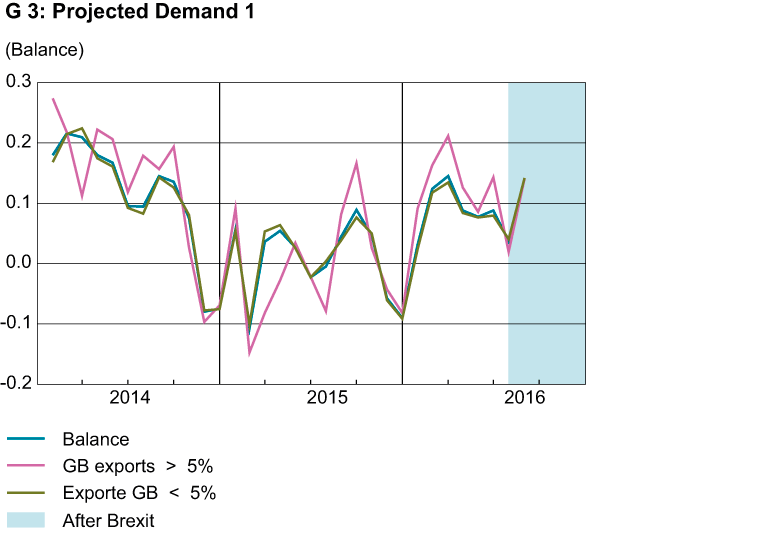

The blue line in graph G 3 shows businesses' demand projections over time. The red line shows expectations for businesses that earn more than five per cent of their revenue from the United Kingdom. The expectations of businesses with lower levels of sales to the United Kingdom fell more sharply in July, the first post-Brexit survey, than for other businesses. However, the number of businesses with exports to the United Kingdom is small compared to other businesses, which makes the red line slightly more volatile. The strong fall in July is not extraordinary compared to past figures, and does not necessarily imply a strong reaction by exposed firms. In addition, diverging trends may be identified within both groups.

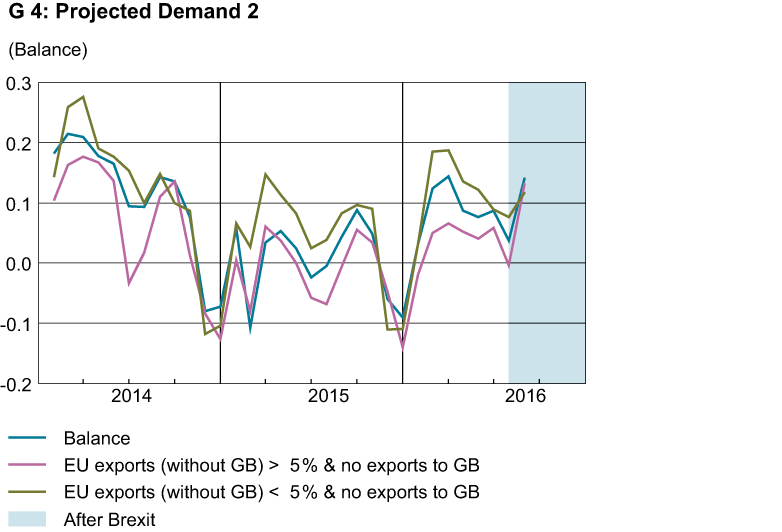

Graph G 4 attempts to identify potential implications of the deterioration in the negotiating position with the EU. The graph divides survey participants into businesses that earn more than five per cent of their revenue in the EU (without the United Kingdom) and business that serve exclusively the Swiss national market. Like figure one, figure two does also not suggest any negative effects on the short-term expectations of Swiss businesses.

The descriptive analysis of the results of the survey shows that the Brexit shockwaves have not (yet) been felt by Swiss businesses. This means that no far-reaching consequences are expected in the short term for Switzerland. The long-term consequences of Brexit at present depend upon too many variables for a definitive conclusion to be drawn.

Contact

Professur f. Wirtschaftsforschung

Leonhardstrasse 21

8092

Zürich

Switzerland