Compensation of the Costs Associated with CTR III: Impact of Taxation on Capital Gains

- Fiscal Policy

- KOF Bulletin

In mid-February, Swiss citizens will vote on the third corporate tax reform (CTR III). To mitigate the effect of lower tax revenues, the Swiss parliament decided in favour of an increase in taxes on dividends but against the introduction of a capital gains tax. KOF researchers have investigated which impacts an additional taxation on capital gains on gross domestic product, investment, employment, consumption and tax revenue could have.

Switzerland, a small open economy, depends to a large degree on migration, trade and international capital flows. Given the increasing mobility of companies and Switzerland’s low tax rates in international comparison, the number of enterprises choosing Switzerland as their domicile has grown significantly in the last few years. Special tax regimes offered by the Swiss cantons, for instance, provide competitive tax conditions for holding companies. These special cantonal tax regimes are based on the principle of lower tax on income generated abroad than on income generated in Switzerland.

New fiscal measures compensating for the scrapping of the special tax regimes

This form of discriminating taxation has become subject to growing criticism from the European Union (EU) and the Organisation for Economic Cooperation and Development (OECD). Pressure to scrap the special tax regimes and replace them with an internationally acceptable taxation system has prompted the authorities to launch a third corporate tax reform (CTR III), which was passed by Parliament in June 2016. On 12 February 2017, the Swiss population will vote on this reform in a referendum.

The law passed by Parliament provides for the abolition of the current special cantonal tax regime. In addition, as partial compensation for the higher taxes payable by some companies, but also as an innovation incentive, the law proposes the introduction of a license box system that reduces taxes on income from intellectual property rights, for instance patents. Furthermore, the new law allows the cantons to introduce an allowance for excess corporate equity that goes hand in hand with an obligation that at least 60 per cent of dividends should be subject to taxation at the cantonal level. Finally, the reform provides for a reduction of the cantons’ ordinary tax rate on earnings. This last measure, however, is not part of the referendum and will be decided individually by each canton.

Economic and budgetary impact of CTR III: which compensatory measure?

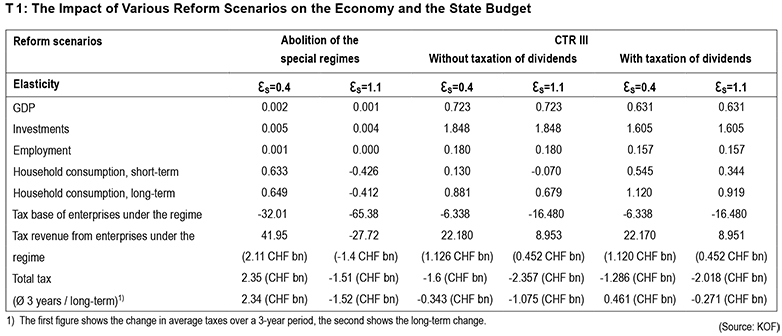

The choice of suitable fiscal compensatory measures in the context of CTR III was the subject of numerous debates before the Swiss parliament ultimately decided to raise taxes on dividends. In its first draft, the Federal Council had also suggested higher taxation on capital gains than currently applicable. According to this proposal, income tax would have been levied on the newly taxed gains. In a recent study, KOF experts investigated the effects of CTR III on the economy and the budget (Chatagny et al., 2016). The article focuses on the various measures, both decided and planned, that have been devised to compensate for reform-related tax deficits. The authors of the study developed three different scenarios (see T 1). In the first scenario (columns 1 and 2), the reform is implemented without any specific compensatory measures. Positive effects arise with regard to GDP (+0.72%), investment (+1.85%), employment (+0.18%) and private consumption, both in the short term (+0.13%) and in the long term (+0.88%). With respect to the tax base, the reform would result in a deficit of 1.6 billion Swiss francs in the short term and 0.3 billion Swiss francs in the long term. Assuming an elasticity factor of 1.1, losses in tax revenue amount to 2.4 billion Swiss francs in the short term and to 1.08 billion Swiss francs in the long term.[1]

Second scenario (columns 3 and 4): This scenario assumes an increase in dividend taxation to limit the reform-related tax deficits. The results show slightly lower positive effects on GDP, investment and employment, while the positive impact of the reform on private consumption increases due to higher transfers in favour of private households. According to the results, an increase in dividend taxation leads to a limitation of tax losses in the short run and even results in an increase in tax revenues in the long run. Assuming an elasticity factor of 1.1, compared to a lower elasticity factor, the positive effects on private consumption go down slightly both in the short and in the long run due to higher tax deficits.

The third scenario (columns 5 and 6) assumes both taxation of capital gains and an increase in the tax on dividends. With a tax gain of 0.36 billion Swiss francs in the short term and 0.56 billion Swiss francs in the long term, and an elasticity factor of 0.4, this scenario is clearly associated with the lowest costs. Given an elasticity of 1.1, the tax losses decline to 0.37 billion Swiss francs in the short run and 0.18 billion Swiss francs in the long run. However, the results also show that taxation of capital gains would have a negative effect on the real economy. The impact on GDP, investment and employment is negative, amounting to -0.7, -1.76 and -0.178 per cent, respectively. Although higher transfers will boost the positive momentum in the field of private consumption in the short run, the effect will tip over in the longer term, due to a reductive impact on growth, and turn negative for any elasticity factor.

In conclusion, it can be stated that the reform adopted by the parliament shows positive effects on the real economy, which are, however, juxtaposed by lower tax revenue. An increase in dividend taxation would allow the government to limit the tax deficit and maintain the positive economic effects of the reform. An additional increase in the capital gains tax would allow the government to minimise the tax losses or even generate higher tax revenues. However, this measure would have a negative impact on the real economy that eliminates the positive effects of the reform.

[1] Elasticity (εS) measures the sensitivity of the income of enterprises with special tax regimes to changes in the taxation differential between Switzerland and abroad. A high elasticity factor indicates higher sensitivity. In other words, high elasticity indicates that, given the same increase in the SPC tax burden in Switzerland relative to the foreign tax burden, the probability of a move abroad is higher.

Contact

No database information available