Innovation Activities in the Swiss Economy: Growing Concentration of R&D Expenditure

- Innovation

- KOF Bulletin

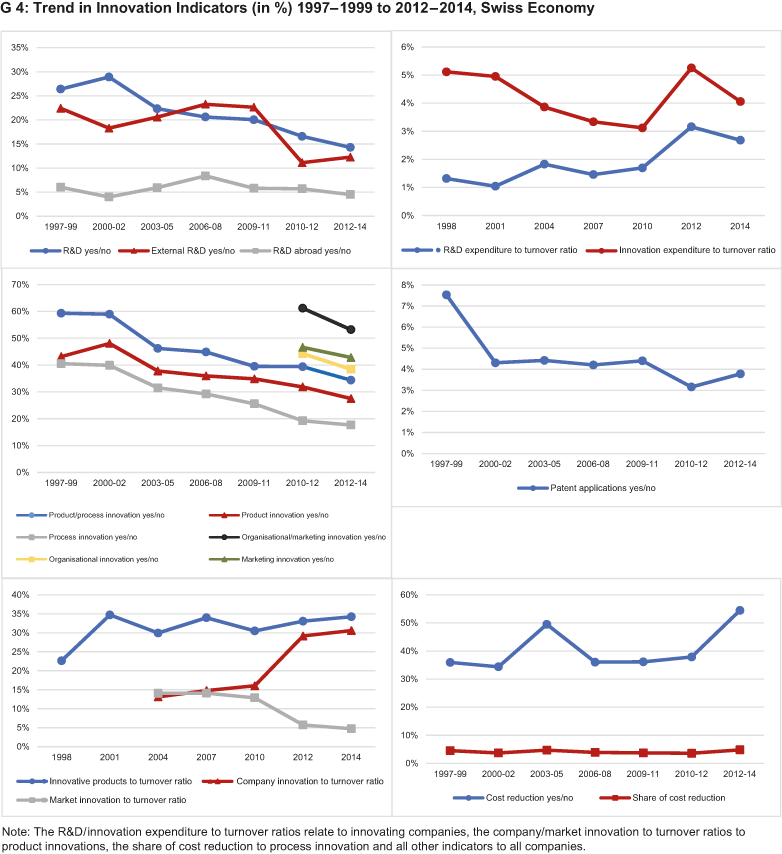

Swiss companies are still among the most innovative enterprises in the world. However, the percentage of innovators has declined. Among the companies that generate innovations, the innovation expenditure to turnover ratio has nevertheless gone up. These are the results of the tenth Innovation Survey of the Swiss Economy for the years 2012 to 2014.

During the latest observation period (2012 to 2014), the negative trend towards declining percentages of companies performing research and development activities (R&D) continued. A total of 14.3 per cent of all companies engaged in R&D. At 16.6 per cent, the respective share was still higher in the period 2010 to 2012. The decline is predominantly due to the high-tech industry (pharmaceuticals, chemicals, mechanical engineering, electrical engineering, medical technology, vehicles, clocks) as well as the traditional service industries (retail/wholesale, transport/logistics, hotel and catering, real estate, personal services), and to a lesser degree to modern services (financial sector, IT media, telecommunications, business support services) and the low-tech industries (e.g. food, print, metal production, energy).

In 2014, the R&D expenditure to turnover ratio declined (see G 4). However, over a longer period of time, the ratio has increased substantially. In the years 2012 to 2014, companies engaged in R&D activities invested, on average, 2.7 per cent of turnover in R&D projects and 4.1 per cent in innovation projects (including R&D expenditure). This increase is particularly pronounced among low-tech companies, traditional service providers and big enterprises.

Cost savings through process innovation on the rise

All in all, organisational and marketing innovation is more prevalent than process innovation. However, in the period from 2012 to 2014, cost cutting through process innovation has become significantly more important. The service sector was the main driving force behind this development. On the whole, organisational and marketing innovation declined compared to the previous period.

Fewer new products on the market

Innovation success as measured by the innovative product to turnover ratio has improved both overall and in most sub-aggregates. This is exclusively due to an increase in the ‘company innovations’ share of turnover. This type of innovation is new for the company but not for the market. Hence, there is a relatively low innovation content. In contrast, the share of ‘market innovations’ declined slightly.

Costs and amortisation times act as barriers

Barriers to innovation have become progressively less significant. The importance of shortages of R&D staff, and specialists in general, which has been widely discussed in public, has declined since the period from 2006 to 2008. While the shortage of specialists is relatively small in big companies, it is a comparatively bigger barrier to innovation in medium-sized companies.

As before, the main barriers to innovation are high investment costs and excessive amortisation times. This applies particularly to industrial enterprises and big companies. Market risks represent another significant barrier for big companies. For enterprises with less than 50 employees, lack of equity is more frequently a barrier to innovation than for bigger enterprises.

The percentage of companies receiving public innovation subsidies has risen since 2009. The latest figure is 9.1 per cent. Although most enterprises receive support in the context of national subsidy schemes, international programmes are becoming more prevalent.

Cooperation is gaining importance

R&D cooperation agreements, predominantly with other Swiss companies or university institutions, have also become more important during the period under review, especially since 2009. Over time, cooperation with competitors and companies in other sectors has been declining.

The use of information and communication technologies (ICT) was also investigated in the survey period 2012-2014. In comparison to all other companies, big industrial enterprises invest most in ICT and are most frequently procuring inputs via internet channels. However, the sale of products and services is of greater significance for the service sector. While bigger companies are more frequent users of social media and cloud computing, they are also more often affected by ICT security problems than smaller companies.

Innovation study:

KOF investigates innovation activities in the Swiss economy on behalf of the State Secretariat for Economic Affairs (SECO). The current tenth Innovation Survey covers the period from 2012 to 2014 and is based on the responses of 1,778 companies.

The study is available at: https://www.kof.ethz.ch/publikationen/kof-studien.html

Contact

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland

No database information available

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland