Further Recovery of the Swiss Economy

- Swiss Economy

- Forecasts

- KOF Bulletin

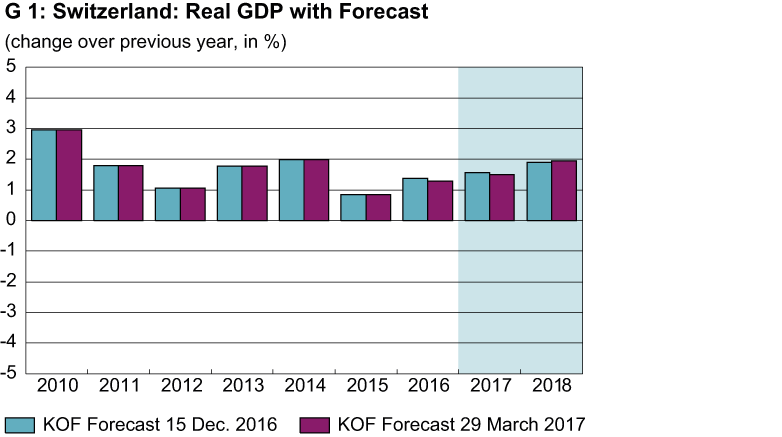

After turbulent times for a large number of Swiss businesses, the available economic indicators, such as the KOF Economic Barometer and the KOF Business Tendency Surveys, are now pointing towards a somewhat more optimistic assessment of Swiss economic performance. In terms of overall economic development, the KOF is therefore forecasting Swiss gross domestic product (GDP) growth of 1.5 per cent this year and (unchanged) 1.9 per cent next year.

These sound prospects for economic development (see G 1) are attributable also to the economic recovery in the eurozone. The moderate upturn in the eurozone economies continued, above all thanks to positive development in Germany, Spain and the Netherlands. On the other hand, the dynamic in France and Italy remained weak. Economic growth in the United Kingdom, untroubled by the “Brexit” vote, made a considerable contribution to growth rates.

Over the forecast period, confidence is projected to rise in developed economies, whilst expectations in developing and emerging countries will remain cautious. However, it is expected that increases in raw material prices will have an invigorating effect on these regions. In view of the economic growth dynamic in the eurozone and the stabilising economic situation in emerging countries, demand for Swiss goods and services is projected to grow moderately. Exports of other services will also increase slightly, although due to the continuing fraught exchange rate situation, income from tourism will rise only gradually. As was the case last year, it is expected that Swiss foreign trade will be strongly influenced by growth in exports of pharmaceutical products. These helped to ensure that, despite a poor closing quarter, export growth in 2016 remained comfortably positive.

More momentum behind investment in plant and machinery and real estate

Imports are also projected to rise in the wake of stronger export growth. Import growth, and even more so the growth in investment in equipment, have been fuelled by special factors, such as the importation of aircraft and rolling stock. The economic recovery is expected to lead to gradual increases in investment. Due to a statistical overhang from 2016 however, the growth rate for this year will still be negative (-0.9%). An increase of one per cent is forecast for the coming year.

Investment in construction is also expected to bounce back, following a period of stagnation last year. The 1.1 per cent increase in construction investment this year has been driven by investment in rail and road infrastructure as well as healthcare and education facilities. Due to the still moderate demand and the rise in long-term interest rates, residential construction will grow only marginally.

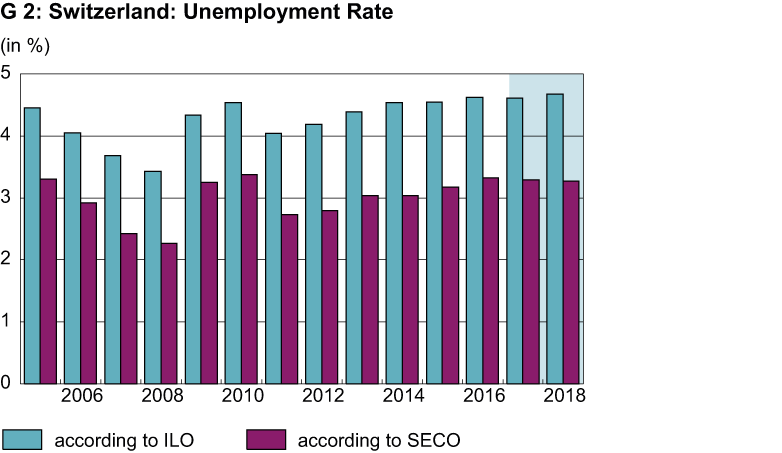

Hardly any increase in employment – unemployment persists

It is expected that the upward pressure on the Swiss franc will continue. Margins of businesses remain under pressure due to the strong franc. This pressure in the economic sectors that are exposed to international competition will result in further rationalisation. This means that increasing employment numbers are essentially expected only in labour-intensive and protected sectors, such as education and health and social care. Overall, employment growth will be comparatively low and the registered unemployment rate is forecast to remain at the current level (2017 and 2018: 3.3%, see G 2). As regards the internationally comparable unemployment rate according to the definition of the International Labour Organization (ILO), which also covers persons not officially registered as unemployed, the KOF is expecting a minor increase from 4.6 per cent this year to 4.7 per cent in 2018.

Due to the sluggish labour market growth and negative price inflation last year, wage growth remains weak. In view of this fact, along with the continuing strong Swiss franc, inflation will remain low. The KOF is forecasting an increase in consumer prices this year (2017: 0.3%) due to the slightly higher prices of petroleum products compared to last year as well as temporarily high prices for fresh produce.

However, no broad inflationary pressure will emerge on a national level in the near future.

The low interest rates in the eurozone continue to preclude a reduction in negative short-term interest rates in Switzerland, and it is expected that interest rates will only increase again after the end of the forecasting horizon in 2018. However, long-term interest rates are expected to be raised earlier; it is expected that they will move back into positive territory again at the start of 201

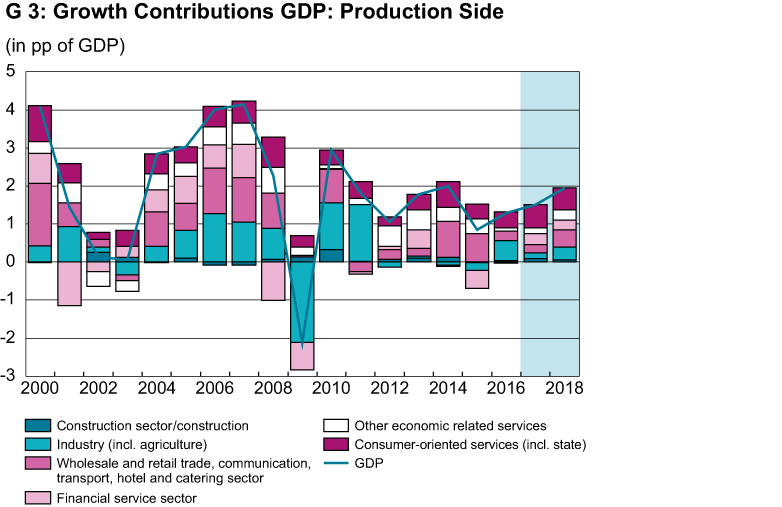

Sectoral development

Quarterly estimates for the past year point to a mixed picture of economic development. Production growth was contained last year at 1.3 per cent. Retailers and wholesalers provided a below-average contribution to economic development. Retailers continued to suffer from the strong Swiss franc, which has resulted in a significant fall in sales revenue. Whilst foreign purchases have not increased during the most recent period, they have also not fallen. With growth last year of just over 10 per cent, real added value from transit trade (as a part of wholesale trade) increased by less than in both of the previous two years (20% and 16%).

The strongest increase was reported last year for education and health and social care. Having grown by 4.8 per cent, the share of this sector out of value added for the economy as a whole rose to 7.9 per cent. The sector is even more important for the labour market: 14.1 per cent of employees and 12.4 per cent of full-time equivalent positions related to the health and social care sector last year.

Health and social care will continue to post robust growth during the forecasting period. After a very weak half-year in 2016, trade overall will be able to increase added value both this year and in particular in the coming year (see G 3). The situation in the hotel and catering sector will now gradually stabilise after some difficult years. Business activity will be buoyant in the financial services and insurance sector both this year and in the coming year.

News

Detailed information of the forecast can be found on the forecast website or in the Downloadpdf (PDF, 1.8 MB)vertical_align_bottom of the KOF Bulletin.

Contact

KOF FB Konjunktur

Leonhardstrasse 21

8092

Zürich

Switzerland