KOF Business Tendency Surveys: Business Situation Improves Further

- KOF Business Situation Indicator

- KOF Bulletin

- Surveys

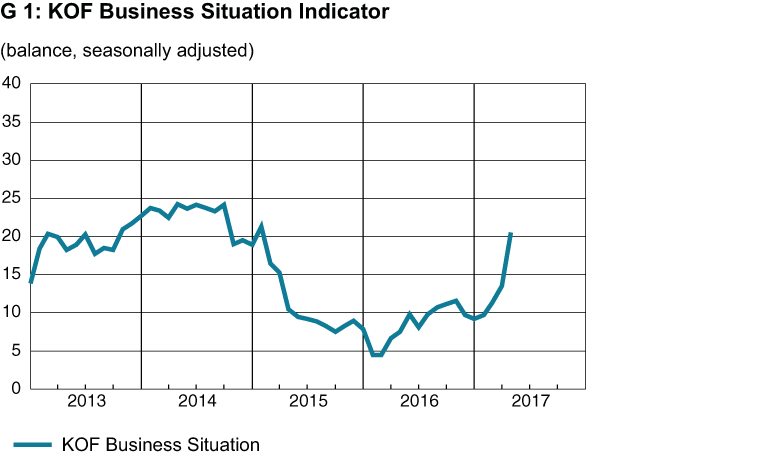

In April 2017, the business situation of businesses in the private sector was significantly more favourable than during the previous month (see G 1). This means that businesses have been able to improve their situation continuously since the start of 2017. In addition, firms’ expectations concerning the course of business over the coming six months are more confident than previously. The Swiss economy has started the spring with a swing in its step.

Significant recovery trend in the manufacturing sector…

The business situation improved further in April in the manufacturing sector. Following the rise in the indicator for the fourth time in a row, the situation of businesses is now classified as virtually satisfactory. Order books expanded slightly, and the level is now higher than in April of last year. Slightly less survey participants reported no order backlog. They have been able to step up production activity over the recent period, with the result that capacity utilisation of machinery and equipment over the last three months has been higher than previously. The level of capacity utilisation of 81 per cent is at a similar level to the equivalent period from last year, although it is still below the long-term average. This is in part also due to the fact that businesses have invested further in capacity expansion. Since firms have been forced to cut prices less frequently than previously, earnings performance is no longer as bleak as it was before. Firms hope that they will be forced to cut prices less often in the immediate future. However, they also fear higher prices when purchasing intermediate products. The expectations of businesses in relation to incoming orders and production over the next three months may not be as positive as they were over the last three months, but are clearly on an upward trend. All in all, the survey results for the manufacturing sector point to a clear recovery trend over the winter and into spring.

…further improvement in construction

In the two building-related sectors of construction and project engineering, the already good business situation improved further. In the construction sector, the recovery in the business situation, which has been ongoing since the start of the year, therefore continued. Demand increased at an accelerated rate. Compared to the previous quarter, capacity utilisation grew somewhat, whilst earnings performance was not as negative as previously. However, businesses are quite sceptical regarding the future development of earnings. In addition, demand projections are also muted. Businesses are expecting demand to fall in both building construction and civil engineering. On the other hand, the demand expectations of the finishing trade are stable. Project engineering firms are expecting the demand dynamic to remain virtually unchanged. They have already expanded their services over the last three months and also plan a small increase in the near future. In the view of these firms, the earnings position will remain unchanged into the near future.

Situation in the retail and wholesale sectors no longer as tense as previously

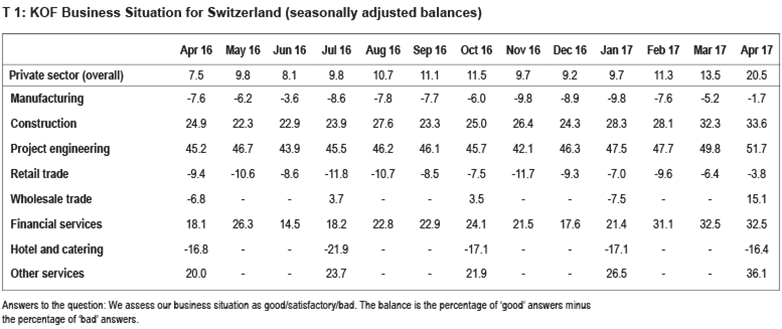

The unfavourable business situation in the retail sector eased in April for the second time in a row (see T 1). Customer footfall reached approximately the previous year’s level and sales volumes did not fall for the first time in more than two years. Earnings performance was not as unfavourable as it previously was. Although retailers are somewhat sceptical regarding the further development of sales and thus remain reticent about ordering new goods, they plan to cut prices less frequently than previously. Overall, the situation in the retail sector has therefore relaxed somewhat, although a clear reversal in the trend is not yet apparent. The business situation also improved significantly in the wholesale sector following a marked cooling in the previous quarter. Demand increased for wholesalers over the last three months, with the result that sales of goods were higher than the comparable period from last year. Businesses are expecting demand to increase further over the coming period, although, as before, they are concerned that purchase prices may rise faster than selling prices. Nevertheless, their business expectations for the coming six months have improved significantly.

In the hotel and catering sector, dissatisfaction with the business situation decreased slightly once again. The situation is now considered to be slightly less negative than in the same period last year. However, businesses in mountain areas complained much less of a poor business situation than one year ago. In the big cities on the other hand, the situation one year ago was almost exactly as satisfactory as it is now. In the restaurant sector, the business situation is now less tense compared to last summer, although it remains unsatisfactory overall. According to the answers provided by survey participants, the problems associated with insufficient demand have abated. Restaurateurs are hoping that demand will pick up slightly over the next three months and, in addition, that prices will remain stable. Occupancy rates for hoteliers grew slightly and the business situation is no longer considered to be as negative as it was during the previous quarter. Bookings are falling at a slower rate compared to the previous year. Businesses are expecting practically stable numbers of overnight stays and hope that they will be under less pressure to cut prices over the coming three months.

Situation stable in the financial and insurance sector…

In the financial and insurance sector the business situation overall is just as good as it was in March, and thus significantly more favourable than at the start of 2017. Whilst demand growth for these services was not as dynamic as it was last month, survey participants are nonetheless confident that demand will remain robust. Although the number of employees in this sector is considered to be more or less appropriate, there will be some pressure to reduce the workforce in the near future. Businesses hope that operating expenses will increase at a lower rate than revenues in the coming months, thereby resulting in a significantly improved earnings position. Banks are more satisfied than they were last month in terms of their situation with both national and foreign clients, although, as previously, foreign client business is lagging behind business with domestic clients. Firms are more confident than they were previously concerning the development of business over the coming year. They are expecting a major boost, in particular from domestic private client business. Banks are expecting their profits to grow from trade-related business, commission business and, albeit very slightly, also from interest-related business.

…and significantly improved for other service providers

The business situation of other service providers improved significantly in April. Demand has risen over the last three months, whilst the earnings situation has also improved. This positive trend is apparent both in the sub-sector of transport, information and communications as well as the business services sector. Overall, service providers project demand to continue to follow an upward path over the next three months. They therefore plan to take on more staff. However, businesses are more widely forecasting a need to lower the prices of their services: whilst business expectations for the coming six months are more positive than previously, overall confidence is more contained.

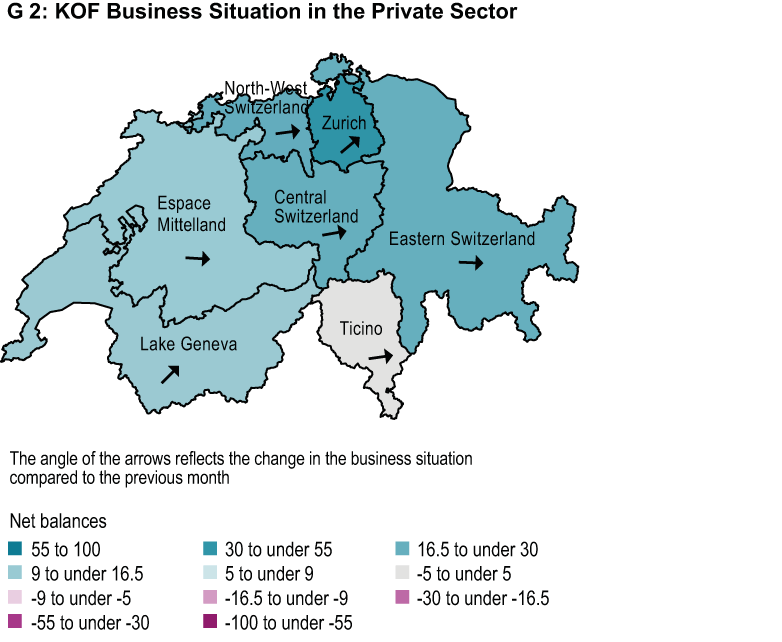

Business situation according to region

In regional terms, the business situation improved in most of the major regions as defined by the Federal Statistics Office (FSO, see G 2). The improvement was particularly evident in the Zurich and Lake Geneva regions. However, businesses in Central Switzerland, North-West Switzerland and Ticino also reported a more favourable situation compared to the previous month. On the other hand, the figures for Espace Mittelland and Eastern Switzerland fell slightly.

The results of the current KOF business tendency surveys from April 2017 incorporate the answers provided by more than 4,500 businesses from industry, construction and the major service sectors. This corresponds to a response rate of around 56 per cent.

Further information about the KOF Business Tendency Surveys and how to participate can be found here

Contact

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland