Structural Budget Underruns at the Swiss Federal Level

- Public Budget

- KOF Bulletin

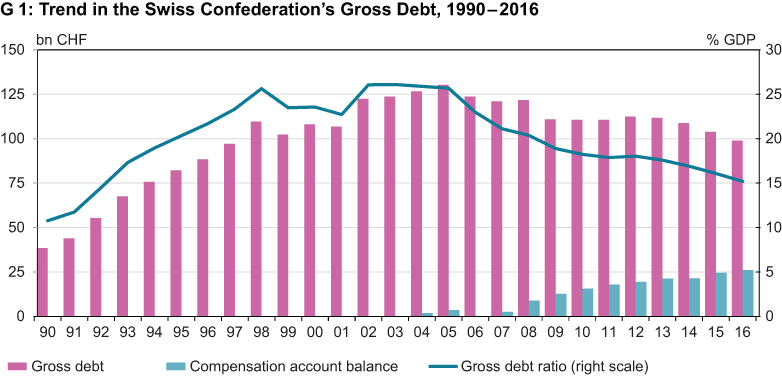

Both in Switzerland and abroad, the Swiss ‘debt brake’ is often seen as one of the country’s big success stories. Since its entry into force in 2003, the government’s gross debt has declined from 124 billion Swiss francs to 99 billion Swiss francs (2016), despite the financial crisis and the Swiss franc shock (see G 1). Nevertheless, some politicians are worried.

It was, after all, not the budgeted surpluses that allowed the budget to exceed the minimum target under the debt brake concept, i.e. the permanent balancing of income and expenditure (Art. 126 para. 1 Swiss Federal Constitution [BV]). Around half of the non-budgeted surpluses are due to budget underruns on the expenditure side. It is not unlikely that such budget underruns will also occur in the future. According to Graph G 2, the underruns have quite a tradition by now. As one of the consequences of the underruns, the federal accounts have systematically exceeded the budget, and debt has been gradually reduced. In the period from 2003 to 2016, the average expenditure-based budget underruns amounted to 1.2 billion Swiss francs a year.

Given this background, the Swiss Federal Council engaged an expert committee to examine the question whether future budget underruns should be used to stock up the expenditure fund rather than reducing debt even further. Chaired by KOF’s Director Jan-Egbert Sturm, the members of the expert committee, external pageMarius Brülhartcall_made (University of Lausanne), external pagePatricia Funkcall_made (Università della Svizzera Italiana), external pageChristoph A. Schalteggercall_made (University of Lucerne) and external pagePeter Siegenthalercall_made (Board of Directors of SBB and BEKB, former Director of FFA), arrived at two essential conclusions 1:

1. An extension of the debt brake is currently not recommended

According to the group of experts, substantial interventions in the current regulations would not be astute. The experts expect a natural reduction of budget underruns in the coming years on at least two grounds. Firstly, the so-called New Management Model of the Swiss Federal Government (NFB), which was introduced on 1 January 2017, may result in lower underruns. Secondly, in the past few years, Switzerland has been in the extraordinary position of overestimating its inflation and interest rate forecasts while simultaneously underestimating growth rates. These forecast errors have made compliance with the budget requirements easier on the expenditure side. If the economic and currency trends change, however, compliance with the budget requirements should become a lot more difficult than suggested by the development of the last few years.

Even if it looks now as if budget underruns are on the decline, they are unlikely to disappear altogether. Nevertheless, as long as they are of a modest nature, the expert committee sees no reasons to amend the current regulations. According to the committee, the potential negative effects of feasible alternatives are too high.

The committee therefore recommends leaving the current regulations as they are, at least for the foreseeable future. However, in addition to the NFB, they could imagine a regulation according to which overdrafts would only need to be justified in the accounts in the case of loans that the Federal Council and the administration do not control in the budget implementation context. The incentive for the administration to include safety margins in the budget can be further reduced by a materiality limit as a percentage of the preliminary borrowing budget and a maximum ceiling for the other loans. The group of experts believes that any further non-budgeted debt reduction is not problematic.

2. Potential tax cuts in the case of sustainable and substantial budget underruns

Should the budget underruns turn out to be both substantial and sustainable over the coming years, this may indicate that taxes and charges have been higher than necessary. Since taxes go hand in hand with macroeconomic losses, low taxes appear attractive from a macroeconomic perspective.

The expert committee has identified a feasible option in connection with one of the next few tax reforms associated with loss of revenue. Compensatory savings measures or tax increases could be waived in the amount of the anticipated budget underruns.

However, the group of experts is currently not advising this procedure. Since it is not clear whether or not substantial budget underruns should be expected in the future, the regulations should, at present, remain unchanged.

1) The expert committee would like to thank Mr Florian Chatagny (KOF) for his research support.

Contact

Director of KOF Swiss Economic Institute

Professur f. Wirtschaftsforschung

Leonhardstrasse 21

8092

Zürich

Switzerland

No database information available