Global Economy is Picking up Speed

- KOF Bulletin

- World Economy

The global economy has been growing substantially for over a year now. The tempo even accelerated in the second quarter of 2017. Growth rates in the USA, Japan and the Eurozone significantly exceeded the potential. In the USA, the economy is close to full capacity, in Japan already above. In contrast, the production gap has not yet closed in the Eurozone. The Chinese economy is slowly passing the peak of its boom.

Upswing on a broader basis

The current global economic dynamics are not only stronger than in the past few years but also supported by a wider basis on the demand side. Until autumn 2016, the upswing was moderate and mostly driven by consumption, while investment and external trade remained on the weak side. Since the winter of 2016/17, investment has been expanding much faster and has even remained robust at the beginning of the year, despite significant political uncertainty.

This recovery pattern is, however, rather atypical. Usually, it is the investment economy that recovers first after an economic downturn. One likely reason for the lengthy slump in investments is the debt reduction programmes and more prudent strategies adopted by many companies due to the massive economic crises witnessed in the recent past (major recession, European debt crisis, emerging market crisis). Other economists believe that weak investments are a long-term phenomenon 1.

Slow monetary divergence continues

As expected, the gradual divergence between the big economic regions is continuing. In mid-June, the FED raised the Federal Funds Rate – the US key interest rate – by a further 0.25 percentage points. The Funds Rate target range is now between one and 1.25 per cent. Towards the end of the year, a further adjustment is likely.

Last winter, the Chinese central bank also adopted a less expansive approach with the aim of reducing outflows of capital and mitigating the Yuan devaluation. In contrast, the Japanese central bank is adhering to its extremely loose monetary policy. Given persistently low inflation rates, the bank has had to postpone its two per cent inflation target for the fourth time in five years – most recently to the year 2020.

The European Central Bank (ECB) is also pursuing its previous expansive monetary policy with little change. In April, according to schedule, the government and corporate bond buying programme was reduced by 20 billion euros to a monthly volume of 60 billion euros. The programme is set to continue until the end of the year. If the upswing continues in the Eurozone, the ECB is likely to gradually reduce its purchases thereafter.

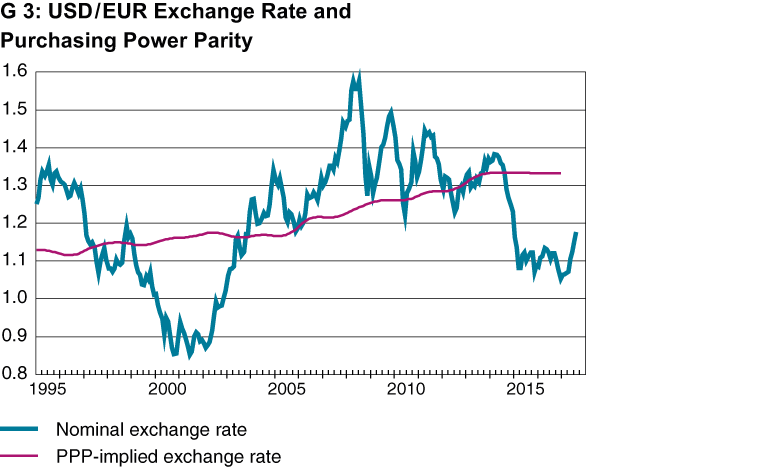

A rise in key interest rates in Europe is not likely before the middle of 2018. Increasingly, ECB communications in the first half of this summer contained intimations of an envisaged monetary turnaround. In a speech held in July, ECB President Draghi mentioned ‘reflationary forces’ in the Eurozone and indicated that tapering may be introduced next year. However, sceptical voices on the ECB council have been gaining ground again. Due to positive economic news in the Eurozone and less uncertainty after the French elections, the euro has gained significantly against the US dollar and other important currencies (around 10 per cent against the US dollar since April 2017). This trend puts a break on Eurozone inflation and has an opposing effect on the ECB’s reflationary policy – at least in the short-term.

According to the purchasing power parity concept, the euro is highly undervalued vis-à-vis the US dollar (see Graph 3). At least in the long term, this concept has a certain predictive power in respect of exchange rate movements 2. It is therefore possible that increasing price pressure in the course of the Eurozone’s economic upswing will be thwarted by a further appreciation of the Euro. This phenomenon has been observed in Japan in the recent past.

Positive outlook, lower risks

The global upturn is likely to continue apace in the coming quarters. Thereafter, dynamics are likely to flatten to some degree. Recently, economic/political uncertainty at the international level has declined substantially from its high level at the beginning of the year. This trend is affecting both the USA and Europe. In the USA, Republican Congressmen are increasingly standing up to President Trump while also showing greater political fragmentation. As a consequence, KOF estimates that the implementation of the Trump administration’s radical but extremely vague plans in the fields of trade agreements, tax reform and infrastructure investment will proceed at a very gradual pace. Hence, no major deviations from previous trade and fiscal policies are expected.

The risk of political distortions within Europe has also declined. EU-sceptic parties lost the elections both in the Netherlands and in France. According to the latest statements made by the UK government, KOF believes that a Brexit with an additional two-year transitional period is becoming more likely. Although this will extend uncertainty caused by the departure process, the UK government will have more time to negotiate free trade agreements with the EU and other countries.

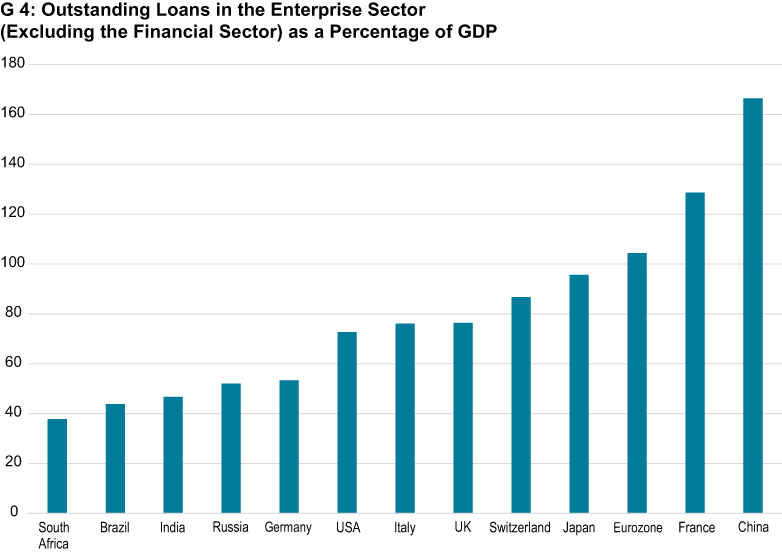

The Chinese economy continues to pose a substantial risk to global economic development. In the last few years, debt in the enterprise sector has risen enormously and is now at an extremely high level, even in international comparison (see Graph 4). It is rare that a country’s economy can avoid a substantial longer-term slowdown after a debt explosion. A structured debt conversion and relief process initiated by the Chinese government would put a dampener on growth dynamics. However, since the government is mostly refraining from implementing such a process, for the time being, the economy is likely to continue expanding significantly at rates above or close to six per cent. At the same time, the danger of a crisis-laden slump increases.

[1] Cp. discussion on ‘Secular Stagnation Theory’, e.g. in R. Baldwin and C. Teulings (2014): Secular Stagnation: Facts, Causes and Cures, CEPR Press, London.

[2] Cp. for instance Cheung, Y.-W.; M. Chinn; A. G. Pascual and Y. Zhang (2017): Exchange Rate Prediction Redux: New Models, New Data, New Currencies, ECB Working Paper 2018 (February), European Central Bank, Frankfurt/M.

Contact

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland