Consumers in Buying Mood – How Much Will Domestic Retailers Benefit?

- Swiss Economy

- KOF Bulletin

With the Christmas business just around the corner, Swiss consumers appear to be quite optimistic – a fact that should be appreciated by domestic retailers. However, this year is likely to have been another dynamic one in terms of cross-border shopping. It remains to be seen how much money will roll in for domestic retailers and how much they will be forced to surrender to their competitors across the border.

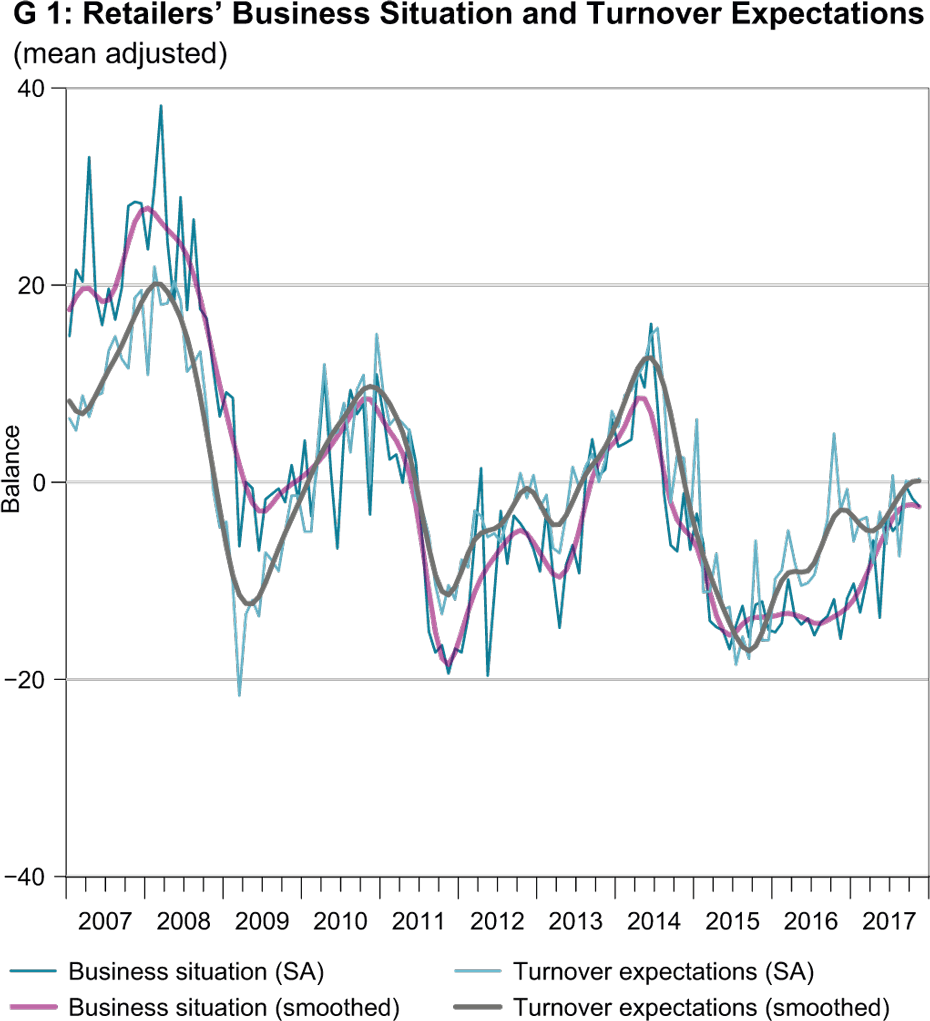

In the first nine months of the year, real retail sales recovered to some degree and returned to the previous year’s level. The results of the KOF retail survey indicate a similar trend. Since the beginning of the year, retailers’ assessments of their business situation have improved and customer frequency has increased at the same time. Nevertheless, both indicators remain at a rather low level. Turnover expectations for the coming three months show a less significant upward trend this year. However, it should be remembered that in contrast to the other indicators, they had already recovered last year. At present, more retailers expect turnover to increase than decrease in the near future, although all in all, expectations remain muted (see G 1).

Confident consumers

According to the index published by the State Secretariat for Economic Affairs (SECO), fourth quarter consumer sentiment will have changed very little compared to the previous quarter and will thus remain above the long-term average. In the coming twelve months, consumers mainly anticipate improved economic trends and lower unemployment figures. In contrast, respondents were slightly more subdued when it came to their own future financial situation, and viewed bigger purchases with caution.

The consumer survey conducted by external pageErnst & Youngcall_made on the subject of intended purchases confirms current consumer optimism. At close to CHF 300, the average budget for Christmas presents is likely to remain just under the previous year’s figure. Nevertheless, since this is the second-highest Christmas gift budget since 2012, retailers expect a healthy Christmas business.

Will cross-border shopping ruin the Swiss Christmas business?

Despite these relatively positive prospects, retailers remain cautious. Among the reasons for this caution is cross-border shopping. It is difficult to measure and put a figure on the extent of Swiss consumers’ shopping activities abroad. The data collected by the Swiss National Bank (SNB) on payments and cash withdrawals provide a rich source of information. For instance, the data indicate how much money was paid abroad using Swiss payment cards (issued by domestic financial institutions) and how much cash was withdrawn.

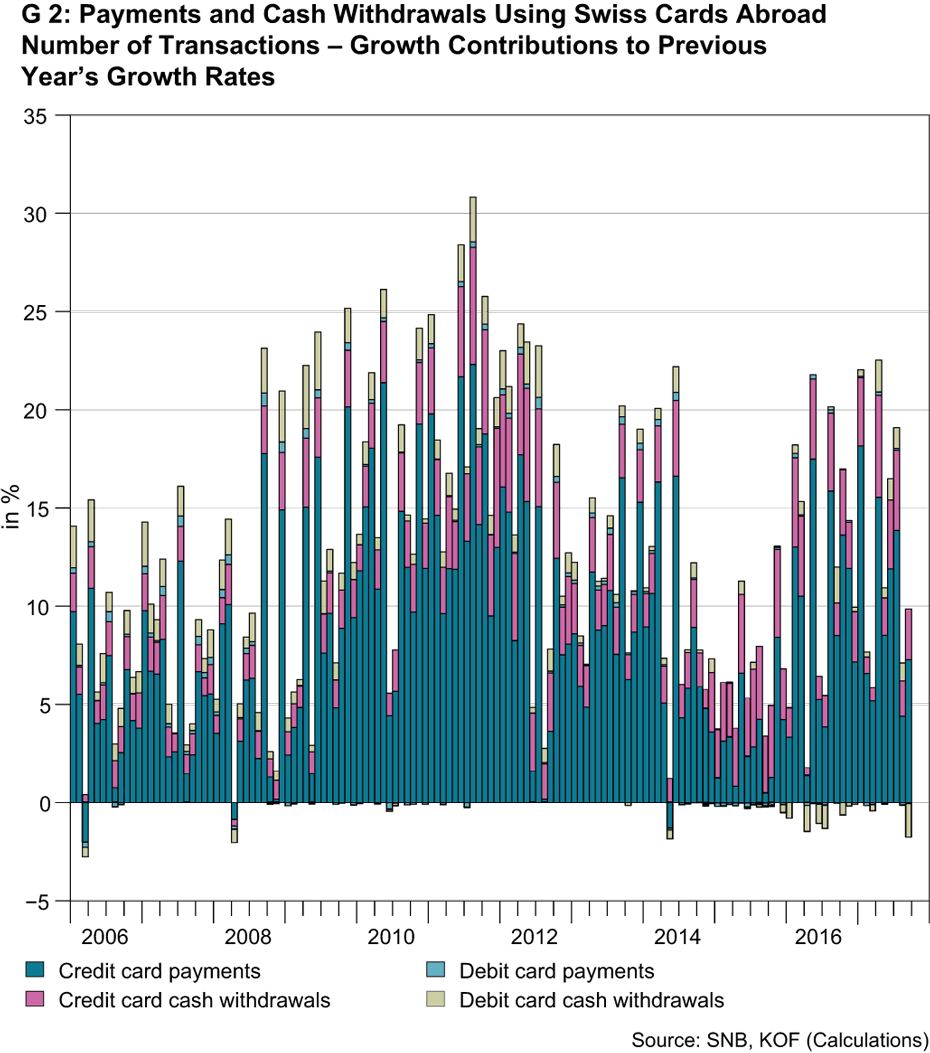

The dynamics involved in cross-border shopping have been analysed via the combined number of transactions made with the two types of card. Graph 2 presents the four components’ contributions to the previous years’ growth rates on a monthly basis. Since the cards also include company cards, an exact assessment of the number of transactions made by domestic consumers abroad is not possible. However, since they allow us to infer the dynamics in play, it is fair to say that corporate spending does not seem to be the main driver of the trend.

Transactions performed with Swiss cards abroad underwent a significant increase in the years 2010 and 2011 when the value of the Swiss Franc began to go up and the minimum exchange rate was introduced. Interestingly, the number of transactions abroad seems to have increased relatively slowly in 2015, while rising more significantly again in 2016.

The graph also shows that Swiss consumers have made numerous foreign transactions in the current year, which, in turn, probably slowed down the recovery of the domestic retail sector. Nevertheless, the renewed depreciation of the Swiss Franc appears to have held back cross-border shopping in August and September. On the other hand, close to 30% of the respondents in the Ernst & Young study stated that they planned to buy either all or at least some Christmas presents abroad. This indicates that Swiss consumers will continue to spend money with retailers abroad.

Contact

No database information available