Global Economy Booms

- KOF Bulletin

- World Economy

The world economy is on a positive path. For the time being, the global economic upswing is likely to continue until it will gradually slow down once China phases out its fiscal stimulus programme. The financial system has become more robust and the risk of a new financial crisis is limited.

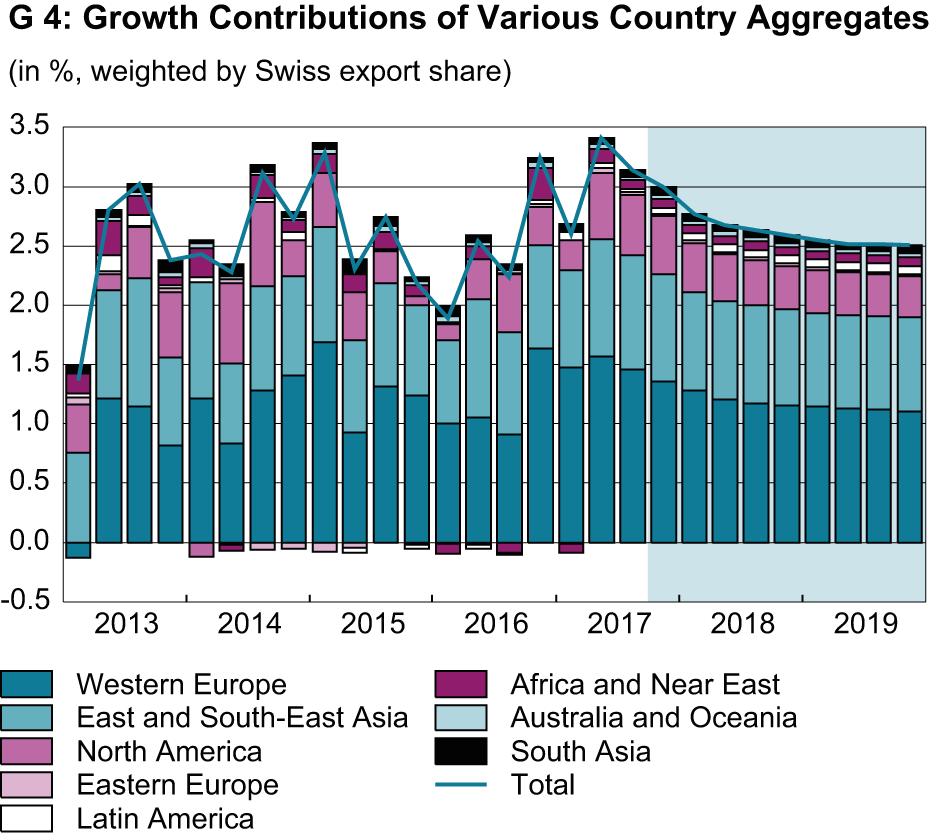

The substantial upswing of the global economy continued in the third quarter 2017. Supported by a robust trend in private consumption and a significant increase in investments, the developed economies contributed substantially to global economic growth. Thanks to the positive economic situation, production gaps in the Eurozone and the USA should be almost, or entirely, closed by now. High growth contributions were also made by East and South-East Asia. While the boom continued in China due to fiscal stimulation measures, economic expansion slowed down slightly in Japan. The upswing in Latin America was held back by the sluggish economic recovery in Brazil and the impact of the devastating earthquakes in Mexico. Following India’s reforms of its cash and VAT systems, the Indian economy is slowly regaining its footing (see G 4).

The current monetary divergence between the main economic regions continues. While the Japanese Central Bank persists with its expansive policy, the Fed has embarked on the path of monetary normalisation. For the present, the European Central Bank (ECB) intends to reduce its bond purchases by half at the beginning of 2018 and is likely to implement its first interest rate adjustment in 2019.

Past economic crises have shown that overly rapid rises in interest levels can lead to frequent defaults and hence to substantial distortions on the financial markets. The low interest rate environment of the past few years has encouraged private borrowing. On top of this, investors searching for higher returns have gone for more risky investments. In some western European and U.S. stock markets, for instance, there are significant overvaluations in historical comparison. The returns on highly speculative bonds are also extremely low at present.

Risk of a further financial crisis has declined

The gradual flattening of the interest rate curve in the USA indicates that the financial markets are slightly agitated. In the past, flat interest rate curves have been reliable indicators of an imminent economic slowdown. However, the amount of investments at risk of default is now significantly smaller than in the run-up to the last financial crisis in 2007. With the financial system having become much more resilient, the likelihood of fresh crises arising on the financial market has declined and their potential effects are likely to be limited. Furthermore, after the experience of the big recession and the Euro crisis, central banks are more willing to swiftly intervene and support the system in the case of fiscal distortions.

The global upswing is likely to continue for the time being until it will gradually slow down once China phases out its fiscal stimulus programme. In the forecast period, increasing over-utilisation of production factors in the developed economies will go hand in hand with a slowdown in economic growth in Europe and North America. This forecast is supported by the results of the current ‘World Economic Survey’ published by the ifo Institute for Economic Research. Assessments of the current situation in the developed economies are still at a high level, while expectations of the business situation in six months’ time have declined to some degree. Developing and emerging markets currently view their situation negatively, but have a (more) optimistic outlook for the future. Both the upturn in global trade and the recovery of commodity prices should support the upswing in the emerging markets.

Contact

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland

Contact

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland

Contact

No database information available