International Economy Is Booming

- KOF Bulletin

- World Economy

The global economy is in excellent condition, with global trade expanding at an above-average rate for the first time in five years. However, KOF anticipates a slight decline in global dynamics in the coming months.

Following a very lively development in the summer months, the global upswing slackened off slightly towards the end of 2017. This gradual slowdown occurred in most economic regions. However, all in all, the global economy had a very successful year. Especially the developed economies moved up a gear in 2017. A significant upswing is buoying up the economies in the USA as well as in the EU and Japan. East and South East Asia also made substantial contributions to global growth, first and foremost China, which extended its boom with the help of fiscal stimuli. In the course of the year, Latin America and Russia delivered the first positive impulses in some time. Although India’s cash system and VAT reform significantly affected production for some time, activities picked up again towards the end of the year.

After five weak years with average growth rates of 2%, global trade recovered in line with the substantial upswing of the global economy and expanded by 4.5% last year. Prices of energy sources and other industrial commodities picked up in the course of the year, although this recovery did not have any significant effects on consumer prices. The underlying price pressure, which is measured as core inflation excluding energy and food prices, increased only moderately last year. There are, however, regional differences: While core inflation in the United States is approaching the target rate, it remains far from the target in both the Eurozone and Japan. Inflation in the UK is still dominated by the impact of the GBP devaluation following the Brexit vote in summer 2016, and the underlying price pressure is substantially higher than target inflation. In China, the robust economy had little effect on consumer prices.

Slow withdrawal from expansive monetary policies

In the past year, monetary divergence between the main currency regions increased and is set to become even more pronounced this year. On the one side, the FED effected three interest rate hikes and the Bank of England one. This year, the two central banks are likely to raise interest rates to the same degree as last year. On the other side, the Japanese central bank further extended its expansive policy, or at least announced such a move. The European Central Bank (ECB) kept interest rates low last year but initiated a normalisation of its monetary policy in April by reducing the net volume of its bond buying programme from EUR 80 billion a month to EUR 60 billion. In January of this year, the ECB lowered the volume further to EUR 30 billion a month. The first hike in key interest rates in the Eurozone is not expected before 2019.

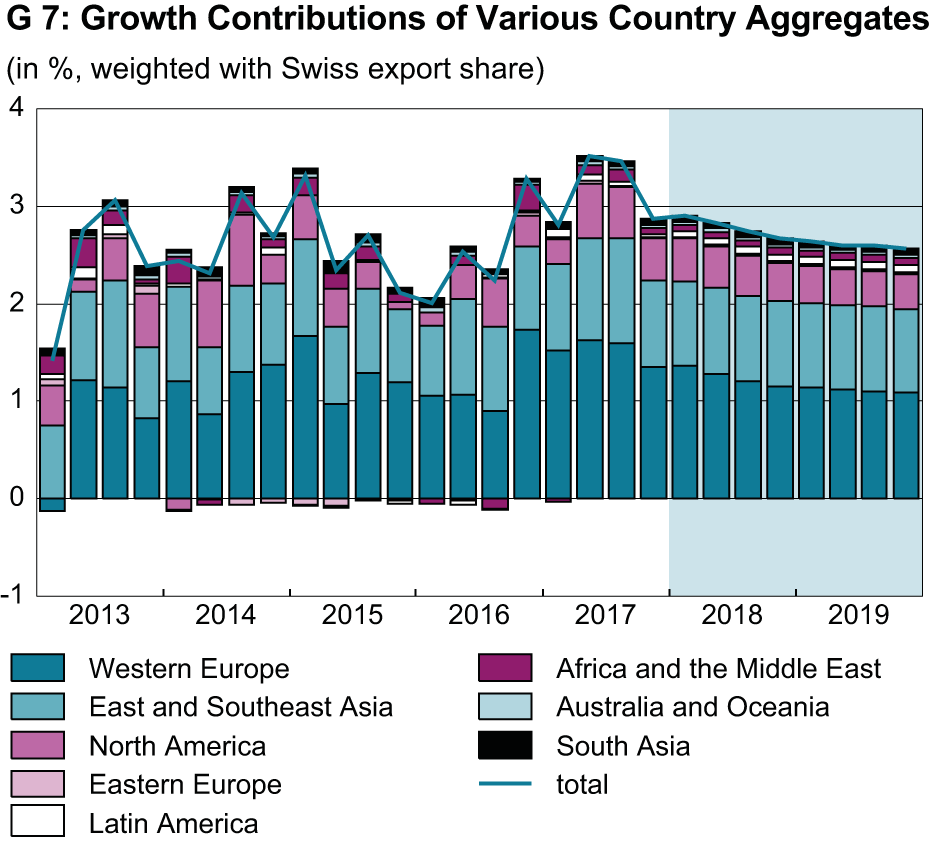

The global economy’s soaring dynamics are likely to decline gradually over the forecast period (see Graph 7). On the whole, production gaps in the developed economies, the main drivers of the upswing so far, should have closed in the past year. However, companies are expected to increase capacities further in the current positive economic policy climate. Consequently, over-utilisation of production factors should progress slowly, which will result in a gradual weakening of growth rates. Rising production capacities are also the reason why we expect the rise in inflation in the developed economies to be noticeable but not massive. Declining fiscal stimuli and the adoption of a more service-oriented economic model in China will also reduce the country’s contribution to global economic growth. The upswing is likely to last longer in other developing countries and emerging markets that are still at an earlier stage of the economic cycle and tend to benefit from rising commodity prices.

US trade policy and tax reform increase forecast uncertainty

At the moment, the trade and fiscal policies of the US government under President Trump are causing forecast insecurity. Given that the USA imports comparatively few crude metals from Europe, the punitive tariffs on steel and aluminium imports are unlikely to have a noticeable effect on the European economies. However, the announcement that America would react with a massive expansion of import restrictions on vehicles and other goods to any retaliation measures taken by the EU – even very selective ones – conjures up the risk of a trade dispute. Cars are the main export goods for several European countries, and the USA is an important export market. In Germany, 1.7% of all exports would be affected by punitive tariffs, in Italy 0.9% and in the UK even 2.1%. Due to Europe’s integrated supplier structure, any decline in exports due to punitive tariffs would lead to further substantial export losses.

Since the European economy is largely export-driven at the moment, a trade dispute would have much more serious effects on Europe than on the USA, at least in the short term. Current lively investment dynamics are also likely to be affected by any significant downturn in export prospects.

Furthermore, it is difficult to gauge the effects of the recent tax reform in the USA. In the short term, it is likely to fuel both private

consumption and investment activities. Due to this additional demand, European companies will benefit temporarily from higher exports (provided the US government does not impose any further import restrictions). Since the USA already has a high capacity utilisation rate, the momentum the tax reform is providing for the real economy is likely to decline progressively in the course of the forecast period.

Instead, pressure on consumer and asset prices is likely to rise. However, the reform also makes the USA more attractive as a target for additional foreign direct investment. At the same time, due to the exemption of profits made by foreign subsidiaries in the USA, high-tax countries, such as Germany or France, will become relatively less attractive for US direct investment than low-tax countries such as Ireland. Hence, high-tax countries will suffer losses unless they engage in tax competition with the USA and adjust their tax systems accordingly.

Contact

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland

No database information available

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland