Eurozone Debt (3/3): Private Households and Non-Financial Companies

- KOF Bulletin

- World Economy

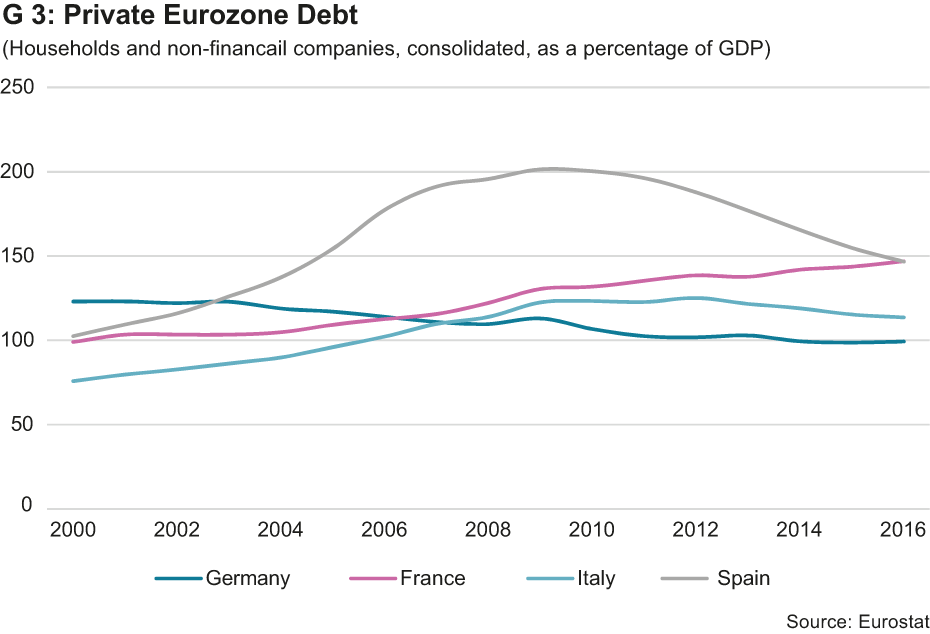

The debt ratio in the non-financial private sector of the Eurozone has stabilised since its peak in 2009 and has recently even declined. In contrast to the strong economic performance before the crisis years, the current upswing is therefore not driven by debt. However, in historic comparison, the debt level is still high and the trends in the various countries are heterogeneous.

Research studies have shown that high debt in the non-financial private sector may have a negative impact on future economic growth. Moderate debt helps smooth out private consumption over several periods and thus results in a more stable growth path. However, when debt levels are high, households are forced to raise their savings quota to cover their debt commitments, which in turn lowers their consumption. When corporate borrowing is high, companies have fewer funds for investment at their disposal. At the same time, high private debt levels have a negative impact on bank lending since the latter often goes hand in hand with a higher share of loans at risk of default (see part 2 of our series). 1

The debt ratio of the non-financial private sector in the Eurozone had been rising steadily until the debt crisis. At its peak in 2009, it amounted to around 145% of GDP. Since then, however, it has dropped to 139%. In Germany, private borrowing has been on the decline for years and currently makes up around 100% of GDP (see graph G X). The figures in Italy, Malta, Greece and the Eastern European Eurozone members are also below the average. At just under 60%, Lithuania has the lowest debt ratio. By contrast, figures are high in Cyprus, Ireland and the Benelux countries. While private borrowing in Spain and France is roughly at the Eurozone average, dynamics vary in the different countries. In Spain, high levels of private debt relief and the rapid economic expansion have resulted in a significant drop in the debt ratio. In France, however, the ratio has been rising steadily for years. Greece also saw a substantial debt write-off in the private sector. Due to the significant decline in macroeconomic production, debt did not decline substantially in relation to GDP.

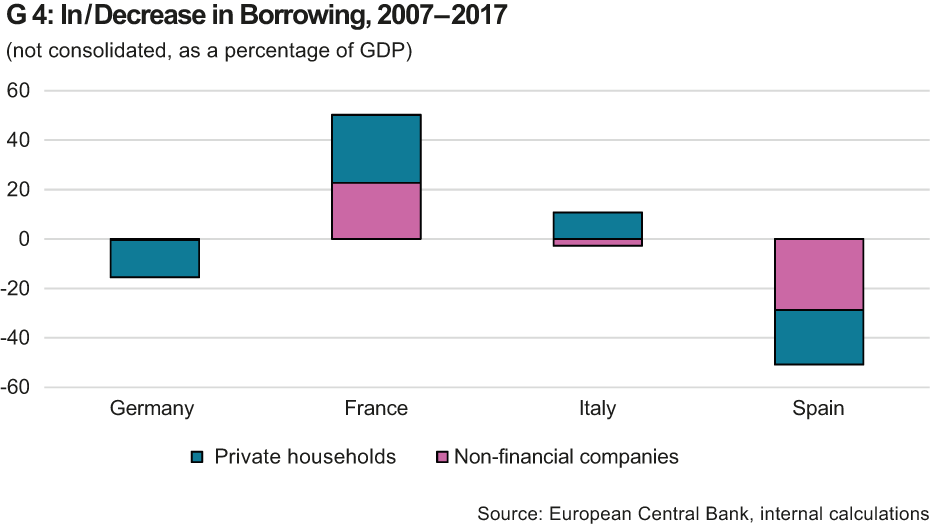

Companies account for little more than half of the borrowing in the non-financial private sector of the Eurozone, households make up the rest. Germany, where private household debt is higher than non-financial companies, is an exception. In Ireland, Cyprus and Luxembourg, corporate borrowing is particularly high, which is however due to specific internal corporate loans. The decline in the Eurozone debt ratio is primarily due to deleveraging in the non-financial sector. However the individual countries are following different trends (see graph G 4). While debt reduction has advanced further in Germany, borrowing has increased in France among both households and companies. In Spain and Portugal, the overall debt ratio of the non-financial private sector went down significantly, which represents a backlash against the pre-crisis years and contributed to the substantial decline in GDP (deleveraging) at the time.

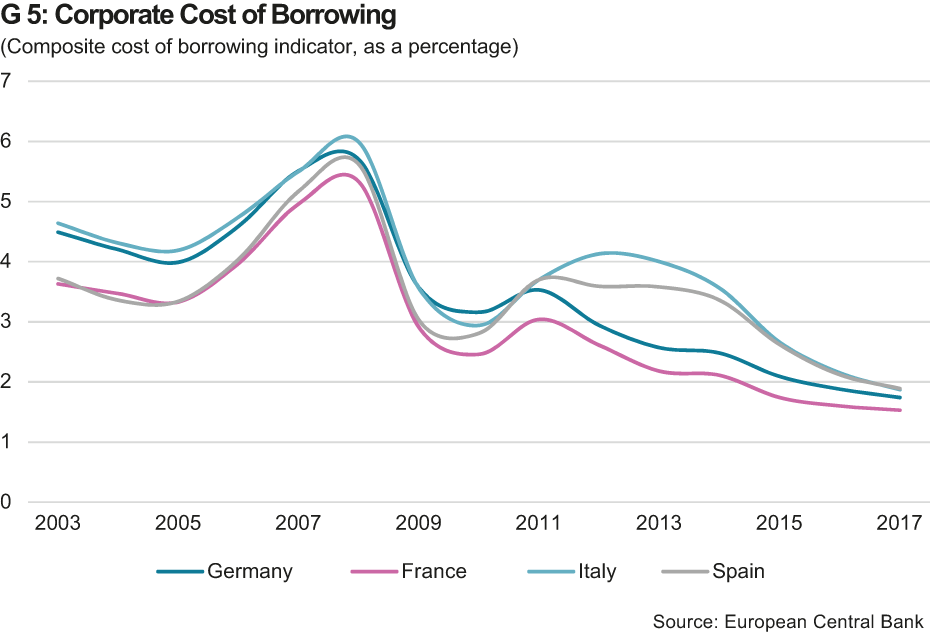

Thanks to the extremely favourable financing environment, interest charges in the private sector have declined substantially in the last few years (see graph G 5).2 Since the beginning of the big recession, companies’ interest expenses in relation to income dropped by around 50%. Most recently, they amounted to approximately 5% of the gross operating surplus in the big Eurozone economies. The same applies to private households, which have lately spent just around 1% of their disposable income on interest payments. Any monetary tightening would result in higher interest charges in the private sector.

How high the charges will be depends on the share of outstanding loans with variable interest rates. The share of these loans in total loans is unclear; nevertheless, the new lending figures show that it has dropped substantially in many countries since the big recession. In Portugal and Spain, where around 90% of all new mortgage loans had variable interest rates before the big recession, the percentage has decreased to around 60% and 40%, respectively. The relevance of variable interest mortgage loans has declined in the entire Eurozone. All in all, the trend suggests that a different interest-rate environment will lead to higher charges in the private sector. However, the decline in the share of variable interest loans compared to the years before the onset of the big recession implies that this burden is likely to be less painful than during the last rate hike phase.

1 See: Myers, S. C., “Determinants of Corporate Borrowing”, Journal of Financial Economics, Vol. 5, Issue 2, 1977, pp. 145-75 or Mian, A.R., Sufi, A. and Verner, E., “Household debt and business cycles worldwide”, National Bureau of Economic Research Working Papers No 21581, issued September 2015.

2 At the same time, interest income has also declined.

Debt in the Euro Area

The first two articles on public debt in the euro area can be found here: