Schumpeter Got It Right

- Innovation

- KOF Bulletin

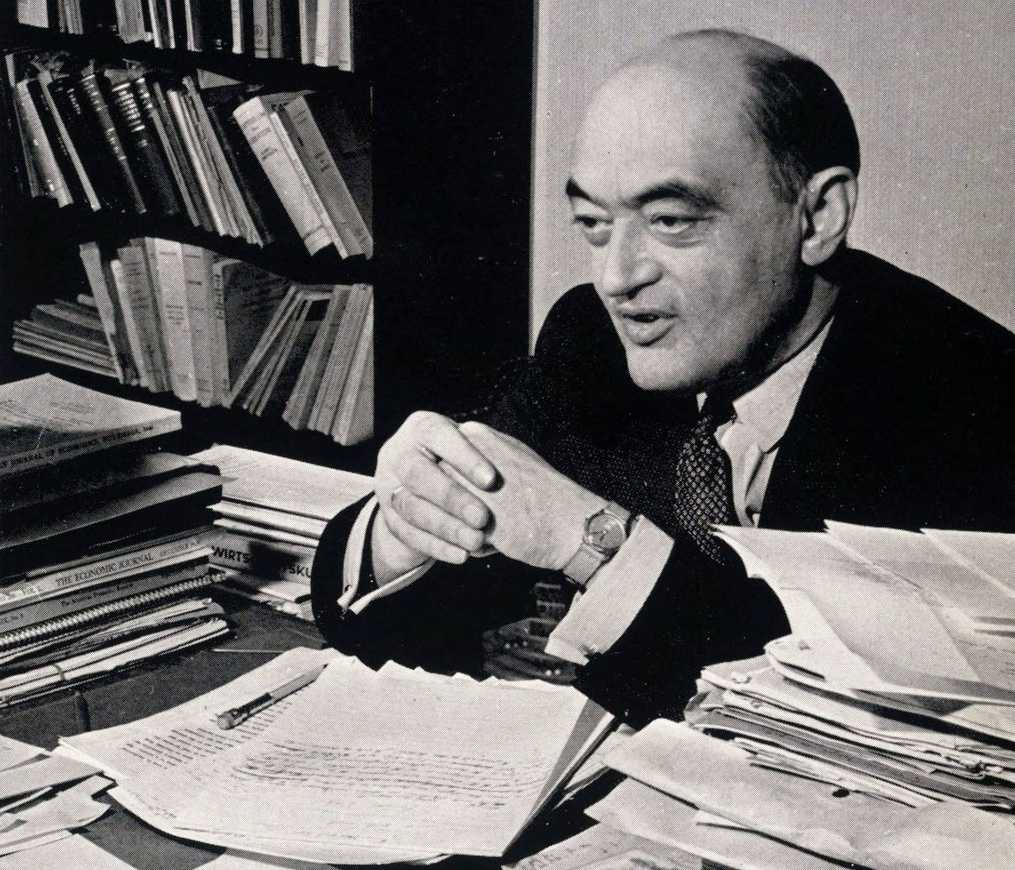

“Without innovation, there is no business cycle movement” is a famous statement made by Joseph Schumpeter. In a new paper based on Swiss data, Andrin Spescha and Martin Wörter confirm this claim that there is a relationship between innovation and business cycle movements.

In his 1939 book Business Cycles, Joseph Schumpeter argued that the business cycle is mainly driven by technological innovation, in other words that innovation fuels economic growth. Without innovative actions by firms, the economy would continue to reproduce itself, in the so-called ‘stationary flow’ of economic activity. Hence, it would not experience any sort of change at all without innovation. Only the wave-like introduction of large numbers of firm innovations can move the ‘stationary flow’ of economic activity sufficiently out of balance to create the ups and downs of the business cycle. Today, the notion that innovation is an important driver behind economic growth has found widespread acceptance among most theoretical economists.1 In a new paper, Andrin Spescha and Martin Wörter investigate if Schumpeter’s hypotheses can be depicted empirically in the Swiss business cycle movement.

Findings for Switzerland

Based on a representative panel data-set of Swiss firms covering the period 1996–2014, Spescha and Wörter analyse how the empirical relation between innovation and firm growth changes over the different stages of the macroeconomic business cycle. They find that innovative firms exhibit significantly higher sales growth rates than non-innovative firms, confirming the Schumpeterian premise that innovation leads to higher firm growth. This finding extends to both firms that introduce innovations based on R&D activities and firms that introduce innovations based on other, non-R&D innovation activities.

However, the authors also show that the higher sales growth of firms relying on R&D activities stems from different stages of the business cycle. Whereas firms that introduce innovations based on R&D activities outgrow non-innovative firms in periods dominated by economic recessions, they show similar sales growth rates as non-innovative firms in periods of economic booms. In contrast, firms that introduce innovations based on other, non-R&D innovation activities show the exact opposite pattern; they display similar sales growth rates as non-innovative firms in periods dominated by economic recessions, but tend to outgrow non-innovative firms in periods of economic booms. Hence, while firms with R&D-based innovations are more resilient to business cycle fluctuations than non-innovative firms, firms with innovations based on other, non-R&D innovations activities are more sensitive to business cycle fluctuations than non-innovative firms.

The observation that, in periods dominated by recessions, innovative firms achieve higher growth rates than non-innovative firms is in line with Schumpeter’s business cycle theory, where economic recessions bring about a renewal of the aggregate production of the economy. The most outdated, non-innovative products and services are eliminated from the economy and a relative shift of market shares towards superior innovative products and services takes place. Once the economy has reached bottom, a new cycle begins and new innovations enter the scene. Thus, looking only at the aggregate growth rates of an economy hides the aspect that the business cycle movement is actually also about replacing the old with the new.

Innovation increases resilience of the economy

The obtained results suggest that high-quality innovations may greatly contribute to the resilience of an economy in the face of periods dominated by economic recessions. Potential policy measures to strengthen the innovation capacities of firms usually target an increase in economic well-being. However, our results suggest that, as a secondary effect, such measures may also increase the resilience of firms against internationally triggered economic crises. An economy populated by firms always producing the most innovative products and services will be better protected from the pressure induced by a fall of aggregate demand in international markets. Importantly, the innovation capacity of an economy has to be strengthened well before an economic crisis hits. Policy interventions during a crisis will not achieve the same results anymore.

1 See Spescha and Wörter (2018) for a literature overview.