Monetary Policy Is Tightening Up

- Monetary Policy

- KOF Economic Forecasts

- KOF Bulletin

The FED is in the process of pushing interest up further and reducing its balance sheet. In the Eurozone, the ECB has also taken a further step towards abandoning its ultra loose monetary policy. This is the environment in which the Swiss National Bank is currently operating.

At its September meeting, the Swiss National Bank (SNB) resolved to keep its monetary policy, which is based on the two pillars of ‘negative interest’ and ‘readiness to intervene’, on the expansive side. Both the -0.75% rate on sight deposits at the National Bank and the Bank's willingness to intervene on the foreign exchange market are to ensure that investments in Swiss francs remain less attractive, thus reducing pressure on the Swiss franc. In its announcement, the SNB still referred to the Swiss franc as high and assessed the foreign exchange market situation as fragile. At present, the SNB believes that the inflationary risk is low. According to its conditional inflation forecast, inflation will rise no further than 1.2% in 2020 even if the key interest rate remains unchanged. According to the Bank, there is still a medium-term risk of a price correction in the real estate market’s residential investment property segment.

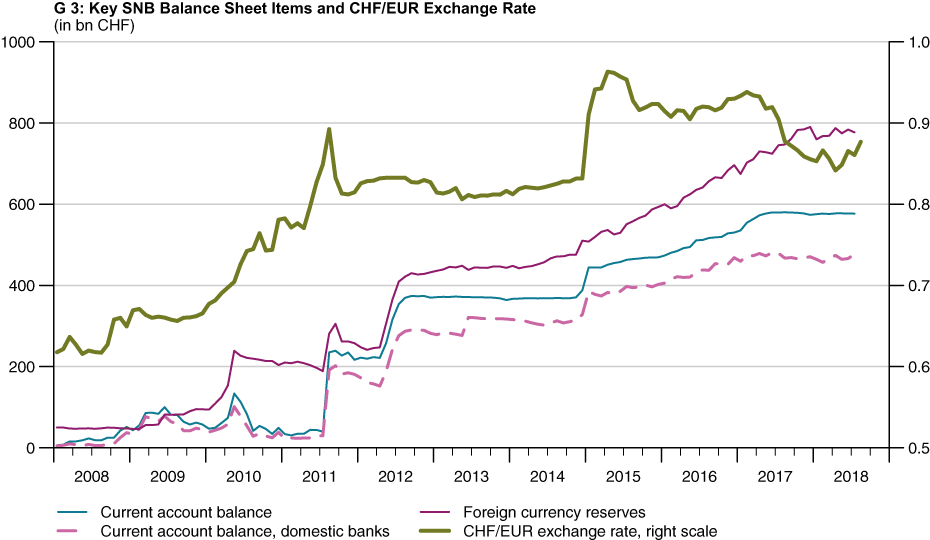

In the course of the international trade dispute, the political situation in Italy and the looming crisis in the emerging markets, the Swiss franc’s value has gone up since June due to its function as a safe haven. However, pursuant to current account data, it does not look as if the SNB has resorted to significant intervention as yet (see G 3). In August, inflation stood at 1.2% and was hence within the price stability range. At 0.6%, core inflation, which excludes the trend in prices of fresh and seasonal products as well as energy and fuel, was still substantially lower since domestic price pressure is still low. KOF expects that, boosted by the latest appreciation of the Swiss franc, inflationary pressure will be moderate and inflation will be well within the price stability range. According to the KOF Consensus Forecast of September 2018, which reflects the joint opinion of around 21 economists, at 1.2%, long-term inflation expectations (inflation rate in five years) are marginally lower than in the June survey and thus remain well anchored.

In view of the inflation outlook and the expected ECB policy, the Swiss National Bank will adhere to its negative interest policy fore some time to come. Thanks to the favourable economic situation and the associated rise in production capacity utilisation, a first interest rate adjustment by the SNB is not unlikely in the second half of 2019 in parallel with the ECB. However, the downside risks associated with this scenario have gone up. If the situation on the foreign exchange market deteriorates further, the SNB will once again intervene on the market. An escalating international trade war, a flare-up of the European debt crisis and/or turbulence on the international financial markets would all jeopardise the interest rate reversal in Europe.

Exchange rates and yields

Due to international tension, political uncertainty in the Eurozone and volatility in a number of emerging markets, the Swiss franc’s value has gone up again in recent time as investors are fleeing unsafe assets in favour of the Swiss franc. The value of the Turkish lira and the Argentinian peso, for instance, has dropped dramatically since the beginning of the year. So far, however, the Turkish and Argentinian crises have remained localised. While the CHF rate was still at a three-year high close to the former EUR minimum rate in April, it dropped to around CHF 1.13/EUR in September. All in all, the real external value of the Swiss franc on a trade-weighted basis has risen slightly and is currently close to the value before the suspension of the minimum exchange rate.

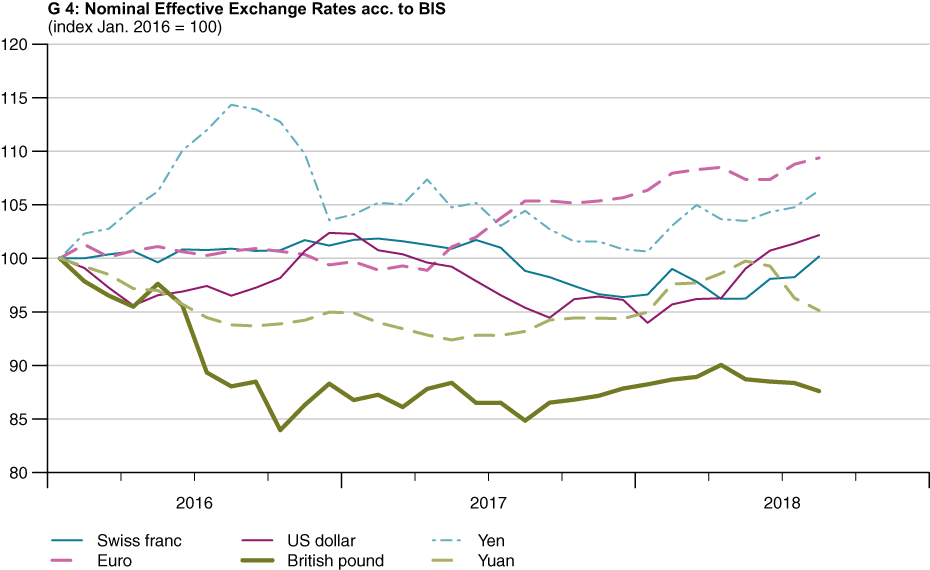

Given the nominal exchange rates since the beginning of 2018, the Swiss franc has gained significantly against both the Euro and the British pound, while remaining relatively unchanged against the US dollar and the Japanese yen. In the past year, the value of the US dollar has increased substantially on a trade-weighted basis due to the healthy economic trend and rising interest rates (see G 4).

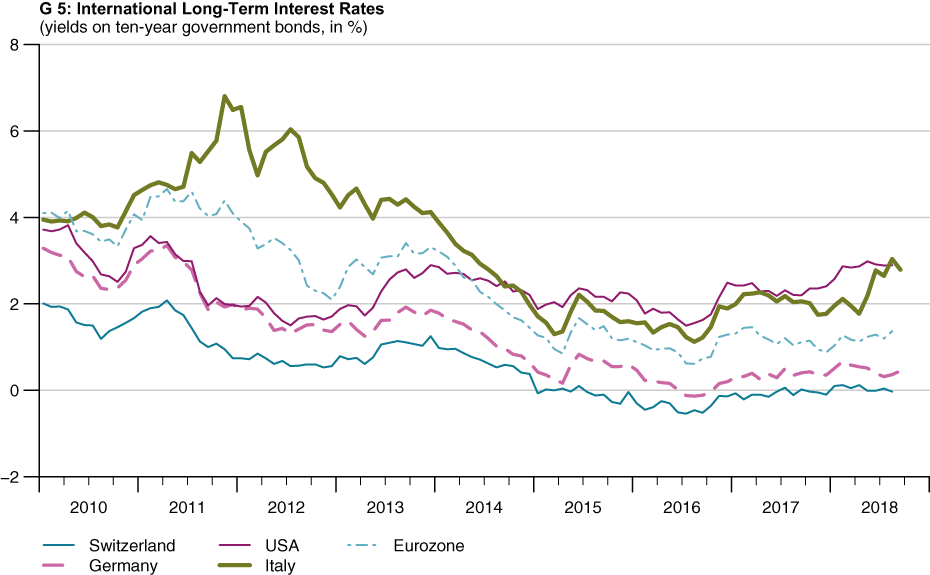

Within the space of a year, long-term interest rates have gone up considerably in the USA. Rising inflation, the FED’s balance sheet reduction and the hike in key interest rates are pushing up the yield. As a consequence, long-term interest rates also rose in Europe. The ten-year yields on Federal bonds have moved up significantly into the positive zone, only to drop below zero again on a temporary basis as safe investments became more attractive due to rising insecurity (see G XXX). German yields also declined, while the risk premium on Italian bonds rose due to increased political insecurity regarding Italy’s public finances. However, the risk premium on Italian government securities has recently gone down again. Against the backdrop of a favourable economic situation and a slow decline in monetary adjustments worldwide over the coming months, KOF expects yields to recover, although the level will remain low in historic comparison.

Contact

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland