Swiss Companies Maintain Brisk Investment Activities

- KOF Bulletin

- KOF Economic Forecasts

Swiss investment activities have continued at a high level for a long time now and KOF expects a further rise in the coming year. Nevertheless, there are signs that the end of the investment cycle is imminent.

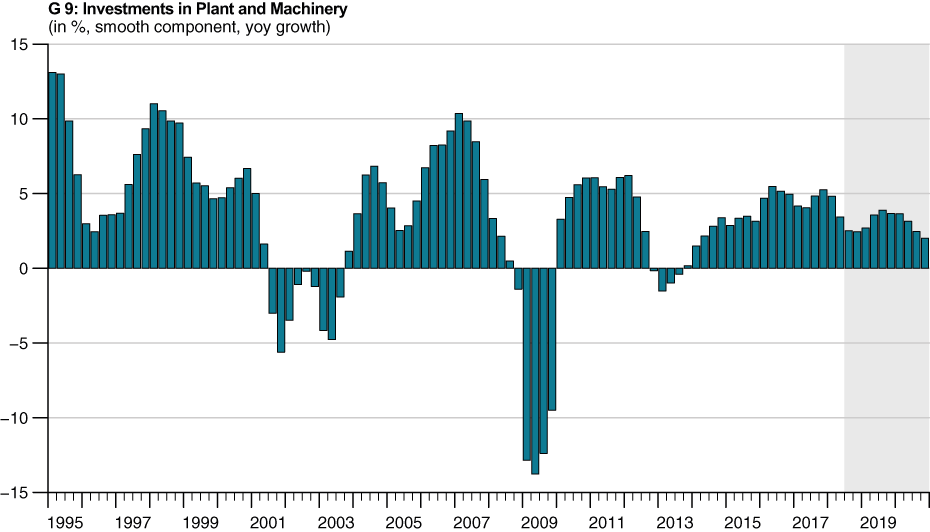

The Swiss economy is experiencing a sustained phase of brisk investment activities. Although rather flat in historic comparison, the current investment cycle, which started in 2014, has been a remarkably long one. It also continued in the first half of 2018 (see Graph 9). Given its inclusion of the year 2015 when Swiss companies were struggling with the suspension of the CHF/EUR minimum exchange rate, the cycle has been surprisingly robust. There are two main reasons why companies have been able to raise investments in plant and machinery by 2.7% despite declining margins. On the one hand, capital goods accounted for a high share of imports, which lowered the cost of investment projects for companies. On the other, the appreciation of the Swiss franc resulted in a relative increase in the price of labour versus the price of capital, which made rationalisation investments more attractive. As a consequence, the share of companies investing in rationalisation went up substantially in 2015, while expansion investment played a comparatively minor role.

In 2016 and 2017, general investments in plant and machinery picked up speed. According to current estimates by the Federal Statistical Office (FSO), investments in plant and machinery went up by 5.4% in 2016. In 2017, Switzerland recorded a further 4.5% rise in investments. During these two years, a shift occurred from one investment type to another. According to the respondents of the KOF Investment Survey, the importance of rationalisation investments declined continuously throughout 2016 and 2017, while the share of companies engaging in expansion investments increased successively. The results of the current Investment Survey of June 2018 show that this trend is unbroken in 2018: In the current year, investment activities are dominated by expansion investments while rationalisation investments are playing a minor role.

Pursuant to the year-on-year growth rates published by the State Secretariat for Economic Affairs

(SECO), real investments in plant and machinery recorded another substantial increase in the first quarter of the year. In the second quarter, investments declined somewhat from this high level. Following several quarters of above-average growth, investments in plant and machinery dropped by approximately 1.2%. Consequently, KOF currently anticipates an approximately 0.5% decline in real investment activities in the third quarter. However, in the fourth quarter of the year, investments in plant and machinery are likely to pick up again. KOF anticipates an increase of approximately 5%. All in all, this year’s investments in plant and machinery are expected to exceed the previous year by 3.3%.

In 2019, KOF anticipates another 3.4% increase. Quarter-on-quarter growth in the coming year will be dominated by purchases of new aeroplanes. If these special factors are excluded, investment dynamics will gradually slow down over the coming quarters. The end of the investment cycle is likely to occur in around two years’ time.

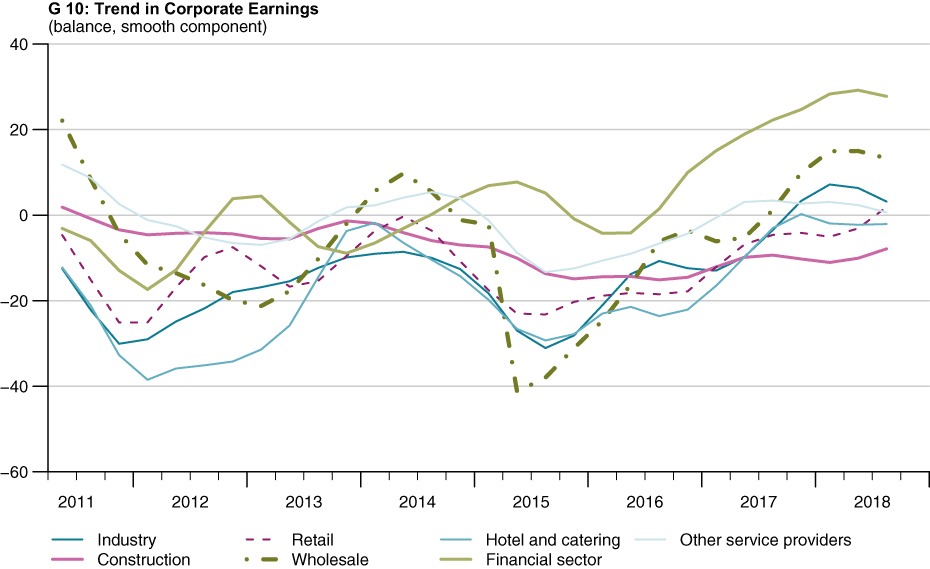

Future investment activities will be dominated by several factors. Over the last two years, virtually all sectors have recovered from the 2015 slump in corporate earnings (see G 10). In 2017, the earnings of Swiss industrial companies improved considerably and for the first time reached the level of 2010 in the first quarter 2018. Retailers and wholesalers as well as the financial sector are all reporting a substantial recovery. Although the earnings of Swiss hotel and catering enterprises also improved in 2017, dynamics flattened substantially at the start of 2018. Construction companies and other service providers were the only sectors that reported stagnation in the last two years. The favourable earnings trend allowed companies to generate higher gross operating surpluses. While gross operating surpluses still declined by 1% in 2015, they increased by 0.8% in 2016 and 0.9% in 2017. For the current year, KOF expects a remarkable 4.2% rise in gross operating surpluses. This increase should give companies the financial leeway to make new investments. In the coming year, KOF anticipates a slightly slower increase in surpluses of 1.9%.

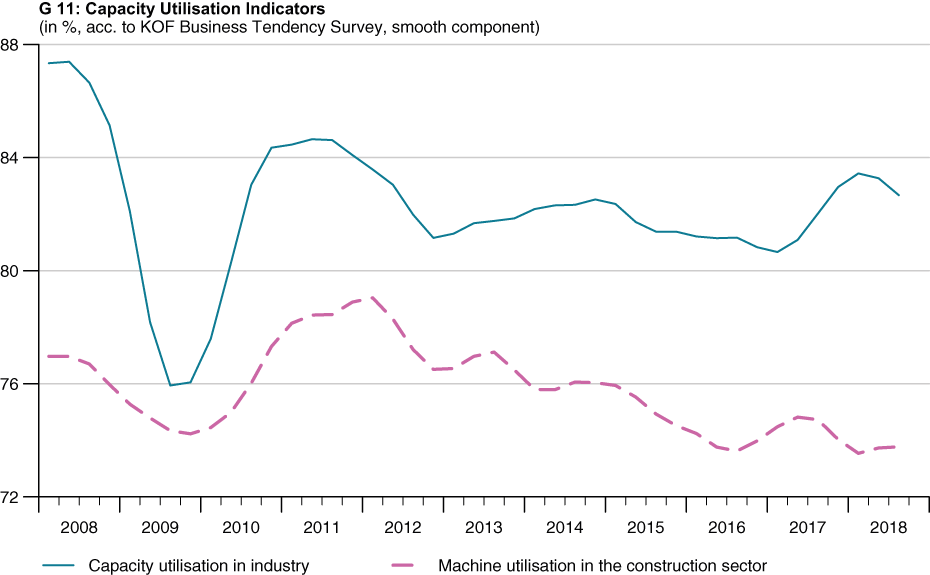

While higher operating surpluses drive investments, the latest trend in capacity utilisation is likely to have a slowdown effect on future investment dynamics (see G 11). Traditionally, capacity utilisation serves as an indicator of future investment activity. This is based on the following underlying mechanism: When average capacity utilisation rises, companies come under increased pressure to make expansion investments in order to meet the surplus demand. In the first quarter 2018, capacity utilisation in Switzerland reached the highest figure in six years. This rise is likely to have triggered investment decisions in certain companies. However, since the value of the capacity utilisation measured in the first quarter is just slightly above the historic average, all in all the observed rise is probably too weak to trigger a sustained investment boom in the industrial sector. On top of this, the KOF Industrial Surveys in April and July 2018 have shown that the degree of capacity utilisation has already gone down slightly, which should reduce any future investment pressure. Since the degree of machine capacity utilisation in the construction sector has tended to slow down over the last year, construction companies are not expected to provide any unusual investment impulses.

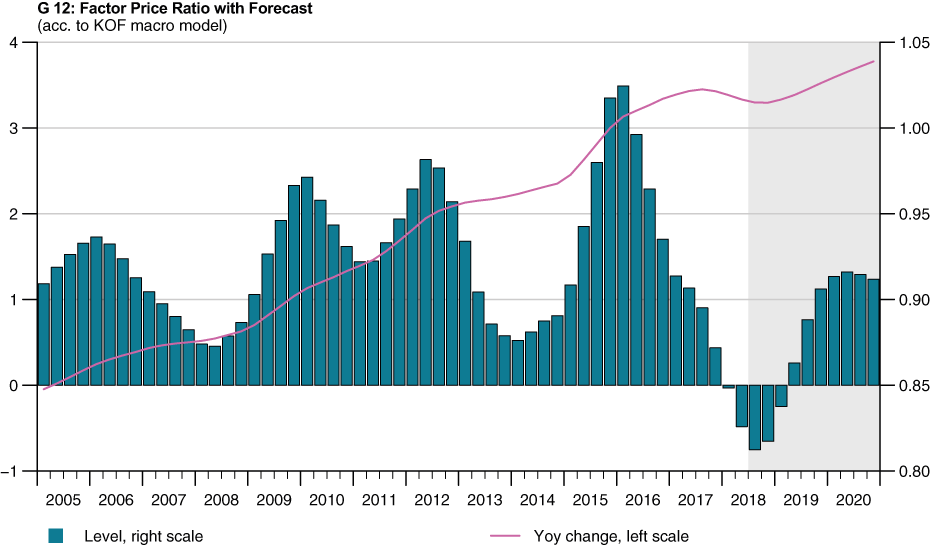

Similar to the trend in capacity utilisation, the latest development of the factor price ratio should also have a slow-down effect on future investments. For the first time since the end of the 1980s, the factor price of capital has become more expensive compared to the price of labour (see Graph G 12). This means that pressure on companies to reduce personnel expenses via rationalisation investments has declined.

Contact

No database information available