KOF Business Tendency Surveys from October 2018: Business Situation Hardly Changed

- KOF Business Situation Indicator

- KOF Bulletin

- KOF Economic Forecasts

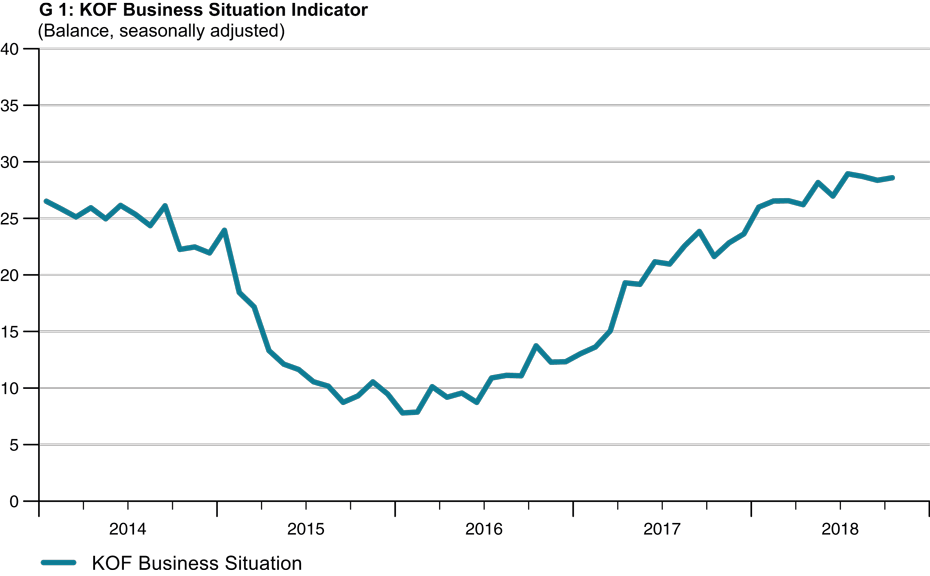

The KOF business situation is barely any different in October compared to the previous month. This means that the business situation of Swiss companies has not changed significantly since July of this year (See G 1). Optimism on the part of companies regarding future business trends has fallen back slightly. The Swiss economy is continuing to ride high, although with slightly less of a tail wind.

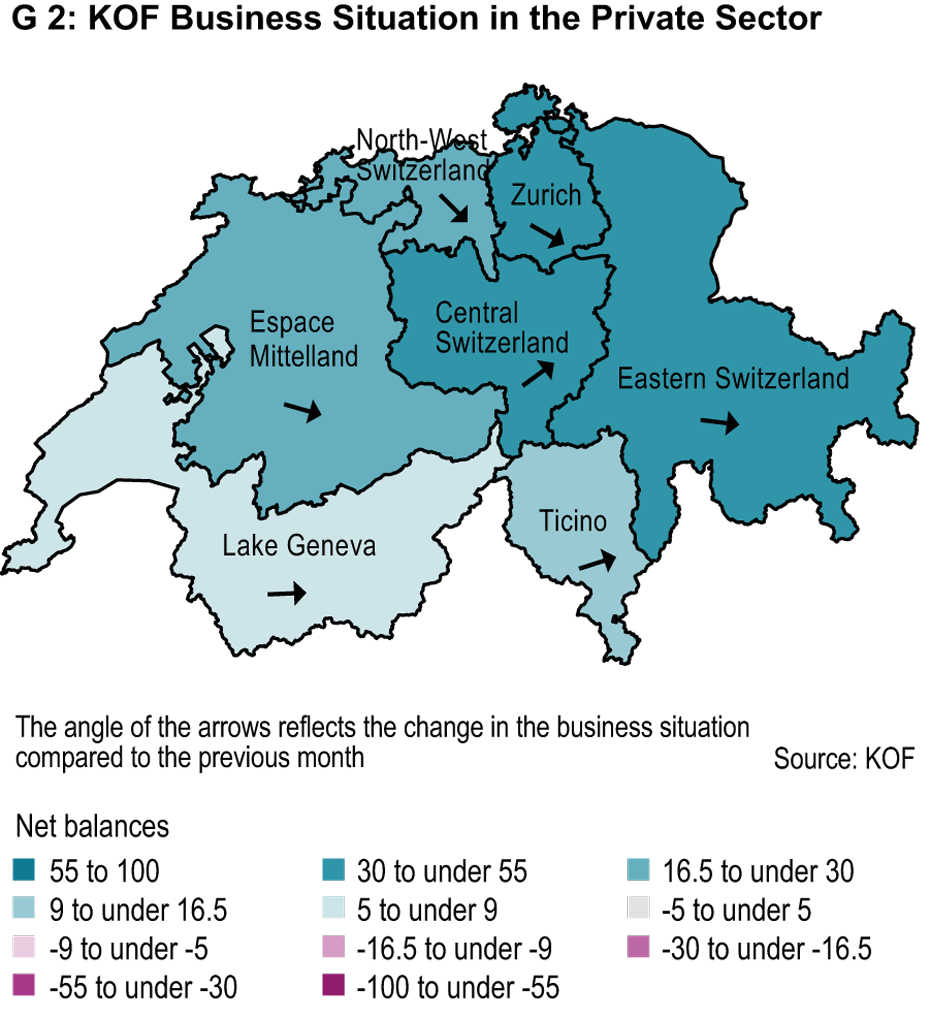

Business situation by region

In regional terms, the business situation has also developed unevenly. The business situation has improved in particular in Central Switzerland. However, it has also recovered somewhat in Ticino. The business situation in the Lake Geneva area is practically unchanged compared to October. On the other hand, it has cooled slightly in Eastern Switzerland and Espace Mittelland. The situation worsened slightly more markedly in the Zurich region and in North West Switzerland.

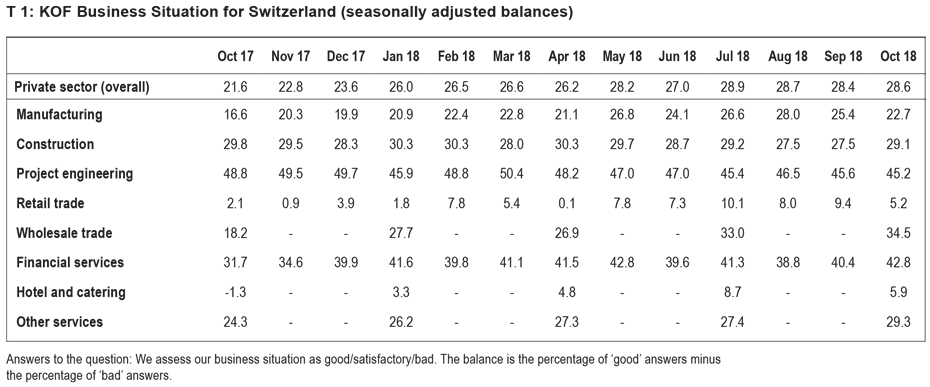

Business situation according to economic sectors

The comparably stable development in the Business Situation Indicator for the Swiss private sector masks sharply differing performance trends within the various sectors of the economy (See T 1). In the manufacturing sector, the Business Situation Indicator has fallen for the second month in a row. The Business Situation Indicator has also fallen back in the hotel and catering and retail trade sectors. The business situation has hardly changed in the project engineering sector. On the other hand, companies from construction as well as from the area of financial and insurance services and other services report an improvement in the business situation.

Focus on individual sectors

The manufacturing sector has been encountering a headwind: the business situation is no longer as good as it was during the summer months, capacity utilisation has fallen slightly and corporate earnings are no longer increasing. The business situation in the manufacturing sector has worsened for the second month in a row. Order books only expanded marginally and companies are no longer as satisfied with order volumes as they were in the previous month. Businesses are no longer expanding production, and capacity utilisation has fallen slightly. At the same time, capacity utilisation remains above average in historical terms. However, not as many companies have created additional capacity as did during the first half of this year. The international competitive position – in particular on the EU market – has again failed to improve and corporate earnings have stagnated. Companies nevertheless remain optimistic regarding future order levels overall and export business performance. However, very few are planning to raise prices, and business expectations are overall not as optimistic as previously.

The business situation remains good in the construction-related project engineering sector and the construction sector itself, and the outlook does not suggest that there will be any significant change in the situation. The positive business situation has only changed marginally in the project engineering sector. Demand for planning services has risen overall once again, although with a consolidating downward trend for new business in the area of residential construction. In addition, the share of renovations and maintenance within construction spending is increasing compared to new builds. Overall, project engineering firms are now expecting the business trend to remain stable into the near future. However, they are increasingly looking to hire additional staff. The business situation has improved slightly in the construction sector. Whilst order books have thinned out slightly, companies remain largely satisfied with existing levels of orders. Construction activity has expanded a little more in the last few months than it did previously, although this has not had any effect on the level of capacity utilisation, which has remained unchanged. However, corporate earnings grew less than they did during the first half of the year. As regards future development however, companies are now expecting earnings to stabilise, with demand for their services remaining essentially unchanged.

The retail sector has posted a small fall, with sales stagnant and the business situation even worsening; however, businesses remain confident regarding future sales trends. The Business Situation Indicator has fallen in the retail sector. This means that the position at the start of the autumn is significantly worse than it was during the summer months. Customer footfall and sales of goods have not posted any further gains. By contrast, traders are increasingly complaining that their inventory levels are too high. However, companies continue to be confident regarding the future development of business. They expect sales prices to remain stable and to increase sales over the next three months.

The upward trend in the wholesale sector has fizzled out a little, although further moderate increases in demand are expected over the coming period. The business situation has improved slightly more in the wholesale sector. However demand has fallen, albeit not as strongly as in previous quarters. Corporate earnings have stagnated in the recent period, which is considered to be due in particular to purchase prices rising faster than selling prices. This price dynamic is projected to continue into the coming months. Wholesalers are positive overall regarding the trend in demand, which they expect to be less buoyant, but nonetheless to continue along its slightly upward trajectory into the near future.

The situation in the hotel and catering sector only changed marginally and is overall satisfactory; hotel businesses are expecting a stable development in the near future, whilst caterers are becoming more confident. The Business Situation Indicator for the hotel and catering sector was not as positive in October as it was in the previous quarter. Nonetheless, businesses are largely satisfied with their business situation. Demand has increasingly risen over the last three months. Corporate earnings have also improved significantly. Companies are confident regarding the future development of the business situation, although are expecting less robust improvements than previously. Hotels posted a large increase compared to the previous quarter for overnight stays by Swiss residents and foreign visitors. This also resulted in an occupancy rate that was higher than it was during the same period last year. Since booking figures are no longer rising at the moment, companies are expecting the number of overnight stays to remain stable, but not to increase, in the near future. The stabilising trend has consolidated itself within the catering sector. It has been broadly speaking possible to maintain the sales volumes achieved during the previous year. Sales have been generally stable also in terms of volume. Restaurateurs are more confident than they previously were regarding future development, and expect sales of both food and drink to rise.

The business situation in the area of finance and insurance services improved, with banks reporting a more positive business trend with domestic customers. Banks are also more optimistic about the prospects for success in the near future within significant areas of business. The business situation has improved further for financial and insurance service providers. The situation can be classified as very good here. Demand has picked up further, although operating costs have increased slightly more compared to the previous quarter. Since, by contrast, corporate earnings have increased less widely, the earnings position has not improved as vigorously as previously. Assuming that prices for services remain stable, the KOF forecasts a further rise in demand in the near future. However, companies are at present rather reticent about recruiting additional staff. The business situation for the sub-group of banks has improved in terms of their business with domestic customers. Demand from foreign customers has tailed off. Banks are more optimistic than they were previously regarding positive results from trading-related, commission and fixed-income business in the near future. However, since operating costs are expected to increase more widely, they are forecasting a more gradual improvement in corporate earnings than previously.

The business situation has improved for other service providers and demand increased across the board; more companies are thus looking to hire staff. The business situation has improved for companies in the sector of other service providers. Demand has picked up, even more strongly than in the previous quarter. Since service providers have expanded their staff resources in the last few months, capacity usage remains at a similar level to the same period last year, despite the increase in demand. Nevertheless, corporate earnings have improved slightly. As regards future development, service providers are forecasting a further increase in demand, although expectations are no longer as positive as they were last year. Service providers are increasingly looking to expand staffing levels; however, reports of worker shortages have also fallen slightly.

The results of the current KOF Business Tendency Surveys of July 2018 are based on the replies of over 4,500 private companies active in industry, construction and the main service sectors. The response rate was approximately 59%.

Contact

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland