Swiss Companies Face Headwinds

- KOF Business Situation Indicator

- KOF Bulletin

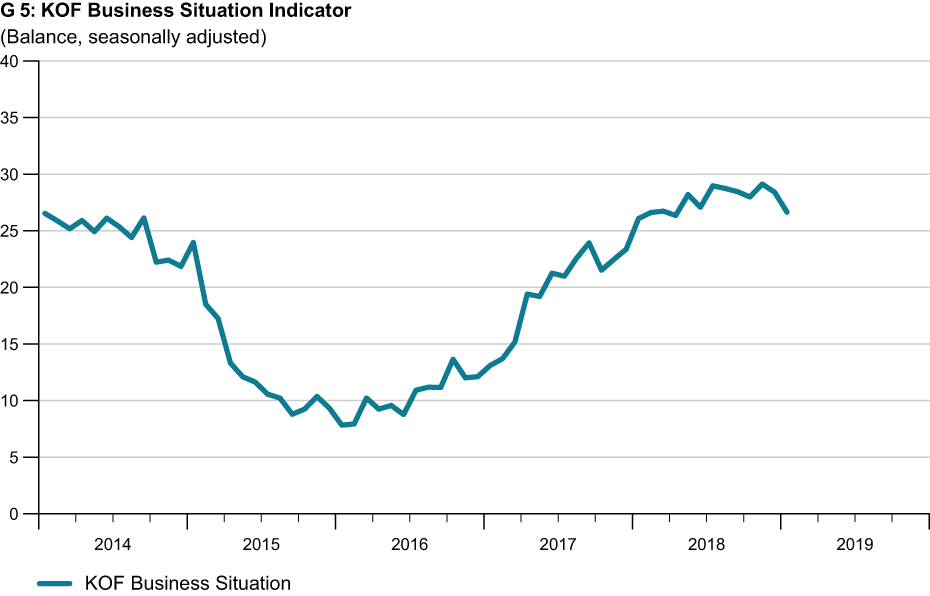

According to the results of the current KOF Business Tendency Surveys, which were conducted among 9,000 businesses, companies assess their current business situation as slightly less favourable than before. The KOF Business Situation Indicator has begun the year in the minus (see G 5). Companies are also less positive about their expected business trend. However, confidence about the future business development predominates. Nevertheless, companies are increasingly facing some headwinds.

The decline of the Business Situation Indicator results specifically from unfavourable trends in the wholesale and other services sectors. The business situation in the wholesale sector remains favourable, although it has slowed down for the first time in half a year. All in all, demand and sales rose only slightly. Since wholesalers also expect no more than a small rise in demand in the near future, they anticipate stable delivery times. Both purchase and selling prices are likely to go up less dynamically than before. In January, the business situation of the other service providers is no longer quite as good as in the preceding quarter. Corporate earnings are under pressure since there is little room for price rises. Nevertheless, confidence still dominates companies’ business expectations and employers once again plan to take on further staff.

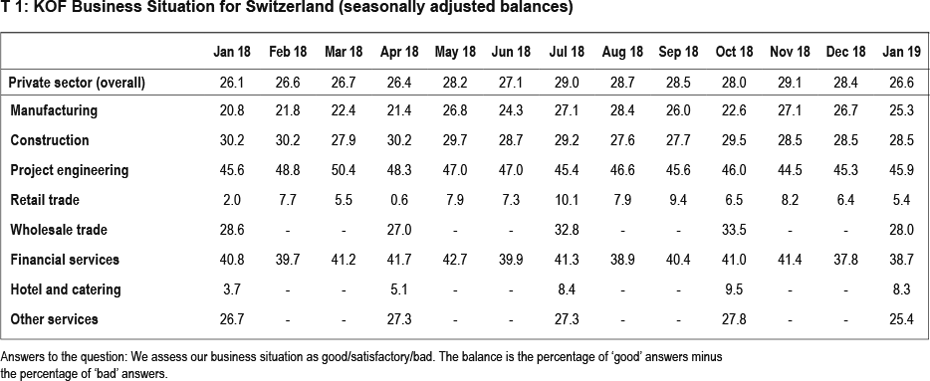

In addition, the Business Situation Indicator shows slight setbacks in the manufacturing industry, the hotel and catering sector and the retail trade (see T 1). Although the trend in the manufacturing industry is currently less dynamic than in summer 2018, the business situation remains positive. Since, once again, companies had to make more concessions on selling prices, corporate earnings came under slight pressure. Order books are satisfactory and the companies are mostly confident about their future business development. The export expectations of companies are distinctly less optimistic than in the last few quarters, partly because their competitive position on the EU markets has deteriorated slightly. However, all in all, confidence regarding the business trend in the coming six months predominates among companies in the manufacturing industry.

In the hotel and catering sector, the business situation did not change much and corporate earnings are stable. Business prospects are mostly considered favourable. Hotel businesses recorded a smaller increase in the number of overnight stays by both Swiss residents and foreign visitors than in the preceding quarters. Despite a rather stagnant trend in room occupancy, businesses expect the number of overnight stays to pick up, especially due to additional stays by Swiss residents. Catering businesses posted slightly higher turnover than during the same period last year. However, sales volumes of food and beverages changed very little. In terms of the future trend, catering businesses anticipate another slight increase in demand.

The business situation in the retail sector has worsened slightly for the second month in a row. Customer footfall was lower at the beginning of this year than at the start of 2018. Accordingly, sales of goods recorded a minor drop and inventory pressure went up. With retailers less positive about their future turnover trend than before, they plan to be more restrained when it comes to ordering fresh goods. In addition, the companies do not really expect to push through any further price rises. All in all, business expectations are therefore less confident than before.

The construction industry, the project engineering sector and the financial and insurance providers are all bucking the downward trend of the Business Situation Indicator, reporting either very little change in their business situation or even a slight improvement. The business situation in the construction-related building and project engineering sectors remains favourable. In the construction industry, capacity utilisation has gone up while the order backlog is at a normal level. However, with pressure on construction prices likely to rise, income prospects are slightly less favourable than before. Project engineering businesses are increasingly looking for additional staff as demand for their services is picking up. Nevertheless, they often state that it is very difficult to find suitable employees.

The business situation remains positive for the financial and insurance service providers, even though the income trend has recently been slow-moving. According to the respondents, in the past three months, operating expenses rose more frequently than operating income. Nevertheless, the business prospects are positive, albeit less promising than at the end of last year. Demand among foreign customers is weaker and the banks are not expecting any impulses from this customers group in the near future. Demand among domestic customers is expected to increase further, although at a slower pace than before.

Contact

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland