Brexit and Trade Relations – The Main Issues

- World Economy

- KOF Bulletin

Important decisions on Brexit are due in mid-March. It is still unclear whether the United Kingdom will withdraw from the European Union in a regulated or unregulated manner - or whether the Brexit vote will be taken again. In the present state of things, Switzerland and the United Kingdom signed a bilateral trade agreement on 11th February which would regulate post-Brexit relations. This article shows the importance of the countries for each other and how they are linked to the rest of the EU.

Importance of the trading partners to each other

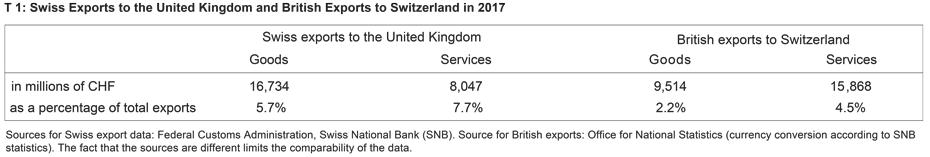

The share of Swiss exports of goods and services to the UK amounts to 5.7% and 7.7% respectively, based on total Swiss exports of goods and services (see T 1). The UK is Switzerland’s sixth largest export market for goods. Vice versa, the share of UK exports of goods and services to Switzerland amounts to 2.2% and 4.5% respectively, based on total UK exports of goods and services.

Categories of goods traded between the UK and Switzerland

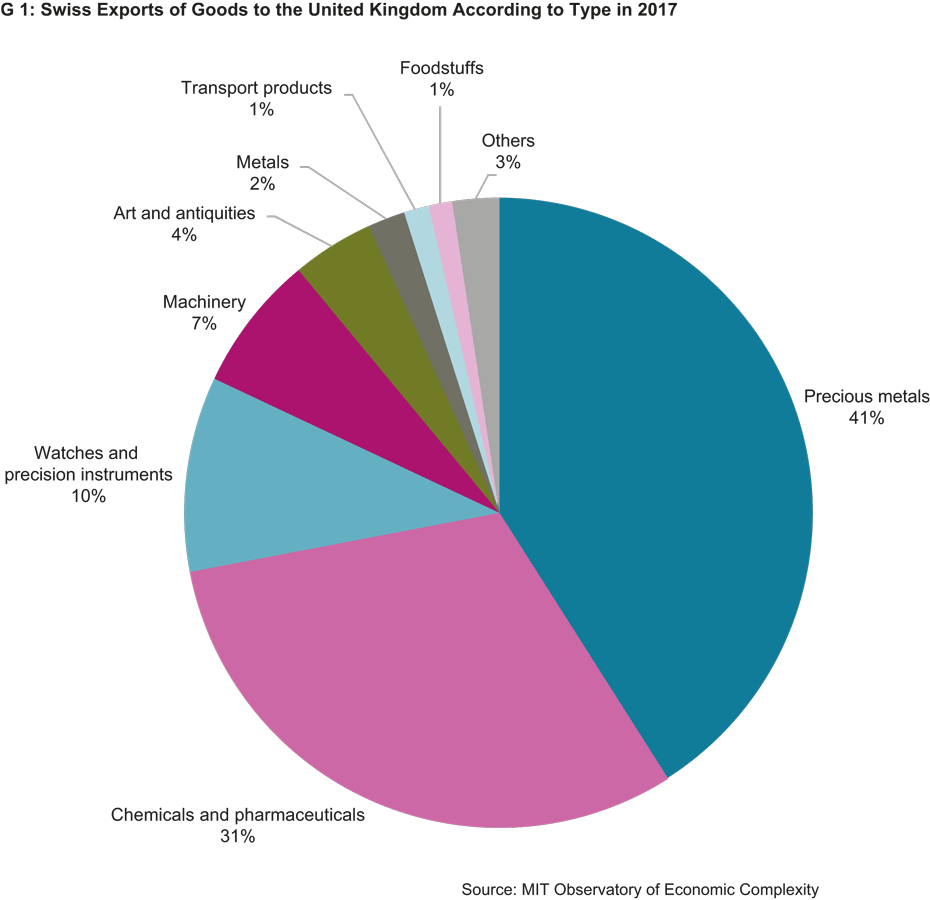

The trade in precious metals (gold, silver, etc.) between Switzerland and the UK is very brisk. Accordingly, 41% of Switzerland’s total exports to the UK are in the precious metal category (see G 1). At 31%, chemical and pharmaceutical products are the second largest export category, followed by watches and precision instruments (10%) and machines (7%). In contrast to the long-running trade surplus in goods with the entire world, Switzerland has mostly recorded a trade deficit in goods with the UK in the past few years. However, adjusted by the precious metal trade, Switzerland actually runs a trade surplus in goods with the UK.

Importance of the new trade agreement to the UK and to Switzerland

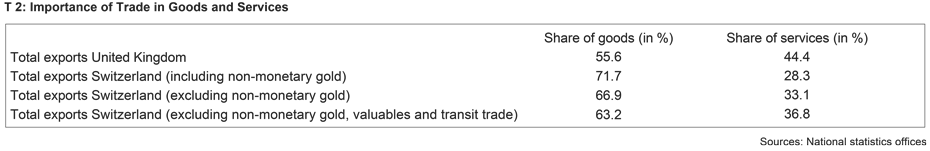

According to official sources, the recent trade agreement between Switzerland and the UK comprises approximately three quarters of the volume of goods traded between Switzerland and the UK that was previously covered by Swiss agreements with the EU. The new agreement also includes pharmaceutical products, which are a key export category for Switzerland. By contrast, the UK benefits to a lesser degree from the trade agreement with Switzerland since the trade in services, the majority of which is not included in the agreement, is relatively important for the UK in international comparison. Only 56% of all exports relate to goods, 44% to services. In the case of Switzerland, however, the trade in goods including non-monetary gold accounts for 72% of all exports. Excluding non-monetary gold, the share is 67%, while services account for 33%. Once the volatile components, such as other valuables and merchanting, are also excluded, the trade in goods accounts for a mere 63% in Switzerland, while services make up 37%.

Importance of the EU-27 to the UK and vice versa

The EU-27 (EU excluding the UK) is by far the most important market for British goods. All in all, the UK exported goods worth CHF 189 billion to other EU countries in 2017. This corresponds to around 48% of its total goods exports. Further key trading partners are the United States at 11% and China at 5.6% of all goods exports, giving China roughly the same importance to the UK as Ireland. In absolute figures, the UK is more important for the EU than vice versa. In 2017, the other EU countries exported goods worth CHF 330 billion to the UK. However, this figure only corresponds to just under 7% of all goods exports by the other 27 EU countries.

Importance of the EU-27 to Switzerland and vice versa

The EU is also the most important trading partner for Switzerland. In 2018, goods worth CHF 112 billion were exported to the 27 EU countries, which corresponds to approximately 48% of total goods exports. In the past year, Switzerland’s other important trading partners consisted of the United States at 16.2% and China at 5.2% of all goods exports. Switzerland’s importance to the EU-27 is much lower. At CHF 135 billion, a mere 3% of all EU-27 goods exports went to Switzerland.

UK economic development since joining the EU in 1973 and Switzerland’s economic development in the same period

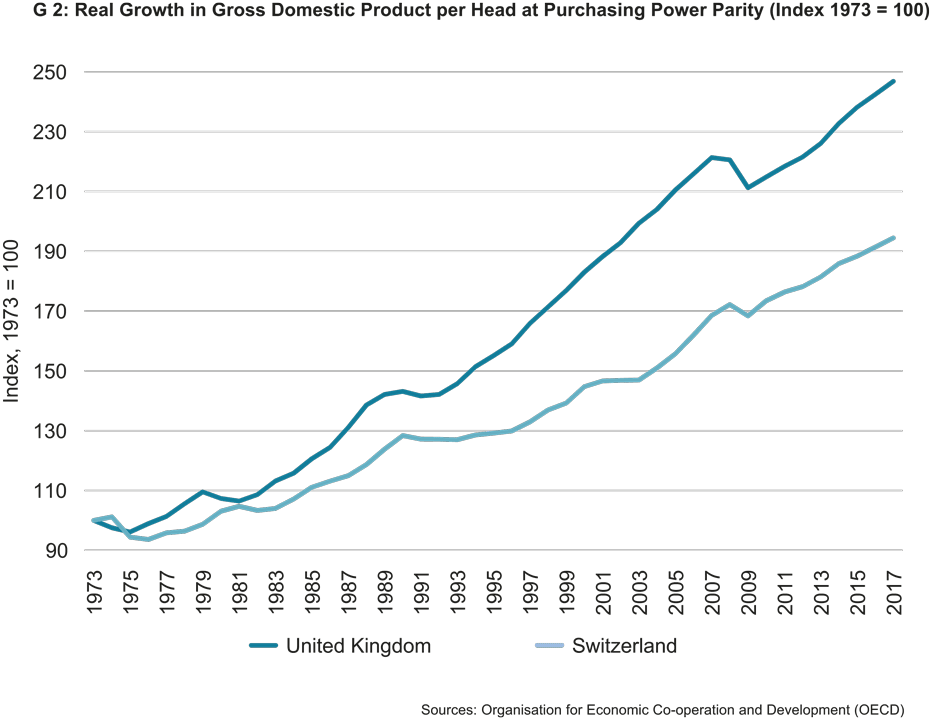

In the UK, per capita GDP adjusted for purchasing power has increased much faster since 1973 than per capita GDP in Switzerland (see G 2). Swiss economic development was much less dynamic, especially in the 1990s. However, since the middle of the 2000s, Switzerland has once again been growing faster than the UK. Moreover, absolute per capita GDP adjusted for purchasing power is still close to one and a half times higher in Switzerland than in the UK.

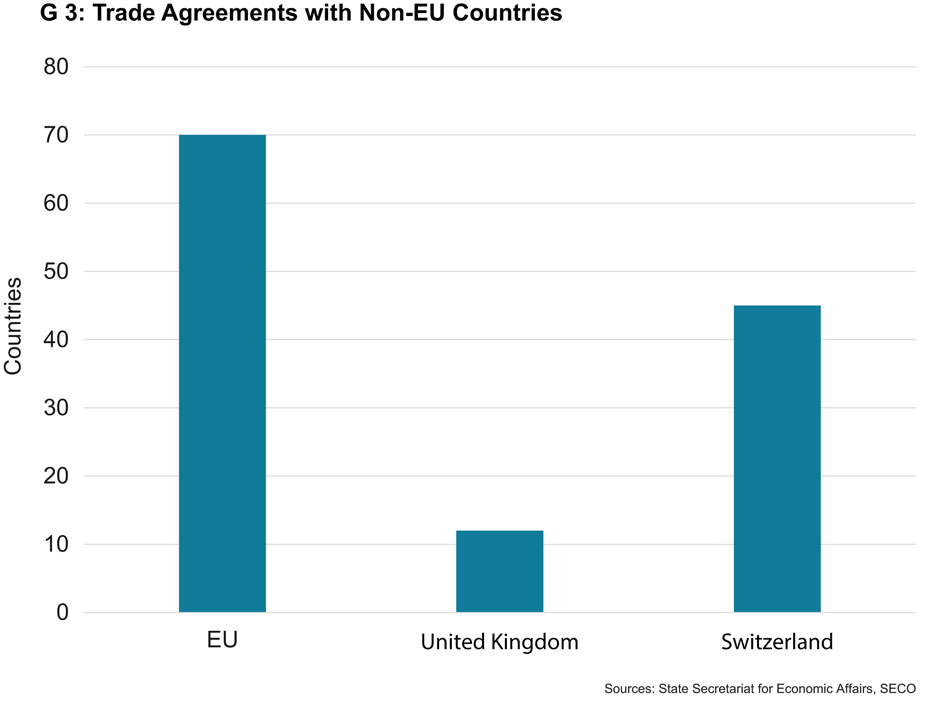

Countries with which the UK has concluded trade agreements since the Brexit vote and number of countries with which Switzerland has concluded trade agreements

As a EU member, the UK benefits from the trade agreements between the EU and 70 countries worldwide (see G 3). To retain access to these markets, the UK must replicate these agreements before its departure from the EU. To date, the UK has managed to conclude agreements with no more than twelve countries. Switzerland is in a position to conclude its own trade agreements on a global basis and currently maintains trade relations with 45 countries.

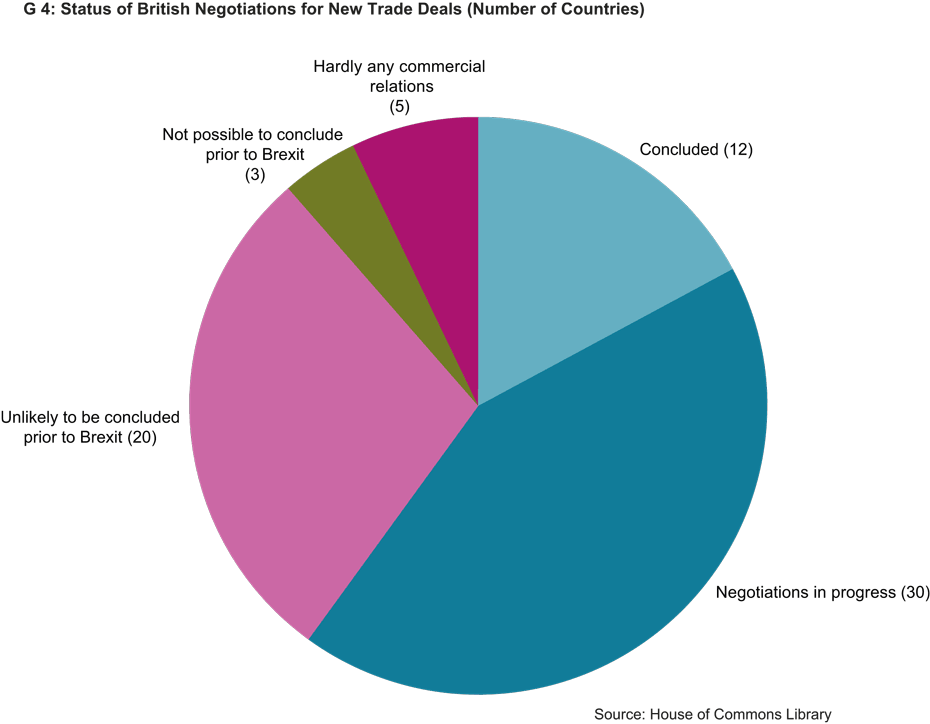

UK’s ability to conclude the remaining trade agreements

It is unlikely that the UK will be able to replicate all outstanding agreements by the time it might leave the EU on 29 March. Negotiations are ongoing with around 30 countries, among them important trading partners such as South Africa, South Korea and Norway (see G 4). In the case of 20 countries, conclusions before the departure date are very unlikely. These countries include Mexico, Egypt and Ukraine. Agreements with key trading partners, such as Japan and Turkey, which make up just under 2% of all sales of goods each, are not feasible until the departure date. All in all, the UK's global market access is likely to decline significantly after its exit from the EU.

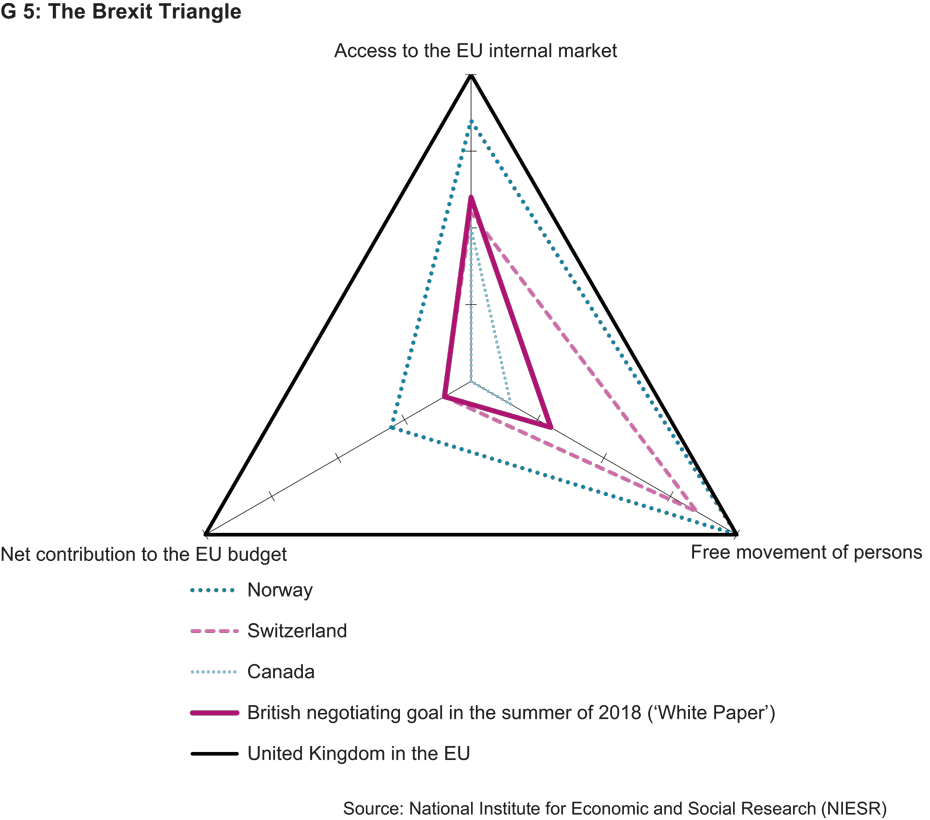

Potential future relations between the UK and the EU

The current negotiations between the EU and the UK focus on the modalities of the departure and on future relations. The National Institute of Economic and Social Research (NIESR), a UK-based partner institute of KOF, has summarised the UK’s options in terms of its future relationship with the EU in a so-called Brexit triangle and has compared these options with the solutions Switzerland and other countries have chosen (see G 5). In its White Paper published in summer 2018, the UK government aims for relatively extensive access to the EU Internal Market for Goods and Services accompanied by a relatively low degree of integration into the labour market (free movement of persons) and low net contributions to the EU budget. The desired degree of integration in the goods and services market is higher than Switzerland’s current integration, while the desired integration in the labour market is significantly lower. The EU, however, insists on the inseparability of its four basic freedoms (free movement of people, goods, services and capital) and uses access to the Internal Market as a bargaining chip to achieve greater freedom of movement for people.

Contacts

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland

No database information available