Quantitative Easing in the Eurozone: Who Benefits?

- Monetary Policy

- KOF Bulletin

After the global financial crisis, lending to companies slowed down considerably in the eurozone. The European Central Bank chose unconventional measures to alleviate the situation. According to a current KOF study, small and medium-sized enterprises have benefited from the ECB’s quantitative easing – albeit to different degrees in different countries.

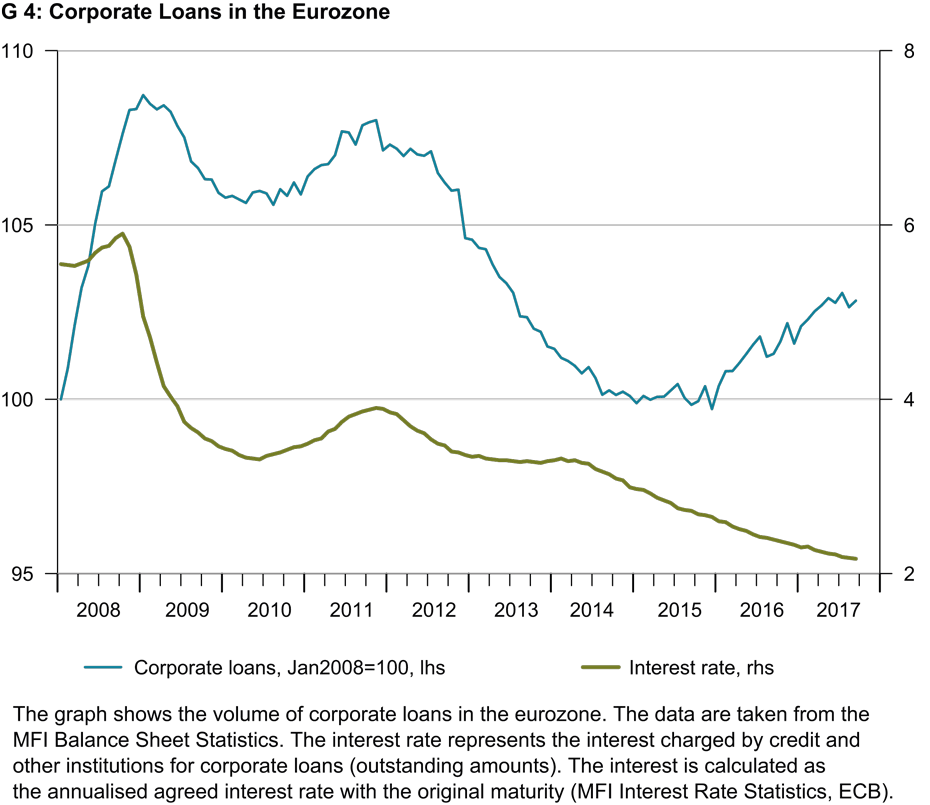

A few years ago, the deterioration of the European sovereign debt crisis and slow debt reduction by the banks brought the European economy close to a credit crunch. Between 2011 and 2015, the volume of corporate loans slumped despite a massive decline in the key interest rate and hence the interest companies pay on their loans (see G 4). The European Central Bank (ECB) took unprecedented measures in order to preserve the credit channel within its monetary policy, which included, for instance, Targeted Long Term Repurchase Operations (TLTRO).

However, a sustained improvement in the lending situation did not occur before quantitative easing began in the form of the Public Sector Purchase Programme (PSPP) in March 2015 (announced in January 2015). The ECB’s Bank Lending Survey (BLS) and Survey on the Access to Finance of Enterprises (SAFE) show that a fundamental improvement of lending conditions did not set in until after 2015. It is not clear whether the ECB's unconventional monetary policy measures, such as the PSPP, also contributed towards the facilitation of financing conditions for small and medium-sized enterprises (SMEs).

-

- Targeted Long Term Repurchase Operations (TLTRO): These are long-term financing options for banks which are offered at attractive terms and are intended to stimulate lending to the real economy.

- Public Sector Purchase Programme (PSPP): This is the ECB’s large-scale government bond buying programme.

Difficult access to financing for SMEs

Especially in comparison to the USA, companies in the eurozone are highly dependent on bank loans (see for example Praet, 2016, or Kraemer-Eis et al., 2017). Between 2002 and 2008, non-financial corporations obtained an average of 70% of their financing from banks. In general, SMEs are heavily reliant on bank loans as a source of finance. Most companies in the eurozone are SMEs. They employ more than two-thirds of the labour force and generate around 60% of the value added (Kraemer-Eis et al., 2017). Their financing conditions therefore play an important role for the economy and monetary policy. However, it is more difficult for SMEs to access financing and they incur higher financing costs than large companies.

Based on SAFE corporate data, a current study conducted by KOF analyses the effects of the ECB bond buying programme on SMEs’ access to financial resources. Compared to the existing literature on bank lending, analysis based on these data allows for a focus on SMEs without approximating the companies with small-scale loans or small banks. Secondly, it allows for direct comparison between eurozone countries. Thirdly, company characteristics and macroeconomic parameters can be controlled in the credit demand context.

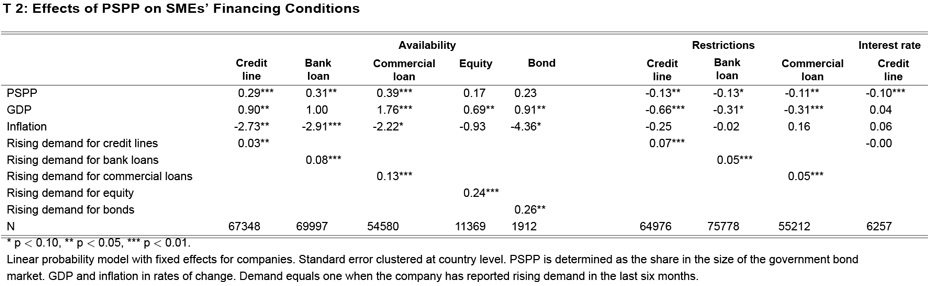

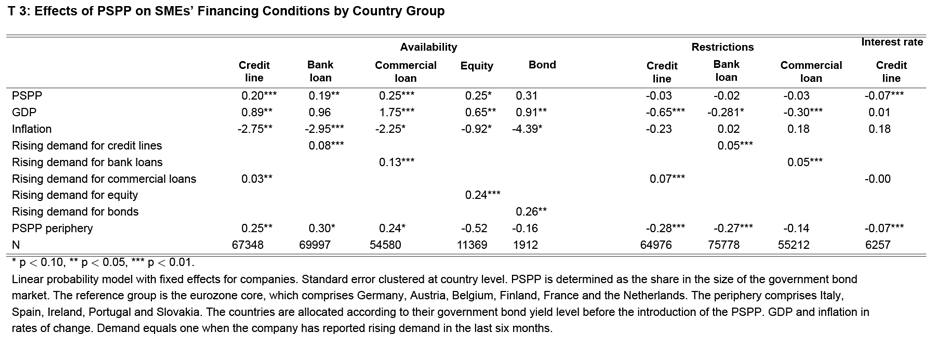

According to the analysis, the ECB's quantitative easing programme has indeed improved SMEs’ access to financial resources by raising credit availability, easing financial restrictions and lowering interest rates on credit lines and overdrafts (see T 2). However, the PSPP has had very different effects in the individual countries. SMEs in the eurozone periphery, for instance Italy, Spain or Ireland, have benefited most from the programme (see T 3). The differences are due to bank capitalisation. The PSPP has a bigger impact on financing conditions where banks have low equity ratios since it improves the health of their balance sheets and hence stimulates lending (see for example Acharya et al., 2017, or Gambacorta and Marques-Ibanez, 2011).

These results have important implications for economic policy. Aside from big corporations, SMEs also benefit from the ECB’s PSPP. Although the ECB’s mandate is to achieve price stability in the eurozone, its policies may have very different effects in the different countries and depending on the economic agent involved. SMEs in the countries that require the most support have so far benefited most from the PSPP.

Literature

Acharya, V., T. Eisert, C. Eufinger, and H. Christian (2017): Whatever it takes: The real effects of unconventional monetary policy. SAFE Working Paper Series, 152.

Gambacorta, L. and D. Marques-Ibanez (2011): The bank lending channel – lessons from the crisis. ECB Working Paper, (1335).

Kraemer-Eis, H., A. Botsari, S. Gvetadze, F. Lang, and W. Torfs (2017): European Small Business Finance Outlook June 2017. European Investment Fund Working Paper Nr. 43.

Praet, P. (2016): Monetary policy transmission in the euro area. Speech at the suerf conference, European Central Bank.

Contact

No database information available