Situation for Companies is Becoming More Difficult

- KOF Business Situation Indicator

- KOF Bulletin

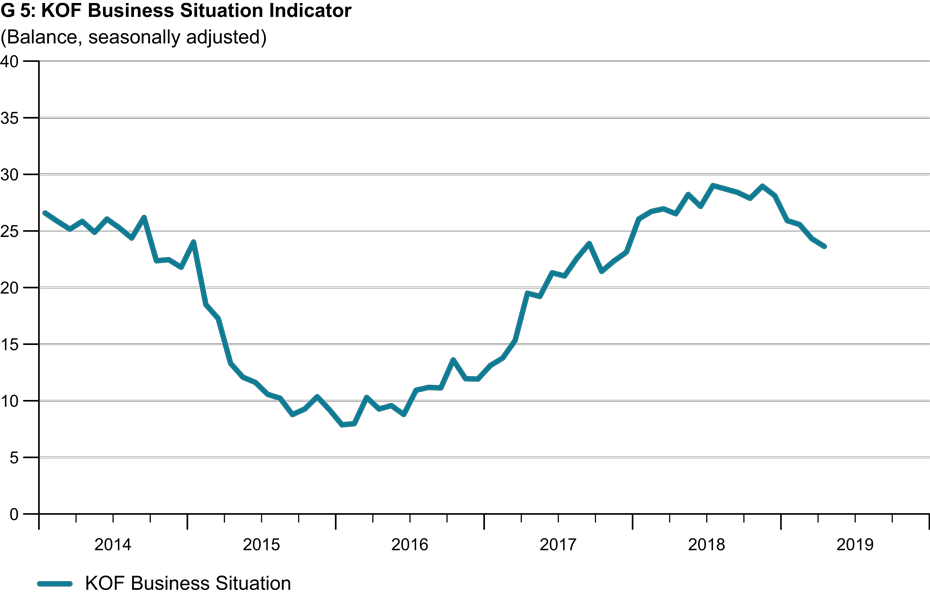

In April, the business situation of Swiss companies worsened once again. The Business Situation Indicator declined for the fifth month in a row (see G 5). With the exception of the construction and project engineering sectors, all other sectors have been struggling to sustain their business situation since the start of the year. By contrast, the companies’ expectations for the coming six months have not fallen any further.

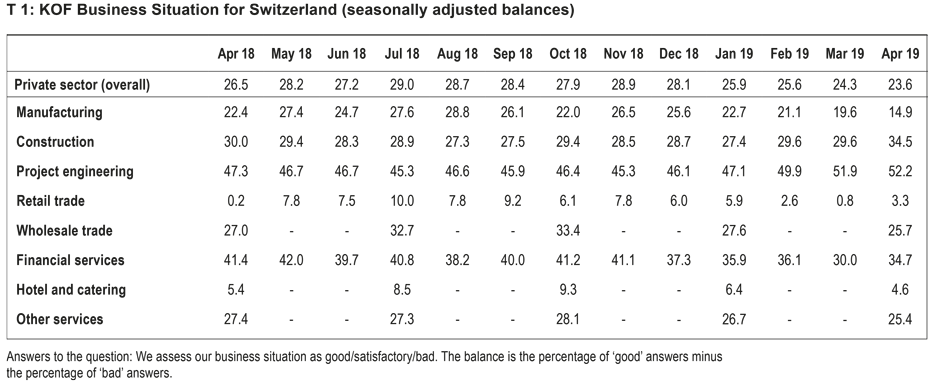

Broken down by sector, a mixed picture emerged in April (see Table). The business situation in the manufacturing industry is still on the decline, slowing down for the fifth consecutive month. Both domestic and export-oriented companies are less satisfied with their business situation than before. Although output expanded on a very moderate scale, order books are shrinking and inventories of finished goods are growing. This pattern is suggestive of weaker demand.

With respect to incoming orders and output, companies’ expectations are less positive than in the previous spring, although they still foresee further increases. Companies are thus preparing for a further cooling of the market, although they are not expecting an abrupt slowdown or even contraction.

Improved business situation in the construction and retail trade industries

The building-related construction and project engineering sectors reported an improvement in their business situation in April. With the construction industry recording brisk demand, companies are more satisfied with their order books than they were previously. Corporate earnings are under less pressure than before and the companies are hoping for stable earnings in the near future. The business situation of project engineering firms has improved slightly, although demand for their services increased less substantially than before. Total construction costs in the industrial-commercial segment contracted. In terms of the demand trend, companies once again anticipate a stable development.

The business situation in the retail trade has improved for the first time in four months, although earnings remain under a little pressure. Retailers are now more confident about their turnover trend in the near future. Wholesalers are less positive in their assessment of the business situation for the second quarter running.

For a second consecutive quarter, the hotel and catering sector recorded a slight slowdown of its business situation. This is due to the assessments of catering companies, which have rated their business situation as just about satisfactory. Compared to the same quarter last year, turnover is no longer on the rise and corporate earnings have been under a little pressure lately. Catering enterprises are more confident regarding the future development of their business. The favourable business situation in the hotel sector has changed very little. Although the number of overnight stays rose somewhat more slowly and the occupancy rate dropped slightly, the need for price reductions continues to wane. According to respondents, the number of overnight stays is set to rise substantially in the near future.

Banks anticipating stronger demand from domestic customers

In April, the business situation of the financial and insurance services sector improved again. The situation is predominantly good, albeit no longer as positive as at the beginning of 2019 or last spring. Expectations of the corporate earnings trend are now showing more confidence. In the banking segment, the business situation with domestic and international customers is improving. Nevertheless, business with both customer groups is less brisk than in the same period last year. In the near future, banks expect a demand to rise substantially among domestic companies and domestic private customers.

The business situation in the other services sector is slowing down for the second consecutive quarter, with the Indicator declining specifically in the transport, information and communications segment. However, all in all the business situation of service providers remains predominantly favourable. As regards the coming three months, companies anticipate demand to rise further, although they have been more optimistic on this score in previous quarters.

You can find more information about the KOF Business Situation Indicator here.

Kontakt

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland